Transcription of Sponsored in part by - dailylivestockreport.com

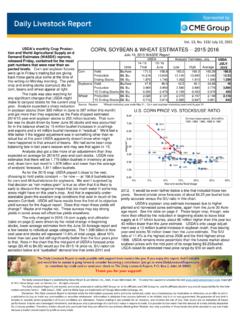

1 Sponsored in part by Copyright 2018 Steiner Consul ng Group, DLR Division, Inc. All rights reserved. Vol. 16, No. 210 / October 24, 2018. Steer Weights. 5-day WEIGHTED moving average Fed ca le futures were lower yesterday but li le seems to have Ca l cul a te d Us i ng Ma nda tory Pri ce Reporti ng Da ta for Negoti a ted a nd Formul a ted Net Tra des . Stei ner Cons ul ti ng changed in terms of market direc on. Winter and early spring futures have 940. gained considerable ground in the last three months and prices con nue to 930. hover not far from contract highs. There was nothing par cularly alarming for 920. the beef market from the last Cold Storage' report while COF data was quite 910. suppor ve. One need only look at what beef rib prices are doing these days to understand why some end users jumped early to put some product away in cold 900. storage. It is clear that during certain mes of the year, and especially going 890. into Christmas, there are not enough ribs to sa sfy demand.

2 The value of the rib 880. primal last night was calculated by USDA at $394/cwt, almost $50/cwt or 14% 870. higher than a year ago. Light boneless ribeyes printed at over $900/cwt - and it 860. is only October. The choice cutout last night was quoted at $210/cwt, $10. higher than a year ago. More than half of that increase is due to the higher 850. 2015 2016 2017 2018. value of the rib primal. Loin, thin meats and brisket values also remain above 840. year ago levels. On the other hand, round and chuck values are near or under Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec year ago levels. Increased compe on in the retail meat case has helped keep prices for these beef items in check. But there is no good replacement for a rib Beef Loads Sold For Delivery 61 - 90 Days. 4-WK MA. Da ta Source: USDA Ma nda tory Pri ce Reporti ng Sys tem roast or steak and in this booming economy middle meats and fa y export 400. items con nue to carry the carcass. In addi on to the robust prices for middle meats, there are other 350.

3 Indicators that may support beef and ca le prices in the near term. It appears 300. that some early fall storms may have impacted ca le performance. The latest 250. USDA carcass weight data is for October 6. More recently, however, we have seen fed steer carcass weights plummet. The chart to the right shows a ve day 200. average of carcass weights for nego ated and net formula ca le. This is a subset 150. of the ca le that come to market each week but direc onally it coincides well 100. with the o cial weight data. In the last few days the average carcass weight of this subset of ca le is down Other data also suggests that the slowdown 50. 2015 2016 2017 Series4. in carcass weights is real. The comprehensive ca le report that USDA released - yesterday shows, among other things, the average dressed weight of the ca le Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec captured in that report. According to that report, the average weight of both steers and heifers for the week ending October 22 was 868 pounds, down 1% Beef Loads Sold For Delivery +90 Days.

4 4-WK MA. from the previous week. Futures currently maintain a premium going into the Da ta Source: USDA Ma nda tory Pri ce Reporti ng Sys tem winter. In part this re ects expecta ons for seasonally lower supplies and 700. ongoing strong demand. But it is also a weather risk premium and recent shi 600. in carcass weights highlights precisely such risks. A er holding out for much of the fall it appears some end users have 500. nally decided it is me to take some forward posi ons. This could be retailers 400. that want to promote beef in January and February or foodservice operators that want to run features and promo ons late in the winter or next spring. Last 300. week there were some 660 loads sold for delivery +90 days out. Last me we 200. saw that kind of volume for this window was last April, when end users took advantage of the low prices to cover summer needs. Forward sales for other 100. me slots were higher as well. Export numbers may not be as robust as last 2015 2016 2017 Series4.

5 - summer but they remain solid nonetheless. Packers have also been buying more ca le for delivery 15-30 days out and their forward coverage remains light. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec The Daily Livestock Report is made possible with support from readers like you. If you enjoy this report, find it valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report, Box 4872, Manchester, NH 03018. Thank you for your support! The Daily Livestock Report is published by Steiner Consul ng Group, DLR Division, To subscribe, support or unsubscribe please visit The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its a liates and CME Group Inc. and its a liates disclaim any and all responsibility for the informa on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc.

6 Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an o er to sell or a solicita- on to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract's value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can a ord to lose without a ec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to pro t on every trade.