Transcription of Mortgage Application Guide 3 YEAR FIXED RATE MORTGAGE ...

1 Bank of China (UK) Limited is registered in England. Registered Number: 6193060. Registered Address: 1 Lothbury, London EC2R 7DB MORTGAGE Application Guide YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE 1. Bank of China (UK) Limited MORTGAGE interest rates are correct as of 21 March 2016. 2. The Bank of England base rate is a variable interest rate which can go up or down throughout the term of the loan.

2 Bank of England base rate is as at 21 March 2016. 3. All applications are subject to status, creditworthiness assessment, terms and conditions, and approval by Bank of China (UK) Limited. 4. The regulated MORTGAGE contract will be secured by a MORTGAGE on residential immovable property in the UK mainland only (excludes Northern Ireland). 5. APRC is variable. The actual rate available will depend upon your circumstances. Ask for a personalised illustration in branch. 6. On or before completion of your MORTGAGE , you are required to open a Bank of China (UK) Limited personal current account.

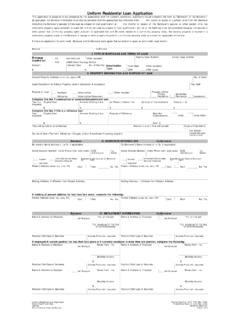

3 7. For more information, please email 3 YEAR FIXED RATE MORTGAGE (RESIDENTIAL) RATES EFFECTIVE FROM 21 MARCH 2016 Interest Rate (initial rate for the first 3 years) Final rate ( + Bank of England base rate) Final rate ( + Bank of England base rate) Final rate ( + Bank of England base rate) Final Rate ( + Bank of England base rate) The overall cost for comparison is APRC APRC 4% APRC APRC Loan to value Up to 60% Over 60% & Up to 80% Up to 75% Up to 70% Loan Amount From 50,000 & Up to 500,000 From 50,000 & Up to 500,000 Over 500,000 & Up to 1,000,000 Over 1,000,000 & Up to 5,000,000 Arrangement Fee 1295 1295 2495 of loan amount Booking Fee 299 299 299 299 Valuation Fee Based on purchase price.

4 Payable at the time of Application . Telegraphic Transfer Fee 35 for wiring the loan amount to your nominated solicitor. Deed Discharge Fee 95 payable when your MORTGAGE is redeemed fully. Early Repayment Charge 1% of the original loan amount. Payable only if the loan is fully repaid in the first year. Interest Calculation FIXED rate for the initial 3 years and variable rate after the initial 3 years / capital and interest repayment MORTGAGE / interest calculated daily Bank of China (UK) Limited is registered in England. Registered Number: 6193060.

5 Registered Address: 1 Lothbury, London EC2R 7DB MORTGAGE Application Guide YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE 1. Bank of China (UK) Limited MORTGAGE interest rates are correct as of 21 March 2016. 2. The Bank of England base rate is a variable interest rate which can go up or down throughout the term of the loan. Bank of England base rate is as at 21 March 2016.

6 3. All applications are subject to status, terms and conditions and approval by Bank of China (UK) Limited. 4. The MORTGAGE contract will be secured by a MORTGAGE on immovable property in the UK mainland only (excludes Northern Ireland). 5. APRC is variable. The actual rate available will depend upon your circumstances. Ask for a personalised illustration in the branch. 6. On or before completion of your MORTGAGE , you are required to open a Bank of China (UK) Limited personal current account. 7. For more information, please email 3 YEAR FIXED RATE MORTGAGE ( BUY-TO-LET ) RATES EFFECTIVE FROM 21 MARCH 2016 Interest Rate (initial rate for the first 3 years) Final rate ( + Bank of England base rate) Final rate ( + Bank of England base rate) Final rate ( + Bank of England base rate) Final rate ( + Bank of England base rate)

7 The overall cost for comparison is APRC APRC APRC APRC Loan to value Up to 60% Over 60% & Up to 75% Up to 70% Up to 65% Loan Amount From 50,000 & Up to 500,000 From 50,000 & Up to 500,000 Over 500,000 & Up to 1,000,000 Over 1,000,000 & Up to 5,000,000 Arrangement Fee 1895 1895 3195 of loan amount Booking Fee 399 399 399 399 Valuation Fee Based on purchase price. Payable at the time of Application . Telegraphic Transfer Fee 35 for wiring the loan amount to your nominated solicitor. Deed Discharge Fee 95 payable when your MORTGAGE is redeemed fully.

8 Early Repayment Charge 1% of the original loan amount. Payable only if the loan is fully repaid in the first year. Interest Calculation FIXED rate for the initial 3 years and variable rate after the initial 3 years / capital and interest repayment MORTGAGE / interest calculated daily Bank of China (UK) Limited is registered in England. Registered Number: 6193060. Registered Address: 1 Lothbury, London EC2R 7DB MORTGAGE Application Guide MORTGAGE Application DOCUMENT CHECKLIST 1. Application Forms Original completed and signed MORTGAGE Application Form Original completed and signed Application Form For Personal Account Original completed and signed Faxed Instructions Authority Note: Please ensure all signatures match ID provided to the Bank.

9 2. Proof of Identity Original or certified copy of valid passport, including photo ID page, signature page and UK VISA (if applicable) Original or certified copy of Resident Identity Card (if applicable), including both sides Note: Copy certified by a Bank of China Branch or local Notary Public Office is acceptable. 3. Proof of Address One of the following original documents showing applicant s name and residential address: Resident Registration / Utility Bill / Landline Bill / Council Tax Bill / Bank Account or Credit Card Statement Note: Bill or statement must be dated within the last 3 months.

10 4. Credit Reference Original credit reference issued by local credit agency dated within the last 3 months: UK: Experian, Equifax or Call Credit China Mainland: People s Bank of China Credit Report Hong Kong: Singapore: Malaysia: Bank Negara Malaysia Credit Report Note: If applicant has relocated, the Bank may ask for additional credit reports. 5. Proof of Deposit Original or certified copy of last 3 months bank statement showing sufficient funds to pay deposit Original bank reference letter dated within the last 3 months confirming sufficient account balance to pay deposit Original solicitor reference if deposit has been paid to solicitor If deposit is gifted, please provide donor s full name and residential address Note: Copy certified by a Bank of China Branch is acceptable.