Transcription of SASOL LIMITED FINANCIAL RESULTS

1 SASOL LIMITED FINANCIAL RESULTS for the six months ended 31 December 2017 Copyright , 2017, SASOL 2 Copyright , 2018, SASOL SASOL may, in this document, make certain statements that are not historical facts that relate to analyses and other information which are based on forecasts of future RESULTS and estimates of amounts not yet determinable. These statements may also relate to our future prospects, developments and business strategies. Examples of such forward-looking statements include, but are not LIMITED to, statements regarding exchange rate fluctuations, volume growth, increases in market share, total shareholder return, executing our growth projects (including LCCP), oil and gas reserves and cost reductions, including in connection with our BPEP, RP and our business performance outlook. Words such as believe , anticipate , expect , intend", seek , will , plan , could , may , endeavour , target , forecast and project and similar expressions are intended to identify such forward-looking statements, but are not the exclusive means of identifying such statements.

2 By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and there are risks that the predictions, forecasts, projections and other forward-looking statements will not be achieved. If one or more of these risks materialise, or should underlying assumptions prove incorrect, our actual RESULTS may differ materially from those anticipated. You should understand that a number of important factors could cause actual RESULTS to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors are discussed more fully in our most recent annual report on Form 20-F filed on 28 August 2017 and in other filings with the United States Securities and Exchange Commission. The list of factors discussed therein is not exhaustive; when relying on forward-looking statements to make investment decisions, you should carefully consider both these factors and other uncertainties and events.

3 Forward-looking statements apply only as of the date on which they are made, and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. Please note: One billion is defined as one thousand million. bbl barrel, bscf billion standard cubic feet, mmscf million standard cubic feet, oil references brent crude, mmboe million barrels oil equivalent. All references to years refer to the FINANCIAL year 30 June. Any reference to a calendar year is prefaced by the word calendar . Comprehensive additional information is available on our website: Introduction Forward-looking statements INTRODUCTION Bongani Nqwababa and Stephen Cornell Copyright , 2017, SASOL 4 Copyright , 2018, SASOL Key messages What you will hear today Largely strong set of RESULTS in a volatile but growing global economy Steady progress on LCCP with a drive towards commissioning, operations and business readiness Change in dividend policy to a more consistent Core HEPS base Strong balance sheet enhanced by proactive hedging programme with short- to medium-term funding plan in place Continued sustainability and heightened investment focus in Southern Africa Focused strategy and disciplined capital allocation supports compelling investment case Copyright , 2017, SASOL 5 Copyright , 2018, SASOL Group RCR at 0,30, regrettably two fatalities Sales volumes 3%1 for Performance Chemicals, 1%1 for Base Chemicals, and liquid fuels 3% Synfuels Operations production volumes 1% Eurasian Operations volumes 2%.

4 Natref volumes 21% Safety and operational challenges at Mining in ramping up to pre-strike production run-rates Successful start-up of 17th oxygen train and Gemini HDPE; FTWEP progressing well Stronger rand per barrel price benefitting RESULTS HEPS 17% to R17,67, EPS 21% to R11,29 Response Plan delivery of R75,6bn exceeding upper-end of target with sustainable annual cash savings of R3,5bn Gearing managed to 39%, below our ceiling of 44% Normalised cash fixed costs 2% in real terms with FY18 forecast tracking our expected inflation rate of 6% Interim dividend of R5,00 per share based on Core HEPS Key messages Core HEPS up 5% to R18,22 Largely strong earnings performance driven by higher oil prices for transfer of ethylene business from PC to BC OPERATIONAL PERFORMANCE FINANCIAL RESULTS Copyright , 2017, SASOL 6 Copyright , 2018, SASOL Cost and schedule on track Overall project 81% complete with construction execution at ~54% $8,8bn spent of $11,13bn project cost On track for start-up of first units in H2CY18 US tax reforms contributing ~0,5% to returns Project returns ~7,5 - 8,5% (previous guidance ~7 - 8%)

5 Returns based on Q4CY17 spot pricing ~9 - 9,5% (previous guidance ~8 - 8,5%) Strong focus on commissioning, operations and business readiness Progressive start-up of utilities ongoing and gaining momentum Engaging prospective new markets and customers; Gemini HDPE first product to market Contracts for major distribution channels in place Key messages LCCP adds up to 20% to EBITDA by FY22 or $1,3bn real1 Steady progress on LCCP FY22 based on our assumptions Copyright , 2017, SASOL 7 Copyright , 2018, SASOL Key messages FCF positive in FY19 Strong balance sheet enhances shareholder value asset value Protect and strengthen the balance sheet and maintain investment grade credit ratings Target a superior dividend payout ratio of 40% on Core HEPS Incremental investment in existing assets Balance growth and value returned to shareholders Safe, stable and reliable operations Increased cash flows supported by Continuous Improvement Continued hedging programme beyond peak gearing Optimal capital structure and funding plan with disciplined capital allocation Asset divestment opportunities with NAV1 >US$1bn which will yield additional liquidity benefits Deleveraged balance sheet, targeting 30% gearing and net debt.

6 EBITDA of 1,5 - 2,0x LIMITED shareholder dilution through Inzalo refinancing and LTI hedge options Superior value to our shareholders through dividends and growth Strategy Delivered Resulting 2018 2022 Copyright , 2017, SASOL 8 Copyright , 2018, SASOL SASOL LIMITED B-BBEE scorecard improved from Level 8 to Level 6 and on track for at least Level 4 by 2020 R4,9bn preferential procurement from black-owned enterprises for HY18 Shareholders approved our SASOL Khanyisa B-BBEE transaction Invested >R630m in skills and socio-economic development programmes for HY18 R530m in education and skills development R100m in community development, including SASOL Ikusasa in the Metsimaholo and Govan Mbeki municipalities Invested >R20bn in SA on flagship projects over the past three years Investment of R8,7bn for HY18 in key South African industrial hubs Includes FTWEP and 17th oxygen train project Key messages Positive SA sentiment driving increased investor confidence Continued sustainability and heightened investment focus in South Africa Copyright , 2017, SASOL 9 Copyright , 2018, SASOL Key messages Ongoing commitment to entrench SASOL s position as a trusted partner Continued sustainability and heightened investment focus in Mozambique SASOL and its partners invested >US$3bn with >US$1,1bn contribution to the state Local procurement of US$1.

7 2bn Invested US$33m mainly towards education and skills development US$285m spent on PSA drilling and surface facilities >300 permanent jobs sustained across our businesses >90% are Mozambican ~600 additional contractor job opportunities for communities around CPF Access to electricity for >2m Mozambicans through CTRG ~2 000 consumers benefitting from domestic gas reticulation systems Support in-country industrialisation and gas monetisation ambitions Further exploration to unlock beneficiation of resources Focused on increasing capacity and participation of locally owned businesses and building local SMMEs Committed to train >460 artisans for the oil and gas sector CONTINUED BENEFITS TO STAKEHOLDERS GOING FORWARD STRONG HISTORICAL PROGRESS Copyright , 2017, SASOL 10 Copyright , 2018, SASOL To be a leading integrated global chemical and energy company, proudly rooted in our South African heritage, delivering superior value to our stakeholders To create superior value for our customers, shareholders and other stakeholders.

8 Through our talented people, we use selected technologies to safely, profitably and sustainably source, produce and market chemical and energy products LEVERAGE COMPETITIVE ADVANTAGE FROM OUR STRONG ASSET BASE TO ENSURE LONG-TERM SUSTAINABILITY AND VALUE VALUE-BASED GROWTH STRATEGY SUPPORTS OUR COMPELLING INVESTMENT CASE FINANCIAL AND OPERATIONAL PERFORMANCE Paul Victor Copyright , 2017, SASOL 12 Copyright , 2018, SASOL FINANCIAL and operational performance What you will hear today Largely strong set of RESULTS with continued focus on cash, cost and capital management Ability to generate strong cash flows enables increased dividend payout ratio on Core HEPS and quality growth investments Protect and strengthen the balance sheet through continued hedging beyond peak gearing, a robust funding plan and deleveraging to improve flexibility Outlook for FY18 and positioning for the medium-term Copyright , 2017, SASOL 13 Copyright , 2018, SASOL Macroeconomic environment Chemical product prices trending up.

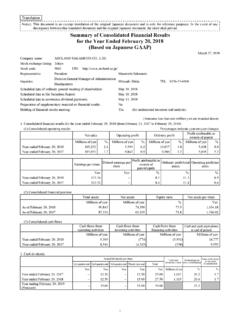

9 Exchange rate remains volatile Volatility in a growing global economy % change y-o-y Solvents basketPolymers basketBrent$/mmbtu (gas price) US$/bbl BrentProduct priceHenry HubStronger crude oil prices drives higher chemical prices US$1 = ZAR Currency volatility remains as rand strengthens Base chemical prices vs Brent HY17 HY18 $2,95 $2,93 $48 $71 $60 $57 HY17 (4%) 28% 19% HY17 HY18 R13,99 R13,40 HY18 US$/unit Average HY18 % vs HY17 Brent/bbl 56,74 19 Fuel products/bbl 71,23 18 Base Chemicals/ton1 826 10 Performance Chemicals/ton1 1 436 7 Export coal/ton 85 19 Product prices R13,74 R12,37 restated for the transfer of US ethylene to BC and kerosene sales in Alkylates business Prices reflect international commodities or baskets of commodities and are not necessarily SASOL specific Sources: RSA Department of Energy, ICIS-LOR, Reuters, Platts, International Energy Agency Average rate during period Closing rate at period end Copyright , 2017, SASOL 14 Copyright , 2018, SASOL Group profitability Core HEPS up 5% to R18,22 Strong core operating profit performance HY17 HY18 % Mining 1 534 2 864 87 Exploration and Production International (EPI) 204 (2 649) >100 Performance Chemicals (PC) 4 020 3 878 4 Base Chemicals (BC) 2 360 2 552 8 Energy 5 529 5 748 4 Group Functions 25 (607) >100 Operating profit (Rm) 13 672 11 786 14 Earnings per share (R) 14,21 11,29 21 Headline earnings per share (R) 15,12 17,67 17 Core headline earnings per share (R) 17,41 18,22 5 Dividend per share (R) 4,80 5,00 4 Capital expenditure (Rbn) 30,2 27,7 8 42 44 14 ChemicalsEnergyMining and other72 14 11 SANorth AmericaEuropeRest of WorldCore operating profit (%) by product Core operating profit (%)

10 By geography includes impact of strike action amounting to R1,0bn includes R2,8bn (CAD281m) relating to the partial impairment of our Canadian shale gas assets RESULTS have been restated for the transfer of the US ethylene business from PC to BC includes R1,1bn (US$83m) relating to the scrapping of the US GTL assets 3 Copyright , 2017, SASOL 15 Copyright , 2018, SASOL TAILWINDS Higher crude oil and product prices Higher refining margins and resilient US$ margins in chemical businesses Hedging strategy protects and strengthens balance sheet Response Plan sustainable annual cash cost savings of R3,5bn achieved HEADWINDS Real cash fixed costs up 2% due largely to operational challenges Stronger exchange rate Higher remeasurement items Operating profit Operating profit impacted by changing macro environment and once-off items 1. Excludes mark-to-market valuation on hedges 2. Includes remeasurement items (-25%) and prior year mining strike (+7%) 3. Includes cost inflation (-8%), growth costs (-7%) and production interruptions (-7%) 11 786 13 672 2% (25%) 3 (16%) 2 36% (11%) HY18 Sales volumesCost and other Once-off items andyear-end adjustmentsCrude oil andproduct prices Exchange rate HY17Rm Macro environ- ment Costs and volumes Copyright , 2017, SASOL 16 Copyright , 2018, SASOL Cash fixed costs FY18 cash fixed cost to track 6% inflation assumption Impacted by growth-related costs and production interruptions 25 053 22 628 HY18 Exchange rateInflation Production interruptions Once-off business establishment New capital projects US growth(LCCP & Gemini)HY17Rm Study, growth and once-offs Costs and volumes Macro environ- ment 151 190 572 513 1 074 75 (0,7%) (0,8%) (2,5%) (2,3%) (4,7%) 0,3% Growth costs Once-off in RP savings due to the end of the Eskom PPA (R0,4bn), costs associated with our digital transformation (R0,2bn) and Khanyisa transaction (R0,1bn)