Transcription of Strategies for Assessing Commercial Tenant Credit - Re Meter

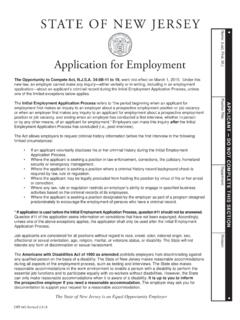

1 Utm_content=bufferc0c13&utm_medium=socia l&utm_source= Strategies for Assessing Commercial Tenant Credit R. Kymn Harp 43 inShare When considering a lease, tenants are usually focused on the location, size and quality of the leased space, and perform some minimal diligence on the landlord and property manager to ensure fair treatment over the course of the term. Landlords have a more difficult task, however. A prospective Tenant , and most importantly, that Tenant s ability to pay rent, is often unknown to the landlord. In recent years, real estate professionals have witnessed expansion in the array of users of Commercial space and at the same time, property owners have been compelled to seek out new types of tenants.

2 Increasing numbers of start-ups and new ventures are seeking to lease space, many of which are backed by various types of equity financing. As a result of these changes, landlords should be particularly vigilant in understanding how their tenants make money, as well as the financial identities of the parties backstopping the obligations of those tenants. Analyze Tenant Credit Landlords should always analyze Tenant Credit in the context of the lease. After all, the success of leased real estate, as well as the property owner s ability to borrow against that asset, is dependent upon the stability of its tenants.

3 While rent is the primary economic factor in any lease transaction, other factors such as term (including rights of extension), area of the premises (including rights of expansion and rights of first refusal on additional space) and the scope of Tenant improvements create the platform upon which a Tenant s Credit can be evaluated. For example, substantial build-out (regardless of who pays for it) that may inhibit the re-letting the space following a default. Therefore, landlords should be mindful of the Tenant s capacity to pay its construction obligations, which capacity is usually encapsulated in the Tenant s Credit and litigation history.

4 A proper underwriting of a Tenant s Credit requires a thorough understanding of that Tenant s business. A prudent landlord will pay attention not only to the Tenant s sources of revenue, but to the market upon which the Tenant relies and the business plan upon which the Tenant charts its future success. What are the contours of the business model? Is the revenue sustainable? What is the plan for future growth? Has the Tenant gone through restructuring or been forced to lay off personnel? Landlords can avoid doing business with troubled or unstable tenants by performing background, lien and litigation searches on the Tenant parties as part of the underwriting process.

5 This kind of diligence can usually be completed in a short time-frame at a reasonable cost, and may save substantial time and money if the landlord is forced to evict a Tenant it should have known to be at increased risk of default. Technology has given rise to new products which enhance the process of underwriting Tenant Credit . For example, the Chicago firm (RE) Meter has created the first Credit score for Commercial tenants, which captures and synthesizes proposed lease transaction terms and basic Tenant financial information with exclusive data maintained by a number of federal agencies, including the Census Bureau, the Department of Labor and the Internal Revenue Service ((RE) Meter is the first firm to access IRS information in this context).

6 The end product, called the TIL Report, can be completed in a mere 15 minutes and offers landlords a sector- and market-specific analysis of its prospective tenants, reflecting a number of detailed metrics including growth trends, profitability and rent per employee. Innovations like these have altered the landscape of Tenant underwriting and will enable landlords to make more prudent decisions when marketing space and Assessing the risk of potential tenants. Tenant Credit Enhancements Conventionally, several mechanisms exist to enhance the Credit of a prospective Tenant who fails on its own to meet the underwriting criteria of the landlord.

7 The first and foremost of these is the security deposit, which is posted by the Tenant in the form of cash or letter of Credit and held by the landlord for all or part of the duration of the lease. The deposit may be applied by the landlord towards unpaid amounts payable under the lease like rent, proportionate common area expenses or taxes, or reimbursement of amounts expended to repair damage to the premises. A stronger Credit Tenant may receive the benefit of a return of all or part of the deposit held by landlord over time, provided the Tenant has not defaulted. Security Deposits While cash security deposits have historically been the industry standard in Commercial leasing, landlords are increasingly requiring letter of Credit security deposits instead.

8 For many landlords, the benefits of cash on hand are overshadowed by the security of an obligation issued by a third-party bank, particularly when the landlord is able to draw on the letter of Credit following a default without notice to or consent by the Tenant . Letters of Credit also may bear advantages to the landlord following a bankruptcy by the Tenant , as the obligation of the issuing bank to pay on the letter of Credit is independent of the Tenant s obligations under the lease. However, some courts have found that letter of Credit security deposits are part of the Tenant s bankruptcy estate and thus subject to the cap on a landlord s claim for damages under Section 502(b)(6) of the United States Bankruptcy Code.

9 Lease Guaranties Guaranties are a common alternative for securing the Credit of a Commercial Tenant . In the context of Commercial leasing, a guaranty is a legally enforceable undertaking by a third party to fulfill the payment or performance obligations of the Tenant under a lease. A guaranty may be given by an entity, such as a corporate parent or affiliate, or an individual, such as a majority owner or other key principal of the Tenant . To most effectively backstop the Credit of the Tenant , a guaranty should be a guaranty of payment as opposed to a guaranty of performance. This distinction ensures that the landlord will not be forced to exhaust its remedies against the Tenant before pursuing enforcement of the guaranty.

10 Rather, the landlord may pursue the Tenant and guarantor simultaneously for unpaid amounts under the lease. Once a landlord has determined that it will require a guaranty to secure the Tenant s obligations under the lease, what should the landlord look for in evaluating potential guarantors? The most straightforward factor, notwithstanding whether the proposed guarantor is an individual or an entity, is cash on hand and other liquid assets. In satisfaction of the landlord s inquiry, an guarantors may produce income tax returns, bank statements, financial statements, balance sheets or other evidence of personal holdings.