Transcription of THE MASTER OF THE HIGH COURT - Justice Home

1 About wills, trusts and the distribution of the estates of deceased personsTHE MASTER OF THE high COURTFREQUENTLY ASKED QUESTIONSFREQUENTLY ASKED QUESTIONS about wills, trusts and the distribution of the estates of deceased personsNote: The information contained in this brochure is intended to inform the reader about some basic aspects of wills, trusts and the distribution of the estates of deceased persons. It is not meant to be a comprehensive guide. The information on intestate succession is also merely intended to provide information about the basic rules of intestate succession. It is not meant to replace the provisions of the Intestate Succession Act, 1987 (Act 81 of 1987).TABLE OF CONTENTS PAGEADMINISTRATION OF DECEASED ESTATES 1 INTESTATE SUCCESSION 4 WILLS 8 CUSTOMARY LAW 11 TRUSTS 14 GUARDIAN S FUND 15 GLOSSARY OF TERMS 18 CONTACT DETAILS 191 What is a deceased estate?

2 A deceased estate comes into existence when a person dies and leaves property or a document, which is a will or is intended as a will. Such an estate must then be administered and distributed in terms of the deceased s will or, in the absence of a valid will, in terms of the Intestate Succession Act,1989 (Act 81 of 1989). The procedure that must be followed to administer a deceased estate is prescribed by the Administration of Estates Act, 1965 (Act 66 of 1965), as deaths must be reported to the MASTER of the high COURT ?The death of a person who dies within the Republic of South Africa and leaves property or any document that is a will or is intended as a will; and the death of a person who dies outside of the Republic of South Africa, but who leaves property and/or any document that is a will or is intended as a will, in the Republic of South Africa, must be reported to the MASTER of the must estates be reported?

3 Where the deceased was living in the Republic of South Africa, the estate must be reported to the MASTER of the high COURT in whose area of jurisdiction the deceased was living 12 months prior to his/her death. Where the deceased was not living in the Republic of South Africa at the time of his/her death, the estate may be reported to any MASTER of the high COURT , provided it is reported to only one MASTER . An affi davit in which it is stated that the letters of executorships have not already been grated by any other MASTER of the high COURT in the Republic of South Africa must accompany the reporting documents. From 5 December 2002, all Magistrates Offi ces are designated service points for the MASTER of the high COURT and estates can be reported , these service points have limited jurisdiction.

4 All estates with wills, as well as estates that exceed R50 000 in value, will be transferred to the provincial MASTER s Offi ce. Therefore, it is advisable to report these estates directly the MASTER s Offi ce. ADMINISTRATION OF DEcEASED ESTATES2 Note: If the estate value is less than R 125 000 and there is a minor heir, Legal Aid (LASA) can be contacted to assist in this and by whom must estates be reported?The estate of a deceased person must be reported to the MASTER of the high COURT within 14 days of the date of death. The death is to be reported by any person having control or possession of any property or documents that is or intends to be a will of the deceased. The estate is reported by lodging a completed death notice and other reporting documents with the MASTER which may be obtained from any Office of the MASTER of the high COURT , Magistrate s Office or on do you report an estate to the MASTER or to a service point of the MASTER of the high COURT ?

5 The reporting documents will differ slightly depending on the value of the estate and the type of appointment required. If the value of the estate exceeds R125 000, letters of executorship must be issued and the full process prescribed by the Administration of Estates Act must be , if the value of the estate is less than R125 000, the MASTER of the high COURT may dispense with letters of executorship and issue letters of authority in terms of Section 18(3) of the Administration of Estates Act, (Act 66 of 1965).The Magistrates Office service points will only have jurisdiction if the deceased did not leave a valid will and the gross value of the estate is less than R50 000. Letters of authority entitle the nominated representative to administer the estate without following the full procedure set out in the Administration of Estates documents will be required in the event of the value of the estate exceeding R125 000?

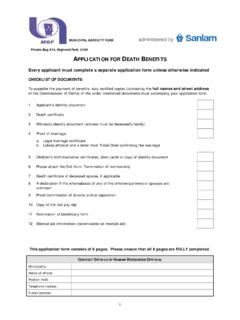

6 The following reporting documents are required: Completed death notice (form J294) Original or certified copy of the death certificate Original or certified copy of a marriage certificate (if applicable) All original wills and codicils or documents intended as such (if any) Next-of-kin affidavit if the deceased did not leave a valid will (form J192) Completed inventory form (form J243) Nominations by the heirs for the appointment of an executor in the case of an 3intestate estate, or where no executor has been nominated in the will, or the nominated executor has died or declines the appointment. Completed acceptance of trust as executor forms in duplicate by the person(s) nominated as executor(s) (form J190) plus a certified copy of the photo page of the executors ID document Undertaking and bond of security, unless the nominated executor has been exempted from providing security in the will, or is the parent, spouse or child of the deceased (form J262) Affidavit by the next-of-kin of a deceased person who has died without leaving a valid will, to the effect that the estate has not already been reported to another MASTER or service point (if applicable) Declaration of subsisting marriagesWhat documents will be required in the event of the value of the estate being less than R125 000?

7 The following reporting documents are required: Completed death notice (form J294) Original or certified copy of the death certificate Original or certified copy of a marriage certificate (if applicable) All original wills and codicils or documents intended as such (if any) Next-of-kin affidavit if the deceased did not leave a valid will (form J192) Completed inventory form (form J243) List of creditors of deceased (if applicable) Nominations by the heirs for the appointment of a MASTER s representative in the case of an intestate estate or where no executor has been nominated in the will or the nominated executor declines the appointment. Undertaking and acceptance of MASTER s directions (form J155) Declaration confirming that the estate has not already been reported to another MASTER s Office or service point of the MASTER Declaration of subsisting marriages4 What happens if I do not leave a will (intestate succession)?

8 If you die without leaving a valid will, your estate will devolve in terms of the rules of intestate succession, as stipulated in the provisions of the Intestate Succession Act, 1987 (Act 81 of 1987). In case of a marriage in community of property, one half of the estate belongs to the surviving spouse and, although it forms part of the joint estate, will not devolve according to the rules of intestate succession. For more information on the Intestate Succession Act, please consult the Act or your legal the event of intestate succession, what happens if the deceased is survived by a spouse or spouses but not by (a) descendant/sThe spouse or spouses will be the sole intestate is a spouse for purposes of intestate succession?As starting point it can be said that any party to a valid marriage in terms of the Marriage Act, 1961 (Act 25 of 1961) (a civil marriage) is regarded as a spouse for purposes of intestate party in a subsisting customary marriage which is recognized in terms of section 2 of the Recognition of Customary Marriages Act,1998 (Act 120 of 1998) is also a spouse for intestate succession purposes.

9 These marriages include customary marriages which were validly concluded before the Act came into operation, and which still existed at the commencement of the Act (15 November 2000) as well as marriages concluded in terms of the provisions of the Act after the commencement of the Act. Section 3(1) of the Reform of Customary Law of Succession and Regulation of Related Matters Act, 2009 (Act 11 of 2009), which came into operation on 20 September 2010, has created a further group of women who qualify as spouses for intestate succession purposes. They are the seed-bearing woman in terms of Customary SUccESSION5 Persons married in terms of Muslim and Hindu religious rites should be regarded as spouses for purposes of intestate succession and are entitled to inherit from their deceased partner in terms of the Intestate Succession Act, despite the fact that their marriage is not recognised as a valid marriage in terms of our current lawPersons who died before 1 December 2006, and were partners in a same-sex life partnership at the time of their death, should be regarded as spouses for purposes of intestate succession.

10 While persons in same-sex relationships who died on or after 1 December 2006 should only be regarded as spouses if they had entered into a marriage or civil partnership in terms of the Civil Union the event of intestate succession, what happens if the deceased is survived by a descendant/s, but not by a spouse?The descendant will inherit the intestate the event of intestate succession, what happens if the deceased is survived by a spouse/s as well as (a) descendant/s?The spouse or spouses inherit the greater of R125 000 per spouse or a child s share, and the children the balance of the estate. A child s share is determined by dividing the intestate estate by the number of surviving children of the deceased and deceased children who have left issue, plus the number of surviving of the child s share in the event of a polygamous marriage: In this case the value of the intestate estate is R1 000 000.