Transcription of P:ScottBankruptcy BasicsBB 11.11 - United States …

1 BankruptcyBASICSA dministrative Officeof the United States CourtsBankruptcyBASICSB ankruptcy Judges DivisionAdministrative Officeof the United States CourtsNovember 2011 Revised Third EditionWhile the information presented is accurate as of the date of publication, it should not be citedor relied upon as legal authority. It should not be used as a substitute for reference to theUnited States bankruptcy Code (title 11, United States Code) and the Federal Rules ofBankruptcy Procedure, both of which may be reviewed at local law libraries, or to local rules ofpractice adopted by each bankruptcy court . Finally, this publication should not substitute forthe advice of competent legal ofCONTENTSI ntroduction 5 The Discharge in bankruptcy 9 Chapter 7. Liquidation Under the bankruptcy Code14 Chapter 13. Individual Debt Adjustment22 Chapter 11.

2 Reorganization Under the bankruptcy Code29 Chapter 12. Family Farmer or Family Fisherman Bankruptcy43 Chapter 9. Municipality Bankruptcy49 Chapter 15. Ancillary and Other Cross-Border Cases57 SCRA. Servicemembers Civil Relief Act60 SIPA. Securities Investor Protection Act64 bankruptcy Terminology71 bankruptcy BasicsA Publication ofthe bankruptcy Judges DivisionIntroductionBankruptcy Basics is designed to providebasic information to debtors, creditors, courtpersonnel, the media, and the general publicon different aspects of the federal bankruptcylaws. It also provides individuals who may beconsidering bankruptcy with a basicexplanation of the different chapters underwhich a bankruptcy case may be filed and toanswer some of the most commonly askedquestions about the bankruptcy Basics provides generalinformation only.

3 While every effort has beenmade to ensure that the information containedin it is accurate as of the date of publication, itis not a full and authoritative statement of thelaw on any particular topic. The informationpresented in this publication should not becited or relied upon as legal authority andshould not be used as a substitute forreference to the United States BankruptcyCode (title 11, United States Code) and theFederal Rules of bankruptcy importantly, bankruptcy Basics shouldnot substitute for the advice of competentlegal counsel or a financial expert. Neither theBankruptcy Judges Division nor theAdministrative Office of the United StatesCourts can provide legal or financial advice may be obtained from acompetent attorney, accountant, or ProcessArticle I, Section 8, of the United StatesConstitution authorizes Congress to enact uniform Laws on the subject ofBankruptcies.

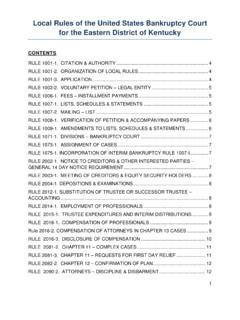

4 Under this grant of authority,Congress enacted the bankruptcy Code in1978. The bankruptcy Code, which iscodified as title 11 of the United States Code,has been amended several times since itsenactment. It is the uniform federal law thatgoverns all bankruptcy procedural aspects of the bankruptcyprocess are governed by the Federal Rules ofBankruptcy Procedure (often called the bankruptcy Rules ) and local rules of eachbankruptcy court . The bankruptcy Rulescontain a set of official forms for use inbankruptcy cases. The bankruptcy Code andBankruptcy Rules (and local rules) set forththe formal legal procedures for dealing withthe debt problems of individuals andbusinesses. There is a bankruptcy court for each judicialdistrict in the country. Each state has one ormore districts.

5 There are 90 bankruptcydistricts across the country. The bankruptcycourts generally have their own clerk court official with decision-makingpower over federal bankruptcy cases is theUnited States bankruptcy judge, a judicialofficer of the United States district court . Thebankruptcy judge may decide any matterconnected with a bankruptcy case, such as6eligibility to file or whether a debtor shouldreceive a discharge of debts. Much of thebankruptcy process is administrative,however, and is conducted away from thecourthouse. In cases under chapters 7, 12, or13, and sometimes in chapter 11 cases, thisadministrative process is carried out by atrustee who is appointed to oversee the debtor s involvement with the bankruptcyjudge is usually very limited.

6 A typicalchapter 7 debtor will not appear in court andwill not see the bankruptcy judge unless anobjection is raised in the case. A chapter 13debtor may only have to appear before thebankruptcy judge at a plan confirmationhearing. Usually, the only formal proceedingat which a debtor must appear is the meetingof creditors, which is usually held at theoffices of the trustee. This meeting isinformally called a 341 meeting becausesection 341 of the bankruptcy Code requiresthat the debtor attend this meeting so thatcreditors can question the debtor about debtsand fundamental goal of the federal bankruptcylaws enacted by Congress is to give debtors afinancial fresh start from burdensome Supreme court made this point about thepurpose of the bankruptcy law in a 1934decision:[I]t gives to the honest but new opportunity in life and a clearfield for future effort, unhampered by thepressure and discouragement of Loan Co.

7 V. Hunt, 292 234, 244(1934). This goal is accomplished through thebankruptcy discharge, which releases debtorsfrom personal liability from specific debts andprohibits creditors from ever taking any actionagainst the debtor to collect those debts. Thispublication describes the bankruptcydischarge in a question and answer format,discussing the timing of the discharge, thescope of the discharge (what debts aredischarged and what debts are notdischarged), objections to discharge, andrevocation of the discharge. It also describeswhat a debtor can do if a creditor attempts tocollect a discharged debt after the bankruptcycase is concluded. Six basic types of bankruptcy cases areprovided for under the bankruptcy Code, eachof which is discussed in this publication.

8 Thecases are traditionally given the names of thechapters that describe 7, entitled Liquidation, contemplatesan orderly, court -supervised procedure bywhich a trustee takes over the assets of thedebtor s estate, reduces them to cash, andmakes distributions to creditors, subject to thedebtor s right to retain certain exemptproperty and the rights of secured there is usually little or nononexempt property in most chapter 7 cases,there may not be an actual liquidation of thedebtor s assets. These cases are called no-asset cases. A creditor holding anunsecured claim will get a distribution fromthe bankruptcy estate only if the case is anasset case and the creditor files a proof ofclaim with the bankruptcy court . In mostchapter 7 cases, if the debtor is an individual,he or she receives a discharge that releaseshim or her from personal liability for certaindischargeable debts.

9 The debtor normallyreceives a discharge just a few months afterthe petition is filed. Amendments to theBankruptcy Code enacted in to theBankruptcy Abuse Prevention and Consumer7 Protection Act of 2005 require the applicationof a means test to determine whetherindividual consumer debtors qualify for reliefunder chapter 7. If such a debtor s income isin excess of certain thresholds, the debtor maynot be eligible for chapter 7 13, entitled Adjustment of Debts ofan Individual With Regular Income, isdesigned for an individual debtor who has aregular source of income. Chapter 13 is oftenpreferable to chapter 7 because it enables thedebtor to keep a valuable asset, such as ahouse, and because it allows the debtor topropose a plan to repay creditors over time usually three to five years.

10 Chapter 13 isalso used by consumer debtors who do notqualify for chapter 7 relief under the meanstest. At a confirmation hearing, the courteither approves or disapproves the debtor srepayment plan, depending on whether itmeets the bankruptcy Code s requirements forconfirmation. Chapter 13 is very differentfrom chapter 7 since the chapter 13 debtorusually remains in possession of the propertyof the estate and makes payments to creditors,through the trustee, based on the debtor santicipated income over the life of the chapter 7, the debtor does not receivean immediate discharge of debts. The debtormust complete the payments required underthe plan before the discharge is received. Thedebtor is protected from lawsuits,garnishments, and other creditor actions whilethe plan is in effect.