Transcription of O ffice of the New York State Comptroller Tiers 3, 4, …

1 Tiers 3, 4, 5 & 6 loan Application(For Members Covered by Articles 14, 15 or 22)RS 5025-A(Rev. 1/18) Office of the New york State Comptroller New york State and Local Retirement SystemReceipt DateMail completed form to:NEW york State AND LOCAL RETIREMENT SYSTEM110 State STREET - MAIL DROP 5-9 ALBANY NY 12244-0001 Please see pages 4 and 5 for instructions on completing this form. If you are not sure you are eligible for a loan , please call us toll-free at (866) 805-0990 or (518) 474-7736 in the Albany, New york must answer all questions in ink and the application must be signed and notarized, or it will be Information Security Number Registration Number (if known) Employees Retirement System (ERS) Police and Fire Retirement System (PFRS)Last NameFirst Mailing AddressStreet Address (Street or PO Box)Unit or Apt #Street AddressCityStateZip CodeHome PhoneWork/Cell PhoneExtension-()-()

2 -2 Required Information Must be Completed (See page 4 for instructions)If you participate in another retirement plan offered through your employer (such as a 457 deferred compensation plan, 403-a qualified annuity plan, 403-b tax sheltered annuity plan or 401 qualified trust), and have an existing loan through that plan, you must disclose this information or this loan application will be rejected. If you have memberships in both PFRS and ERS, and have an existing loan in one System at the time you apply for a loan in the second, you do not have to include this information below.

3 The balances required will be included automatically when you apply for your loan . The Internal Revenue Code requires us to consider these loan balances when we calculate the taxability of a loan from our System. Note that this may result in significant tax consequences on your loan from this System. (See tax information on page 5.) you have an outstanding loan balance with your current employer through any of the retirement plans noted above? No Go to 3 Ye s You must answer the following(If you have loan balances outstanding with more than one employer retirement plan, pleaseprovide the combined total of these balances in each section below) much money do you currently have invested in the retirement plan(s) from which yourloan(s) was issued?

4 Is your current total balance outstanding on your plan loan (s)? the past 12 months, what was your highest loan balance through this plan(s)?,.00$,.00$,.00$--RS 5025-A (Rev. 1/18) Page 2 of 5 See pages 4 and 5 for important information and instructions. Before choosing a loan type, call our automated information phone line toll-free at (866) 805-0990 or (518) 474-7736 in the Albany, New york area. Once you access the loan menu, you can receive specific information relating to your account for multiple and refinanced Type You must select ONLY ONE of the following or we cannot accept your loan Type 1 Check here if you want a loan and do NOT have an existing loan with loan Type 2 (This is called a multiple loan .)

5 Check here if you already have a loan with us and want to take another single repayment amount for multiple loans is higher than a single repayment on a refinanced loan Type 3 (This is called a refinanced loan .) Check here if you already have a loan with us and want to add to ! The taxable amount for a refinanced loan will always be greater than for a multiple loan , unless the entire amount of the refinanced loan is non-taxable. To avoid severe tax consequences, verify your taxable amount using our automated information line. I am aware of the possible tax consequences of taking a refinanced loan and authorize the Retirement System to processmy application as am applying for(Choose only one):i.

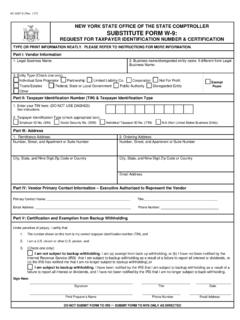

6 A maximum NON-TAXABLE loanii. A loan of: ,.00$iii. A maximum Repayment Amount(per pay period) MinimumORHigher Than MinimumIf you want to pay higher than the minimum required, and chooseLoan Type 2 (multiple loans), your payroll loan deduction will remain the same until all loans are paid or a new loan is taken.,.00$ Citizenship Status(Choose only one): Citizen* Resident Alien**If you are a CitizenorResident Alien: This form will be used as a substitute for the W-9 tax form. By completing and signing this formyou are agreeing to the certification statements outlined penalty of perjury, I certify that:1.

7 The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); am not subject to backup withholding because: (a) I am exempt from backup withholding or (b) I have not been notified by the InternalRevenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRShas notified me that I am no longer subject to backup withholding (you must cross out item 2 if you have been notified by the IRS you are currently subject to backup withholding because you failed to report all interest or dividends on your tax return), and3.

8 I am a citizen or other person (defined in the instructions) and4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. (Note: This item doesnot apply for the loan application.) Non-Resident Alien**If you are a Non-Resident Alien: You must submit a W-8 BEN tax form with your loan application. Please refer to the instructions section for directions to obtain this form. loan applications received without a W-8 BEN tax form will be rejected. Federal Taxes must be withheld for Non-Resident Aliens (skip section 4D).

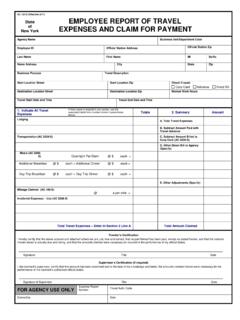

9 Tax Withheld If your loan is taxable, Federal law requires us to withhold 10 percent of the taxable amount of this loan , unless youcheck the box below (you may incur additional taxes and/or penalties if your withholding is insufficient). Federal withholding can significantlyreduce the loan amount payable to you. Do not deduct 10 percent withholding : If you are a CitizenorResident Alien living outside of the United states , we are required to deduct 10 percent federal withholding tax from your : If you are a Non-Resident Alien, we are required to deduct withholding from your loan in accordance with the tax treaty between the United states and your country.

10 In many instances, the amount withheld will exceed 10 percent and will result in the issuance of a loan check in an amount considerably less than the loan you are (Employer payroll from which loan repayments will be deducted) Frequency (Check one box only) Weekly Bi-Weekly Semi-Monthly Monthly Quarterly Semi-Annual Term(Check one box only) I am a 12-Month Employee I am a 10-Month Employee I am a Seasonal Employee,.00$RS 5025-A (Rev. 1/18) Page 3 of 56TO THE Comptroller OF THE State OF NEW york :I am applying for a loan from the Retirement System as shown above.