Transcription of Pension Reforms in India - Cognizant

1 Pension Reforms in IndiaPension Reforms are yet to benefit a large section of the Indian population. Significant changes on the policy and regulatory fronts, better marketing and better pricing of products can give this sector a much-needed SummaryLife expectancy has shot up in recent decades. When public Pension systems were first estab-lished, people could typically look forward to only a few years of retirement if any. Today, globally, the probability of a newborn boy surviving until age 65 is over 80%; the figure is over 90% for a girl child. Aging populations are a high-class problem, said President Bill Clinton in his 1999 State of the Union address. He continued: It s the result of something wonderful: the fact that we are living a lot longer. Nevertheless, there is no denying that aging populations pose significant challenges for economic, social and health policies in general and Pension systems in is no exception to this global trend.

2 Demographic projections indicate that the share of the aged will rise to 9% of the total popula-tion by 2016 and to by 2026. Life expec-tancy has increased significantly in India , thanks to economic development and better access to medical care. This also means that a significant percentage of the population is expected to live beyond 75 years of age. Therefore, it is essential that a formal mechanism of benefits to reach a large section of the aged population is in place and cost-effective products are available to the population for creating a retirement of Pension ReformsIndia does not have a universal social security sys-tem. A large number of India s elderly are not cov-ered by any Pension scheme. Pension Reforms and a Pension system with greater reach will not only ensure citizens welfare in their golden years but will also help the central and state governments cut their future liabilities.

3 With these broad objec-tives in mind, the government of India set up an expert committee in 1998 to devise a new Pension system for India . Project Oasis, which was chaired by Dave, submitted its report in The report recommended setting up a new Pension system in India . It recommended creating a Pension system based on individual retirement accounts (IRAs). An individual would save and accumulate assets through his entire working life. Upon retirement, the individual would be able to use his Pension assets to buy annuities from annuity providers and obtain a monthly Pension . The Pension amount would be governed by what the employees Pension fund account could earn from market investments. Cognizant 20-20 insights | june 2013 Cognizant 20-20 Insightscognizant 20-20 insights2 This was a paradigm shift, from the existing defined returns philosophy to a defined contribu-tions philosophy.

4 The committee suggested creating a profession-ally managed system with a large base of Pension account holders across all sectors of the economy and centralized record-keeping. The proposed system would ensure fair competition among professional fund managers so as to provide a wide range of choices to employers and fair market-linked returns to the account line with the above recommendations, the government set up its New Pension System (NPS), India 's answer to the 's 401(k) The NPS was launched in 2004 for central and state government employees, who had to subscribe mandatorily. In 2009, it was thrown open to all Indian citizens in the 18-60 age group. However, it has failed to take off in the voluntary segment given the anemic subscriptions from the private sector (see Figure 1).

5 Challenges in ImplementationThe scheme s lack of popularity has been attributed to several factors, such as weak incen-tives to intermediaries, a lack of awareness among the general population, insufficient mar-keting and promotion of the product and lower returns compared to other investment options. The scheme has delivered 5% to 12% returns in the past three years. Compare this to a return of for employees provident fund for the financial year 2012-13, % for Public provident fund and and from National Savings Certificate for five and 10 years, closer look at the finer elements of the scheme reveals that there are other issues that need to be addressed to improve investor sentiment for this product. One of the most important issues is the tax treatment. There is no clarity on the taxation of funds at withdrawal.

6 In India , returns from annuity insurance plans are not exempt from taxation. Another significant impediment is the compulsory annuity feature of the scheme. Even on maturity, the account holder can withdraw only up to 60% of the accumulated sum. The remaining amount has to be used to buy annui-ties, the returns from which are not tax-exempt. Also, the annuity can be bought only from one of the six PFRDA-approved insurers. This restricts the investor s fact that the scheme caps equity exposure at 50% is a dampener for younger investors, who usually have a higher appetite for risk and would prefer a larger equity allocation. Also, the scheme faces stiff competition from the mandatory employees provident fund (EPF), which remains the main retirement savings instrument for a majority of Indian employees.

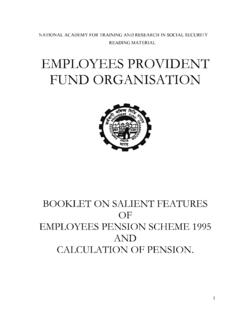

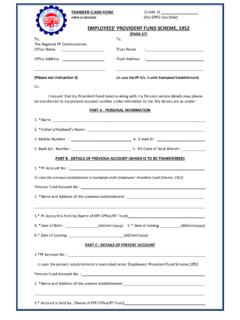

7 Given the mandatory retirement contribution to EPF, employees are reluctant to put in additional money in challenge is to popularize this scheme in the unorganized sector where financial literacy is poor and workers rarely have surplus money to invest. NPS has come up with a scheme, Swalam-ban Yojana,5 which seeks to target this sector. Under the scheme, the government contributes 1,000 rupees per year for three years for each NPS account opened in the past three financial years. However, this is not a sustainable model in the long run. For this scheme to survive with-out government funding, awareness campaigns and marketing targeted to this segment of the working population are NPS Status as of March 2, 20133 Figure 1Sl. of SubscribersCorpus Under NPS (in billion rupees)1 Central Government11,25, Government15,85, Sector2,02, ,79, ta l44,93, 20-20 insights3 Managing the ShiftIn defined contributions models, the burden of changes in life expectancy is borne by individual retirees in the form of lower pensions.

8 When people retire in a defined-contribution plan, the accumulated contributions and investment returns is converted from a lump sum into a regular Pension payment, known as an annuity. The calculation of the annuity is based on projected life expectancy of retirees at the time of retirement. Pension replacement rates the percentage of a worker s pre-retirement income that is paid out by a Pension program upon the worker s retirement will therefore be automatically lower as people live India s Pension system, the shift from a defined benefits model to a defined contribu-tions model will impact pensioners. The defined benefits model has some advantages such as a stable income replacement rate with market and longevity risk borne by the employers. In contrast, in defined contribution plans the amount of retirement income cannot be known in advance.

9 The move to a defined contribu-tion plan would require employees to carry out complex financial calculations in both the asset accumulation and retirement phases. Policy mak-ers would need to design simple default solutions that do not require complex calculations. They would also need to assume the responsibility of creating greater awareness among pensioners ChileUnited KingdomNetherlandsFranceSwedenChinaAustr aliaIndiaSingaporeJapanKoreaSwitzerlandG ermanyPolandCanadaBrazilUnited StatesDenmarkGlobal Grades for Pension SystemSource: Melbourne Mercer Global Pension Index October 2012 Figure 2 GradeIndex ValueCountriesDescriptionA>80 DenmarkA first class and robust retirement income system that delivers good benefits, is sustainable and has a high level of +75 80 Netherlands & AustraliaA system that has a sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade 75 Sweden, Switzerland & CanadaC+60 65UK & ChilieA system that has some good features, but also has major risks and/or shortcomings that should be addressed.

10 Without these improvements, its efficacy and/or long-term sustainability can be 60 USA, Poland, Brazil, Germany, Singapore & FranceD35 50 China, Korea (South), Japan & IndiaA system that has some desirable features, but also has major weaknesses and/or omissions that need to be addressed. Without these improvements, its efficacy and sustainability are in < 35 NilA poor system that may be in the early stages of development or a nonexistent 20-20 insights4who have shifted to the defined contributions model and educate them on the intricacies of the risks and returns from each type of plan. Treat-ment of the corpus in line with the employees provident fund or the Public provident fund (no tax is levied at the investment, accumulation or withdrawal stages) would certainly help increase the popularity and acceptance of the defined contributions life expectancy continues to increase, annuity providers will be expected to provide regular monthly benefits to retirees for longer periods.