Transcription of TODAY’S FINANCE PRIORITIES: SECURITY, DATA, ANALYTICS …

1 2019 Global FINANCE Trends Survey Report TODAY'S FINANCE PRIORITIES: SECURITY, DATA, ANALYTICS . AND INTERNAL CUSTOMERS. CFOs and FINANCE leaders are focused as much on strategic matters as operational issues EXECUTIVE SUMMARY. The single factor that distinguishes This is good news. Doing more is necessary given how much more complex the business , top-performing FINANCE organizations economic and geopolitical landscapes have from the rest of the pack is more. become over just the past year. As new threats ( , cybersecurity and data breaches) and CFOs and FINANCE executives are more opportunities ( , the emergence of new determined than ever to exceed the increasing talent management models and powerful expectations of internal customers. They are new technologies) appear, organizations count more concerned with data security, privacy on their CFOs and FINANCE teams to drive the and governance. They are more focused on behavioral changes needed to execute more, and robotic process automation (RPA), artificial increasingly strategic, FINANCE priorities while intelligence (AI), blockchain, predictive improving their service to internal customers.

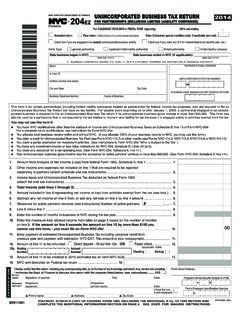

2 ANALYTICS , cloud-based applications and other advanced technologies. They want to make We take a look at these and other trends in their financial planning and management breaking down the findings of our latest Global reports more insightful to more stakeholders. FINANCE Trends Survey. And they are embracing and espousing a more strategic mindset and operating model. Today's FINANCE Priorities: Security, Data, ANALYTICS and Internal Customers 1. In our survey, respondents were asked to rate 40 different FINANCE areas based on a 10-point scale, where 1 reflects the lowest priority and 10 reflects the highest priority for the FINANCE function to improve its knowledge and capabilities over the next 12 months. Rankings are based on the percentage of respondents who scored these areas at 8 or higher. TOP 10 OVERALL PRIORITIES FOR CFOs/VPs FINANCE Security and privacy of data 84%. Enhanced data ANALYTICS 79%. Process improvement: process and data ANALYTICS 75%. Changing demands and expectations 73%.

3 Of internal customers Embracing new technologies 73%. Internal controls 73%. Accounting and FINANCE implications of IT 72%. Financial planning and analysis 71%. Strategic planning 71%. Profitability reporting and analysis 70%. The CFO, controller and FINANCE leader community have clearly earned a seat at the strategy table, and their interests and concerns show a focused intent to add maximum value in that role. At the same time, they are mindful of the need to cover important blocking and tackling, and contend with a changing financial reporting landscape, which requires an emphasis on and, . rather than or, as they plan and staff up for the coming years. Christopher Wright, Managing Director Global Leader, business Performance Improvement Protiviti KEY FINDINGS. Data, privacy, ANALYTICS and customer service are top FINANCE priorities FINANCE 01 organizations are becoming more security-minded, more strategic, more data-driven, and more external and internal customer-focused.

4 It's time to embrace advanced technologies More FINANCE organizations are migrating 02 from enterprise resource planning (ERP) systems and related applications to a cloud model, implementing RPA and AI, improving how they leverage and protect data, and investigating blockchain applications and virtual currencies. As FINANCE executives continue to evolve and enhance their relationships with key internal stakeholders, and align themselves as true strategic partners to the business , it is more important than ever to capture feedback that allows FINANCE teams to have clear line of sight into internal customer needs and preferred engagement models. Bryan Comite, Managing Director, business Performance Improvement Protiviti 4 Protiviti Our survey results are very encouraging in that they indicate FINANCE organizations are looking for opportunities through innovation and new technologies, and further, that these opportunities are backed by planned budget increases. Traditionally, innovation is often seen as an opportunity or nice to have.

5 With more risk-focused concerns such as controls operation and keeping the lights on taking priority to deliver on regulatory-driven deadlines. Consider Sarbanes-Oxley, for example. This has resulted in an environment where processes are often manual and inefficient. But with changing demands from internal customers, CFOs are having to invest in emerging technologies and capabilities to meet these demands. Scott Bolderson, Managing Director, business Performance Improvement Protiviti Deep, impactful and proactive insights delight internal customers As is the case for every 03. organizational function, the FINANCE organization is now in the customer experience business . Financial planning/analysis, strategic planning, and profitability reporting and analysis are highly ranked FINANCE process priorities, in part, because these activities (services) deliver the insights and analyses (products) that FINANCE 's internal customers count on to make critical business decisions.

6 04 Skills and talent gaps drive workforce management innovations CFOs and FINANCE leaders increasingly are employing new, more flexible labor models. Today's FINANCE Priorities: Security, Data, ANALYTICS and Internal Customers 5. P R I O R I T I E S I N F I N A N C E : S E C U R I T Y, D ATA A N D I N T E R N A L C U S TO M E R S. The results of our research offer compelling severe financial loss and significant operational evidence that FINANCE organizations are operating impact, have undoubtedly put FINANCE teams on notice with a more strategic mindset while prioritizing that the data they maintain must be secured and security, innovation and customer service. managed properly. Compounding these concerns is the reality that, in all likelihood, most FINANCE leaders We see that FINANCE leaders want to optimize security lack sufficient understanding of the technical aspects and data management capabilities and improve how and requirements of appropriate security and they meet the rapidly changing expectations of a privacy measures, resulting in a fear of the unknown growing body of internal customers.

7 They realize that and a substantial reliance on the effectiveness of failing to make progress in protecting and leveraging others. Essentially, they may be unsure if they should data assets, whether on-premises or in the cloud, and feel comfortable about their current control state, addressing the needs of internal customers could while concurrently having regulatory responsibility to result in a failure to meet the business 's strategic- report a breach. Unlike other financial-related risks level expectations. and controls, FINANCE leaders rely on others , IT. and security teams to articulate and implement It is understandable to find security and privacy of specific controls and protections for cyber risk. data atop the list of priorities for CFOs and FINANCE Of note, this dynamic drives many CFOs to be leaders. They see what is going on in the market and involved in the process of procuring cyber insurance read about it in the media. Continued reports of data for the organization to help mitigate this risk from a breaches, involving the loss of millions of records, financial perspective.

8 6 Protiviti Among the other top-rated priorities, enhanced data These priorities, top areas of focus and related budgeting ANALYTICS and related process improvements, along with decisions also show that FINANCE leaders and their groups meeting the changing demands of internal customers, all are committed to supporting and in some cases tie into providing the business with more, better and often even leading their organization's ongoing digital real-time information. CFOs and FINANCE leaders have transformation and embrace of the innovation economy. As more customers than ever before within the organization. we can see in our results, there is growing interest in the use And those customers want more specific insights, metrics of, and investment in, advanced technologies such as data and ANALYTICS that provide insights into financial and visualization, RPA and blockchain. These and other leading- operational performance, and thus drive strategic decision- edge tools and activities are being implemented in tandem making.

9 From the board down to operational line managers with the execution of the FINANCE organization's core and even third-party partners, there is greater demand for responsibilities, which include closing the books, filing stronger and clearer financial metrics. The FINANCE function periodic financial reports, and responding to regulatory is on notice to put into place processes and practices to and legislative changes ( , the ongoing ripple effects of deliver on these expectations. The FINANCE function has the Tax Cuts and Jobs Act), resulting in a tough balancing act also, though, earned a new or expanded seat at the table in for FINANCE leadership. strategic discussions, as this information is often requested or required in real-time. Key Action Items for CFOs and FINANCE Leaders Ensure that the FINANCE organization understands and is involved in the enterprise's overall security measures and data protection strategies while monitoring data security, privacy and governance related to all FINANCE and accounting data and activities.

10 Consider mechanisms for monitoring and responding to changing internal customer expectations and demands regarding the financial analyses and insights the FINANCE organization produces to help their business partners make better, more forward-looking decisions. Today's FINANCE Priorities: Security, Data, ANALYTICS and Internal Customers 7. Respondents were asked to rate 16 different FINANCE areas based on a 10-point scale, where 1 reflects the lowest priority and 10 reflects the highest priority for the FINANCE function to improve its knowledge and capabilities over the next 12 months. HIGH PRIORITIES (PERCENTAGES OF RATINGS WITH A SCORE OF 8 10). 84%. Security and privacy of data 77%. 79%. Enhanced data ANALYTICS 70%. 75%. Process improvement: process and data ANALYTICS 68%. Changing demands and expectations 73%. of internal customers 61%. 70%. Federal tax changes 58%. 70%. Cloud-based applications that support FINANCE 55%. 70%. Mobile FINANCE applications 53%. 69%.