Transcription of Woodside Petroleum Limited ASX Code: WPL Price: $30.77 12 ...

1 Business SummaryWoodside Petroleum Limited (WPL) is an Australian oil and gas companyinvolved in hydrocarbon exploration, evaluation, development, production andmarketing. WPL also has a portfolio of offshore platforms, oil floatingproduction storage and off-loading vessels. WPL also holds operating assetsboth in Australia and (NWS)Australia:The project is located in the CarnarvonBasin about 190km NW of Karratha, WA. This is a standalone deep waterLNG development. NWS pipeline gas was MMboe and, from mid-2017,our equity share of NWS pipeline gas will reduce from 50% under theDomestic Gas Joint Venture to :The project is located in the Carnarvon Basin about 190kmNW of Karratha, WA. Plutos average annualised capacity has increased Mtpa to Mtpa. In 2016, Pluto produced mt at a production cost of$ :WPL owns and operates a number of oil developmentsoffshore WA and in the Timor Sea.

2 These projects include Enfield which isplanning for cessation potentially from Q4 for which the annualproduction were down due to low reliability and natural reservoir :WPLexplorationcontinuestogrowinAustrali a,Asia-Pacific,Atlantic Margins and ResearchD/g to Neutral: Buy thesis doesn t hold post cleansing statementsD/g to Neutral CEO Coleman stated an expectation of a Browse tollingagreement only being completed in ~18 months once NWS JV partnershad either exited or committed. With the past two days cleansingstatements out of the way, we struggle with catalysts near term, aside frompossible Scarborough debottlenecking. The P/BV of producing assets is~ , implying the market is not paying for growth. Our buythesis had been predicated on a discount to the base business, howeverimpairment disclosures have led us to cut our valuation by 14% such thatwe now rely on growth to be more positive.

3 This requires both patiencebeyond our 12 month recommendationhorizon, and flawless execution despite challenging JV negotiations;however, we fear Burrup Hub does not work at a more conservative deckthan WPL s $65 oil and $8 LNG, and following impairments ofWheatstone/Senegal we are now too cautious to give the company thebenefit of the doubt for using its balance sheet for accretive M& to Neutral / High more information see research 17 Jul - EnergyWoodside Petroleum LimitedASX Code: WPLP rice: $ Mth Target Price: $ : Neutral - HighImportant Disclaimer -This may affect your legal rights: Because this document has been prepared without consideration of any specific client's financial situation, particular needs and investmentobjectives, a Bell Potter Securities Limited investment adviser (or the financial services licensee, or the proper authority of such licensee, who has provided you with this report by arrangement withBell Potter Securities Limited ) should be consulted before any investment decision is made.

4 While this document is based on the information from sources which are considered reliable, Bell PotterSecurities Limited , its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or does Bell Potter Securities Limited accept any responsibility to inform you of any matter that subsequently comes to its notice, which may affect any of the information contained in this document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities Limited . This is generalinvestment advice only and does not constitute advice to any of Interest:Bell Potter Securities Limited receives commission from dealing in securities and its authorised representatives, or introducers of business, may directly share in thiscommission.

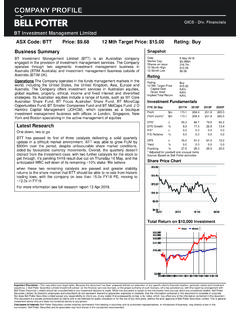

5 Bell Potter Securities and its associates may hold shares in the companies on issue12 Month High12 Month Low14 August 2020$19, $ $ Mth Target PriceCapital GainGross YieldImplied Total ReturnNeutral - High Risk$ FundamentalsFYE 31 Dec2019A2020F2021F2022 FProfit$m1, 1, 1, (norm)*$m1, 1, 1, * Growth% * Relative% * Adjusted for goodwill and unusual itemsSource: Based on Citi estimatesShare Price ChartTotal Return on $10,000 InvestmentProfit & Loss ($M)2015A2016A2017A2018A2019 ASales Revenue6,8855,7165,0507,5367,141 Total Revenue ex. ,9355,7165,0507,5367,141 EBITDA2,6803,7423,6385,3413,991 Depreciation & ,076-1,824-1,523-2,056-2,409 Goodwill Amortisation----------EBIT6041,9182,1153 ,2861,582 Net Interest-116-66-108-259-327 Profit Before Tax4871,8522,0083,0261,255 Income Tax-333-507-572-890-685 Outside Equity after Tax361,2001,3131,991514 Significant Items after Tax-------58-24 Reported Profit after Tax361,2001,3131,933490 Preferred Dividends----------Cash Flow ($M)2015A2016A2017A2018A2019 AReceipts from Customers----------Funds from Operations----------Net Operating Cashflow3,2523,5753,0774,6704,717 Capex-2,490-2,242-1,782-2,519-1,731 Acquisitions & Investments-4,978-965------Sale of Invest.

6 & Investing Cashflow-7,468-3,418-2,010-2,511-1,767 Proceeds from Issues------2,761--Dividends Paid-2,368-391-1,059-1,288-1,516 Net Financing Cashflow-7970-1,032-225452 Net Increase Cash-4,295228351,9343,403 Cash at Beginning4,4731693654512,389 Exchange Rate at End1673944082,3725,792 Ratios and Substantial Shareholders2015A2016A2017A2018A2019 AProfitability RatiosEBITDA Margin% Margin% Profit Margin% on Equity% on Assets% RatiosNet Debt/Equity% 5 Substantial ShareholdersBlackRock Sheet ($M)2015A2016A2017A2018A2019 ACash & Equivalent1673944082,3725,792 Receivables669616618690490 Inventories233206238220251 Other Current Assets2092835120100 Current Assets1,4771,2441,2993,4166,633 Prop. Plant & Equipment26,43326,87325,05027,00927,723 Intangibles----------Other Non-Current Assets337265233415450 Non-Current Assets31,15232,96431,26734,96335,264 Total Assets32,62934,20832,56538,37941,897 Interest Bearing Debt6,0796,8736,4945,8649,814 Other Liabilities5,9855,6915,7136,5567,234 Total Liabilities12,06412,56412,20612,42017,04 8 Net Assets20,56521,64520,35925,95924,849 Share Capital8,9619,5628,87112,58112,860 Reserves1,2811,3111,2331,3521,360 Retained Earnings9,2299,6349,19110,8469,498 Outside Equity ,0941,1371,0641,1801,130 Total Shareholders Equity20,56521,64520,35925,95924,849 Current Analyst Recommendations ** Source: Morningstar.

7 This chart shows the spread of recommendations from thosebroker analyst's in Australia with research coverage of this & DirectorsPrincipalsCompany SecretaryMr Andrew CoxMr Warren BaillieDirectorsMr Christopher (Chris) Michael Haynes(Non-Executive Director)Mr Gene Thomas Tilbrook(Non-Executive Director)Mr Richard James Barr Goyder(Non-ExecutiveDirector,Non-Executi ve Chairman)Mr Frank Charles Cooper(Non-Executive Director)Mr Peter John Coleman(Chief Executive Officer,Managing Director)Ms Ann Darlene Pickard(Non-Executive Director)Dr Sarah Elizabeth Ryan(Non-Executive Director)Mr Ian Elgin Macfarlane(Non-Executive Director)Mr Larry Archibald(Non-Executive Director)Ms Swee Chen Goh(Non-Executive Director)To access further Research or for information regarding our recommendations and ratings please 2020 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liabilityfor its use or distribution.

8 Any Morningstar ratings/recommendations contained in this report are based on the full research report available from Morningstar or your adviser. Any general advice or class service havebeen prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation orneeds. Refer to our Financial Services Guide (FSG) for more information at You should consider the advice in light of these matters and if applicable, the relevant ProductDisclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performancedoes not necessarily indicate a financial product s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.

9 Some material is copyright and published under licence fromASX Operations Pty Ltd ACN 004 523 Petroleum LimitedBell Potter Securities ResearchAFS Licence No. 243480 ABN 25 006 390 772 Email