Transcription of Motor Vehicle Tax Calculation Table

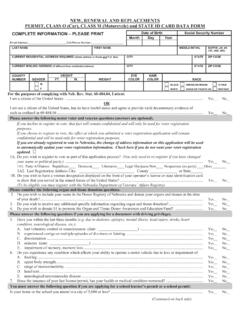

1 Motor Vehicle Tax Calculation TableMSRP Table for passenger cars, vans,motorcycles, utility vehicles and lightduty trucks w/GVWR of 7 tons or YearBase TaxAmount1 2345678910 & 1112 & 1314+95% (year 1)(see below)$0to$3,999$ $25$ $ $ $ $ $ $ $ $ $ $ $ $4,000to$5,999$ $35$ $ $ $ $ $ $ $ $ $ $ $ $6,000to$7,999$ $45$ $ $ $ $ $ $ $ $ $ $ $ $8,000to$9,999$ $60$ $ $ $ $ $ $ $ $ $ $ $ $10,000to$11,999$ $100$ $ $ $ $ $ $ $ $ $ $ $ $12,000to$13,999$ $140$ $ $ $ $ $ $ $ $ $ $ $ $14,000to$15,999$ $180$ $ $ $ $ $ $ $ $ $ $ $ $16,000to$17,999$ $220$ $ $ $ $ $ $ $ $ $ $ $ $18,000to$19,999$ $260$ $ $ $ $ $ $ $ $ $ $ $ $20,000to$21,999$ $300$ $ $ $ $ $ $ $ $ $ $ $ $22,000to$23,999$ $340$ $ $ $ $ $ $ $ $ $ $ $ $24,000to$25,999$ $380$ $ $ $ $ $ $ $ $ $ $ $ $26,000to$27,999$ $420$ $ $ $ $ $ $ $ $ $ $ $ $28,000to$29,999$ $460$ $ $ $ $ $ $ $ $ $ $ $ $30,000to$31,999$ $500$ $ $ $ $ $ $ $ $ $ $ $ $32,000to$33,999$ $540$ $ $ $ $ $ $ $ $ $ $ $ $34,000to$35,999$ $580$ $ $ $ $ $ $ $ $ $ $ $ $36,000to$37,999$ $620$ $ $ $ $ $ $ $ $ $ $ $ $38,000to$39,999$ $660$ $ $ $ $ $ $ $ $ $ $ $ $40,000to$41,999$ $700$ $ $ $ $ $ $ $ $ $ $ $ $42,000to$43,999$ $740$ $ $ $ $ $ $ $ $ $ $ $ $44,000to$45.

2 999$ $780$ $ $ $ $ $ $ $ $ $ $ $ $46,000to$47,999$ $820$ $ $ $ $ $ $ $ $ $ $ $ $48,000to$49,999$ $860$ $ $ $ $ $ $ $ $ $ $ $ $50,000to$51,999$ $900$ $ $ $ $ $ $ $ $ $ $ $ $52,000to$53,999$ $940$ $ $ $ $ $ $ $ $ $ $ $ $54,000to$55,999$ $980$ $ $ $ $ $ $ $ $ $ $ $ $56,000to$57,999$1, $1,020$ $ $ $ $ $ $ $ $ $ $ $ $58,000to$59,999$1, $1,060$ $ $ $ $ $ $ $ $ $ $ $1, $60,000to$61,999$1, $1,100$ $ $ $ $ $ $ $ $ $ $ $1, $62,000to$63,999$1, $1,140$1, $ $ $ $ $ $ $ $ $ $ $1, $64,000to$65,999$1, $1,180$1, $ $ $ $ $ $ $ $ $ $ $1, $66,000to$67,999$1, $1,220$1, $ $ $ $ $ $ $ $ $ $ $1, $68,000to$69,999$1, $1,260$1, $1, $ $ $ $ $ $ $ $ $ $1, $70,000to$71,999$1, $1,300$1, $1, $ $ $ $ $ $ $ $ $ $1, $72,000to$73,999$1, $1,340$1, $1, $ $ $ $ $ $ $ $ $ $1, $74,000to$75,999$1, $1,380$1, $1, $ $ $ $ $ $ $ $ $ $1, $76,000to$77,999$1, $1,420$1, $1, $ $ $ $ $ $ $ $ $ $1, $78,000to$79,999$1, $1,460$1, $1, $1, $ $ $ $ $ $ $ $ $1, $80,000to$81,999$1, $1,500$1, $1, $1, $ $ $ $ $ $ $ $ $1, $82,000to$83,999$1, $1,540$1, $1, $1, $ $ $ $ $ $ $ $ $1, $84,000to$85,999$1, $1,580$1, $1, $1, $ $ $ $ $ $ $ $ $1, $86,000to$87,999$1, $1,620$1, $1, $1, $ $ $ $ $ $ $ $ $1, $88,000to$89,999$1, $1,660$1, $1, $1, $ $ $ $ $ $ $ $ $1, $90,000to$91,999$1, $1,700$1, $1, $1, $1, $ $ $ $ $ $ $ $1, 's value when new60-3,185 January 1, 2012 Motor Vehicle Tax Calculation TableRegistration YearBase TaxAmount1 2345678910 & 1112 & 1314+95% (year 1)(see below)

3 Vehicle 's value when new$92,000to$93,999$1, $1,740$1, $1, $1, $1, $ $ $ $ $ $ $ $1, $94,000to$95,999$1, $1,780$1, $1, $1, $1, $ $ $ $ $ $ $ $1, $96,000to$97,999$1, $1,820$1, $1, $1, $1, $ $ $ $ $ $ $ $1, $98,000to$99,999$1, $1,860$1, $1, $1, $1, $ $ $ $ $ $ $ $1, $100,000andover$1, $1,900$1, $1, $1, $1, $ $ $ $ $ $ $ $1, TrailersBase TaxAmount0to1,000 10$ $10$ $ $ $ $ $ $ $ $ $ $ $ ,001 to1,999 25$ $25$ $ $ $ $ $ $ $ $ $ $ $ ,000 andover40$ $40$ $ $ $ $ $ $ $ $ $ $ $ VehiclesBase TaxAmount0to8,000 160$ $160$ $ $ $ $ $ $ $ $ $ $ $ ,001 to11,999 410$ $410$ $ $ $ $ $ $ $ $ $ $ $ ,000 andover860$ $860$ $ $ $ $ $ $ $ $ $ $ $ TaxAmountOver 7to9360$ $360$ $ $ $ $ $ $ $ $ $ $ $ $ $560$ $ $ $ $ $ $ $ $ $ $ $ $ $760$ $ $ $ $ $ $ $ $ $ $ $ $ $960$ $ $ $ $ $ $ $ $ $ $ $ , $ $1,160$1, $ $ $ $ $ $ $ $ $ $ $1, TaxAmountTrailers except semi trailers10$ $10$ $ $ $ $ $ $ $ $ $ $ $ $ $110$ $ $ $ $ $ $ $ $ $ $ $ $ $60$ $ $ $ $ $ $ $ $ $ $ $ $ $25$ $ $ $ $ $ $ $ $ $ $ $ $ $50$ $ $ $ $ $ $ $ $ $ $ $ $ $50$ $ $ $ $ $ $ $ $ $ $ $ $ $360$ $ $ $ $ $ $ $ $ $ $ $ a Motor Vehicle has a previous salvage brand on the title, the tax amount is reduced by 25%.

4 When a Motor Vehicle is registered which is newer than the current model year, the Motor Vehicle is subject to the initial tax in the first registration period and 95% of base tax in the 2nd registration period. Assembled cabin trailers, recreational vehicles and buses shall be designated as 6th year Motor vehicles in their first year of (ASVE) 7 ton or lessRegistered Weight, Weight, Over 7 TonsCategoryAssembled MC (HOMD)60-3,185 January 1, 2012 First Year100%Second Year90%Third Year80%Fourth Year70%Fifth Year60%Sixth Year51%Seventh Year42%Eighth Year33%Ninth Year24%Tenth and Eleventh Years15%Twelfth and Thirteenth Years7%Fourteenth Year and Older0% Vehicle TypeYears 1-5 Years 6-10 Years11 & AfterCars, trucks, utility vehicles & vans up to 7 tons - MSRP<$20, $ $ $ Cars, trucks, utility vehicles & vans up to 7 tons - MSRP=$20,000 to $39, $ $ $ Cars, trucks, utility vehicles & vans up to 7 tons - MSRP=$40,000 & $ $ $ Motorcycles & Assembled $ $ $ Cabin Traiilers & Recreational $ $ $ Trucks over 7 ton & Assembled Trucks over 7 $ $ $ $ $ $ Low-Speed $ $ $ $ $ $ $ $ $ Other trailers (including homemade)

5 $ $ $ Assembled 7 tons and $ $ $ The Motor Vehicle fee is calculated by multiplying the base fee times the fraction which corresponds to the age category of the YearFractionFirst through through and a Motor Vehicle is registered which is newer than the current model year, the Vehicle is subject to the initial Motor Vehicle fee for six registration Vehicle Fee CalculationMV Tax - Fraction Which Corresponds to the Age Category of Vehicle60-3,185 and 60-3,190 Updated 1/2012