Transcription of Statutory Residence Test Flowchart - KPMG

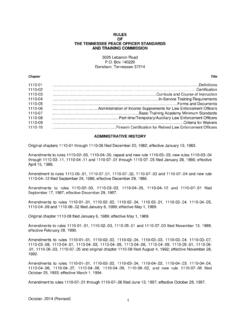

1 Statutory Residence Test FlowchartFinance Act 2013 Not resident throughout the whole of the previous three tax years andpresent in UK < 46 days in the current tax yearResident in UK in at least one of previous three tax years andpresent in UK < 16 days in the current tax yearLeave UK to work full-time overseas, present in UK < 91 daysand < 31 days spent working in UKNon-residentResidentPresent in UK 183 days in the current tax yearAll homes are in the UK ( 30 days present in home)Works sufficient hours in the UK (see overleaf)

2 Not resident in UK throughout all of the previous three tax yearsThe number of ties below, together with whether resident at any time in the three previous years and the number of daysspent in the UK, determine the individual's Residence status for the tax year as shown in the table Resident FamilySubstantive UK Employment 40 UK days in tax yearAccessible UK Accommodation stayed in 1 nightPresent 91 days in either of previous two tax yearsTotal tiesUK Resident FamilySubstantive UK Employment 40 UK days in tax yearAccessible UK Accommodation stayed in 1 nightPresent 91 days in either of previous two tax yearsPresent in UK any other single countryTotal tiesWhen non resident

3 Throughout the threeprior tax yearsWhen resident at any time in the three prior tax yearsNumber of days in the UK in a tax year1 or No UK ties2 UK ties3 UK ties4+ UK tiesNo UK ties1 UK ties2 UK ties3 UK ties4+ UK tiesFewer than 16daysNRNRNRNRNRNRNRNRNR16 to 45 daysNRNRNRNRNRNRNRNRR46 to 90 daysNRNRNRRNRNRNRRR91 to 120 daysNRNRRRNRNRRRR121 to 182 daysNRRRRNRRRRR183 days plusRRRRRRRRRThis Flowchart and the notes overleaf are intended to summarise how the Statutory Residence Test determines Residence status in the UK, However the legislation comprises over 60 pages of rules and definitions.

4 HMRC have also issued over 100 pages of guidance. Accordingly the information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the one should act on such information without appropriate professional advice after a thorough examination of the particular for individuals, not trusts or other entities, where the individual is alive throughout the tax yearYesYesYesYesYesYesNoNoNoNoNoNoNoYesS tart 2016 KPMG LLP.

5 A UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity. All rights Residence Test FlowchartFinance Act 2013 Days SpentAn individual spends a day in the UK for SRT purposes if he is in the UK at the end of the , he is not treated as spending a day in the UK if the day is considered a transit day with no work or the individual is in the UK due to specified exceptional circumstances beyond his control for a maximum of 60 days.

6 In certain circumstances an individual will be deemed to spend a day in the UK even though he is not in the UK at the end of the full-time overseas (WFTO)The individual must work sufficient hours overseas (average of 35 hours per week disregarding certain defined days) in the tax year with no significant breaks from overseas work and spend fewer than 91 days in the UK and work (in this instance for morethan three hours a day) in the UK for fewer than 31 Homes are in the UKAn individual will be regarded as resident if the individual has a home in the UK for more than 90 days in which the individual is present on at least 30 separate days in the relevant tax year.

7 In addition for 91 consecutive days, at least 30 of which are in the tax year, the individual must have no home overseas in which the individual is present on 30 separate days in the tax year. If the individual has more than one home in the UK, the test must be met in relation to at least one of those homes when considered separately from the other home(s).Works Sufficient Hours in the UK (WSHUK)The individual must work sufficient hours in the UK over a 365 day period (average of 35 hours per week disregarding certain defined days where all or part of the 365 day period is in the current tax year) with no significant breaks from UK work.

8 More than 75% of the days in the period when the individual does more than three hours work per day must be worked in the UK and the individual must work for more than three hours in the UK on at least one day in the current tax work day in the UK for the purposes of the SRT is a day on which more than three hours work is performed. Work includes incidental and non incidental duties and most travel. There is a complicated test to determine whether an individual works sufficient hours in the UK or overseas for the WFTO or the WSHUK the distinction between incidental and substantive duties is not relevant for the purposes of the SRT the distinction remains important for the purposes of calculating the tax liability of employees.

9 When the employee is regarded as being non UK resident, incidental duties will continue to be deemed to be performed offshore and only substantive UK duties are Ties TestWhen an individual does not meet any of the automatic overseas tests nor any of the automatic UK tests, the individual s Residence will depend upon the number of UK ties (or connections) the individual has and the number of days spent in the resident familyA family tie exists if a person s spouse, civil partner or minor child is resident in the UK in the relevant tax year.

10 A person with whom the individual is living as husband and wife or as if they were civil partners is also included. Where a minor child is UK resident because they are in full-time education in the UK, they will not be treated as UK resident for family tie purposes unless they spend more than 20 days in the UK outside of term time during t he tax yearsAlthough an individual can only be regarded as resident for a complete tax year, special rules apply when an individual commences or ceases Residence which are outside the scope of this Flowchart .