Transcription of NEW JERSEY AUTO INSURANCE - State

1 AUTO INSURANCE NEW JERSEYBUYER S GUIDEPhil Murphy GovernorMarlene Caride CommissionerSheila Oliver Lt. GovernorWHAT'S INSIDEWHERE DO I START?.. 1 UNDERSTANDING YOUR 2-6 Types of CoveragesStandard and Basic PoliciesWhat are Limits and Deductibles?UNDERSTANDING YOUR 6-11 Personal Injury Protection (PIP) uninsured / underinsured motorist CoverageComprehensive coverage /Collision CoverageThe Right to SuePOLICY OPTIONS 12 WHERE TO GET MORE INFORMATION 13 Car INSURANCE is required in New JERSEY . Whether you are buying a newinsurance policy or renewing your current policy, you must make many decisionsabout what coverage you need and how much you can pay. The followingguide outlines how to make choices that work for YOUR NEEDS. Do you rent or own your own home?Do you have assets to protect (including income from a job)? Will your ownhealth INSURANCE cover auto accident injuries?

2 How much INSURANCE coveragecan you afford? These are some of the questions you should ask yourselfbefore choosing a specific coverage YOUR OPTIONS. Use this guide to learn about thewords and phrases used in auto policies. Know the many coverage the different benefits of each CONSUMER PROTECTIONS. As a New Jerseyauto INSURANCE consumer, you have rights. You have a right to fair and equaltreatment, and you have the right to get the information you need to makeinformed decisions. Agents, brokers and companies must inform you of your coverageoptions when applying for a new policy, or at any time upon yourrequest if you are already insured. You have the right to know howeach choice may affect what you pay and what your benefits wouldbe in the event of an accident. You always have the right to ask aboutadditional options. You can shop for auto INSURANCE at any time not just when yourpolicy is up for renewal, and if you find a better price, you can cancelyour old policy and seek a refund of your unused premium.

3 You have the right to change your coverages and policy limits atany time, even if you are not near your renewal date. If you selectoptions that save you money, you have a right to a refund of yourunused premium within 60 WHERE DO I START? 2 INSURANCE policies use terms that may be unfamiliar to the average driver. It isuseful to understand what these terms mean so you can make better, moreinformed decisions about your Your auto INSURANCE policy is divided into differentcoverages based on the type of claim that will be paid to you or COVERAGES are:PERSONAL INJURY PROTECTION Otherwise known as PIP, this is your medical coverage for injuries you (and others) suffer in an autoaccident. PIP pays if you or other persons covered under your policy areinjured in an auto accident. It is sometimes called no-fault coverage becauseit pays your own medical expenses no matter who caused the auto has two parts (1) coverage for the cost of treatment you receive fromhospitals, doctors and other medical providers and any medical equipmentthat may be needed to treat your injuries and (2) reimbursement for certainother expenses you may have because you are hurt, such as lost wages andthe need to hire someone to take care of your home or This coverage pays others for damages from an auto accidentthat you cause.

4 It also pays for a lawyer to defend you if you are sued fordamages that you are two kinds of liability coverage : BODILY INJURY andPROPERTY INJURY LIABILITY coverage Pays for claims andlawsuits by people who are injured or die as a result of an auto accident youcause. (See page 10 for lawsuit options). It compensates others for pain,suffering and economic damages, such as lost coverage is typically given as two separate dollar amounts: (1) an amountpaid per individual and (2) an amount paid for total injuries to all peopleinjured in any one accident that you cause. It can sometimes be purchased asa combined single limit, which offers a maximum limit of protection peraccident of bodily injury and property damage liability combined. UNDERSTANDING YOUR POLICYT ypes of CoveragesPROPERTY DAMAGE LIABILITY coverage Pays for claimsand lawsuits by people whose property is damaged as a result of an autoaccident you cause.

5 (May also be purchased as a combined single limitwith bodily injury liability coverage .) uninsured motorist coverage Pays you for propertydamage or bodily injury if you are in an auto accident caused by an motorist coverage Pays you for propertydamage or bodily injury if you are in an auto accident caused by a driver whois insured, but who has less coverage than your underinsured coverage Pays for damage to your vehicle as theresult of a collision with another car or other coverage Pays for damage to your vehiclethat is not a result of a collision, such as theft of your car, vandalism, flooding,fire or a broken windshield. However, it will pay if you collide with an YOUR POLICY UNDERSTANDING YOUR POLICY Types of Coverages continued 3 Jane purchases $100,000 in liabilitycoverage and $100,000 in underinsuredmotorist coverage .

6 Sam purchases only$15,000 in liability coverage . Sam crasheshis car into Jane s car, causing $25,000 indamages. Sam s INSURANCE company pays$15,000 of the damages, while Jane sinsurance company pays the remaining$10,000 from her underinsured ofUNDERINSUREDMOTORISTCOVERAGET here are two common types of auto INSURANCE policies in New JERSEY . Theyare referred to as STANDARD and BASIC. Both offer options as POLICY The Standard Policy provides anumber of different coverage options and the opportunity to buyadditional protection. The Standard Policy is the type of policychosen by most New JERSEY POLICY The Basic Policy usually costssignificantly less than a Standard Policy, but provides limitedbenefits. It is not for everyone, but it does provide enough coverageto meet the minimum INSURANCE requirements of New JERSEY Basic Policy could be an option for those with few familyresponsibilities and few assets to protect (including income froma job).

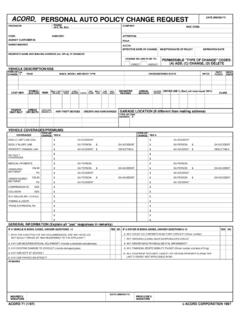

7 See chart on page 5 for differences between the STANDARD and YOUR POLICY UNDERSTANDING YOUR POLICYS tandard and Basic Policies 4 The Special Policy is a new initiativeto help make limited auto insurancecoverage available to drivers who areeligible for Federal Medicaid withhospitalization. Such drivers canobtain a medical coverage -onlypolicy at a cost of $365 a year. Formore information, ask your agent orcompany representative or call theDepartment of Banking andInsurance at POLICYFOR MEDICAIDRECIPIENTS ONLY 5 The chart below compares the differences between the STANDARD and BASIC policies:UNDERSTANDING YOUR POLICY UNDERSTANDING YOUR POLICY Standard and Basic Policies continued*permanent or significant brain injury, spinal cord injury or disfigurement or formedically necessary treatment of other permanent or significant injuries renderedat a trauma center or acute care hospital immediately following an accident anduntil the patient is stable, no longer requires critical care and can be transferred toanother facility in the judgment of the POLICYBASIC POLICYBODILYINJURYLIABILITYAs low as.

8 $15,000 per person,$30,000 per accidentAs high as:$250,000 per person,$500,000 per accidentCoverage is not included,but $10,000 for all persons,per accident, is available asan optionPROPERTYDAMAGE LIABILITYAs low as:$5,000 per accidentAs high as:$100,000 or more$5,000 per accidentPERSONAL INJURYPROTECTIONAs low as:$15,000 per person oraccidentAs high as:$250,000 or moreUp to $250,000 for certaininjuries* regardless ofselected limit$15,000 per person,per accidentUp to $250,000 for certaininjuries* uninsured /UNDERINSUREDMO TORISTCOVERAGEC overage is available up toamounts selected for liabilitycoverageNoneCOLLISIONA vailable as an optionAvailable as an option (fromsome insurers)COMPREHENSIVEA vailable as an optionAvailable as an option (fromsome insurers)LIMITS The maximum dollar amount the insurer will pay following anauto accident. Limits vary with each coverage within the Payments you have tomake before the insurerpays.

9 For example, a$750 deductible meansthat you pay the first $750of each YOUR POLICY UNDERSTANDING YOUR POLICYWhat are Policy Limits and Deductibles?DEDUCTIBLE OPTIONS In addition to anysavings you may realize from how much coverageyou buy, deductibles also provide savingsopportunities. Cost savings can be achieved bychoosing higher deductibles. Thus, if you feel youneed a high level of PIP coverage but want to reduceyour premium, you can save money by agreeing topay more out-of-pocket through a higher deductibleif you are injured in an auto accident. Your insurerwill pay the medical bills over the deductible amountyou choose. No matter what deductible you choose,there is also a 20 percent co-payment for medicalexpenses between the deductible selected and$5,000. That means you pay 20 percent, and yourinsurer pays 80 YOUR POLICYUNDERSTANDING YOUR OPTIONSP ersonal Injury Protection (PIP)John has a car accident.

10 Hisrepair shop estimates thecost of repairs at $2, pays $750 of the billand his INSURANCE companypays the higherdeductiblemay saveyou moneyon CARE PRIMARY Cost savings can also be achieved byusing your own health INSURANCE as a primary source of coverage in the caseof injury related to an auto accident. Before selecting this option, you shouldfind out if your health INSURANCE will cover auto accident injuries and howmuch coverage is provided. MEDICARE and MEDICAID cannot be usedfor the Health Care Primary PIP PACKAGE coverage These are additional benefitoptions provided under the STANDARD CONTINUATION If you cannot work due to accident-related injuries, this coverage pays lost wages, less Temporary DisabilityBenefits you may receive if your disability prevents you from working, upto the amount you SERVICES Pays for necessary services that younormally do yourself, such as cleaning your house, mowing your lawn,shoveling snow or doing laundry, if you are injured in an auto BENEFIT In the case of death, family members or estateswill receive any benefits not already collected under the incomecontinuation and essential services EXPENSE BENEFIT Pays for reasonable funeralexpenses up to the limit you select if you die as a result of an auto accident.