Transcription of MUTUAL FUND Investor Guide THE ETF Investor Guide

1 1 Market Perspective: As Volatility Increases, Portfolio Rebalancing is CrucialThe Federal Reserve formally announced an ac-celerated taper and put three rate increases on the table for 2022. Economic growth remained strong, the dollar strengthened and inflation concerns were realized in hard data such as re-tail sales. Employment data showed the economy almost back to maximum employment. For the month ended December 15, the S&P 500 Index was buoyed by Apple (AAPL) and gained percent, but the small-cap Russell 2000 Index slid percent. Profitless tech companies bore the brunt of selling, while defensive sectors rallied to new all-time highs as investors opted for quality companies with positive earnings.

2 At the December FOMC meeting, the Federal Reserve announced the taper would end three months earlier in March, and via the dot plots, it indicated three rate hikes were possible. Only two days later, Christopher Waller, a member of the Board of Governors of the Federal Reserve, said that rate hikes should start in March, and the Fed could begin selling down its balance sheet in July. He also discussed how these public comments ar-en t random but are designed to shift the public s perception of policy. As happened in November, Federal Reserve Chairman Jerome Powell deliv-ered a dovish press conference that muddled the Fed s policy oil declined the last two times the Fed tapered, and Fed members no doubt expected a third drop, but Powell s dovish press conference sent oil higher by about $3 per barrel.

3 This in turn triggered more inflation trades in the market: the buying of energy, commodities and financials along with the selling of tapers have always increased volatility in some markets, most reliably commodities. This time, stocks and commodities are confused by Powell s dovish comments and what seems to be a major policy shift with inflation-fighting taking precedence over asset prices. Adding to risk are millions of novice investors entering the market during the pandemic. These investors have never known a Federal Reserve that didn t work aggres-sively to prevent asset price story short, the Federal Reserve has em-barked on a major policy shift, and the market has yet to fully understand the change.

4 The key variable for the near future is crude oil. If crude oil moves higher, inflation and inflation expecta-tions will rise, and the Federal Reserve will turn more hawkish. It will be as hawkish as it needs to be to rein in inflation. If oil falls enough, then the Fed will likely delay rate hikes. Still, the economy is close to full employment. Many people exited the workforce during the pandemic, and a portion of them decided to stay out. These mostly fall into two groups: early re-tirees and stay-at-home parents. While this trend could reverse over time, evidence suggests these are semipermanent shifts. Chairman Powell also admitted, when questioned on the subject, that the rising stock market has allowed people to re-tire early.

5 To some extent, the Federal Reserve is chasing its own tail if it maintains easy monetary policy in the hopes of boosting labor participa-tion. November s employment report was very strong. The headline number missed, but private analysts believe the government s seasonal adjustment model confuses pandemic reopening jobs with temporary workers. There were big adjustments to summer jobs numbers in September after the BLS did its revision. Analysts predict the same will happen in January or February, with a big revision that shows the economy added about 500,000 jobs in November. With unemployment down to percent, the economy is almost at full employment for everyone who wants a job. Moreover, supply chain disruptions, remaining lockdown policies and vaccine mandates are still causing some temporary unemployment.

6 The final piece for a more hawkish Federal Re-serve is inflation expectations and how that may impact consumer behavior. For months, sentiment surveys have shown that consumers believe now is the worst time to buy a car, a home or an ap-pliance. Those sentiment surveys ticked up in the FUND Investor GuideMatthew D. SauerFounder & Chief Investment OfficerMatthew Sauer is the Founder and Chief Investment Officer of the MUTUAL Fund Investor Guide family of newsletters. Each month he analyzes and provides buy, sell and hold recommendations for hundreds of MUTUAL funds and ETFs in three newsletters: The Investor Guide to Fidelity Funds, The ETF Investor Guide and The Investor Guide to vanguard is also the Founder and Chief Investment Officer of MDS Wealth Advisors, a Registered Investment Advisor that provides personalized investment ETF Investor Guide (continued on page 2)IN THIS ISSUE 1 Perspective 2 Model Portfolio Updates 4 Data & Rankings15 Fund Spotlight: ETFs for Rising VolatilityDECEMBER 20212 DECEMBER 2021 | PHONE: (888) 252-5372 THE ETF Investor Guidelatest readings, indicating a bottom may have been reached, but retail sales missed in November.

7 The Commerce Department reported percent growth in headline sales and percent in sales ex-autos. Economists forecast percent and percent growth in those numbers, respec-tively. Sales are measured by receipts, and the number is not adjusted for inflation. It is possible the volume of goods and ser-vices sold declined when measured in total units. Manufacturing and service PMIs dipped in December according to flash readings. Both remained well above the 50 level that marks the line between contraction and expansion. Companies are hiring and re-port minimal impact from the coronavirus. Worries about rising input prices dented optimism though. Wages, transportation and energy are all increasing faster than companies would like.

8 With volatility rising, investors have shifted into higher-quality stocks and more stable sectors. Consumer staples, real es-tate, healthcare and utilities were strong in December. vanguard dividend Appre-ciation (VIG) and iShares Minimum Volatility (USMV) outperformed all the major indexes. Some technology funds performed well, such as SPDR Technol-ogy (XLK). It gained percent because Apple is nearly 24 percent of the S&P 500 tech sector. Microsoft (MSFT) is close behind at 21 percent. Without Apple s 20 percent advance over the past month, XLK would have declined. For investors who have been late to rebalance their technol-ogy exposure, this may be a good time to take some profits. If history is any Guide , the major tech stocks will eventually de-cline, though not to the degree suffered by more speculative funds such as ARK Inno-vation (ARKK).

9 Apple and XLK are trad-ing near their all-time highs, but ARKK has declined nearly 40 percent from its February peak. China s economy is showing clear signs of a slowdown. The country relied on steel production to create higher GDP growth numbers for years, but production this au-tumn declined 20 percent from last year. Inflation is also likely masking slower growth. The producer price index in China is well into the double digits. Supply chain slowdowns are impacting factories, with new orders slowing. The country contin-ues seeing real estate developer defaults as they cannot repay foreign bonds for lack of foreign currency. The bank regulator raised the reserve requirement on foreign cur-rency loans in December.

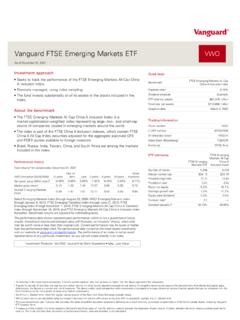

10 That will drain more foreign currency from the economy but also signals the government is growing concerned. China maintains strict capital controls to keep dollars and other foreign currency from easily flowing out of the country. Finally, after threatening a technical breakout against the dol-lar, the government intervened to push the yuan lower. We have seen this confluence of events before, and it has always had knock-on effects in emerging markets and commodities. The prior two times China s Market Perspective: As Volatility Increases, Portfolio Rebalancing is Crucial (continued)Model Portfolio UpdatesThe S&P 500 Index gained percent over the past month. The Dow Jones In-dustrial Average lost percent, the Nasdaq , the MSCI EAFE per-cent and the Russell 2000 Index S&P 500 Index has risen per-cent in 2021, the Nasdaq percent, the Dow Jones Industrial Average percent, the Russell 2000 Index per-cent and the MSCI EAFE percent.