Transcription of RESIDENT, NON-RESIDENT AND PART-YEAR RESIDENT …

1 Form 80-100-18-8-1-000 (Rev. 10/18). RESIDENT , NON-RESIDENT . AND. PART-YEAR RESIDENT . INCOME TAX INSTRUCTIONS. 2018. INDIVIDUAL INCOME TAX BUREAU. PO BOX 1033. JACKSON, MISSISSIPPI 39215-1033. TABLE OF CONTENTS. WHAT'S NEW! 3. LEGISLATIVE AND OTHER CHANGES 3. REMINDERS 3. FILING REQUIREMENTS 4. DO I HAVE TO FILE? 4. AM I A RESIDENT OR A NON-RESIDENT ? 4. WHEN AND WHERE SHOULD I FILE? 4. LINE ITEM INSTRUCTIONS 5. FORMS 80-105 AND 80-205 5. TAXPAYER INFORMATION 5. FILING STATUS AND EXEMPTIONS 5. MISSISSIPPI ADJUSTED GROSS INCOME 7. DEDUCTIONS 7. TAX AND CREDITS 7. PAYMENTS 8. REFUND OR BALANCE DUE 9. INCOME 10. ADJUSTMENTS 12. NON-RESIDENTS AND PART-YEAR RESIDENTS 14. FORM 80-107 15. FORM 80-108 15. SCHEDULE A ITEMIZED DEDUCTIONS 15. SCHEDULE B INTEREST AND DIVIDEND INCOME 16.

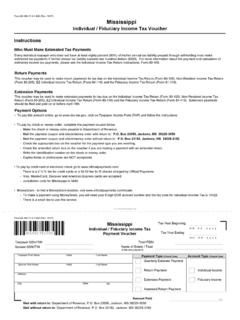

2 SCHEDULE N OTHER INCOME/ LOSS & SUPPLEMENTAL INCOME 16. INCOME TAX CREDITS 17. GENERAL INFORMATION 19. ELECTRONIC FILING 19. TAXPAYER ACCESS POINT (TAP) 19. WHO MUST SIGN? 19. TAX PAYMENTS 19. INSTALLMENT AGREEMENT 19. DECLARATION OF ESTIMATED TAX 20. INTEREST AND PENALTY PROVISIONS 20. ROUND TO THE NEAREST DOLLAR 20. WHAT TAX RECORDS DO I NEED TO KEEP? 20. TAX RATES 21. AMENDED RETURN 21. DEATH OF A TAXPAYER 21. REFUND INFORMATION 21. CONTACT US 20. TELEPHONE ASSISTANCE 21. DISTRICT SERVICE OFFICES 22. FAQs 22. APPENDIX 24. COUNTY CODES 24. TAX CREDIT CODES 24. SCHEDULE OF TAX COMPUTATION 25. 2. WHAT'S NEW! individual or the lesser of $1,000 or the amount of the LEGISLATIVE AND OTHER CHANGES contribution in any taxable year for a married couple filing a joint return.

3 The following is a brief description of selected legislative changes. A copy of all legislative bills is available at House Bill 1359 Miss. Code Ann. 27-7-15. This bill excludes from gross income amounts paid by an agricultural disaster program as compensation to an House Bill 799 - Miss. Code Ann. 27-7-51, 27-7-53, 27-7- agricultural producer, cattle farmer or cattle rancher who has 315, 27-7-327 and 27-7-345 suffered a loss as a result of a disaster or emergency. Reduce the interest rate from 1% to 1/2% per month over a five year period. The interest rate reduction is as follows: Tax Cuts and Jobs Act (TCJA). Effective January 1, 2015 9/10th of 1% Mississippi will follow the federal TCJA changes listed below: Effective January 1, 2016 8/10th of 1%.

4 Moving expenses will no longer be deductible except Effective January 1, 2017 7/10th of 1%. for active duty members of the military based on Effective January 1, 2018 6/10th of 1% military orders. Miss. Code Ann. 27-7-18 (2). Effective January 1, 2019 of 1% provided the deduction from Mississippi income taxes in accordance with federal provisions. Senate Bill 2858 Miss. Code Ann. 27-7-18 Medical expenses that exceed of federal This bill provides that a portion of the federal self-employment adjusted gross income (AGI) are allowable as an taxes assessed against self-employed individuals shall be itemized deduction. allowed as an adjustment to gross income under the state State and local tax deduction is limited to $10,000. income tax law. The allowance is as follows: The mortgage interest deduction is limited to the Taxable years ending in calendar year 2017 17% interest on loans up to $750,000 of acquisition indebtedness.

5 Interest on home equity loans are Taxable years ending in calendar year 2018 34% deductible if used for home improvements only. Taxable years ending in calendar year 2019 and 50% The limitation on the amount of cash contributions thereafter allowable as a charitable contribution has increased House Bill 1601 Miss. Code Ann. 27-7-15 from 50% to 60%. Seating for college athletic This bill authorizes contributions made to a First-Time Home events is no longer allowable as charitable Buyer Savings account and any interest earned on those contribution. contributions to be excluded from gross income. The amount Casualty and theft losses are only deductible for of contributions made by an account holder in any tax year to losses attributable to federally declared disaster an account is $2,500 for a single filer or $5,000 for a married areas.

6 Filing joint filer. Any withdrawals from an account for any purpose other than the payment of eligible cost must be added Miscellaneous itemized deductions subject to 2% of to gross income. federal AGI are suspended for tax years 2018. through 2025. Senate Bill 2311 Miss. Code Ann. 27-7-15. This bill creates the Mississippi Achieving A Better Life The overall limitation on itemized deductions (the Experience (ABLE) act that allows amounts contributed to the Pease Limitation) is suspended until 2025. ABLE Trust Fund to be excluded from income. Contribution Qualified education expenses for purposes of 529. limitations to the Able Trust Fund follow the federal limitation. plans are no longer limited to higher education but Withdrawals made for unqualified disability expenses must be will also include elementary or secondary public, added to gross income.

7 Private, home schools or religious expenses up to $10,000 per year. House Bill 1566 Miss. Code Ann. , 27-7- and The limitation on the amount of contributions to an This bill authorizes an income tax credit for cash contributions ABLE account allowed as a deduction has increased to a Qualifying Charitable Organization and Qualifying Foster to $15,000. Care Charitable Organization as well as increases the credit allowed on qualified adoption expenses not to exceed $5,000. for each child legally adopted under the laws of this state. The REMINDERS. credit allowed for a Qualifying Charitable Organization is the lesser of $400 or the amount of the contribution in any taxable Important tips to help expedite processing of your return: year for a single individual or the lesser of $800 or the amount of the contribution in any taxable year for a married couple Use black ink when preparing the return.

8 Filing a joint return. The credit allowed for a Qualifying Foster Care Charitable Organization is the lesser of $500 or the Make sure your social security number is entered correctly amount of the contribution in any taxable year for a single on all returns, schedules and attachments. 3. Sign and date your tax return (on a joint return, the TAP e-mail lets you know that you have new correspondence husband and wife signature is required). to view on-line. You then logon to TAP to read the letter or message and take appropriate action on your account. Only Attach a copy of the federal return behind the state return. you, or persons you authorize, can see your correspondence. W-2s, 1099s, any additional schedules and attachments should be stapled to the back of the return.

9 Do not place When making payments or updating profile information, you a staple in the barcode area of the form. should always log directly into TAP using your User ID and password. TAP does not provide links containing your Do not include W-2Gs with your tax return. Gaming transaction or personal information to any external web site. withholding cannot be claimed as a deduction on your tax return. Remember, you can pay your bill on-line through TAP without registering for a TAP account. For more information on TAP, Copies or reproductions of the official tax forms are not view the Electronic Filing section of this booklet. acceptable. Visit our website at to download forms by tax year and tax type. TAXPAYER ACCESS POINT (TAP). TAP is easy to use, convenient and free.

10 With TAP, you have the option to Go Paperless. This means that you pay your taxes on-line and receive certain correspondence electronically. FILING REQUIREMENTS. Deceased taxpayer if you are a survivor or representative DO I HAVE TO FILE? of a deceased taxpayer, you must file a return for the taxpayer who died during the tax year on or before the 2018. You should file a Mississippi Income Tax Return if any of the return is due. For more information on the filing following statements apply to you: requirements of a deceased taxpayer, see the Death of a Taxpayer section of this booklet. You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). AM I A RESIDENT OR A NON-RESIDENT ? You are a NON-RESIDENT or PART-YEAR RESIDENT with income taxed by Mississippi (other than gambling income).