Transcription of Understanding UCDP Proprietary Risk Score Messages

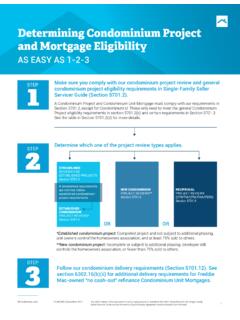

1 October 2018 Freddie Mac Learning Understanding UCDP Proprietary Risk Score Messages The Uniform Collateral Data Portal (UCDP ) is a single portal for the electronic submission of appraisal data files and facilitates the electronic collection of appraisal report data. It communicates with Loan Collateral Advisor to analyze submitted appraisal reports and provide lenders with critical information to help drive appropriate levels of appraisal review. In addition, the UCDP provides an immediate view of collateral representation and warranty relief for property value at no cost to you. Loan Collateral Advisor s results include a real-time risk Score , providing a view of overvaluation risk, that is returned as Proprietary message in the UCDP. Freddie Mac is also using these results internally our Quality Control (QC) team uses the results, including the risk Score and feedback Messages , to assist in its sampling and review of appraisal reports.

2 Where are the Loan Collateral Advisor risk Score and findings Messages returned in the UCDP? The Loan Collateral Advisor risk Score (LCA Risk Score ) and findings Messages are returned within the appraisal : Findings section of the UCDP report under the Freddie Mac tab. The message is also returned on the UCDP Submission Summary Report (SSR) under Freddie Mac Proprietary Edit Findings and available via UCDP Direct Integration. Examples of risk Score Messages returned in appraisal : Findings section October 2018 Freddie Mac Learning Page 2 Understanding UCDP Proprietary Risk Score Messages The following is a list of risk Score Messages that may be returned: Message ID Message Examples Freddie Mac Severity Indicator FRE4020 LCA Risk is assessed at [Risk Score ] indicating a [Risk Level] risk of overvaluation. Notification FRE4030 The appraised value may have a significant risk of undervaluation. Notification FRE4040 LCA Risk could not be assessed for this submission.

3 Please review the Freddie Mac findings for additional information. Notification NOTE: Risk scores are currently returned for Form 70/1004 and 465/1073 appraisal reports only. What does the LCA Risk Score indicate? The LCA Risk Score provides greater transparency into the tool s view of over-valuation risk associated with an appraisal . Appraisals that are well aligned, or below the Home Vale Explorer 1 (HVE 1) point value, are considered lower risk of overvaluation and, therefore, exhibit lower risk scores. The following table shows the LCA Risk Score values and their associated risk levels. LCA Risk Score A risk measure of Loan Collateral Advisor s assessment of overvaluation risk. Score 1 2 3 4 5 Risk Very Low Low Moderate High Very High October 2018 Freddie Mac Learning Page 3 Understanding UCDP Proprietary Risk Score Messages The scenarios in the table below provide additional insight into what the risk scores mean.

4 Then it Very Low and Low Risk Scores (for example, a Score of ) The appraisal is not missing critical data and there is a minimal risk of overvaluation. Moderate Risk Scores (for example, a Score of 3) There is some risk of over-valuation considering the appraised value and the HVE1 value. There may also be certain defects within the appraisal construction. It may be beneficial to consider the information available within the UCDP s Freddie Mac Submission Summary Report (SSR) to determine whether the appraisal report provides sufficient information to support the analysis and conclusions. The Proprietary Messages within the SSR can help guide the actions you may need to take. High Risk Scores (for example, a Score of ) There is more significant over-valuation risk considering the appraised value and the HVE value. There may also be more critical defects within the appraisal construction. You should consider the information available within the UCDP s Freddie Mac Submission Summary Report (SSR) to determine whether the appraisal report provides sufficient information to support the analysis and conclusions.

5 The Proprietary Messages within the SSR can help guide the actions you may need to take. No LCA Risk Score An LCA Risk Score of 99 is returned. This may be due to HVE being unavailable, not having a value for the property or because the report may be incomplete/missing critical information. Proprietary Messages will indicate the reason for the Score : If you receive an HVE is unavailable message, you may resubmit the appraisal report to the UCDP at a later time so it can be reassessed by Loan Collateral Advisor. If the report is missing critical information, UCDP Messages will provide specific feedback for you to address. You may resubmit the appraisal report to the UCDP once the report has been corrected to include missing information so it can be reassessed by Loan Collateral Advisor. 1 HVE is a Freddie Mac Automated Valuation model (AVM) tool that generates an estimate of property value. NOTE: Photos and commentary provided by the appraiser should always be reviewed as they may provide additional information to support the appraiser s analysis and conclusions.

6 October 2018 Freddie Mac Learning Page 4 Understanding UCDP Proprietary Risk Score Messages What is the Freddie Mac tab under the appraisal 1: Findings section of the UCDP report and how is it organized? The Freddie Mac tab under the appraisal 1: Findings section provides actionable information to assist you in performing QC and underwriting of the appraisal . Messages within this section are organized into lender-friendly categories to make it easier for you to determine what type of message is returned. The categories include: Category Description Risk Level (4000) Highlights the Loan Collateral Advisor risk level and if the appraisal is eligible for collateral rep and warranty relief for property value. Example: This appraisal is eligible for representation and warranty relief for property value, pending an assessment of the loan. Valuation (4100) Highlights specific valuation concerns based on information available to Freddie Mac and/or information provided on the appraisal .

7 Example: The current valuation of the subject property is more than 20% higher than a recent transfer on 2018-04-26 for $200,000. Please ensure that the appraisal addresses this transfer and that the current value is accurate and well supported within the appraisal . In addition, when Freddie Mac identifies significant risk of appraised value being undervalued, a specific message (message 4030) is returned. Comp Selection / Adjustment Appropriateness (4200) Highlights comparable selection and/or adjustment issues. Example: The appraisal contains less than 2 comparable sales/listings from within the subject property's zip code; however, 6 or more potentially comparable property(-ies) were identified within the subject property's zip code. Report Completeness (4300) Highlights incorrectly completed or incomplete sections of the report. Example: No selection has been made for conditions that affect livability, soundness or structural integrity.

8 Report Inconsistencies (4400) Highlights areas within the report that contain inconsistent information. Example: Predominant housing price is outside the High and Low prices noted in Neighborhood section. Data Discrepancy (4500) Highlights areas where data on the appraisal conflicts with data from historical appraisals or other data sources available to Freddie Mac. October 2018 Freddie Mac Learning Page 5 Understanding UCDP Proprietary Risk Score Messages Category Description Example: The reported foundation type of Concrete Slab for the subject property disagrees with the foundation type on the following appraisals: 2018-01-06 - Crawl Space, 2015-08-15 - Crawl Space. Eligibility (4600) Highlights potential issues with loan or property eligibility in meeting Freddie Mac s guidelines. Example: The appraisal report indicates that the zoning is Legal Nonconforming and that rebuilding to current density is not permitted.

9 Please ensure that this mortgage is eligible for sale to Freddie Mac. How can the information provided in the UCDP be used? UCDP Proprietary Messages can be flexibly implemented within your current processes. For example, you can: Use the LCA Risk Score as a factor in defining risk tolerance levels for your organization. Determine which appraisals may take advantage of a streamlined review process and which appraisals may require escalation to a more experienced appraisal underwriter or staff appraiser. Leverage the LCA Risk Score and Messages to direct workflow and allocate resources. NOTE: The LCA Risk Score is not, taken on its own, an indication of purchase eligibility. Any loan with an appraisal that has a successful UCDP status may be eligible for sale to Freddie Mac. However, it remains the seller s responsibility to confirm that the collateral and associated appraisal meet Freddie Mac requirements.

10 How can Loan Collateral Advisor help me optimize my review process? based upon the LCA Risk Score and Proprietary Messages under the Freddie Mac tab in the appraisal : Findings section of the UCDP If you have determined that appraisal risk is low, you might consider a more streamlined appraisal review: - Route low-risk appraisals to underwriters with generalized skill sets. - Review Messages to ensure there are no data discrepancies specific to condition or quality. - Ensure photos and commentary are consistent with conclusions such as Condition and Quality Ratings within the report. - Ensure required addendums are included. - Ensure appraisal certifications and required signatures are included. If you have determined that appraisal risk is high, you might consider an escalation process: October 2018 Freddie Mac Learning Page 6 Understanding UCDP Proprietary Risk Score Messages - Escalate the appraisal to more senior underwriters or staff appraisers for a detailed review and analysis.