Search results with tag "Internal revenue"

2020 20 INTERNAL REVENUE - IRS tax forms

www.irs.govInternal Revenue Service Data Book, 2020 Internal Revenue Service Data Book, 2020 * Chief Counsel reports to both the Commissioner and the Treasury Department General Counsel in circumstances specified by the Internal Revenue Service Restructuring and Reform Act of 1998. Commissioner, Small Business / Self-Employed Commissioner, Wage and Investment

Wisconsin Tax Bulletin - Wisconsin Department of Revenue

www.revenue.wi.govfiduciaries of nuclear decommissioning trust or reserve funds, "Internal Revenue Code" means the federal Internal Revenue Code as amended to December 31, 2020, with certain exceptions. a. Amendments to the federal Internal Revenue Code enacted after December 31, 2020, do not apply for Wisconsin. b.

19 Internal Revenue Service Department of the Treasury

www.irs.govDepartment of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit (PTC) and reconcile it with advance payment of …

W-9 Request for Taxpayer - Internal Revenue Service

www.irs.govDepartment of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification. ... Section references are to the Internal Revenue Code unless otherwise noted. ... the rules under section 1446 require a partnership to presume that a …

Income Tax Information Bulletin #119 - Indiana

www.in.gov“Internal Revenue Code” as the version in effect on Jan. 1, 2020. During the 2021 session, the Indiana General Assembly enacted a revised definition of “Internal Revenue Code” to include various items from which a tax provision that is enacted outside the Internal Revenue Code.

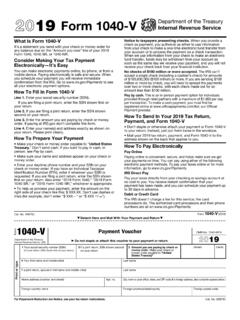

2019 Form 1040-V - Internal Revenue Service

www.irs.govInternal Revenue Service P.O. Box 37008 Hartford, CT 06176-7008 A foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code 933), or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien or nonpermanent resident of Guam or the U.S. Virgin Islands

740-NP - revenue.ky.gov

revenue.ky.govfollows the administrative regulations and rulings of the Internal Revenue Service in those areas where no specific Kentucky law exists. PROVISION FEDERAL ... Education Tuition Tax Credit Tax credit based on expenses Credit allowed Form 8863-K required ... conforms to the Internal Revenue Code as of December 31, 2018, Kentucky Form 8863-K was ...

(Under Section 501(h) of the Internal Revenue Code ...

www.irs.govon behalf of the above named organization. election. revocation (Signature of officer or trustee) (Type or print name and title) (Date)General Instructions. Section references are to the Internal Revenue Code. Section 501(c)(3) states that an organization exempt under that section will lose its tax-exempt status and its qualification to receive ...

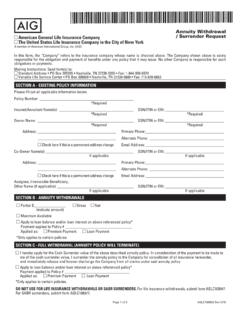

Annuity Withdrawal / Surrender Request

www.goforforms.comThe Company will provide you and the Internal Revenue Service with an informational tax form after the close of the calendar year. Additional Information For Qualified Products: The Internal Revenue Code Sec. 401(a)(9) provides for certain mandatory distributions from …

2017 Form 1040-V - IRS tax forms

www.irs.govInternal Revenue Service P.O. Box 37910 Hartford, CT 06176-7910 A foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code 933), or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien or nonpermanent resident of Guam or the U.S. Virgin Islands.

Department of the Treasury Internal Revenue Service Notice ...

www.irs.govInternal Revenue Service Have You Told Your Employees About the Earned Income Credit (EIC)? What Is the EIC? The EIC is a refundable tax credit for certain workers. Which Employees Must I Notify About the EIC? You must notify each employee who worked for you at any time during the year and from whose wages you did not withhold income tax.

Tax Treaty Table 1 2019 - Internal Revenue Service

www.irs.govTable 1. Tax Rates on Income Other Than Personal Service Income Under Chapter 3, Internal Revenue Code, and Income Tax Treaties (Rev. Feb 2019) This table lists the income tax rates on interest, dividends, royalties, and other income that is not effectiv ely connected with the conduct of a U.S. trade or business.

Instructions for Form 943-X (Rev. February 2021)

www.irs.govInternal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 943-X and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form943X. The February 2021 revision of Form 943-X updates

Ministers Audit Techniques Guide - Internal Revenue Service

www.irs.govUnder the Internal Revenue Code of 1986, as amended, (hereinafter referred to as 'IRC'), ministers are accorded some unique tax benefits for income, social security and Medicare taxes, which present several potential examination issues on ministers' tax returns in addition to income and expenses issues found in most examinations.

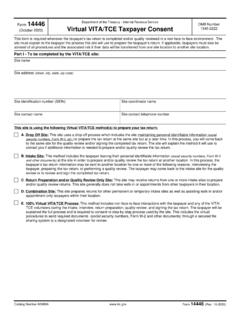

Form 14446 Department of the Treasury - Internal Revenue ...

www.irs.govDepartment of the Treasury - Internal Revenue Service Virtual VITA/TCE Taxpayer Consent OMB Number 1545-2222 This form is required whenever the taxpayer’s tax return is completed and/or quality reviewed in a non-face-to-face environment. The site must explain to the taxpayer the process this site will use to prepare the taxpayer’s return.

FATCA and CRS Entity Classification Guides

business.aib.iefacilitate the implementation of FATCA. Participating Financial Institution Institution is a Financial Institution which has entered into an FFI agreement with the Internal Revenue Service (IRS) under section 1471(b) of the Internal Revenue Code and § 1.1471-4 of the Treasury treated as a participating FFI. Exempt Beneficial Owner

November2020 Disclosure and Use of Tax Information – …

www.irs.gov5471 (11-2020) Catalog Number 75168J Department of the Treasury Publication Internal Revenue Service www.irs.gov. November2020 Disclosure and Use of Tax Information – Internal Revenue ... including volunteer preparers – who intend to use or disclose a taxpayer’s tax return information for a purpose other than current, prior and subsequent ...

Department of the Treasury Department of Labor Pension ...

www.dol.govDepartment of the Treasury Department of Labor Pension Benefit Guaranty Corporation Internal Revenue Service Employee Benefits Security Administration 21 Instructions for Form 5500 Annual Return/Report of Employee Benefit Plan Code section references are to the Internal Revenue Code unless otherwise noted. ERISA refers to the Employee ...

(EX) 09-20 20 PA Department of Revenue PA-40 or PA-41

www.revenue.pa.govPA PIT law does not permit any of the bonus depreciation elections added to the Internal Revenue Code (IRC). PA PIT law limits IRC Section 179 current expensing to the expensing allowed at the time you placed the asset into service or in effect under the IRC of 1986 as amended Jan. 1, 1997.

Forms and Instructions

otr.cfo.dc.govgranted an exemption by the DC Office of Tax and Revenue (OTR). If you are an exempt organization with unrelated business income, as defined in the Internal Revenue Code (IRC) §512, you must file a Form D-20, by the 15th day of the fifth month after the end of your tax year. You are required to pay at least the minimum tax even if

26 CFR 601.602: Tax forms and instructions. 6651, 6652 ...

www.irs.govThis revenue procedure sets forth inflation-adjusted items for 2021 for various provisions of the Internal Revenue Code of 1986 (Code), as amended as of October 26, 2020. To the extent amendments to the Code are enacted for 2021 after October 26, 2020, taxpayers should consult additional guidance to determine whether these

Publication 1167 (Rev. October 2021) - IRS tax forms

www.irs.govRevenue Procedure 2021-42 Reprinted from IR Bulletin 2021-43 Dated October 25, 2021 Publication 1167 General Rules and Specifications for Substitute Forms and Schedules IRS Department of the Treasury Internal Revenue Service Publication 1167 (Rev. 10-2021) Catalog Number 47013F www.irs.gov

Form MO-1120 Instructions - Missouri Department of Revenue

dor.mo.govfrom federal income tax. The preceding sentence shall notexempt apply to unrelated business taxable income and other income on which Chapter 1 of the Internal Revenue Code imposes the federal income tax or any other tax measured by income; Note: Any corporation filing a Federal Form 990, 990EZ, 990N, or

Partnership Return of Income - files.hawaii.gov

files.hawaii.govSTATE OF HAWAII—DEPARTMENT OF TAXATION 2018 INSTRUCTIONS FOR FORM N-20 (REV. 2018) Partnership Return of Income (Section references are to the Internal Revenue Code (IRC) unless otherwise specified.)

Instructions for Form 1024-A (Rev. January 2021)

www.irs.govInternal Revenue Service. You must file Form 8976 within 60 days of formation. Providing notice on Form 8976 is not a determination that the IRS recognizes you as exempt under section 501(c)(4). Optional application for recognition of exemption. You may (but are not required to) file Form 1024-A, Application for Recognition of Exemption under

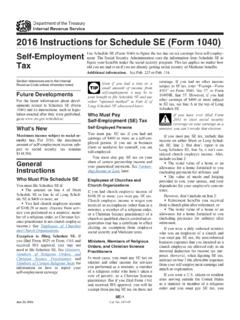

2016 Instruction 1040 Schedule SE - Internal Revenue …

www.irs.govPage 2 of 6 Fileid: … I1040SCHSE/2016/A/XML/Cycle04/source 9:20 - 12-Oct-2016 The type and rule above prints on all proofs including departmental reproduction ...

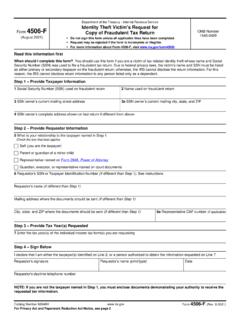

Identity Theft Victim’s Request for 4506 ... - IRS tax forms

www.irs.govto the requested return(s) under the Internal Revenue Code. We need this information to properly identify the return(s) and respond to your request. If you request a copy of a tax return, sections 6103 and 6109 require you to provide this information, including your SSN or EIN, to process your request. If you do not

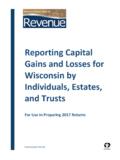

Pub 103 Reporting Capital Gains and Losses for Wisconsin ...

www.revenue.wi.gov: Within certain limits, sec. 179 of the federal Internal Revenue Code(IRC) allows an individual who places depreciable property in service to expense the cost of tha t propert y. As long as the sec. 179 requirements are met, you may elect to claim a different amount of sec. 179 expense for Wisconsin than was claimed for federal purposes.

Individual Income Tax Rates, 1984 - Internal Revenue …

www.irs.govIndividual Income Tax Rates, 1984 return for 1984 increased to between $19,000 and $20,000 from between $17,000 and $19,000 for 1983 [3]. For further information on the number of returns, income tax, and average tax by size of AGI, see Table 3 at the end of this report.

Instructions for W-2c and W-3c (Rev. January 1999)

www.irs.govInternal Revenue Service Change To Note Instructions for preparing Forms W-2c and W-3c. The instructions for preparing Forms W-2c, Corrected Wage and Tax Statement, and W-3c, Transmittal of Corrected Wage and Tax Statements, were removed from the forms and combined into these separate instructions. General Instructions Purpose of forms.

UPDATED APRIL 27, 2021

www.sba.govSupplemental Targeted Advance payments of $5,000 to the hardest hit small businesses and nonprofit organizations. Applicants that may qualify for the Supplemental Targeted Advance must meet additional eligibility criteria. Specifically, the business must be located in a low-income community as defined by section 45D(e) of the Internal Revenue

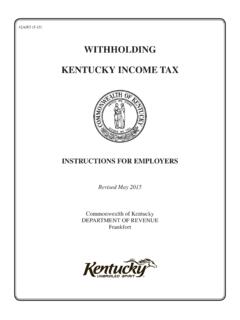

WITHHOLDING KENTUCKY INCOME TAX - Department of …

revenue.ky.govFor withholding tax purposes, the terms wages, employee and employer mean the same as defined in Section 3401 of the Internal Revenue Code currently in effect for Kentucky. Therefore, wages or other payments made for services performed in Kentucky, which are subject to withholding of federal income tax, are subject to Kentucky withholding.

SC1040 INSTRUCTIONS 2020 (Rev. 12/22/2020 ... - South …

dor.sc.govIf Internal Revenue Code sections adopted by South Carolina which expired on December 31, 2019 are extended, ... † If you are claiming a deduction for dependent children under six, enter the number of children under six. Claim your deduction ... † Add back any charitable contribution of land deducted under IRC Section 170 unless it meets ...

2020 Form 1099-DIV - Internal Revenue Service

www.irs.govthe 20% qualified business income deduction under section 199A. See the instructions for Form 8995 and Form 8995-A. Box 6. Shows your share of expenses of a nonpublicly offered RIC, generally a nonpublicly offered mutual fund. This amount is included in box 1a.

ACA Requirements for Medium and Large Employers to Offer ...

www.ncsl.orgJun 22, 2016 · provisions under section 4980H of the Internal Revenue Code (added to the Code by the Affordable Care Act). As defined by the statute, a full-time employee is an individual employed on average at least 30 hours of service per week. An employer that meets the 50 full-time employee threshold is referred to as an applicable large employer.

Tax Changes You Need to Know - National Tax Research Center

ntrc.gov.phprovisions of the National Internal Revenue Code of 1997 on personal income taxation, passive income for individuals both and corporations , estate tax, value-added tax (VAT) , donor's tax, excise tax, documentary stamp tax (DST) , and tax administration, among others. It likewise introduced new taxes such

Due Date Update Important Notice for Persons Receiving ...

www.revenue.wi.govFor an inclusive list of federal provisions adopted under 2021 Wisconsin Act 1, see the Internal Revenue Code update articles under the new tax laws section of Wisconsin Tax Bulletin 212, available on the department's website on Monday, February 22, 2021. State Grant Programs During the COVID-19 Pandemic

Duke Faculty and Staff Retirement Plan Summary Plan ...

forms.hr.duke.eduaccruals under a Code Section 403(b), 401(k), or 401(a) ... are limited by Internal Revenue Service (IRS) rules. IRS contribution limit information for the ... the limits contained in Sections 403(b) or 415 of the Code may limit your voluntary contributions. If you have questions about your contribution limits, contact the Human Resource ...

Title VII of the Civil Rights Act of 1964

das.ohio.govInternal Revenue Code of 1954], except that during the first year after March 24, ... is a conference, general committee, joint or system board, or ... sentence shall not include employees subject to the civil service laws of a State government, governmental agency or …

Internal Revenue Service Department of the Treasury

www.novoco.comFeb 14, 2022 · Internal Revenue Service Department of the Treasury Washington, DC 20224 Number: 202206016 Release Date: 2/11/2022 ... manner as may be prescribed by the Commissioner of Internal Revenue in the Internal Revenue Service forms or instructions, or in publications or guidance published in the Internal Revenue Bulletin.

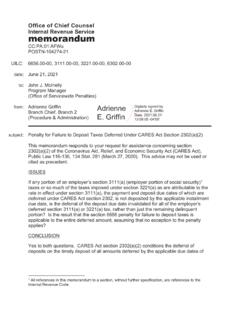

Internal Revenue Service memorandum

www.irs.govJun 21, 2021 · Internal Revenue Service . memorandum . CC:PA:01:AFWu . POSTN-104274-21 . ... An employer that is a monthly depositor is required to deposit the section 3111(a) tax by electronic funds transfer no later than the 15th day of the calendar month ... Notwithstanding section 6302 of the Internal Revenue Code of 1986, an

Revenue Procedure 84-35 - Bradford Tax Institute

www.bradfordtaxinstitute.comRevenue Procedure 84-35 January 1984 SECTION 1. PURPOSE The purpose of this revenue procedure is to update Rev. Proc. 81-11, 1981-1 C.B. 651, to conform to the small partnership provisions of section 6231 (a) (1) (B) of the Internal Revenue Code. Rev. Proc. 81-11 sets forth the procedures under which partnerships with 10 or fewer

Internal Revenue Code (IRC or “Code”) section 512 Treasury ...

www.aicpa.org1 April 17, 2018 The Honorable David Kautter Mr. William M. Paul Acting Assistant Secretary for Tax Policy Acting Chief Counsel Department of the Treasury Internal Revenue Service

Internal Revenue Service Department of the Treasury

www.irs.govThis letter responds to a letter dated D1, and supplemental information, submitted on behalf of Taxpayer requesting a ruling on whether Taxpayer and other third parties are related persons under section 1239(b) of the Internal Revenue Code. Facts Taxpayer represents that the facts are as follows: B1 and B2 are brothers. B1 and W1 are husband ...

Internal Revenue Service

www.irs.govInternal Revenue Service What is the purpose of the ACA Application for TCC ? The purpose of the application is to request authorization to participate in electronic filing of the Affordable Care Act Information Returns. An ACA Transmitter Control Code (TCC) will be assigned for each role on your application. The application currently sup -

Similar queries

Internal Revenue, IRS tax forms, Internal Revenue Service Data Book, Internal Revenue Service, Wisconsin Tax Bulletin, Wisconsin Department of Revenue, Internal Revenue Service Department of the Treasury, Department of the Treasury Internal Revenue Service Section references, Request for Taxpayer, Department of the Treasury Internal Revenue Service, Section references, Section, Information Bulletin #119, Indiana, 2019 Form 1040-V, Tuition, Organization, Organization exempt, Exempt, Annuity Withdrawal / Surrender Request, Internal Revenue Code, The Internal Revenue Code, Form 14446, Treasury, Treasury - Internal Revenue Service Virtual VITA/TCE Taxpayer Consent, Taxpayer, FATCA, Internal Revenue Service www.irs.gov, Volunteer, Department of the Treasury Department, Revenue, Service, Unrelated business income, Revenue procedure, Bulletin, Missouri, Income tax, Unrelated business taxable income, Income, Instructions, 2016 Instruction 1040 Schedule SE, Request, Return, Tax return, Individual Income Tax Rates, 1984, 1984, Instructions for, Supplemental, WITHHOLDING KENTUCKY INCOME TAX, Withholding, Kentucky, Kentucky withholding, Under, Charitable, Form 1099-DIV, Qualified business, Section 199A, Code Section, Code, Conference, State, Internal Revenue Service Department of the Treasury Washington, Monthly, Chief Counsel