Transcription of Week in review November 9, 2018 - Fidelity

1 week in reviewNovember 23, 2018 HighlightsFalling oil prices and a sell-off in the technology sector hurt global equities over the week . Ongoing trade tensions between the and China also continued to weigh on markets. The Brent and crude oil prices fell to their lowest levels in a year over supply concerns. equities ended a holiday-shortened week sharply lower, with information technology stocks declining the most, on concerns about a weakening outlook. Warnings from retailers also encouraged a cautious mood among investors, who were already on edge about the risk of slowing global growth and rising interest rates. In Canada, health care and energy stocks pushed the S&P/TSX Index lower, while gains in the consumer staples and communication services sectors somewhat offset the losses. Weak economic data and a lack of progress on resolving global trade tensions weighed on investor sentiment. In response to declining oil prices and equity markets, benchmark Treasury yields fell as investors began to prefer safe-haven government bonds.

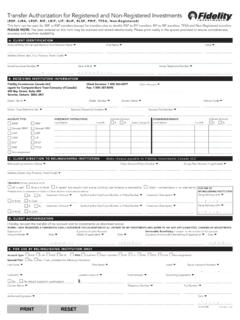

2 Expectations of future inflation declined, reflecting the fall in oil prices, and contributed to the fall of the ten-year Treasury note yield, which declined to The fall in yields indicates a rise in bond : Bloomberg, returns are in local currency. All equity indexes are price returns and do not include dividends.* Please refer to Appendix for the above table in Canadian dollar ,00012,00013,00014,00015,00016,00017,000 Aug-15 Nov-15 Feb-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jul-18 Oct-18S&P/TSX Composite IndexPrice200-Day MA50-Day 2Y 3Y 5Y 7Y 10Y 30 YTreasury yield , , , , 20001, 1006, Stoxx 503, 22521, Seng25, Comp. 2, income Close WeeklyMTDYTDFTSE TMX Uni. 1, Global Agg. Pref 1, yieldsClosebps chg Weeklybps chg MTDbps chg YTD10 yr Canada Govt. yr yr Canada Govt. yr in reviewNovember 23, 2018 Economic indicatorsPeriodSurveyActualPrior periodCanada retail sales (MoM) CPI (YoY) initial jobless housing durable goods manufacturing of Michigan sharp decline in oil prices affected companies in the energy sector, pushing Canadian equities lower for the week .

3 Gains in the consumer staples and communication services sectors helped contain the losses. Both the Brent and crude oil prices fell to their lowest levels since October 2017 and were on course for their biggest one-month decline since late 2014. Although the Organization of the Petroleum Exporting Countries (OPEC) is expected to curb output, rising oil supply has fuelledpersistent concerns about a global the economic front, a rise in the prices of transport and shelter pushed Canada s annual inflation upwards to in October, above the Bank of Canada s target. Meanwhile, rising sales of food and beverages, cars and clothing supported a gain in Canadian retail sales in September. crude oil prices, a sell-off in technology stocks and underwhelming corporate earnings sent equities sharply lower over a holiday-shortened trading week . Energy stocks also declined sharply, dragged down by a continuing tumble in oil prices, which reached their lowest level in over a year.

4 The typically defensive utilities sector helped to contribute some gains. The FAANG stocks (Facebook, , Apple, Netflix and Google parent Alphabet) entered a bear market, off more than 20% from their highs, as investors reassessed their growth outlooks and lofty declined after reports suggested that the company has cut production orders for the new iPhones unveiled earlier this year. Facebook s share prices fell as the company continued to struggle with more negative publicity regarding the fallout from its handling of the 2016 election and foreign influence on its platform. Elsewhere, retailers Kohl and Target came under pressure after they reported worse-than-expected earnings. On the economic front, housing starts rose slightly less than expected, by , to million in October. Meanwhile, lower demand for transport equipment and primary metals led to a sharp decline of in durable goods orders in of the worldEuropean and Asian equities followed global markets, with the tech sector sell-off and the lack of progress in resolving global trade tensions weighing on investor sentiment.

5 Lacklustre economic reports and continued political uncertainty about Brexit and Italy s budget hurt European equities. Chinese equities led the decline in Asia. Reports that the government was lobbying its allies to avoid buying equipment from Huawei Technologies, citing security concerns, sparked a sell-off in Chinese tech in reviewNovember 23, 2018 SpotlightLooking aheadEconomic indicatorsDateSurveyPrior periodCanada Q3 industrial product price (MoM) Conference Board consumer new home MBA mortgage Q3 initial jobless claims29-Nov220k224kSource: Bloomberg, November 23, 2018. Central banksDateProbability of increaseCurrent rateBank of Central Open Market of bank meetingsEquity income vs. bond yields As the post-crisis fiscal and monetary stimulus fade and financial conditions tighten due to rising interest rates, global central banks may choose not to raise interest rates significantly from the current levels. In this environment, dividend-paying stocks may look attractive compared to bond yields, particularly after the drop in equity markets globally in October.

6 The correction has pushed dividend yields even higher while bond yields hardly moved, boosting equity risk premium, which was already significant. Furthermore, equity yields not only look good relative to bonds and cash, but dividends can afford an element of protection against equity market volatility and inflation. Attractively valued companies that can grow their dividend distribution ahead of inflation provide investors with a positive 'real' : YieldsSpreadCanada 10-yr government bond yieldS&P TSX 12-m Trailing Dividend YieldWeek in reviewNovember 23, 2018 Global markets (Returns in Canadian dollar terms)AppendixSource : Bloomberg, DataStream. All equity indexes returns are price returns and do not include e k lyM TDYTDS&P/TSX 15, 2, 6, 24, 2000 1, 100 6, Stoxx 50 3, 225 21, Seng 25, Comp. 2, ACWI EM incom e Close We e k lyM TDYTDFTSE TMX Uni.

7 1, Global Agg. Pref 1, yieldsClosebps chg Weekly bps chg MTD bps chg YTD10 yr Canada yr yr Canada yr m odities Close We e k lyM TDYTDOil gas 1, Close We e k lyM TDYTDCAD/USD EUR in reviewNovember 23, 2018 Views expressed regarding a particular company, security, industryor market sector are the views only of thatindividual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Such views are subject to change at any time, based upon markets and other conditions, and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment adviceand, because investment decisions for a Fidelity Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity Fund.

8 Certain statements in this commentary may contain forward-looking statements ( FLS ) that are predictive in nature and may include words such as expects, anticipates, intends, plans, believes, estimates and similarforward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest, and assuming no changes to applicable tax or other laws or government regulation. Expectations and projections about future events are inherently subject to, among other things, risks and uncertainties, some of which may be unforeseeable and, accordingly, may prove to be incorrect at a future date. FLS are not guarantees of future performance, and actualevents could differ materially from those expressed or implied in any FLS. A number of important factors cancontribute to these digressions, including, but not limited to, general economic, political and market factors in NorthAmerica and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events.

9 You should avoid placing any undue reliance on FLS. Further, there is no specific intention of updating any FLS, whether as a result of new information, future events or otherwise.