Transcription of Summary The Department of the ... - Unclaimed Property

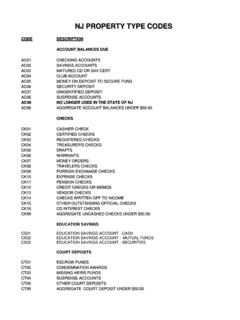

1 PROPOSALS TREASURY GENERAL. Summary The Department of the Treasury, Unclaimed Property administration (UPA), proposes an amendment and a new rule to implement certain provisions of the Uniform Unclaimed Property Act (Act), 46:30B-1 et seq., governing Unclaimed Property , including the provisions of 2010, c. 25, as further amended by 2012, c. 14. and 2015, c. 8, implementing new language related to stored value cards. 17 is proposed for amendment to include definitions for the following new terms: charitable program, consideration.

2 Customer loyalty program, face value, holder, issuer of a stored value card, last known address, promotional program, purchaser, . seller, and stored value card. These new definitions are necessary as a result of the adoption of 2010, c. 25. The definition of Uniform Unclaimed Property Act is also proposed for amendment to make clear what is meant by references to the Act.. 17 is a proposed new rule. It is intended to implement the part of 2010, c. 25, as amended by 2012, c. 14. and further amended by 2015, c. 8, pertaining to stored value cards.

3 Proposed new subsection (a) explains the exemption for reporting stored value cards sold for merchandise or services prior to the effective date of the Act (July 1, 2010), as well as exemptions for reporting stored value cards issued under a promotional, customer loyalty, or charitable program for which there is no consideration tendered or where stored value cards issued in the preceding year beginning July 1 through June 30, are sold with an aggregate total value of $250,000 or less. Proposed new subsection (b) further differentiates the requirements for reporting stored value cards issued by retailers on or after July 1, 2010, that may be redeemed for merchandise or services only at their stores or on their websites from those stored value cards issued by banks and other financial institutions that may be redeemed at multiple merchants.

4 Retailers that issue stored value cards that may be redeemed for merchandise or services only will be required to escheat 60 percent of the value of the unused balance if there is no consumer-generated activity for five years or longer. Proposed new subsection (c) provides that banks and other financial service companies that issue stored value cards that may be redeemed at multiple merchants (general purpose reloadable cards) will be required to escheat the full value of the unused balance if there is no consumer-generated activity for five years or longer.

5 In addition, these banks and financial institutions may charge fees other than for activation or replacement. Proposed new subsection (d) further requires that funds associated _____ with stored value cards issued on or after December 1, 2012, shall be valid until redemption and shall not expire. In addition, under proposed TREASURY GENERAL new subsection (e), beginning September 1, 2012, if a stored value card is issued as a gift card or gift certificate that as a result of its usage has a residual value of $ or less, at the owner's request the merchant or (a) other entity redeeming the card must refund the balance in cash to the Unclaimed Property administration owner.

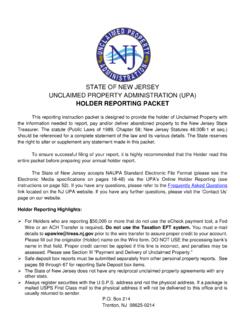

6 Consistent with the Act, proposed new subsections (b), (h), and (i). Unclaimed Personal Property also reiterate that there shall not be any dormancy charges or fees, Proposed Amendment: 17 abandoned Property charges or fees, Unclaimed Property charges or fees, balance inquiry fees, escheat charges or fees, inactivity charges or fees, Proposed New Rule: 17 or any similar charges, fees, or penalties for inactivity imposed with Authorized By: Steven R. Harris, Administrator, Unclaimed respect to the card. Proposed new subsection (f) also makes clear that Property administration .

7 Abandoned stored value cards may also be exempt from reporting Authority: 46:30B-107. requirements as the State Treasurer may determine pursuant to Calendar Reference: See Summary below for explanation of 46 exception to calendar requirement. Subject to the exemptions noted above, proposed new subsection (a). Proposal Number: PRN 2017-268. restates the statutory requirement that the issuer or seller of a stored Submit written comments by February 2, 2018, to: value card must report and remit the unused balance of the card, if and when deemed abandoned, to the State of New Jersey if the last known Robert H.

8 Davidson address on the records of the seller is located in New Jersey. Also, Administrative Practice Officer proposed new subsection (g) states that since a related bank account is Unclaimed Property administration PO Box 214 opened for stored value cards issued for the purposes of wage payments, 50 West State Street, 6th Floor the appropriate dormancy period would be three years from the last Trenton, NJ 08625-0214 transaction date as these stored value card funds are treated as bank E-mail: accounts pursuant to 46:30B-18.

9 Proposed new subsection (h). The agency proposal follows: states that stored value cards issued in lieu of a refund for merchandise returned without a receipt are subject to reporting under the requirements NEW JERSEY REGISTER, MONDAY, DECEMBER 4, 2017 (CITE 49 3665). TREASURY GENERAL PROPOSALS. of 46 Proposed new subsection (i) specifies that the businesses as this term is defined in the Regulatory Flexibility Act, conversion of stored value card funds to bank accounts does not 52:14B-16 et seq. represent owner activity, so that the unused balances are subject to As discussed in the Summary above, the proposed new rule and reporting five years from the last activity under the requirements of amendments contain reporting, recordkeeping, and compliance 46 requirements.

10 All issuers of stored value cards are required to obtain and Proposed new subsection (j) specifies that consideration tendered by maintain the names and addresses of the recipients of the cards. The Act the recipient/owner for a stored value card obtained under a promotional, provides for general reporting and compliance requirements pertaining customer loyalty, or charitable program, may consist of, but not be to Unclaimed Property . These requirements are not contingent on limited to, a rebate for a purchase made, a credit to be given by the business size and must apply uniformly.