Ohio IT K-1

Oct 23, 2020 · Line 2b - Guaranteed payments and/or compensation (20% or greater investors only) Total Column: If, at any time during the tax year, the investor held at least a 20% interest in the profits or capital of the entity, enter total guaranteed payments (reported in box 4 of a federal K-1) or compensation (reported in box 1 of a W-2) paid to the ...

Tags:

Capital, Payments, Interest, Ohio, Guaranteed, Guaranteed payments

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

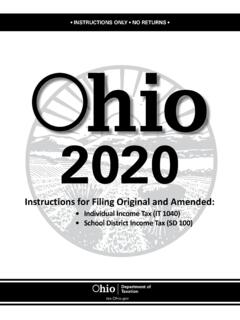

INSTRUCTIONS ONLY • NO RETURNS •

tax.ohio.govOhio Income Tax Tables. Beginning with tax year 2018, Ohio's individual income tax brackets have been adjusted so that taxpayers with income of $10,850 or less are not subject to income tax. Also, the tax brackets have been indexed for inflation per Ohio Revised Code section 5747.02(A)(5). Electronic Estimated Payments. Beginning with tax

2019 - Ohio Department of Taxation

tax.ohio.govThe Department of Taxation's website at tax.ohio.gov has many resources available to assist you when filing your Ohio individual income and school district income tax returns: FAQs – Review answers to common questions on topics such as business income and residency issues.

Department, Ohio, Taxation, Department of taxation, Ohio department of taxation

Employee’s Withholding Exemption Certificate

tax.ohio.govTaxation Employee’s Withholding Exemption Certificate IT 4 Rev. 12/20 As of 12/7/20 this new version of the IT 4 combines and replaces the following forms: IT 4 (previous version), IT 4NR, IT 4 MIL, and IT MIL SP. IT 4 Instructions Most individuals are subject to Ohio income tax on their

Ohio Employer Withholding Tax General Guidelines

tax.ohio.govAgricultural labor as defined in Division G of Section 3121 of Title 26 of the United States Code; 2. Domestic service in a private home, local college club, or local ... West Virginia or Pennsylvania, who work in and/or perform personal ... Corrections 1. To Employee and the Ohio Department of Taxation (W-2 or 1099-R). An employer must furnish ...

Virginia, Division, Employers, West virginia, West, Correction, Withholding, Employer withholding

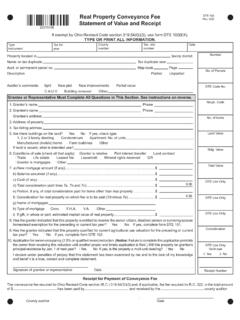

Real Property Conveyance Fee DTE 100 Statement of Value ...

tax.ohio.govg) List mortgagee or mortgagees (the party who advances the funds for a mortgage loan). h) Check type of mortgage. i) In the case of a gift, in whole or part, enter the estimated price that the real estate would bring in the open market. Line 8

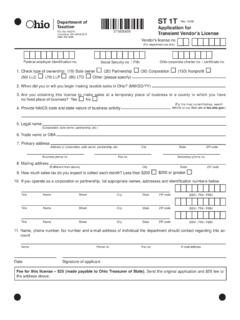

hio Department of ST 1T Taxation Application for Transient ...

tax.ohio.govNAICS on our Web site at $200 or greater hio Department of ST 1T Rev. 12/09 . Taxation . Application for. P.O. Box 182215 . 07100100. Columbus, OH 43218-2215 . …

OHIO IT 3

tax.ohio.govOhio IT 3. Transmittal of W-2 Statements. Instructions. 1. Filing Deadline: The Ohio IT 3 must be filed by January 31st or within 60 days after discontinuation of business.

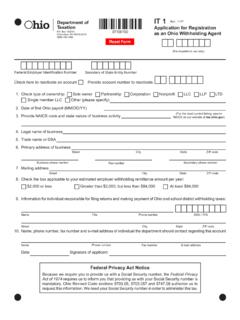

IT 1 Rev. - Ohio Department of Taxation > Home

tax.ohio.govFederal Employer Identification Number Check here to reactivate an account . Provide account number to reactivate. 1.Check type of ownership: Sole owner Partnership Corporation Nonprofit LLC …

INSTRUCTIONS ONLY • NO RETURNS •

tax.ohio.govThe reference to the federal 1040-NR-EZ, which is not in use for 2020, was removed from the line 13 instruction on page 15. The line 7a instruction was added on page 20 due to recent law changes. The heading for the $82,000 tax table on page 36 was corrected.

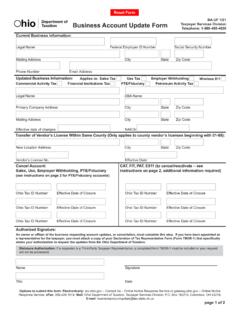

Current Business Information: Updated Business Information ...

tax.ohio.govobtain a new vendor’s license; however, you must complete this form to update your information with the Ohio Department of Taxation If you hold a permit issued by the Ohio Department of Commerce, Division of Liquor Control, the vendor’s license and permit must have the identical name and address as shown on the permit.

Related documents

Guaranteed Payments for Capital: Interest or Distributive …

www.gibsondunn.comGuaranteed Payments for Capital: Interest or Distributive Share? By Andrew Kreisberg Introduction It is common for partners who contribute capital to a partnership to receive some form of a preferred return on their investment. Preferred returns can be structured in many ways, and the ultimate tax characterization of those returns will ...

Capital, Payments, Interest, Shares, Guaranteed, Distributive, Guaranteed payments for capital, Interest or distributive, Interest or distributive share

1350 STATE OF SOUTH CAROLINA DEPARTMENT OF …

dor.sc.govLine 4: Guaranteed payments (from partnerships) In Column C, enter Column B guaranteed payments for use of capital that are not passive investment income. Do not include guaranteed payments for services. Line 5: Interest income Interest income is considered passive income and is not included in Column C unless it results from the sale of:

Capital, Payments, Interest, Guaranteed, Guaranteed payments

Form IT-204-IP New York Partner’s Schedule K-1 Tax Year 2021

www.tax.ny.govG Did the partner sell its entire interest during the tax year? ... 4 Guaranteed payments..... 4 4 5Interest income ... A – Partner’s distributive share items C – New York State amount Partner’s share of income, deductions, etc.

Payments, Interest, Guaranteed, Distributive, Guaranteed payments

Form CT-1065/CT-1120SI 2021

portal.ct.gov5b. If late, enter interest. Multiply the amount on Line 4 by 1% (.01). Multiply the result by the number of months or fraction of a month late. 5b. .00 5c. Interest on underpayment of estimated tax: See instructions. 5c. .00 5d. If annualizing estimated payments, check here: 5. Total penalty and interest: Enter the total of Lines 5a, 5b and 5c. 5.

SCHEDULE K-1 OWNER’S SHARE OF INCOME, CREDITS, …

revenue.ky.govGuaranteed payments to partners 6231 net gain IRC §1 (loss)(other than due to casualty or theft) 7 Other income (loss) (attach schedule) 8 Charitable contributions (attach schedule) 979 expense deduction (attach federal Form 4562 IRC §1 entucky Form 4562)and K 10 Deductions related to portfolio income (loss) (attach schedule)

For CALENDAR YEAR 2021 or FISCAL YEAR beginning Name n

www1.nyc.govment Capital Net Average Value (column C minus column D) Issuer's Allocation Percentage Value Allocated to NYC (column E X column F) % % (To treat cash as investment capital, you must include it on this line.) SCHEDULE D Investment Capital and Allocation and Cash Election 60442191 *60442191*

Partners’ Distributive Share Items—International

www.irs.govSCHEDULE K-2 (Form 1065) 2021 Partners’ Distributive Share Items—International Department of the Treasury Internal Revenue Service Attach to Form 1065.