Search results with tag "Revenue"

UNITED STATES OF AMERICA Before the SECURITIES AND …

www.sec.govthe 2010 audit, Allen’s projected revenue for 2011 was $26 million when Holdings’s revenues for the first three quarters of 2011 had only reached approximately $2.3 million. Allen resisted H&A’s efforts to obtain more audit evidence for the revenue projections and suggested that H&A’s request could lead to a termination of the relationship.

DEPARTMENT OF THE TREASURY INTERNAL REVENUE …

www.irs.govdepartment of the treasury internal revenue service washington, d.c. 20224 may 1, 2000 number: 200025055 release date: 6/23/2000 cc:intl:idc: wta-n-108604-00 uilc: 32.01-00 7701.09-00 internal revenue service national office technical assistance memorandum memorandum for acting director, international district

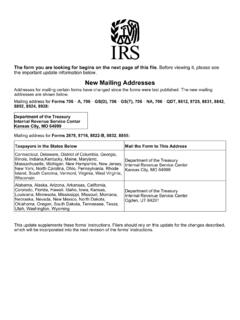

New Mailing Addresses - Internal Revenue Service

www.irs.govDepartment of the Treasury Internal Revenue Service Center Kansas City, MO 64999. Mailing address for . Forms 2678, 8716, 8822-B, 8832, 8855: ... Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wyoming. Department of the Treasury Internal Revenue Service Center ... representative signing for the taxpayer, attach to Form 8822-B a copy ...

General Explanations of the

taxprof.typepad.comMar 29, 2022 · 1 General Explanations of the Administration’s Fiscal Year 2023 Revenue Proposals REVENUE PROPOSALS In the Administration’s Fiscal Year 2023 Budget, the President proposes a number of reforms that would enhance revenues, improve tax administration, and make the tax system more equitable and efficient.

Illinois Department of Revenue IL-505-B ... - e-Form RS

eformrs.commonth, your Form IL-1120 and your payment will be due at the same time as your federal Form 1120. Make your check or money order payable to “Illinois Department of Revenue.” Be sure to write your FEIN, tax year, and “IL-505-B” on your payment. Mail your Form IL-505-B, with your payment, to ILLINOIS DEPARTMENT OF REVENUE PO BOX 19045

PETITION NUMBER (Office use only) CITY OF PHILADELPHIA ...

www.phila.govcity of philadelphia z department of revenue refund petition for all refunds except individual employee wage tax 83-a-15 (rev 01-18-2022) mail completed refund petition to: or fax to: 215-686-6228 city of philadelphia department of revenue p.o. box 53360 philadelphia, pa 19105 refund information: telephone: 215-686-6574, 6575, 6578 fax: 215-686 ...

INLAND REVENUE BOARD OF MALAYSIA INVESTMENT …

lampiran1.hasil.gov.myINLAND REVENUE BOARD OF MALAYSIA INVESTMENT HOLDING COMPANY 10/2015 Date Of Publication: 16 December 2015 Page 4 of 23 Example 4 Source of income Company A Company B Company C Company D Company E Rent (business) Rent (non- business) Dividend Interest Management services fees 85,000 - 5,000 10,000 - 20,000 - ...

Retailers’ Sales Tax (ST-16) - Kansas Department of Revenue

ksrevenue.gov• Write your Tax Account Number on your check or money order and make payable to Retailers’ Sales Tax. Send your return and payment to: Kansas Department of Revenue, PO Box 3506, Topeka, KS 66625-3506. PART I Line 1. Enter the total gross receipts or sales for the reporting period. Do not include the sales tax in this figure. Line 2.

Section 56 zero-rating of goods and services - Revenue

www.revenue.ieRevenue officer, a copy of the authorisation should be in support of the declaration. 7.2 A person authorised under Section 56 of the VAT Consolidation Act 2010 . Tax and Duty Manual Section 56 zero-rating of goods and services.

Florida Department of Revenue

floridarevenue.comATTACHMENT D Florida Department of Revenue LIFE EXPECTANCY GUIDELINES The asset life recommendations have been derived from various sources: Marshall Valuation Service,

Internal Revenue Service

www.irs.govInternal Revenue Code from insurance and sale proceeds received for the destruction and damage of property by Hurricane. ... improvements to land held by the taxpayer to assure the continued utility of the ... Commissioner, 30 T.C. 741 (1958), acq, 1959-2 C.B. 3. In Masser, the taxpayer owned

INSTRUCTIONS 720 KENTUCKY CORPORATION INCOME TAX …

revenue.ky.govFederal form 1120 Series. HOW TO OBTAIN FORMS AND INSTRUCTIONS Forms and instructions are available at all Kentucky Taxpayer Service Centers (page 18). They may also be obtained by writing FORMS, Department of Revenue, P. O. Box 518, Frankfort, KY 40602-0518, or by calling 502-564–3658. Forms can be downloaded from www. revenue.ky.gov.

DEPARTMENT OF TREASURY Internal Revenue Service (IRS)

www.irs.govMay 05, 2003 · DEPARTMENT OF TREASURY Internal Revenue Service (IRS) 26 CFR Part 1 [TD 9056] RIN 1545-BA82 ... Division Counsel/Associate Chief Counsel (Tax Exempt and Government Entities). However, other personnel from the …

Internal Revenue Service 4419 Application for Filing ...

www.irs.govInternal Revenue Service Enterprise Computing Center - Martinsburg Information Reporting Program 230 Murall Drive Kearneysville, WV 25430 . In order to ensure timely filing, submit Form 4419 at least 30 days before the due date of the return. If you prefer, the Form 4419 can be faxed toll-free to (877) 477-0572, but . do not

GOVERNMENT OF MAHARASHTRA - MCHI

www.mchi.netthe government according to Section 13 (7) of Maharashtra Land Revenue Code, 1966. 1.1. According to Section 42 A (1) (A) of Maharashtra Land revenue Code, 1966, regarding usage of land in draft development plan or final developed plan as prepared vide provisions of Maharashtra Regional and Town Planning Act, 1966, there is no need of prior

Official Appeal Waiver (REV-638)

www.revenue.pa.govPENNSYLVANIA DEPARTMENT OF REVENUE . PO BOX 281210 . HARRISBURG PA 17128-1210. PAGE. 1. OFFICIAL APPEAL WAIVER. DEPARTMENT USE ONLY (ET) 07-21 (FI) I/We, am requesting to enter into a deferred payment agreement with . the Pennsylvania Department of Revenue. I acknowledge that by entering into an agreement with the department, I waive all …

contracts, accounts, and annuities. DEPARTMENT OF THE ...

public-inspection.federalregister.gov1 DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Parts 1 and 54 [REG-105954-20] RIN 1545-BP82 Required Minimum Distributions AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Notice of proposed rulemaking and notice of public hearing. SUMMARY: This document contains proposed regulations relating to required minimum …

DR-225 TC Rule 12B-4.003 Effective 01/16 - Florida …

floridarevenue.comtitle and phone number. Resources: Visit the Department’s website at www.floridarevenue.com or call Taxpayer Services at 850-488-6800, Monday through Friday (excluding holidays). Mail your return and payment to: Florida Department of Revenue 5050 W Tennessee St Tallahassee FL 32399-0170 Electronic Funds Transfer (EFT): Florida law requires ...

Caution: The form, instruction, or ... - IRS tax forms

www.irs.govInternal Revenue Service Publication 536 Cat. No. 46569U Net Operating Losses (NOLs) for Individuals, Estates, and Trusts For use in preparing 2018 Returns Get forms and other information faster and easier at: •IRS.gov (English) •IRS.gov/Spanish (Español) •IRS.gov/Chinese (中文) •IRS.gov/Korean (한국어) •IRS.gov/Russian ...

Circular No. 162/18/2021-GST F. No. CBIC-20001/8/2021-GST …

www.cbic.gov.inGovernment of India Ministry of Finance Department of Revenue Central Board of Indirect Taxes and Customs GST Policy Wing **** New Delhi, dated the 25th September, 2021 To, The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/ Commissioners of Central Tax (All)

2021 Property Tax Refund Return (M1PR) Instructions

www.revenue.state.mn.usHomestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund Forms and Instructions > Form M1PR. Homestead Credit Refund (for Homeowners) and Renter’s. Property Tax Refund > Schedule M1PR-AI. Additions to Income. www.revenue.state.mn.us. Questions? We’re here for you. 651-296-3781 1-800-652-9094. Rev. 12/17/21

SUBSTANCE ABUSE ENCOUNTER REPORTING: HCPCS and …

www.michigan.govSUBSTANCE ABUSE ENCOUNTER REPORTING: HCPCS and Revenue Codes Overview of Updates for Fiscal Year 2008 This encounter code and modifier chart, effective 10/1/2007, describes how submitted encounter codes and modifiers will be interpreted by MDCH and its actuarial team. Much of this remains the same as it was for FY2007.

GUIDELINE FOR NEW SME DEFINITION - SME Corporation …

www.smecorp.gov.mySME Corporation Malaysia 2 Currently, the definition of small scale companies for incentives under Malaysian Investment Development Authority (MIDA) and corporate tax treatment under the Inland Revenue Board (IRB) is based on their respective legislations.

E. INSTRUMENTALITIES - Internal Revenue Service

www.irs.govExample (5): P is a soil conservation district created under state law. The law authorizes P to adopt land use ordinances, enforce those ordinances, and levy taxes or make assessments on tracts of land the ordinances benefit. P is a political subdivision. Rev. Rul. 59-373, 1959-2 C.B. 37. b. "Instrumentality"

Internal Revenue Service Memorandum - IRS tax forms

www.irs.govyears beginning after December 31, 1998 “in order to reduce the disparity of treatment between insurance expenses of self-employed individuals and employer-provided health insurance and to help make health insurance more affordable for self-employed individuals.” H.R. Rep. No. 105-817, 105th Cong., 2d Sess. 55 (1998), 1998-4 C.B. 307

e-CIRCULAR TO MEMBERS

www.ctim.org.myThe Institute has received responses from the Inland Revenue Board of Malaysia (“LHDNM”) on 10 January 2022 to clarification sought by the Institute on the LHDNM’s FAQ on deferment of CP204 and CP500 instalments from 1 January 2021 to 30 June 2021 as follows:

[Type here]

www2.deloitte.comGreetings from Deloitte Malaysia Tax Services Deloitte Malaysia Inland Revenue Board of Malaysia Takeaways: 1. Income Tax (Accelerated Capital Allowance) (Machinery and Equipment including ICT Equipment) Rules 2021 [P.U.(A) 268/2021] 2. Income Tax (Deduction for Expenses in Relation to the Cost of Personal Protective Equipment) Rules 2021 [P.U.

Maximum Tax Items - SC Department of Revenue

dor.sc.govCode §12-36-2110. Please note, however, Act No. 40 of 2017 imposed a new infrastructure maintenance fee beginning July 1, 2017, and any sale or purchase of an item that is subject to this fee is exempt from state and local sales and use tax and the casual excise tax. See South Carolina Code §12-36-2120(83). As a result, certain

[To be published in the Gazette of India, Extraordinary ...

einvoice1.gst.gov.inMinistry of Finance (Department of Revenue), No. 13/2020 – Central Tax, dated the 21st March, 2020, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 196(E), dated 21 st March, 2020, namely:-

[To be published in the Gazette of India, Extraordinary ...

www.cbic-gst.gov.inMinistry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customs Notification No. 31/2021 – Central Tax New Delhi, the 30th July, 2021 G.S.R.....(E).— In exercise of the powers conferred by the first proviso to section 44 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Commissioner, on the

Circular No. 18 of 2019 F.No ... - Income Tax Department

www.incometaxindia.gov.inMinistry of Finance Department of Revenue Central Board of Direct Taxes (TPL Division) *** Dated: 8th August, 2019 Clarification in respect of filling-up of the ITR forms for the Assessment Year 2019-20 The Income-tax return (ITR) forms for the Assessment Year (AY) 2019-20 were notified vide notification bearing G.S.R. 279(E).

Composite Useful Lives - Wisconsin Department of Revenue

www.revenue.wi.govComposite Useful Lives Recommended for Use on Equipment Used by Retailers, wholesalers, and Service Organization ... 54185 7312 Outdoor Advertising Structures 10 33422 3663 Pagers – One-Way 6 23731, 23832, 711510 1721 Painter 10 42495, 44412 5198, 5231 Paints & Varnishes 10 322211 2653 ...

Instructions for W-2c and W-3c (Rev. January 1999)

www.irs.govInternal Revenue Service Change To Note Instructions for preparing Forms W-2c and W-3c. The instructions for preparing Forms W-2c, Corrected Wage and Tax Statement, and W-3c, Transmittal of Corrected Wage and Tax Statements, were removed from the forms and combined into these separate instructions. General Instructions Purpose of forms.

IRS Data Retrieval Tool (Troubleshooting)

www.csac.ca.govIRS Data Retrieval Tool (Troubleshooting) Who is eligible to use the IRS DRT? Most students and parents who filed a U.S tax return with the Internal Revenue Service (IRS) are eligible to use the IRS Data Retrieval Tool (IRS DRT) if they have already filed their taxes and have been issued a Social Security Number (SSN).

State of Connecticut | Department of Children and Families ...

portal.ct.govPrevention Plan – Executive Summary ... 2018, Family First was signed into federal law. Family First represents a shift in federal ... completed in partnership with the Fiscal and Revenue Enhancement workgroup was passed on to the Governance Committee who made the ultimate recommendations to the CTDCF Commissioner.

February 24, 2022 Assistant Secretary (Tax Policy ...

us.aicpa.orgDepartment of the Treasury Internal Revenue Service . 1500 Pennsylvania Avenue, NW 1111 Constitution Avenue, NW . Washington, DC 20220 Washington, DC 20224 . RE: Concerns Regarding Schedules K-2 and K-3 Reporting . Dear Assistant Secretary Batchelder and Commissioner Rettig:

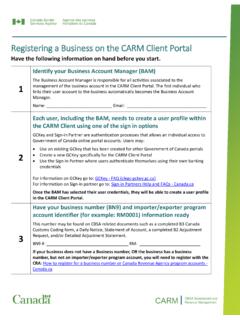

Registering a Business on the CARM Client Portal - CSCB

cscb.caThis number may be found on CBSA related documents such as a completed B3 Canada Customs Coding form, a Daily Notice, Statement of Account, a completed B2 Adjustment ... How to register for a business number or Canada Revenue Agency program accounts - Canada.ca . 2 CARM CBSA Assessment and

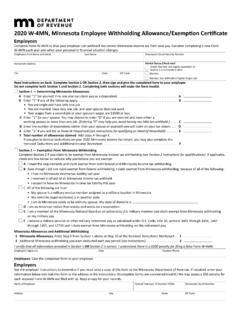

W-4MN, Minnesota Employee Withholding …

www.revenue.state.mn.us2020 W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate Employees: Give the completed form to your employer. Employers See the employer instructions to determine if you must send a copy of this form to the Minnesota Department of Revenue. If required, enter your information below and mail this form to the address in the ...

[To be published in the Gazette of India, Extraordinary ...

www.cbic.gov.inMinistry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customs Notification No. 40/2021 – Central Tax New Delhi, the 29th December, 2021 G.S.R…(E).- In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the

REVENUE CODE, 2006 - UP

bor.up.nic.inthe Uttar Pradesh Revenue Code, 2006. (2) It extends to the whole of Uttar Pradesh. (3) It shall come into force on such date as the State Government may, by notification, appoint, and different dates may be appointed for different areas or for different provisions of this Code. 2. Applicability of the Code.-The provisions of this Code, except

Similar queries

Revenue, DEPARTMENT OF THE TREASURY INTERNAL REVENUE, Department of the treasury internal revenue service washington, Internal Revenue Service, Department, Tennessee, Taxpayer, Administration, Illinois Department of Revenue IL, ILLINOIS DEPARTMENT OF REVENUE, Of philadelphia, Department of Revenue, Of philadelphia department of revenue, Philadelphia, INLAND REVENUE BOARD OF MALAYSIA INVESTMENT, ST-16, Order, Florida Department of Revenue, REVENUE CODE, Land, 1959, Instructions, Series, DEPARTMENT OF TREASURY, Division, Maharashtra, Maharashtra Land revenue Code, 1966, 1966, OFFICIAL APPEAL WAIVER, Notice, Title, IRS tax forms, India Ministry of Finance Department of Revenue, Property Tax Refund, Homestead Credit, SUBSTANCE ABUSE ENCOUNTER REPORTING: HCPCS and, SUBSTANCE ABUSE ENCOUNTER REPORTING: HCPCS and Revenue, Encounter, Malaysia, Investment, Inland Revenue Board, Memorandum, Malaysia Inland Revenue Board, 2017, Ministry of Finance, Central, Ministry of Finance (Department of Revenue) Central, Ministry of Finance Department of Revenue Central, Composite Useful Lives, Wisconsin Department of Revenue, Structures, Instructions for, Internal Revenue, IRS Data, Plan, 2018, Canada Customs, Canada Revenue, Canada, Minnesota, Withholding, Certificate, Minnesota Department of Revenue, 2006, Uttar Pradesh Revenue Code, 2006, Uttar Pradesh, Code