Transcription of TP-584-NYC-I Instructions for Form TP-584-NYC

1 Department of Taxation and FinanceInstructions for form TP-584-NYCC ombined Real Estate Transfer Tax Return,Credit Line Mortgage Certificate, and Certificationof Exemption from the Payment of Estimated Personal Income Tax for the conveyance of Real Property Located in New York CityTP-584-NYC-I(7/21)HighlightsA limited liability company (LLC) must disclose all owners until full disclosure of ultimate ownership to the natural persons. Effective April 19, 2021, members of an LLC that are a publicly traded company, a real estate investment trust (REIT), an umbrella partnership real estate investment trust (UPREIT) or a mutual fund, no longer have to provide names and business addresses of its shareholders, directors, officers, members, managers, and partners with a return. See Single and multi-member conveyanceThe additional base tax and the supplemental tax do not apply to conveyances that are made pursuant to binding written contracts entered into on or before April 1, 2019, provided the date of execution of the contract can be confirmed by independent evidence.

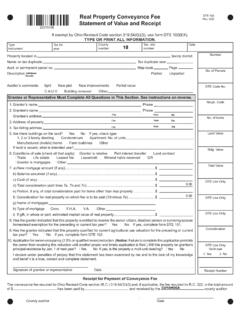

2 form TP-584-NYC and all applicable taxes are due no later than the 15th day after the delivery of the deed or similar legal of form TP-584-NYCForm TP-584-NYC must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale or transfer of real property or cooperative units under Tax Law 663(a).Since this form is used to satisfy the filing requirements of three distinct taxes, rely on the definition of terms and Instructions as they pertain to each must file form TP-584-NYC must be filed for each conveyance of real property from a grantor/transferor to a may not be necessary to complete all the schedules on form TP-584-NYC . The nature and condition of the conveyance will determine which of the schedules you must complete.

3 See the specific Instructions for completing each : Public utility companies, regulated by the Public Service Commission, and governmental agencies that are granted easements and licenses for consideration of less than $500 may use form , Real Estate Transfer Tax Return for Public Utility Companies and Governmental Agencies Easements and Licenses, to record these conveyances. For purposes of form , a governmental agency is the United Nations, the United States of America, New York State, or any of their instrumentalities, agencies, or political subdivisions, or any public corporation, including a public corporation created pursuant to an agreement or compact with another state or conveyance of an easement or license to a public utility company, where the consideration is $2 or less and is clearly stated as actual consideration in the instrument of conveyance , does not require the filing of form TP-584-NYC or form and where to file File form TP-584-NYC with the recording officer of the county where the real property being conveyed is located, no later than the fifteenth day after the delivery of the instrument effecting the conveyance .

4 However, if the instrument effecting the conveyance will not be recorded, or will be recorded later than the time required to file form TP-584-NYC and to pay any real estate transfer tax, file form TP-584-NYC and pay any real estate transfer tax due no later than the fifteenth day after the delivery of the instrument effecting the conveyance , directly with: NYS TAX DEPARTMENT RETT RETURN PROCESSING PO BOX 5045 ALBANY NY 12205-5045 Private delivery services See Publication 55, Designated Private Delivery of estimated personal income taxNonresident individuals, estates, and trusts must comply with the provisions of Tax Law 663, estimating the personal income tax on the gain, if any, from the sale or transfer of certain real property, or shares of stock in a cooperative housing corporation, in connection with the grant or transfer of a proprietary leasehold by the owner of the shares, where the cooperative unit represented by such shares is located in New York State.

5 form IT-2663 Use form IT-2663, Nonresident Real Property Estimated Income Tax Payment form , to compute the gain (or loss) and pay the estimated personal income tax due from the sale or transfer of certain real property. You will need to present form IT-2663 and pay the full amount of estimated personal income tax due, if any, to the recording officer at the time the deed is presented for IT-2664 Use form IT-2664, Nonresident Cooperative Unit Estimated Income Tax Payment form , to compute the gain (or loss) and pay the estimated personal income tax due from the sale or transfer of the cooperative unit. You will need to file form IT-2664 and pay the full amount of estimated personal income tax due, if any, to the NYS Tax Department within 15 days of the delivery of the instrument effecting the sale or transfer of the cooperative DThe requirement for payment of estimated personal income tax under Tax Law 663 does not apply to individuals, estates, or trusts who are residents of New York State at the time of the sale or transfer.

6 However, residents must complete form TP-584-NYC , Schedule D, Certification of exemption from the payment of estimated personal income tax. See Who must complete Schedule D for more 2 of 9 TP-584-NYC -I (7/21)In addition, the requirement may not apply to certain sales or transfers even if the individual, estate, or trust is a nonresident at the time of the sale or transfer. An exemption may be allowed if any of the following apply: The real property or cooperative unit being sold or transferred is a principal residence of the transferor/seller within the meaning of Internal Revenue Code (IRC) section 121. The transferor/seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure or in lieu of foreclosure with no additional consideration. The transferor or transferee is an agency or authority of the United States of America, an agency or authority of New York State, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage Association, or a private mortgage insurance claim any of the above exemptions, nonresidents of New York State must complete Schedule D.

7 See Who must complete Schedule D for more D does not need to be completed if the interest being transferred is anything other than a fee simple interest in real property or a cooperative unit, or if the property is being transferred by anyone or any entity other than an individual, estate, or trust. However, Schedules A, B, and C must still be completed to satisfy the transfer tax and mortgage tax for Schedule A Name and address boxPrint or type the name, address, and Social Security number (SSN) or employer identification number (EIN) of the grantor and grantee as they appear in your deed, lease, or other instrument that conveys the interest in real property. If additional space is needed, attach a schedule in the same format to form TP-584-NYC and include the name, address, and SSN or EIN of all the grantors and grantees. If the grantor or grantee is a single member limited liability company (LLC), enter the name and taxpayer identification number (SSN or EIN or both) for both the LLC and the single member (also see Single and multi-member LLC).

8 If the conveyance is pursuant to a mortgage foreclosure or any other action governed by the Real Property Actions and Proceedings Law, the defaulting mortgagor or debtor is the and multi-member LLCIf the grantor or grantee is an LLC and the property being conveyed is a building containing up to four family dwelling units, form TP-584-NYC cannot be accepted for filing unless accompanied by documentation that identifies all members, managers, and other authorized persons of the LLC. If any member of the LLC is itself an LLC or other business entity, other than a publicly traded entity, a real estate investment trust (REIT), an umbrella partnership real estate investment trust (UPREIT), or a mutual fund, a list of all shareholders, directors, officers, members, managers, and/or partners of that LLC or other business entity must also be provided until ultimate ownership by natural persons is disclosed.

9 See Definition of terms for the real estate transfer tax, for the meanings of natural person and authorized required documentation must include the following information for each individual and entity: name; and address of the business or : On September 16, 2019, RRP, LLC, a single-member LLC, is the grantor in a deed transfer of a two-family house to an individual. RRP, LLC s single member is ABC Partnership. ABC Partnership has four individual partners and one partner, RRP2, LLC, that is a multiple-member LLC. RRP2, LLC has three individual members. Provide all required documentation for: all managers and other authorized persons of RRP, LLC; ABC Partnership; ABC Partnership s four individual partners; RRP2, LLC; RRP2, LLC s three individual members; all officers and directors of ABC Partnership; and all officers, directors, and managers of RRP2, commercial use The documentation requirements apply when the applicable property is partially used for commercial : On September 13, 2019, MP, LLC, a multiple-member LLC, is the grantor in a deed transfer of a four-family house.

10 Three of the units are used as residences, and one unit is used for commercial purposes as a retail store. The documentation requirements and description of property conveyed Provide the location and description of the interest in real property being conveyed by entering the tax map designation, the Statewide Information System Code (SWIS Code), and address as they appear in your deed, lease, or other instrument that conveys the interest in real property. If you do not know your SWIS Code, go to You may also obtain the SWIS Code from your tax bill or by contacting the assessor s office where the property is located. Also include the name of the city or village, town, and county where the property conveyed is of property conveyed Indicate the type of property being conveyed by marking an X in the appropriate box. If you are conveying a one- to three-family house, a residential cooperative apartment, or a residential condominium unit, you may be entitled to the continuing lien deduction.