Transcription of NSE: HINDUNILVR ISIN: INE030A01027

1 Sensitivity: Confidential20th January, 2022 Stock Code BSE: 500696 NSE: HINDUNILVR ISIN: INE030A01027 Dear Sir / Madam,Sub: Outcome of the Board Meeting held on 20th January, 2022 This is further to our letter dated 4th January, 2022, intimating the date of Board Meeting for consideration of Unaudited Standalone and Consolidated Financial Results for the quarterended 31st December, 2021. 1. Pursuant to Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 ( Listing Regulations ), we would like to inform you that the Board in its meeting held today has approved the Unaudited Standalone and Consolidated Financial Results for the quarter ended 31st December, 2021.

2 We attach herewith a copy of the approved Unaudited Standalone and Consolidated Financial Results along with the limited review report of the auditors. A copy of the Press Release issued in this regard is also attached are arranging to publish these results in the newspapers as per Regulation 47 of Listing The Board of Directors in its meeting held today, based on the recommendation of the Nomination and Remuneration Committee have approved the re-appointment of Mr. Dev Bajpai (DIN : 00050516) as a Whole-time Director of the Company, whose term was expiring on 22nd January, 2022 for a further period of five consecutive years or till such time he holds office as a Whole-time Director, whichever is earlier, with effect from 23rd January, 2022, subject to statutory approvals as may be applicable.

3 Further, this is to confirm that Mr. Dev Bajpai, is not debarred from holding the office of Whole-time Director pursuant to any SEBI order or any such authority. None of the Directors of the Company are inter-se related to Mr. Dev Limited,Corporate Relationship Department,2nd Floor, New Trading Wing,Rotunda Building, Towers,Dalal Street,Mumbai 400 001 National Stock Exchange of India LtdExchange Plaza, 5th Floor,Plot No. C/1, G Block, Bandra Kurla Complex,Bandra (E),Mumbai 400 051 Sensitivity: ConfidentialPlease take the above information on record. Thanking You. Yours faithfully, For Hindustan Unilever Limited 6 DQMLY 0 HKWD &KDLUPDQ DQG 0 DQDJLQJ 'LUHFWRU DIN : Encl: as above SANJIV SOSHIL MEHTAD igitally signed by SANJIV SOSHIL MEHTA Date: 15:47:05 +05'30'B S R & Co.

4 LLPC hartered Accountants14th Floor, Central B Wing and North C Wing,Nesco IT Park 4, Nesco Center,Western Express Highway, Goregaon (East),Mumbai - 400 063, IndiaTelephone: +91 22 6257 1000 Fax:+91 22 6257 1010 Registered Office:B S R & Co. (a partnership firm with Registration No. BA61223) converted into B S R & Co. LLP (a Limited Liability Partnership with LLP Registration No. AAB-8181) with effect from October 14, 201314th Floor, Central B Wing and North C Wing, Nesco IT Park 4, Nesco Center, Western Express Highway, Goregaon (East), Mumbai - 400063 Limited Review Report on unaudited standalone financial results of Hindustan Unilever Limited for the quarter ended 31 December 2021 and year-to-date results for the period from 1 April 2021 to 31 December 2021 pursuant to Regulation 33 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015To the Board of Directors of Hindustan Unilever Limited1.

5 We have reviewed the accompanying Statement of unaudited standalone financial results of Hindustan Unilever Limited ( the Company ) for the quarter ended 31 December 2021 and year-to-date results for the period from 1 April 2021 to 31 December 2021 ( the Statement ).2. This Statement, which is the responsibility of the Company s management and approved by the Board of Directors, has been prepared in accordance with the recognition and measurement principles laid down in Indian Accounting Standard 34 Interim Financial Reporting ( Ind AS 34 ), prescribed under Section 133 of the Companies Act, 2013, and other accounting principles generally accepted in India and in compliance with Regulation 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

6 Our responsibility is to issue a report on the Statement based on our We conducted our review of the Statement in accordance with the Standard on Review Engagements (SRE) 2410 Review of Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Institute of Chartered Accountants of India. This standard requires that we plan and perform the review to obtain moderate assurance as to whether the Statement is free of material misstatement. A review is limited primarily to inquiries of company personnel and analytical procedures applied to financial data and thus provides less assurance than an audit. We have not performed an audit and accordingly, we do not express an audit Based on our review conducted as above , nothing has come to our attention that causes us to believe that the accompanying Statement, prepared in accordance with applicable accounting standards and other recognised accounting practices and policies has not disclosed the information required to be disclosed in terms of Regulation 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 including the manner in which it is to be disclosed, or that it contains any material B S R & Co.

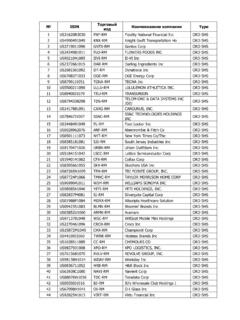

7 LLPC hartered AccountantsFirm s Registration No.:101248W/W-100022 Aniruddha GodbolePartnerMumbaiMembership No.: 10514920 January 2022 UDIN:22105149 AAAAAB9292 ANIRUDDHA SHREEKANT GODBOLED igitally signed by ANIRUDDHA SHREEKANT GODBOLE Date: 15:23:17 +05'30'Unaudited Results for Audited Results for thethe quarter endedyear ended30th September31st March202120202021202120202021 Revenue from operations12,900 11,682 12,516 Sale of products37,146 33,364 45,311 192 180 208 Other operating revenue585 500 685 91 97 113 Other income271 404 513 13,183 11,959 12,837 TOTAL INCOME38,002 34,268 46,509 EXPENSES3,875 3,420 4,092 Cost of materials consumed11,518 11,102 14,951 2,333 1,887 2,229 Purchases of stock-in-trade6,785 5,072 7,117 61 152 (163) 29 (253) (391)

8 657 556 582 Employee benefits expenses1,857 1,707 2,229 25 41 26 Finance costs62 99 108 255 272 265 Depreciation and amortisation expenses764 763 1,012 Other expenses1,189 1,388 1,215 Advertising and promotion3,428 3,324 4,737 1,698 1,605 1,637 Others4,856 4,545 6,029 10,093 9,321 9,883 TOTAL EXPENSES29,299 26,359 35,792 3,090 2,638 2,954 Profit before exceptional items and tax8,703 7,909 10,717 (66) (42) (0)Exceptional items [net credit/ (charge)](92) (241) (227) 3,024 2,596 2,954 Profit before tax8,611 7,668 10,490 Tax expenses(762) (614) (714) Current tax(2,016) (1,834) (2,458) (19) (61) (53) Deferred tax credit/(charge)(104) (23) (78) 2,243 1,921 2,187 PROFIT FOR THE PERIOD (A)6,491 5,811 7,954 OTHER COMPREHENSIVE INCOMEI tems that will not be reclassified subsequently to profit or loss2 2 1 Remeasurements of the net defined benefit plans5 6 (3) (1) (1)

9 (0) Tax on above(1) (2) 1 Items that will be reclassified subsequently to profit or loss6 (0) (7) Fair value of debt instruments through other comprehensive income(1) (0) (0) (2) 0 2 Tax on above0 0 0 10 21 39 Fair value of cash flow hedges through other comprehensive income52 53 70 7 (5) (8) Tax on above3 (43) (47) 22 17 27 OTHER COMPREHENSIVE INCOME FOR THE PERIOD (B)58 14 21 2,265 1,938 2,214 TOTAL COMPREHENSIVE INCOME FOR THE PERIOD (A+B)6,549 5,825 7,975 235 235 235 Paid up Equity Share Capital (Face value Re. 1 per share)235 235 235 Other Equity47,199 Basic (in Rs.) Diluted (in Rs.)

10 Per equity share (Face value of Re. 1 each)31st December31st December STANDALONE FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31ST DECEMBER, 2021(Rs in Crores)Changes in inventories of finished goods (including stock-in-trade) and work-in-progressUnaudited Results for theUnaudited Results forquarter endedParticularsnine months ended#(Rs in Crores)Unaudited Results for Audited Results forthe quarter endedthe year ended30th September31st March202120202021202120202021 Segment Revenue (Sales and Other operating income)4,193 3,409 3,838 - Home Care 11,828 10,119 13,959 5,175 4,841 5,000 - Beauty & Personal Care 14,748 13,415 17,964 3,466 3,356 3,622 - Foods & Refreshment 10,407 9,693 13,204 258 256 264 - Others (includes Exports, Consignment, etc.)