Transcription of Market Survey UK Agricultural Land - Savills

1 Market SurveyUK Agricultural Land2014 Savills World Research UK Value Survey Revisions (Footnote)The farmland values are derived from Savills Farmland Value Survey , which is a comprehensive record of the value of a range of types and quality of bare Agricultural land by region since 1992. It is based on the quarterly valuation of a static portfolio of 9 types of bare land with vacant possession in 25 regions across Great Britain by a panel of Savills Agricultural valuers and others who are experts in their region. It is based on local knowledge, which is sourced primarily from local transaction information, but also takes into account special purchasers, unusual properties, and the tone of the Market in the area at that Survey is a general indicator of Market conditions at the time of the Survey , with no reference to future Market conditions.

2 The data is for general informative purposes only and should not be used as the basis of any property valuation or appraisal. Range values are not definitive and they do not indicate realisable values on a forced accepts no liability whatsoever for any direct or consequential loss arising from the use of this data. 03 2014 The prospects for further growth in farmland values remain positive. However, land quality and location are becoming increasingly criticalMarket SurveyAgricultural LandDuring 2013 there was a diverse mix of active buyers in the farmland Market , but while their motives for acquisition were varied, for most the land choice and location were similar.

3 This led to high sale prices for prime arable land in the East, but weaker or zero growth for either predominantly livestock farms or those with a high proportion of the guide price tied up in the residential the amount of farmland publicly marketed across Great Britain rose during 2013, the area marketed since 2003 has largely remained static and is significantly less than in the years prior to the millennium. Prospects for further growth in farmland values remain positive but land quality and location are becoming increasingly critical. We discuss the key drivers and identify potential risks which could threaten the current is useful to set the UK farmland Market in the context of the global farmland markets (see Graph 1).

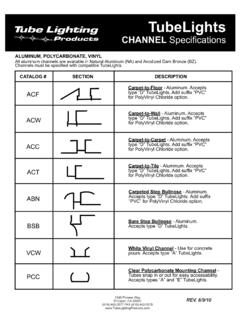

4 Across the world farmland values continue to grow. Our Global Farmland Index shows an average global annualised growth since 2002 of just over 20%, while the UK equals 13%. This growth was fairly steady year-on-year apart from during 2009-10, when the rates of growth in some of the mature markets highest growth rates were recorded in the emerging markets of Romania, Hungary, Poland, Zambia, Mozambique and Brazil, a trend we expect to the mature markets growth has remained healthy (from over 7% to as much as 20%), especially when compared with alternative property 1 Global Farmland Index International contextSource: Savills Research using Eurostat & various data/estimates Our 33rd Agricultural Land Market Survey reviews the performance of the farmland Market in 2013, examines historical trends and considers its outlook for 2014 and beyond.

5 We put UK farmland growth into a global context via our Global Farmland Index, which shows an average annualised growth since 2002 of just over 20%, while the UK equals 13%. Last year, across Great Britain, there was a diverse mix of buyers, who despite varying motives behind their purchase tended to require a similar land type in a similar location. This led to high sale prices for prime arable land in the eastern counties, but weaker or zero growth for either predominantly livestock farms or those with a high proportion of the value tied up in the residential element. Average farmland values during 2013 strengthened by over 12% to 8,500 per acre with a 10-year cumulative average growth of 273%.

6 This compares with 135% for prime central London values over the same period. We expect average farmland values across Great Britain to grow at around 6% per annum over the next five years, but there will be significant variations in the rates of growth with the best performance being quality driven. Across the UK the supply of farmland remains constrained with 144,000 acres publically available last year, which is 50% less than in 2000. We conclude with a comparison of farmland with residential and commercial property SUMMARYKey findings in this publication70,00060,00050,00040,00030,00 020,00010,0000US$ per hectare 2010 2011 2012 AustraliaCzech RepublicCanadaBrazilRomaniaSwedenUnited StatesPolandFranceArgentinaGermanySpainG reat BritainNew ZealandIrelandDenmarkNetherlandsSupply & Values 2013 04 Buyers and Sellers 06 Forecasts and Outlook 07 Property Assets Comparison 09 CONTENTS04 Market Survey | Agricultural Land Over the past 50 years turnover of farmland has fallen from around to of the utilisable Agricultural area of Great Britain Savills ResearchSupply 2013 Our research indicates that the volume of acres publicly marketed across Great Britain during 2013 is broadly similar to recent years with the

7 Long term trend line beginning to plateau. A total of 144,000 acres of farmland were publicly marketed during 2013 and although this is an increase of 7% on the 135,000 acres of 2012, the overall picture is still one of constrained supply. Graph 2 clearly illustrates how volumes have fallen 2013 is 18% less than in 2005 and 50% less than 2000. Over the past 50 years turnover of farmland has fallen from around to of the utilisable Agricultural area of Great report focuses on publicly marketed farmland and takes no account of the privately marketed acreage, but anecdotal evidence suggests this Market represented about 30% of all land traded in 2013.

8 In 2013 the months of May, June, July, August and September were the most active with 75% of the year s acreage marketed in Great Britain during these months. England In 2013, 91,470 acres of farmland were advertised across England. This compares with 88,700 acres in 2012 and represents a 3% increase. However, it is still 21% less than the amount of farmland marketed in England during 2011, 26% less than in 2005 and 45% less than in the year 2000 (Graph 3). All regions across England recorded an increase in activity with the exception of the East and South West. In the South West, both Somerset and Devon saw a fall in the volume of publicly marketed farmland and in the East of England volumes fell in all counties bar For the second year running, supply increased by 9% in Scotland with 43,300 acres of farmland publicly marketed.

9 Although this is the highest Agricultural LandSupply and Value 2013supply in Scotland since 2005 when 43,500 acres were publicly marketed it is still 62% less than the acreage marketed in 2000. Wales The volume of publicly marketed farmland significantly increased in Wales to 9,300 acres. When compared to 2012 this is a 37% rise but is 46% lower than the volume marketed in 2000. GRAPH 2 Constrained supply of farmlandSource: Savills ResearchGRAPH 3 Supply by Country Source: Savills Research350,000300,000250,000200,000150, 000100,00050,0000 Acres19951996199719981999200020012002200 3200420052006200720082009201020112012201 350% less than in the year 2000180,000160,000140,000120,000100,0008 0,00060,00040,00020,0000 AcresEnglandWalesScotland 2000 2005 05 2014 per acre12 month growth per acre growthEast of England 9, 1,667 East Midlands 7, 1,035 North of England 6, 305 West Midlands 6, 168 South West England 6, 436 South East England 6, 384 England 7, 663 Scotland 4, 149 Wales 5, 39 Values 2013 According to the Savills Farmland Value Survey .

10 The average value of prime arable farmland across Great Britain strengthened by to just over 8,500 per acre in 2013. This follows an rise in 2012 and furthermore a 273% increase in average prime arable values during the past 10 years. This compares to 135% for prime central London residential values. England In England, the average value of prime arable land increased by to 8,626 per acre during 2013. This follows an rise in 2012. During 2013, the strongest value growth was recorded across the eastern regions of the country with prime arable land increasing by to average just under 10,000 per acre in East Anglia, in the East Midlands and in the South East.