Transcription of Real Estate Customs by State Yes No Customary Standard Fee ...

1 Information at your fingertipsAt First American Title National Commercial Services, we want to make your job s why we created this helpful State -by- State guide. Containing valuable information, this guide provides a detailed look at local Customs throughout the nation. If you need more information, please reach out to your local First American Title National Commercial Services representative. The content of this brochure is for informational purposes only and is not and may not be construed as legal advice. First American Financial Corporation is not a law firm and does not offer legal services of any kind. No third party entity may rely upon anything contained herein when making legal and/or other determinations regarding title practices. You should consult with an attorney prior to embarking upon any specific course of American Title Insurance Company, and the operating divisions thereof, make no representation as to the accuracy or completeness of the information contained in this guide; and First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions.

2 First American, the eagle logo, First American Title, and are registered trademarks or trademarks of First American Financial Corporation and/or its Title is a subsidiary of First American Financial Corporation. 2018 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAFR ecordation Tax, State Transfer Tax and Country Transfer Tax Counties vary; may haveDocument Stamp, Recording Taxand County Transfer TaxYes; most documents must be approved by a Maryland attorney prior to recordationTitle Insurance RatesForm of ConveyanceState Encumbrance FormsAttorney StatePreliminary Report or CommitmentDeed Transfer TaxMortgage TaxLeasehold TaxExcludes leases with terms of less than 30 years including options to renewNo title insurance companies are licensed within the State . Title policies written outside RateFiled RateFiled RateNot FiledFiled RateFiled RateFiled RateFiled RateFiled RatePromulgated Rate by State Insurance DepartmentPublished RatePosted RateFiled RateNot FiledFiled RateFiled RateFiled RateFiled RateFiled Rate up to $1 millionFiled RateNot FiledFiled Rate up to $1 millionNot FiledFiled RateNot Filed Warranty Deed or Act of SaleWarranty DeedWarranty DeedWarranty DeedWarranty DeedGrant DeedWarranty Deed, Special Warranty Deed, Bargain and Sale Deed (rare), or Quitclaim DeedWarranty DeedQuitclaim DeedSpecial Warranty DeedSpecial Warranty DeedSpecial Warranty Deed or Warranty DeedWarranty DeedWarranty DeedCustomary (non-statutory) forms.

3 Warranty Deed, bargain and sale, and Quitclaim Deed Warranty Deed, Special Warranty Deed, Quit-Claim DeedWarranty DeedWarranty DeedWarranty Deed, Special Warranty Deed, Quit-Claim DeedWarranty DeedWarranty DeedSpecial Warranty Deed (preferred)Quitclaim Deed Warranty DeedWarranty DeedWarranty DeedWarranty DeedWarranty DeedDeed of Trust/PublicTrustee for each CountyMortgageDeed of TrustDeed of TrustMortgageDeed of TrustMortgageDeed of TrustMortgageMortgageDeed of Trust withPrivate Power of SaleMortgageDeed to Secure DebtMortgage (rare)MortgageDeed of TrustMortgageMortgageMortgageMortgageMor tgageMortgageMortgageMortgageMortgage (rare) and Deed of TrustMortgageMortgageDeed of TrustDeed of TrustMortgageVaries by locationLicensed LA attorney must examine title & render written title opinion. All commitments & policies must be signed by LA Licensed ProducerCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyPreliminary Report; Commitment upon requestCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyPreliminary Report.

4 Commitment upon RequestCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyCommitment OnlyDocumentary FeeCity Transfer Fee (in some cities)Recordation TaxBased on full consideration set forth in Affidavit of ValueCounty Documentary Transfer Tax City Tax (in some cities)City Conveyance TaxState Conveyance TaxState Transfer TaxLocal Transfer TaxTransfer Tax Recordation TaxReal Estate Transfer Tax must be accompanied by Real Estate Transfer Tax Declaration FormState Conveyance Tax Certificate Form must accompany Deeds, Leases & Assignments thereof, and Agreements of SaleDocumentary Stamp Tax plus surtax (in Miami-Dade County) State , County and in some cases, a Municipal Transfer TaxReal Estate Transfer Tax. A Real Estate Transfer Declaration of Value and a Ground Water Hazard Statement must accompany all Deeds to be Validation Questionnaire must accompany all Deeds to be recordedOrleans Parish OnlyA Declaration of Value must accompany Deeds to be recordedDeed stamps based on consideration in Deed.

5 Extra county taxes in Barnstable. Land Bank fee in Dukes & Nantucket CountiesBased on full consideration set forth on face of Deed or on a Real Estate Transfer Tax Valuation AffidavitState Deed Tax. A Certificate of Real Estate Value and Well Disclosure Certificate must accompany all Deeds to be recordedYesRecordation Tax on Money loaned subject to any applicable exemptionsBoth Documentary Stamp Tax & Non-Recurring Intangible TaxIntangible Recording TaxMortgage Registration TaxDocumentary transfer tax inOrleans Parish OnlyMortgage Registry TaxYes Unless duration is tantamount to a conveyance, , 99 yearsUnless lease exceeds 5 yearsNo: Unless there is a determinable consideration other than the future duty to pay rent (for example, assignment of leasehold)Applied where unexpired term is for 5 years or more See Deed Transfer TaxAssignments of lessee s interest in a lease with a term of 30 years or more.

6 Affects State , county, Chicago and other municipalities. Chicago also taxes creation of long-term ground Parish OnlyYes: State Transfer and State Recording Tax do not apply to leases of 7 years or less with renewals of 7 years or less; County Transfer Tax variesUnless duration is tantamount to a conveyance, , 99 yearsOwner s PolicyLoan PolicySearch: Exam, Attorney, Abstract FeesTransfer TaxesEscrow FeesRecording/Filing FeesNegotiable, usually SellerNegotiableVariesNegotiable, usually BuyerNegotiable, usually SellerNegotiable, usually SellerNegotiableSeller 60%NegotiableNegotiable, usually BuyerNegotiable, usually BuyerVaries by County - NEGOTIABLEN egotiableNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiableIncluded in premiumIncluded in premiumIncluded in premium, for most counties except for multi-chains of title or special servicesIncluded in premiumNegotiable, usually SellerNegotiableNegotiable, usually SellerMay be charged as Additional FeesIncluded in premiumNegotiableIncluded in premiumNegotiable, usually paid by SellerNegotiable.

7 Usually BuyerVaries by County - NEGOTIABLEN/ADivided EquallyAll deeds must be accompanied by a Conveyance Tax Return even if transfer is exemptN/A Affidavit of Real Property Value must be submitted with deed for recording. Seller pays for SplitN/ANegotiable, usually SellerBuyer pays Recordation Tax Seller pays Transfer TaxN/AN/ANegotiable, usually Divided EquallyVariesDivided EquallyN/AN/ANegotiableDivided EquallyNegotiableVaries by CountyNegotiableDivided EquallyDivided EquallyNegotiable, usually Divided EquallyDivided EquallyNegotiableDivided EquallyNegotiable, usually Divided EquallyNegotiable, Divided Equally if purchase contract silentNegotiable. Divided equally unless otherwise negotiatedShared by partiesNegotiableNegotiableDivided EquallyNegotiableNegotiable, usually Divided EquallyNegotiable, usually SellerSeller pays pre-closing exam and abstractingBuyer pays post-closing chargesNegotiableSeller pays recording fees on documents needed to clear titleNegotiable, usually BuyerDivided EquallyBuyer pays to record Deed & MortgageSeller pays for recording docs to remove encumbrancesBuyer pays all other recording feesSeller pays for recording release of encumbrancesBuyer pays for recording Deed & Mortgage documentsSeller pays for recording of releasesNegotiableNegotiableVariesBuyer pays all other recording feesSeller pays release of encumbrancesBuyer pays to record Deed & MortgageSeller pays for recording docs to remove encumbrancesVaries by County - NEGOTIABLE.

8 NORMALLY BUYERB uyer SellerCustomary Standard Fee SplitsBuyer 40%Buyer pays instruments of conveyance & financingSeller pays instruments to clear titleBuyer pays recording feesSeller pays release recording feesSeller pays pre-closing and abstract chargesBuyer pays post-closing chargesUCC Status: Nearly all states are authorized for UCC Designation: Property & Casualty States: Alabama, arizona , Arkansas, Colorado, Connecticut, Georgia, Idaho, Indiana, Kansas, Kentucky, Michigan, and Minnesota, Mississippi, and Missouri, Nebraska, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oregon, Pennsylvania South Carolina, Tennessee. Title Insurance States: Alaska, California, Delaware, District of Columbia, Florida, Hawaii, Illinois, Iowa, Louisiana, Maine, Maryland, Massachusetts, Montana, Nevada, New York, North Dakota, Oklahoma, Rhode Island, South Dakota, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, pays County taxCity tax variesBuyer pays for Deed of Trust or MortgageSeller pays to record conveyance Deed and release docsBuyer pays for recording Deed and Mortgage docsSeller pays for recording of releasesLocal transfer tax determined by municipal ordinanceSeller pays State and CountyBuyer pays loan policy chargesSeller pays any abstract charges fees varyNegotiable.

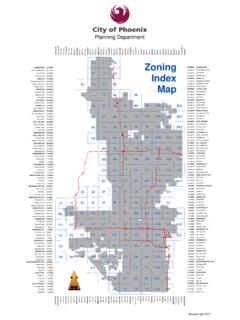

9 Usually Buyer pays for instruments of conveyance and financingSeller pays for instruments to clear titleNegotiableBuyer pays recording feesSeller pays release recording feesNegotiableNegotiableBuyer pays for recording of DeedBuyer pays for recording of DeedNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually BuyerNegotiable, usually Buyer for recording fees and Seller for removing encumbrancesNegotiable, usually SellerStateAlabamaAlaskaArizonaArkansasC aliforniaColoradoConnecticutDelawareDist rict of ColumbiaFloridaGeorgiaHawaiiIdahoIllinoi sIndianaIowaKansasKentuckyLouisianaMaine MarylandMassachusettsMichiganMinnesotaMi ssissippiMissouriReal Estate Customs by StateFirst American Title National Commercial ServicesYes NoYes: Applies to all leases of 35 years or more; whether options to extend are counted for lease term varies by CountySeller pays for Standard coverage of premiumNegotiable, usually Buyer pays for extended coverage portion of premiumYour Guide toReal EstateCustoms by StateBuyer SellerCustomary Standard Fee SplitsNegotiable, usually Buyer pays for extended coverage portion of premium.

10 Seller pays for Standard coverage of premiumSeller pays Standard coverage portion buyer pays additional for extendedNegotiableNegotiable, usually SellerNegotiableNegotiable, usually BuyerNegotiable, usually Buyer pays for extended coverage portion of premium. Seller pays for Standard coverage of premiumNegotiable, usually SellerNegotiableSplit is required only when licensed abstractor must signNegotiableDivided EquallyNegotiable, usually buyerNegotiableSplit is required only when licensed abstractor must signNegotiableNegotiable, usually BuyerNegotiable, usually BuyerIncluded in premiumNegotiableIncluded in premiumIncluded in premiumSeller pays for abstract onlyAttorneys Opinions vary by local practice; abstract fees are various rates filed by each abstract companyIncluded in premiumIncluded in premiumSearch, etc. are NOT included in premium, fees established by attorney-agentVaries by CountyNegotiable except in those counties where search and exam fees are included in the premiumIncluded in premiumIncluded in premium; may be additional Special Project chargeNegotiableIncluded in premiumNegotiableIncluded in premiumBuyer; Exam fees not included in premium; fees established by examining pays; $ per thousandSeller pays but can be negotiatedDivided EquallyN/AOnly in Washington County Negotiable, but customarily divided equallyDivided Equally$ $1000N/AN/AExcise tax up to percent of the sales price plus a $ State Technology feeN/ANegotiable, usually divided equallyDivided EquallyDivided EquallyNegotiable - customarily divided equallyN/ANegotiableNegotiable, usually Divided EquallyNegotiableDivided EquallyIncluded in premiumNegotiableNegotiableVaries by CountyDivided Equally.