Transcription of Tax Commissioner Manual - Georgia Department of Revenue

1 GGEEOORRGGIIAA DDEEPPAARRTTMMEENNTT OOFF RREEVVEENNUUEE LLOOCCAALL GGOOVVEERRNNMMEENNTT SSEERRVVIICCEESS DDIIVVIISSIIOONN Tax Commissioner Procedure Manual For Educational Purposes Only: The material within is intended to give the course participant a solid understanding of general principles in the subject area. As such, the material may not necessarily reflect the official procedures and policies of the Georgia Department of Revenue or the Department s official interpretation of the laws of the State of Georgia . The application of applicability to specific situations of the theories, techniques, and approaches discussed herein must be determined on a case-by-case basis.

2 November 2016 Georgia Department of Revenue Becoming a Tax Commissioner BECOMING A TAX Commissioner Prior to 1972 many of the duties of the tax Commissioner were divided between the tax receiver and tax collector and consequently there are many sections of the law that refer to the receiver and collector Therefore, it is necessary, as tax Commissioner , to be aware of the duties and responsibilities of both titles. When laws refer to the tax collector or tax receiver, they apply equally to the consolidated office of tax Commissioner . Since the office of tax receiver and tax collector has been consolidated in all counties, the term tax Commissioner will be used throughout this handbook to refer to both titles.

3 Contents Qualifications and Certification of Qualifications .. Oath of office .. Bonds .. How Bonds are Acquired .. Required Training .. Code of Ethics .. Figures Figure Oath for Recipient of Public Funds .. Figure Oath for Tax Receivers .. Figure Oath for Tax Collectors .. Figure Example Bond, Covering Tax Figure Example of Blanket Bond .. Figure Copy of Code of Ethics .. 32 The General Assembly can consolidate the offices of tax receiver and tax collector in the office of Tax Commissioner and fix the Commissioner s compensation. Ga. Const. Art IX, 1, 3.

4 The offices of Tax collector and tax receiver have been consolidated in all counties. office of Secretary of State, Max Cleland, State of Georgia 1993 Official Directory of United States Congressmen, State and County Offices (Atlanta: office of Secretary of State, 1993), pp. 136-385. Tax Commissioner Procedures Becoming a Tax Commissioner Georgia Department of Revenue Notes: Becoming a Tax Commissioner Georgia Department of Revenue Becoming a Tax Commissioner Qualifications and Certification of Qualifications The office of tax Commissioner is one that is created by provision of Georgia 's Constitution which provides that the tax Commissioner shall be an elected county officer having a term of office of four years with powers, duties, and responsibilities as established by general One county, Dougherty County, provides by local amendment to the Constitution for the appointment of rather than the election of the tax Commissioner .

5 Tax commissioners cannot hold another county office during their tenure except by special act of the Nor, can they serve as grand jurors during their tenure in Nonpayment of taxes renders a person ineligible for Also, the tax Commissioner cannot be appointed as an assistant or deputy for Certain actions and conditions render a person eligible or ineligible, as the case may be, to hold the office of tax The tax Commissioner must be a citizen of the United States and a resident of the county for which the office is sought for a period of two years prior to qualifying for election to the office . The tax Commissioner must remain a resident of the county during the term of The tax Commissioner must be a registered voter.

6 The person must attain the age of 25 years of age prior to the date of qualifying for election to the The tax Commissioner must have a high school diploma or its recognized A person who has been convicted of a felony offense or any offense involving moral turpitude is not eligible to hold office unless that person's civil rights have been restored and at least ten years have elapsed from the date of the completion of the sentence without a subsequent conviction of another felony involving moral Persons holding public monies illegally are ineligible from holding the 2 48-5-210, Ga. Const. Art. IX, I, III 3 45-2-2 4 15-12-60 5 Sweat v.

7 Barnhill, 171 Ga. 294 <A>, 155 18 <A> (1930). 6 45-2-2 7 48-5-210 8 Griggers v. Moye, 246 Ga. 578 <A>, 272 2d 262<A> (1980) 9 48-5-210 10 Ibid. 11 45-2-1, 1962 Op. Att y. Gen. P. 131 12 48-5-210 Tax Commissioner Procedures Becoming a Tax Commissioner Georgia Department of Revenue Oath of office Tax commissioners must take three oaths as a condition precedent to assuming office and entering into the duties of office13 and these oaths must be filed with the office of the probate judge in the See penalties section in Chapter 9 for failure to do these things. They must swear, among other things, that they are not the holders of any public money due the state which is unaccounted for and that they do not hold certain other They must also affirm support of the constitutions of the United States and the State of Georgia which also involves disavowal of membership in the Communist See the following figure Figure Oath for Recipient of Public Funds The second oath required of tax commissioners relates to the duty of the office as tax receiver and requires the tax Commissioner to swear to faithful performance of the duties as receiver of tax returns of taxable property in the county and to faithful performance in carrying out all of the requirements of the tax laws of

8 The This oath is required except in those counties where the tax assessors have been designated to receive returns. See the following figure Figure Oath for Tax Receivers 13 45-3-8 14 45-3-5 15 45-3-1 16 45-3-11, 45-3-1, 45-3-12, 45-3-13, Const., Art. VI, 17 48-5-101 I, _____ (Name) a citizen of _____and being an employee of _____ and the recipient of public funds for services rendered as such employee, do hereby solemnly swear and affirm that I will support the Constitution of the United States and the Constitution of Georgia , and that I am not a member of the Communist Party. I swear that I will truly and faithfully perform the duties of the receiver of returns of taxable property, or of persons or things specially taxed in the county to which I am appointed as required of me by the laws, and will before receiving returns carefully examine each, and will to the best of my ability carry out all the requirements made upon me by the tax laws.

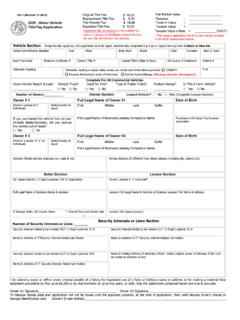

9 So help me God. Becoming a Tax Commissioner Georgia Department of Revenue Becoming a Tax Commissioner The third oath required is similar to the oath for tax receivers except it relates to the duties of the officer as tax collector for the county. It also requires affirmation of faithful performance in the duties of collecting and properly remitting taxes required to be collected by the tax Refer to the following figure Figure Oath for Tax Collectors Finally, candidates for the office of tax Commissioner must, each time they run for office , file with the officer before whom they qualified to run an affidavit certifying that they meet the qualifications for the Bonds Before assuming the office and beginning to function as tax Commissioner , various bonds must be obtained and filed.

10 Under general law, the state and its counties and municipalities all are authorized to require bonds of collecting officers and to adjust the amounts of those bonds as conditions The premiums due on the bonds must be paid by the county fiscal authorities out of county Specific statutory bonding requirements for tax commissioners include: A bond covering the faithful performance of duties relating to the function of tax receiver that is one-fourth of the amount of state tax due in the particular county for the year in which the bond is given. The Revenue Commissioner determines the amount of this bond, but no bond in an amount exceeding $10, may be See figure Bonds covering the faithful performance of duties relating to the function of tax collector are also required.