Transcription of SUPPLEMENT NO. 2 DATED APRIL 3, 2018, TO THE …

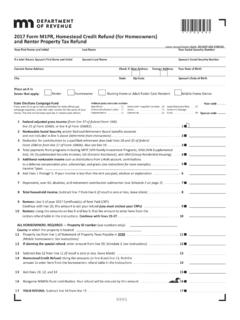

1 1 TIAA PUBLIC SUPPLEMENT NO. 1 DATED SEPTEMBER 30, 2017, TO THE minnesota COLLEGE SAVINGS PLAN PLAN DISCLOSURE BOOKLET DATED JANUARY 30, 2017 This SUPPLEMENT No. 1 provides new and additional information beyond that contained in the January 30, 2017 Plan Disclosure Booklet and Participation Agreement (the Disclosure Booklet ) of the minnesota College Savings Plan (the Plan ). It should be retained and read in conjunction with the Disclosure Booklet. I. OVERVIEW OF THE PLAN On page 2 of the Disclosure Booklet, in the table entry for minnesota Tax Treatment, the following two bullet points are added to the table: Net contributions by a taxpayer who does not claim the minnesota tax credit for contributions are eligible for a subtraction from federal taxable income for minnesota income tax purposes each year up to $3,000 for a married couple filing joint income tax returns, and $1,500 for all other filers.

2 A taxpayer who does not claim the subtraction from federal taxable income for minnesota income tax purposes may be eligible for a non-refundable tax credit equal to 50% of the contributions to Accounts, reduced by any withdrawals, made by that taxpayer during the taxable year, with a maximum credit amount of up to $500, subject to phase-out based on certain federal adjusted gross income thresholds. On page 3 of the Disclosure Booklet, in the table entry for Fees, the first bullet point is deleted and replaced in its entirety with the following: to the Plan Manager, a Plan management fee at an annual rate of (14 basis points) of the average daily net assets of that Option. The Plan Manager fee applies to total market value of assets in the Plan up to $ billion.

3 The Plan Manager fee will be reduced to (13 basis points) once the total market value of assets in the Plan first reaches $ billion. II. ALLOCATION INSTRUCTIONS On page 5 of the Disclosure Booklet, the following paragraph is added as the second paragraph under the sub-heading Choosing investment Options : Effective November 14, 2015, the investment Option(s) you select and the percentage of your contribution you choose to be allocated to each investment Option as indicated on your Application, if submitted after November 14, 2015, will be the allocation instructions for all future contributions made to your Account by any method (except payroll deduction) ( Allocation Instructions ). If you opened your Account prior to November 14, 2015 and you have not submitted Allocation Instructions for your Account for future contributions, you can submit Allocation Instructions at any time online, by telephone or by submitting the appropriate Plan form.

4 You can change your Allocation Instructions at any time online, by telephone or by submitting the appropriate Plan form. On page 5 of the Disclosure Booklet, the paragraph under the sub-heading Changing investment Strategy for Future Contributions is replaced with the following: You may change your Allocation Instructions for future contributions at any time online, by telephone or by submitting the appropriate Plan form. On page 6 of the Disclosure Booklet, the last sentence of the paragraph under the sub-heading Checks, is replaced with the following: If you opened your Account prior to November 14, 2015 and you have not submitted Allocation Instructions for your Account for future contributions, with each contribution by check, you will need to tell the Plan in which investment Option(s) your contribution should be invested and how much of the contribution should be invested in each investment Option.

5 00199682 A40139 2 TIAA PUBLIC On page 6 of the Disclosure Booklet, the following sentence is added to the end of the paragraph under the sub-heading One-time Electronic Funds Transfer : If you opened your Account prior to November 14, 2015 and you have not submitted Allocation Instructions for your Account for future contributions, with each contribution by a one-time electronic funds transfer, you will need to tell the Plan in which investment Option(s) your contribution should be invested and how much of the contribution should be invested in each investment Option. III. PLAN FEES On pages 7-8 of the Disclosure Booklet, the information under Plan Fees is deleted in its entirety and replaced with the following: The following table describes the Plan s current fees.

6 The Board and the Office reserve the right to change the fees and/or to impose additional fees in the future. For certain Accounts deemed to be Dormant Accounts, as previously described, a fee may be charged to attempt to locate the Account Owner and/or Beneficiary of the Account. Fee Table investment Option Plan Manager Fee(1)(2) minnesota Administrative Fee(1)(4) Estimated Expenses of an investment Option s Underlying Investments(3) Total Annual Asset-Based Fees(5) Managed Allocation Option Age Band 0 4 Years Age Band 5 8 Years Age Band 9 10 Years Age Band 11 12 Years Age Band 13 14 Years Age Band 15 Years Age Band 16 Years Age Band 17 Years Age Band 18 Years and over Aggressive Allocation Option Moderate Allocation Option Conservative Allocation Option International Equity Index Option and International Equity Option Large Cap Equity Option Equity and Interest Accumulation Option 100% Fixed-Income Option Money Market Option(6) Principal Plus Interest Option(7) None None None None (1)

7 Although the Plan Manager Fee and the minnesota Administrative Fee are deducted from an investment Option, not from your Account, each Account in the investment Option indirectly bears its pro rata share of the Plan Manager Fee and the minnesota Administrative Fee as these fees reduce the investment Option s return. 3 TIAA PUBLIC (2) Each investment Option (with the exception of the Principal Plus Interest Option) pays the Plan Manager a fee at an annual rate of (14 basis points) of the average daily net assets held by that investment Option. The Plan Manager Fee applies to the total market value of assets in the Plan up to $ billion. The Plan Manager Fee will be reduced to (13 basis points) once the total market value of assets in the Plan first reaches $ billion.

8 (3) The percentages set forth in this column are based on the expense ratios of the mutual funds in which an investment Option invests. The amounts are calculated using the expense ratio reported in each mutual fund s most recent prospectus available prior to the printing of this Disclosure Booklet and are weighted according to the investment Option s allocation among the mutual funds in which it invests. Although these expenses are not deducted from an investment Option s assets, each investment Option indirectly bears its pro rata share of the expenses of the mutual funds in which it invests as these expenses reduce such mutual funds returns. (4) Each investment Option (with the exception of the Principal Plus Interest Option) pays to the State of minnesota a fee equal to of the average daily net assets held by that investment Option to pay for expenses related to the administration of the Plan.

9 (5) These figures represent the estimated weighted annual expense ratios of the mutual funds in which the investment Options invest plus the fees paid to the Plan Manager and to the State of minnesota . (6) Effective July 1, 2011, the Plan Manager and the Office have agreed to voluntarily waive the Money Market Option s Plan Manager Fee and minnesota Administrative Fee, respectively, as necessary in an attempt to maintain at least a return for this investment Option. The Plan Manager, the Office or the Board may discontinue these waivers at any time without notice. Please note that after the waivers, the net return for the Money Market Option may still be negative. (7) The Principal Plus Interest Option does not pay a Plan Manager Fee.

10 TIAA-CREF Life Insurance Company ( TIAA-CREF Life ), the issuer of the funding agreement in which this investment Option invests and an affiliate of TFI, makes payments to TFI, as Plan Manager. This payment, among many other factors, is considered by the issuer when determining the interest rate(s) credited under the funding agreement. investment Cost Example. The example in the following table is intended to help you compare the cost of investing in the different investment Options over various periods of time. This example assumes that: You invest $10,000 in an investment Option for the time periods shown below. Your investment has a 5% compounded return each year. You withdraw your entire investment from the investment Option at the end of the specified periods for Qualified Higher Education Expenses.