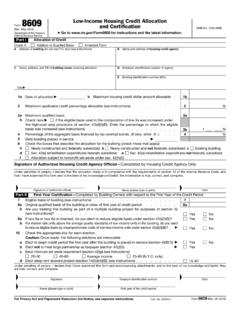

Low Income Housing Credit Allocation

Found 9 free book(s)8609 Low-Income Housing Credit Allocation

www.irs.govForm 8609 (Rev. May 2018) Department of the Treasury Internal Revenue Service . Low-Income Housing Credit Allocation and Certification Go to. www.irs.gov/Form8609

Low Income Housing Tax Credit 2018 Special Housing Need ...

www.idahohousing.comLow Income Housing Tax Credit 2018 Special Housing Need Set Aside Request for Proposals The Idaho Housing and Finance Association (the “Association”) has established a statewide set-aside

An Introduction to the Low-Income Housing Tax Credit

fas.orgAn Introduction to the Low-Income Housing Tax Credit Congressional Research Service 1 Overview The low-income housing tax credit (LIHTC) was created by the Tax Reform Act of 1986 (P.L. 99-

Advanced Topics in Low Income Housing Tax Credits

www.nysafah.orgJim DeBellis is a partner of Salmin, Celona, Wehrle & Flaherty, LLP, CPAs in Rochester.Jim heads up the Tax Department of the firm. Jim has 15 years of experience in the affordable housing sector in the area of Low Income Housing Tax Credit compliance and planning.

IRC §42, Low-Income Housing Credit - MHIC

www.mhic.comRevised September 2014 1-1 Chapter 1 Introduction Introduction The IRC §42 Low Income Housing Credit Program was enacted by Congress as part of the Tax Reform Act of 1986 to encourage new construction and rehabilitation of

MISSOURI HOUSING DEVELOPMENT COMMISSION LOW …

www.mhdc.com1 PREFACE This manual is a training and reference guide for the administration of the Low-Income Housing Tax Credit Program (“LIHTC or the Program”).

American Association of Homes and Services for the Aging ...

www.iowafinanceauthority1.comUnderstanding Low Income Housing Tax Credits American Association of Homes and Services for the Aging 39th Annual Meeting and Exposition Presented By Debbie Burkart $$$$ • Established by Congress in 1986 to encourage

Part I Section 42.--Low-Income Housing Credit (Also §§ 1 ...

www.irs.gov- 2 - for depreciation (1) used in common areas or (2) provided as comparable amenities to all residential rental units in the building. Section 42(d)(4)(C)(i) provides that the …

Financing Supportive Housing with Tax-Exempt Bonds and 4% ...

www.csh.orgAbout the Author Joseph Biber is a housing and development consultant to non-profit organizations principally in New York City, with a particular focus on permanent supportive housing development.

Similar queries

Low-Income Housing Credit Allocation, Internal Revenue Service, Low Income Housing, Credit 2018 Special Housing Need, Credit 2018 Special Housing Need Set Aside Request for Proposals, Housing, Introduction to the Low-Income Housing Tax Credit, Low-income housing tax credit, Advanced Topics in Low Income Housing Tax Credits, Credit, Low-Income Housing Credit, Low Income Housing Credit, MISSOURI HOUSING, Income Housing, American Association of Homes and Services, Section 42.--Low-Income Housing Credit Also