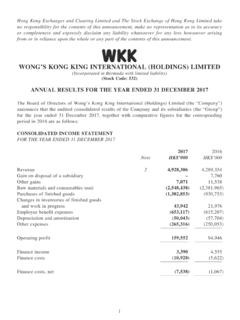

Transcription of WONG’S KONG KING INTERNATIONAL (HOLDINGS) LIMITED

1 1 Hong Kong Exchanges and Clearing LIMITED and The Stock Exchange of Hong Kong LIMITED take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. WONG S KONG KING INTERNATIONAL (HOLDINGS) LIMITED (Incorporated in Bermuda with LIMITED liability)(Stock Code: 532)ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2018 The Board of Directors of Wong s Kong King INTERNATIONAL (Holdings) LIMITED (the Company ) announces that the audited consolidated results of the Company and its subsidiaries (the Group ) for the year ended 31 December 2018, together with comparative figures for the corresponding period in 2017 are as follows.

2 CONSOLIDATED INCOME STATEMENTFOR THE YEAR ENDED 31 DECEMBER 201820182017 NoteHK$ 000HK$ 000 Revenue35,296,4114,928,306 Other gains9,9737,071 Raw materials and consumables used(2,946,791)(2,548,438)Purchases of finished goods(1,302,736)(1,302,853)Changes in inventories of finished goods and work in progress101,09543,942 Employee benefit expenses(675,328)(653,117)Depreciation and amortisation(54,195)(50,043)Net impairment loss on financial assets(588)(5,063)Other expenses(291,607)(260,253)Operating profit136,234159,552 Finance income3,3773,390 Finance costs(20,253)(10,928)Finance costs, net(16,876)(7,538)220182017 NoteHK$ 000HK$ 000 Share of profit of a joint venture1,627711 Write-back of impairment of amount due from a joint venture 3051,6271,016 Profit before income tax120,985153,030 Income tax expense4(32,820)(39,182)Profit for the year388,165113,848 Attributable to:Owners of the Company82,106111,471 Non-controlling interests6,0592,37788,165113,848 Earnings per share for profit attributable to the owners of the Company during the year (expressed in HK cents per share) STATEMENT OF COMPREHENSIVE INCOMEFOR THE YEAR ENDED 31 DECEMBER 201820182017HK$ 000HK$ 000 Profit for the year88,165113,848 Other comprehensive (loss)/income.

3 Items that will not be reclassified subsequently to profit or lossFair value gains on equity investments at fair value through other comprehensive income, net of tax9,334 Remeasurements of post-employment benefit obligations, net of tax665(706)Items that may be reclassified to profit or lossCurrency translation differences(24,562)41,694 Fair value losses on available-for-sale financial assets, net of tax (841)Total comprehensive income for the year73,602153,995 Attributable to:Owners of the Company71,532145,206 Non-controlling interests2,0708,78973,602153,9954 CONSOLIDATED BALANCE SHEETAT 31 DECEMBER 201820182017 NoteHK$ 000HK$ 000 ASSETSNon-current assetsLand use rights12,22312,584 Property, plant and equipment488,550519,077 Deposits and prepayments7,9697,557 Intangible assets5663,185 Interests in joint ventures2,3431,405 Deferred tax assets7,3614,424 Available-for-sale financial assets 43,881 Financial assets at fair value through other comprehensive income57,597 Financial assets at fair value through profit or loss3,632 Club membership and debentures14,42214,422 Total non-current assets594,663606,535 Current assetsInventories972,182811,652 Trade and other receivables61,538,2101,402,954 Contract assets25,334 Deposits and prepayments83,14472,877 Tax recoverable2,4201.

4 397 Derivative financial instruments5 Short-term time deposits71,02778,489 Cash and cash equivalents248,923536,568 Total current assets2,941,2452,903,937 Total assets3,535,9083,510,472 LIABILITIESNon-current liabilitiesObligations under finance leases due after one year4978 Provision for assets retirement obligations1,7101,710 Deferred tax liabilities 416 Retirement benefit obligations7,6128,797 Total non-current liabilities9,37111,001520182017 NoteHK$ 000HK$ 000 Current liabilitiesTrade, bills and other payables7882,2241,085,855 Contract liabilities75,017 Current income tax liabilities20,78922,443 Bank borrowings due within one year876,307711,078 Obligations under finance leases due within one year3534 Derivative financial instruments 667 Total current liabilities1,854,3721,820,077 Total liabilities1,863,7431,831,078 EQUITYC apital and reserves attributable to owners of the CompanyShare capital872,94573,771 Reserves1,529,3321,513,3531,602,2771,587 ,124 Non-controlling interests69,88892,270 Total equity1,672,1651,679,394 Total equity and liabilities3,535,9083,510,4726 NOTES:1.

5 BASIS OF PREPARATIONThe consolidated financial information has been prepared in accordance with all applicable Hong Kong Financial Reporting Standards ( HKFRS ). In addition, the consolidated financial information includes the applicable disclosures required by the Rules Governing the Listing of Securities of The Stock Exchange of Hong Kong LIMITED ( Hong Kong Stock Exchange ) and by the Hong Kong Companies consolidated financial information has been prepared under the historical cost convention, except for certain financial assets and financial liabilities (including derivative financial instruments), which are measured at fair value.(a) New and amended standards, improvement and interpretation adopted by the GroupThe Group has applied the following new and amended standards, improvements and interpretation for the first time for their annual reporting period commencing 1 January 2018: Financial Instruments HKFRS 9 Revenue from Contracts with Customers HKFRS 15 Classification and Measurement of Share-based Payment Transactions HKFRS 2 (Amendments) Clarifications to HKFRS 15 HKFRS 15 (Amendments) Annual Improvements Project HKFRS 1 and HKAS 28 amendments to Annual Improvements 2014-2016 Cycle Foreign Currency Transactions and Advance Consideration HK (IFRIC)-Int 22 The impact of the adoption of HKFRS 9 and HKFRS 15 and the new accounting policies are disclosed in Note 2 below.

6 The adoption of other amended standards and interpretation did not have any impact on the Group s accounting policies and did not require retrospective (b) New standards and interpretations not yet adoptedCertain new accounting standards, amendments and interpretations have been published that are not mandatory for 31 December 2018 reporting periods and have not been early adopted by the forannual periodsbeginning on orafterAmendments to Annual Improvements projectAnnual Improvements 2015-2017 Cycle1 January 2019 Amendments to HKAS 19 Plan Amendment, Curtailment or Settlement1 January 2019 Amendments to HKAS 28 Long-term Interest in Associates and joint Ventures1 January 2019 Amendments to HKFRS 9 Prepayment features with negative compensation1 January 2019 HKFRS 16 Leases1 January 2019 HKFRS 17 Insurance Contracts1 January 2021HK (IFRIC)

7 -Int 23 Uncertainty over Income Tax Treatments1 January 2019 Conceptual Framework for Financial Reporting 2018 Revised Conceptual Framework for Financial Reporting1 January 2020 Amendments to HKFRS 10 and HKAS 28 Sales or Contribution of Assets between an Investor and its Associate or joint VentureTo be determinedThe Group s assessment of the impact of these new standards, amendments and interpretations is set out (i) HKFRS 16 LeasesNature of changeHKFRS 16 was issued in January 2016. It will result in almost all leases being recognised on the balance sheet, as the distinction between operating and finance leases is removed. Under the new standard, an asset (the right to use the leased item) and a financial liability to pay rentals are recognised. The only exceptions are short-term and low-value accounting for lessors will not significantly standard will affect primarily the accounting for the Group s operating leases.

8 As at 31 December 2018, the Group has non-cancellable operating lease commitments of HK$57,767,000. Upon adoption of HKFRS 16 on 1 January 2019, approximately HK$56,056,000 operating lease commitments will be recognised in the consolidated balance sheet as right-of-use assets and lease liabilities. The lease liabilities would subsequently be measured at amortised cost and the right-of-use assets will be amortised on a straight-line basis during the lease of adoption by GroupThe Group will apply the standard from its mandatory adoption date of 1 January 2019. The Group intends to apply the simplified transition approach and will not restate comparative amounts for the year prior to first adoption. Right-of-use assets for property leases will be measured on transition as if the new rules had always been applied.

9 All other right-of-use assets will be measured at the amount of the lease liability on adoption (adjusted for any prepaid or accrued lease expenses).(ii) There are no other standards, amendments and interpretations that are not yet effective and that would be expected to have a material impact on the Group in the current or future reporting periods and on foreseeable future CHANGES IN ACCOUNTING POLICIESThis note explains the impact of the adoption of HKFRS 9 Financial Instruments and HKFRS 15 Revenue from Contracts with Customers on the Group s financial statements and also discloses the new accounting policies that have been applied from 1 January 2018, where they are different to those applied in prior years.(a) Impact on the financial statementsAs a result of the changes in the Group s accounting policies, prior year financial statements had to be restated.

10 As explained in Note 2(b) below, HKFRS 9 was generally adopted without restating comparative information. The reclassifications and the adjustments arising from new impairment rules are therefore not reflected in the restated balance sheet as at 31 December 2017, but are recognised in the opening consolidated balance sheet on 1 January 2018. As explained in Note 2(c) below, the Company has adopted HKFRS 15 using the cumulative effect method (with practical expedients), with the effect of initially applying this standard recognised at the date of initial application ( 1 January 2018). Accordingly, the information presented for 2017 has not been restated it is presented, as previously reported, under HKAS 18 and related balance sheet (extract)31 December 2017 As originally presentedHKFRS 9 HKFRS 151 January 2018 RestatedHK$ 000HK$ 000HK$ 000HK$ 000 Non-current assetsDeferred tax assets4,424(15) 4,409 Available-for-sales financial assets ( AFS )43,881(43,881) Financial assets at fair value through other comprehensive income ( FVOCI ) 49,266 49,266 Financial assets at fair value through profit or loss ( FVPL ) 3,655 3,655 Current assetsTrade and other receivables1,402,954 (50,321)1,352,633 Contract assets 50,32150,321 Current liabilitiesTrade, bills and other payables1,085,855 (107,198)