Transcription of The BOPWe All Sell It, But How Well Do We Really …

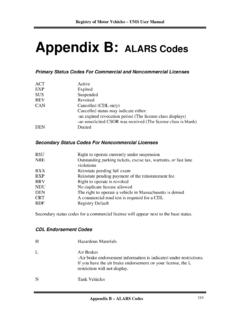

1 SPONSORED BYThe All sell It, But How well Do We Really Know It?!TThe Businessowners Policy MMichael C. D Orlando, CIC, LIA,, CPIA Insurance Training & Consulting Services 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY introduced by Allstate in 1974; ISO version introduced in as the Homeowners Policy of Commercial Lines for certain small and medium sized the reduced risk of certain accountsD. Limited number of endorsements available in early editions .. ISO expanded their program in the 97 and 02 editions vs. Independent filings:Very important to note that many carriers have their own filings which can vary considerably in terms of coverage, rates and eligibilityII. ISO ELIGIBILITY FOR BOPs xUse as a guideline to determine the basic types of businesses that can be written under a BOP.

2 Many carriers have their own eligibility and Residential Buildings not over 6 stories or 100,000 square Buildings which do not exceed a total of 35,000 square feet, and whose occupancy is principally mercantile businesses , eligible service or processing operations, or contractors0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY Personal Property in an office with less than 35,000 square Property in connection with mercantile operations, wholesale, or eligible service or processing operations which do not exceed 35,000 square feet and $6 million in gross sales annually at any insured and Processing Businesses1. Subject to the square footage and sales limitations mentioned above. more than 25% of Annual Gross Sales can come from off-premises limited to contractors in buildings of less than 35,000 square feet per location, no more than $300,000 in annual payroll, and no work at a height over three to the type of contractor, primarily being carpentry, construction of residential property, drywall installation and landscape limited to limited cooking establishments which prepare or serve food cold or cooked using appliances which do not emit smoke or grease-laden vapors (electric sandwich grills, toasters, microwave ovens) have no more than 7,500 square feet and a seating capacity of no more than 75 people.

3 Alcohol sales limited to beer or wine and these sales cannot make up more than 25% of the total gross seating capacity increased to 150 people for eligible fast food restaurants 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY F. Convenience Stores with Gasoline Pumps sales cannot exceed 75% of the total store sales automotive service or repair, no car washes, no propane or kerosene tank filling G. Laundries and Dry Cleaners meet size and sales requirements mentioned above have less than three pick-up stationsH. Wholesalers meet size and sales requirements and can have no more than 25% of sales from retail operations and no more than 25% of the total square footage may be open to the public examples of eligible parts and supplies and tool distributorsc.

4 Clothing or wearing apparel supply distributors0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY III. INELIGIBLE businesses dealers, repair or service stations, parking lots and and Service not specifically identified as not specifically identified as Personal PropertyF. 1-2 Family not specifically identified as , Savings & Loans, Credit UnionsI. Bars, pubs, cocktail loungesJ. Amusement facilitiesIV. ISO BOP Page (BP DS 01 01 10) Coverage Form (BP 00 03 01 10) I Risk of Loss Coverage as found in the Causes of Loss Special Form (CP 10 30) be endorsed with a named peril endorsement which will modify the causes of loss to be the same as found in the Causes of Loss Basic Form (CP 10 10) except the BOP policy provides limited off premises transit II III Common Policy ConditionsC.

5 Endorsements0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY V. BUSINESSOWNERS COVERAGE FORM SECTION I PROPERTY(BP 00 03 01 10) Definition similar to the CPP except: is provided within the building limit for any structure at the described premises (unless specifically identified as Property Not Covered ), without the need to schedule the structure b. Coverage is provided for Personal Property of a landlord in furnished apartments, rooms or common Personal Property Definition similar to the CPP of Others in the insured s care, custody or control is automatically covered within the Business Personal Property limit, however, valuation is subject to Loss Payment Property Loss Condition Paragraph (3)(b): building glass is covered if the insured is a tenant and not carrying building coverage.

6 The glass must be owned by or in the CCC of the insured(3) The following property at actual cash value: (b) Property of others. However, if an item(s) of personal property of others is subject to a written contract which governs your liability for loss or damage to that item(s), then valuation of that item(s) will be based on the amount for which you are liable under such contract, but not to exceed the lesser of the replacement cost of the property or the applicable Limit of Insurance; 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY Not list is considerably shorter than in the of the items listed are actually limited rather than excluded Not Covered includes: , automobiles, motortrucks & Securities unless purchased as Optional Coverage c.

7 Contraband , water, growing crops or lawns fences, antennas, signs, tress, shrubs, plants, etc., except as provided elsewhere while afloat , bills, valuable papers, etc., except as provided elsewhere permanently installed in or designed to be permanently installed in certain vehicles, except while held as stock Data, except as provided under Additional Coverages or as your stock of prepackaged , unless owned by others and boarded by you, or if owned by you, only as stock while inside of buildings0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY Business Income (1) Business Income (a)We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your "operations"during the "period of restoration".

8 The suspension must be caused by direct physical loss of or damage to property at the described premises. The loss or damagemust be caused by or result from a Covered Cause of Loss. With respect to loss of or damage to personal property in the open or personal property in a vehicle, the described premises include the area within 100 feet of the site at which the described prem-ises are located. With respect to the requirements set forth in the preceding paragraph, if you occupy only part of the site at which the described premises are located, your premises means: (i)The portion of the building which you rent, lease or occupy; and(ii)Any area within the building or on the site at which the described premises are located, if that area services, or is used to gain access to, the described premises.

9 (b)We will only pay for loss ofBusiness Income that you sustain during the "period of restoration" and that occurs within 12 consecutive months after the date of direct physical loss or damage. We will only pay for ordinary payroll expenses for 60 days following the date of direct physical loss or damage, unless a greater number of days is shown in the Declarations. (c)Business Income means the: (i)Net Income (Net Profit or Loss before income taxes) that would have been earned or incurred if no physical loss or damage had occurred, but not including any Net Income that would likely have been earned as a result of an in-crease in the volume of business due to favorable business conditions caused by the impact of the Covered Cause of Loss on customers or on other businesses ; and (ii)Continuing normal operating expenses incurred, including payroll.

10 (d)Ordinary payroll expenses:(i)Means payroll expenses for all your employees except: ; ; Managers; under contract; and shown in the Declarations as: zzJob Classifications; or zEmployees. (ii)Include: ; benefits, if directly related to payroll; payments you pay; dues you pay; and ' compensation premiums. Pages 5 & 6 of 49 0 LFKDHO & ' 2 UODQGR &,& /,$ &3,$ 3 DJH ,62 %23 HG 1RY included at no additional charge 10 ISO BOP includes the following Additional Coverages: a. Debris Removal 25% plus $10,000 same as BPP form Recommend BP 14 09 - Debris Removal Add l Ins. Endorsement b. Preservation of Property 30 days same as BPP form Department Service Charge $2,500 Not unique to BOP, but BPP form provides $1,000 d.