Transcription of RETAIL MEAT PRICES, USDA - Daily Livestock Report

1 Vol. 13, No. 11, January 19, 2015 Sponsored by The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Adel, IA and Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2014 Steve Meyer and Len Steiner, Inc. All rights reserved. The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its affiliates and CME Group Inc. and its affiliates disclaim any and all responsibility for the infor ma on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an offer to sell or a solicita on to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted.

2 Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract s value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can afford to lose without affec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. The Daily Livestock Report is made possible with support from readers like you. If you enjoy this Report , find if valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report , Box 2, Adel, IA 50003. Thank you for your support! It was more of the same for RETAIL meat and poultry prices in De cember with new records for beef and s ll strong prices for pork and chick en.

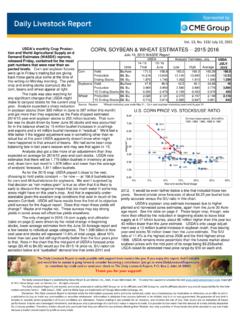

3 RETAIL price data from usda s Economic Research Service appears in the top chart at right. Note that these are based on data gathered by the Bureau or Labor Sta s cs as part of its consumer price monitoring role. The data represent a pre y limited sampling of products and u lize prices only there are no sales volume data gathered so the averages shown here are not weighted by volume. The series has a good number of warts but is about the only consistent measure in the public domain and, being reasona bly consistent over me, s ll provides us a picture of RETAIL level values. Beef once again highlights the RETAIL price data with new records for both Choice and All Fresh product. Choice beef averaged $ per pound in December, up from November s previous record high and higher than one year ago. The All Fresh price which includes Select and store grade product hit $ for the first me ever. That price was higher than last month and is higher than last year.

4 Any think ing that these RETAIL values might back off given lower wholesale prices in December was likely sha ered with the rally of the past three weeks. Last week s average Choice cutout value was $ , up almost $20/cwt since the last week of 2014. The Select cutout gained $9/cwt just last week and, at $ is also nearly $20 higher than at the end of 2014. Retailers will not reduce their asking prices on a whim. The ca le and wholesale mar kets will have to demonstrate clear increases in supply and lower values before retailers back off to any significant degree on asking prices. We think the pork market is the poster child for such reduc ons at present and will likely remain so. The average RETAIL pork price fell by in December to $ per pound. That figure is s ll higher than one year ago but it marks the third straight decline in RETAIL pork values as seasonally lower cutout values are reflected at the RETAIL level. While the decline doesn t sound like much rela ve to the drop in hog prices, the size and speed of the RETAIL adjustment is really pre y surprising.

5 The RETAIL pork price has fallen in just three months. It is clear from the chart that the only similar rapid price decline was in the fall of 2010 when RETAIL pork prices dropped by in just two months. As a rule, these prices are very s cky downward as retailers try to capture larger margins when the cost of the product drops. But the decline in wholesale pork values has been large enough that retailers have maintained and even grown their margins in spite of lower selling prices as wholesale values have dropped. Steady she goes is, per normal, the word for chicken prices. They actually declined by in December to $ on the Composite Broiler price series. That figure is higher than last year and s ll about 4 cents per pound below the October 2013 record of $ per RETAIL pound. We include a turkey price on this chart but note once more that it is a whole bird price that is not at all indica ve, we think, of the demand for turkey parts and products.

6 While nominal dollar prices are important, what counts at least theore cally in consumer demand is rela ve value. And on this the mes sage it is clear: Beef is losing ground FAST! We would argue that a major reason for the surge in both absolute and rela ve beef prices is strong con sumer preferences for beef. The price increases are larger than the supply reduc ons would normally cause! But there s a limit somewhere to just how much more consumers will pay for beef before they subs tute a lower value protein and the pork and chicken sectors are in the process of bringing them product at more and more compe ve prices! The prices of both pork and chicken are the lowest on record versus beef. We expect demands for both products to benefit from this advantage in 2015, especially as the ra os set new record lows. 050100150200250300350400450500550600650 MEAT PRICES, USDAAll-Fresh BeefChoice BeefPorkComposite BroilerTurkeySource: usda Economic Research Service0%10%20%30%40%50%60%70%80%90%100% 8890929496980002040608101214 PercentRETAIL PORK, CHICKEN & TURKEY AS A PERCENT OF RETAIL BEEFPorkChickenTurkeySource: Paragon Economics, Inc.

7 Using data from usda Economic Research ServiceVol. 13, No. 11, January 19, 2015 Sponsored by PRODUCTION AND PRICE SUMMARYWeek Ending1/17/15 ItemUnitsCurrent WeekLast WeekPct. Change Last YearPct. Change YTD Pct. ChangeTotal Meat & Poultry 83,220 SlaughterThou. ,405 Cow SlaughterThou. ,451 Live ,371 Dressed ProductionMillion ,890 Fed Steer$/cwt live Steer$/cwt Feeder Steer700-800 Cutout600-900 $/cwt live , 50% , 90% SlaughterThou. ,812 Sow SlaughterThou. ,813 Dressed ProductionMillion ,570 Minn. Base Carcass PriceWeighted Net Carcass PriceWeighted Cutout200 , 72% Chicken Slaughter*Million ,530 WeightLbs., ProductionMillion Lbs., ,628 ,758 PlacedMillion ,789 Composite Dock Leg Turkey Slaughter*Million ProductionMillion ,132 Region Hen8-16 , Omaha$ per , Minnesota$ per #VALUE!

8 #VALUE!EWheat, Kansas City$ per , S. Iowa$ per Meal, 48% Central Illinois$ per * Chicken & turkey slaughter, production and prices are 1 week earlier than the date at the top of this table. Cow & sow slaughter are for 2 weeks earlierSource: usda Agricultural Marketing Service, various reports