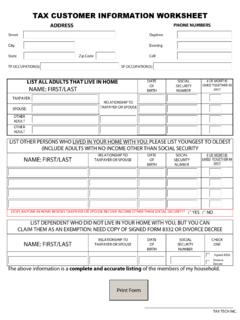

Transcription of TAX CUSTOMER INFORMATION WORKSHEET

1 TAX TECH ADULTOTHER ADULT# OF MONTHS LIVED TOGETHER IN 2017 ADDRESSS treetCityStateZip CodeLIST OTHER PERSONS WHO LIVED IN YOUR HOME WITH YOU: PLEASE LIST YOUNGEST TO OLDEST (INCLUDE ADULTS WITH NO INCOME OTHER THAN SOCIAL SECURITYNAME: FIRST/LASTRELATIONSHIP TO TAXPAYER OR SPOUSEDATE OF BIRTHSOCIAL SECURITY NUMBERTAX CUSTOMER INFORMATION WORKSHEETD aytimePHONE NUMBERSE veningCell# OF MONTHS LIVED TOGETHER IN 2017 SOCIAL SECURITY NUMBERDATE OF BIRTHNAME: FIRST/LASTTAXPAYER:SPOUSE:SOCIAL SECURITY NUMBERDATE OF BIRTHRELATIONSHIP TO TAXPAYER OR SPOUSENAME: FIRST/LASTLIST DEPENDENT WHO DID NOT LIVE IN YOUR HOME WITH YOU, BUT YOU CAN CLAIM THEM AS AN EXEMPTION: NEED COPY OF SIGNED FORM 8332 OR DIVORCE DECREECHECK ONE Signed 8332 Divorce DecreeThe above INFORMATION is a complete and accurate listing of the members of my ALL ADULTS THAT LIVE IN HOMEDOES ANYONE IN HOME BESIDES TAXPAYER OR SPOUSE RECEIVE INCOME OTHER THAN SOCIAL SECURITY?)

2 YESNOTP OCCUPATION(S)SP OCCUPATION(S)RELATIONSHIP TO TAXPAYER OR SPOUSEIf any dependent on return does not have one or both parents also on this return, what is the Taxpayer and Spouse's Relationship to parents and where are they located? Must be asked of Taxpayer/Spouse and TECH SHEETCan someone else claim you as a Dependent?YESNONOYESDo you want your State Taxes filed?NOYESAre you a Citizen? blind or Permanently Disabled?NOYESDid you live in the US for over half of the year? TANF last year? in Oklahoma the entire year?

3 NOYESDo you currently owe the IRS any taxes or penalties?Amount?NOYESDid you have health insurance last year?Months CoveredNOYESAre you currently being audited or aware of any pending audit? a First time Home buyers Credit in 2008?Yearly Payback? any health care exemptions?Proof:NOYESDo you want your refund Direct Deposited into your account?Checking/SavingsRouting Number: Account Number:Taxpayer Signature:Spouse Signature:Date: Referred by:If you have a child who requires child care while you were at work; list the name, relationship and amount paid: (Required if child is under the age of 13)