Transcription of www.boe.ca.gov MICHELLE STEEL Ms. , Assessment Manager …

1 STATE OF CALIFORNIA STATE BOARD OF EQUALIZATION450 N STREET, SACRAMENTO, CALIFORNIA PO BOX 942879, SACRAMENTO, CALIFORNIA 94279-0082 TELEPHONE 916-322-3682 FAX 916-323-3387 December 26, 2007 BETTY T. YEE First District, San Francisco BILL LEONARD Second District, Ontario/Sacramento MICHELLE STEEL Third District, Rolling Hills Estates JUDY CHU, Fourth District, Los Angeles JOHN CHIANG State Controller RAMON J. HIRSIG Executive Director Ms. , Assessment Manager San Luis Obispo County Assessor 1055 Monterey St., Ste. 360D San Luis Obispo, CA 93408 Re: joint tenancy Change in Ownership Dear Ms.

2 : This is in response to your correspondence to me, dated May 21, 2007, in which you modified your prior request for a legal opinion as to the change in ownership treatment of certain transfers involving joint tenancies by providing us with specific factual scenarios and supporting documents. Set forth below is a summary of the applicable law, followed by each of the scenarios (redacted, renumbered and rephrased for clarity) and our analysis thereof. We note that virtually all of the scenarios presented involve some aspect of factual uncertainty, resolution of which is a matter that rests with the assessor with review by the local Assessment appeals board if appealed by the taxpayer.

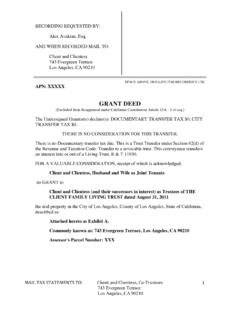

3 Thus, our responses are not necessarily definitive for a specific situation. Legal Background As an initial matter, we note that responding to your questions involves consideration of several areas of law in addition to property tax law: the interpretation of deeds, ownership of various estates in real property, and the law pertaining to trusts. deed Interpretation Generally Deeds that convey or transfer title to real property are interpreted using the same rules applicable to contracts. (Civ. Code, 1040, 1066.) A contract must be so interpreted as to give effect to the mutual intention of the parties as it existed at the time of contracting, so far as the same is ascertainable and lawful.

4 (Civ. Code, 1636.) The intention of the parties is to be pursued, if possible. (Code Civ. Proc., 1859.) Thus, there is a substantial component of factual determination in interpreting deeds for vesting and change in ownership purposes. Ms December 26, 2007 2 There are several rules of construction that assist the assessor in determining ownership and vesting. In interpreting a deed , the office of the Judge is simply to ascertain and declare what is in terms or in substance contained therein, not to insert what has been omitted; or to omit what has been inserted; and where there are several provisions or particulars, such a construction is, if possible, to be adopted as will give effect to all.

5 (Code Civ. Proc., 1858.) To properly construe a contract or deed , the circumstances under which it was made, the subject of the instrument, and of the parties to it, may be considered. (Code Civ. Proc., 1860.) The interpretation of the contract by the acts and conduct of the parties with knowledge of its terms, and before any controversy has arisen as to its meaning, is admissible and given great weight on the issue of the parties intent. [Citations.] (Miller & Starr (3d ed. 2003) California Real Estate, 1:60, p. 164.) Where otherwise proper, parol [oral] evidence is admissible to explain the terms of a deed .

6 (2 Witkin, Cal. Evid. (4th ed.) Doc. Evid., 83.) In any case, parol evidence may be freely offered to explain an ambiguity, whether latent or patent. Thus, if a deed is ambiguous, external evidence of the parties intentions at the time of executing the deed can be used to interpret the deed . However, extrinsic evidence may not be used to give an instrument a meaning to which it is not susceptible. (City of Manhattan Beach v. Superior Ct. (1996) 13 232, 238.) If several parts of a grant are absolutely irreconcilable, the former part prevails.

7 (Civ. Code, 1070.) Finally, all the rules of interpretation must be considered and each given its proper weight, where necessary, in order to arrive at the true effect of a deed . (City of Manhattan Beach (1996) 13 232, 238.) Additionally, there are several presumptions that apply specifically to deed interpretation. It is presumed that a grant of real property intends to convey fee simple title, unless it appears from the grant that a lesser estate was intended. (Civ. Code, 1105.) The owner of legal title is presumed to be the owner of the beneficial title, unless this presumption is rebutted by clear and convincing evidence.

8 (Evid. Code, 662; Cal. Code Regs., tit. 18, , subd. (a).) When more than one person s name appears on a deed , there is a rebuttable presumption that all persons listed on the deed have ownership interests in property, unless an exclusion from change in ownership applies. (Cal. Code Regs, tit. 18, , subd. (b).) Property Tax Rule , subdivision (b) explains the factors that may be considered by the assessor in determining whether the presumption is rebutted. Ownership of Real PropertyPresumptions Under California law, a tenancy in common is the presumptive form of creating title in property held among several Furthermore, tenancy in common interests are presumed to be equal unless otherwise This presumption may be overcome by evidence to the contrary, such as a written agreement.

9 (Nazzisi v. Nazzisi (1962) 203 121, 124.) Under California law, a declaration in a deed or other title instrument that a married couple takes property as joint tenants raises a presumption that the couple intended to take title in joint tenancy . (In re Summers (Banker. 9th Cir. 2002) 278 808) Ms December 26, 2007 3 Creation and Continuation of a joint tenancy Subdivision (a) of section 683 of the Civil Code defines a joint tenancy (termed a joint interest ) applicable to real and personal property, but excluding bank accounts covered under subdivision (b), as follows.

10 A joint interest is one owned by two or more persons in equal shares, by a title created by a single will or transfer, when expressly declared in the will or transfer to be a joint tenancy , or by transfer from a sole owner to himself or herself and others, or from tenants in common or joint tenants to themselves or some of them, or to themselves or any of them and others, or from a husband and wife, when holding title as community property or otherwise to themselves or to themselves and others or to one of them and to another or others, when expressly declared in the transfer to be a joint tenancy , or when granted or devised to executors or trustees as joint tenants.