Search results with tag "Return"

SUPPLEMENT: PAY PER RETURN (PPR)

www.drakesoftware.comUnlike Drake Tax’s unlimited package, the Pay Per Return (PPR) tax pro-gram allows you to purchase only as many returns as you think you will need for the tax season. The PPR package comes with 10 returns ready for use. You can purchase more returns as needed. In the following pages are the steps you can take to purchase and redeem more returns.

Daily Empty Dispatch - Return Information Run By: SCHEDULER

portal.maherterminals.comNo empty returns of 20' 40' and 40'HC to Maher Terminals or Columbia Container Services 1100 Polaris St. Return 45' Empties to Fleet Street Berth 64 NO Reefer returns Line:COSCO Messages Empty Return Information 20' Dry, 40' Dry, and 40' High Cubes are Returned to Fleet Street - Berth 64

2022 General Instructions for Certain Information Returns

www.irs.govElectronic filing of returns. The Taxpayer First Act of 2019, enacted July 1, 2019, authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250-return requirement for 2022 tax returns. If final regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at

Do I Need to File A Return? - Kentucky

revenue.ky.govto file a state income tax return or if you need to change your withholding so you will not have to file an unnecessary return in the future. If you do not anticipate any tax liability for the tax year you can file Form K-4E with your employer. This is a Special Withholding Certificate Exemption that exempts you from state income tax withholding.

File this return online at Gross sales. ST-9 - Massachusetts

www.mass.govDec 12, 2017 · ST-9 — Sales and Use Tax Return See instructions for due dates. Mail to Massachusetts DOR, PO Box 419257, Boston, MA 02241-9257. I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete …

K-99CSV 2020 Information Returns Specifications for …

ksrevenue.govIn instances when a filer cannot format 1099 returns ac cording to IRS guidelines but can put required data in a spreadsheet format, Kansas Department of Revenue will accept data for the following Informational Returns in CSV format. ELECTRONIC RECORDS THAT DO NOT CONFORM TO THE SPECIFICATIONS DEFINED BY THE Kansas Department of Revenue …

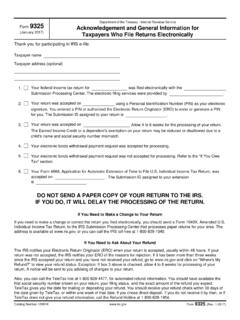

9325 Acknowledgement and General ... - IRS tax forms

www.irs.govIndividual Income Tax Return, to the IRS Submission Processing Center that processes paper returns for your area. The address is available at . www.irs.gov, or you can call the IRS toll-free at 1-800-829-1040. ... If your return has a balance due, you must pay the amount you owe by the prescribed due date. If you paid by electronic funds ...

F O R M 6 - WSIB

www.wsib.caa WSIB report (Health Professional’s Report – Form 8) and send it to the WSIB. On the form there are places for you to give information about yourself and your employer. What about returning to work? It may be possible for you to return to work while you are in treatment and recovering. To help in returning to work, you need to: 1.

2021 IA 1065 Partnership Return of Income

tax.iowa.gov2021 IA 1065 Partnership Return of Income . Who Must File . Every partnership deriving income/loss from real, ... tax year prior to 2020 if the Department, the pass-through entity, and the pass-through entity ... or 800-367-3388 8 a.m. - 4:30 p.m. CT or email idr@iowa.gov. Federal Partnership Return . A copy of the federal partnership 1065 ...

ONLINE RETURN FORM

youandall-ecom-static-assets.s3.ap-southeast-2.amazonaws.com• The product has not been soiled or damaged (this includes products that smell of perfume or smoke or items that ... Please send your return item/s with this completed form to: You + All Online HQ Unit 10/1 Hordern Place Camperdown ONLINE RETURN FORM . …

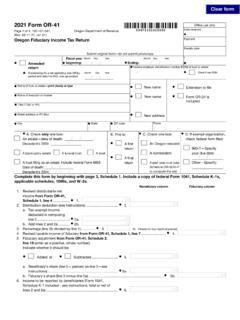

2021 Form OR-41, Oregon Fiduciary Income Tax Return, 150 ...

www.oregon.govreturn • Federal employer identification number (FEIN) of trust or estate • Check if new FEIN • Oregon Department of Revenue 00472101010000 2021 Form OR-41 Oregon Fiduciary Income Tax Return Submit original form—do not submit photocopy Office use only Page 1 of 4, 150-101-041 (Rev. 08-11-21, ver. 01) • 1 Phone If amending for a net ...

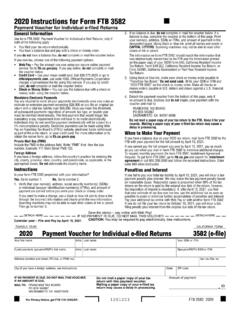

2020 Instructions for Form FTB 3582 Amount ... - California

www.ftb.ca.govPayment Voucher for Individual e-filed Returns General Information Use form FTB 3582, Payment Voucher for Individual e-filed Returns, only if both of the following apply: • You filed your tax return electronically. • You have a balance due and pay with a check or money order. If you do not have a balance due, do not complete or mail the ...

SCHOOL LETTER Returning to School After a Concussion

www.cdc.govReturn to school with the following changes until his or her symptoms improve. (NOTE: Making short-term changes to a student’s daily school activities can help him or her return to a regular routine more quickly. As the student begins to feel better, you can slowly remove these changes.) Is excused from school for days.

SC1041 DEPARTMENT OF REVENUE FIDUCIARY INCOME …

dor.sc.govThe fiduciary of a resident estate or trust must file a South Carolina Fiduciary return (SC1041) if the estate or trust: † is required to file a federal Fiduciary Income Tax return for the taxable year † had any South Carolina taxable income for the taxable year † …

2020 IA 1065 Partnership Return of Income - Iowa

tax.iowa.gov41-017a (10/13/2020) 2020 IA 1065 Partnership Return of Income . Who Must File . Every partnership deriving income/loss from real, tangible, or intangible property owned within Iowa or from a business carried on within Iowa must file. The Iowa partnership form must also be used by syndicates, pools, joint ventures, limited liability

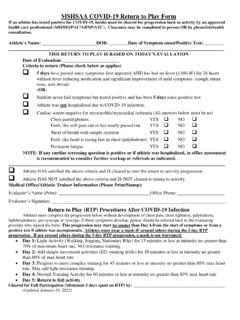

MSHSAA COVID-19 Return to Play Form

www.mshsaa.orgJan 10, 2022 · Return to Play (RTP) Procedures After COVID-19 Infection Athletes must complete the progression below without development of chest pain, chest tightness, palpitations, lightheadedness, pre-syncope or syncope. If these symptoms develop, patient should be referred back to the evaluating provider who signed the form.

The Rate of Return on Everything, 1870 2015 - Economics

economics.harvard.eduImperial College Business School, the CEPR Housing Conference, and CEPR ESSIM at the Norges Bank, as well as seminar participants at Banca d’Italia, the Bank of England, Reserve Bank of New Zealand, Cornell ... the expansion of capital’s share in income, and the growth rate of the economy relative to the rate of return on capital all ...

OR-RP Real Property Return 2022 - Oregon

www.oregon.govOregon Revised Statute (ORS) 308.290. Form OR-RP 2022 County use only Date received Account number Annual report required Oregon law [ORS 308.290(1)(b)] requires that each company must file this annual return with the county assessor on or before March 15. Failure to file will subject the company to a late-filing penalty (ORS 308.295).

Hall Income Tax Manual - tn.gov

www.tn.govthe return. Income received during the period of legal domicil e in another state may be reported on Schedule B of the return. A Tennessee partnership (i.e., a partnership whose comm ercial domic ile is in Tennessee) whose taxable interest and dividend income exceede d …

2022 PERSONAL PROPERTY TAX FORMS AND …

revenue.ky.govINSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS (REVENUE FORMS 62A500, 62A500-A, 62A500-C, 62A500-L , 62A500-S1, 62A500-W and 62A500–MI) Definitions and General Instructions The tangible personal property tax return includes instructions to assist taxpayers in preparing Revenue Forms 62A500, 62A500-A,

Tax Tables 2022 Edition - Morgan Stanley

www.morganstanley.comJan 18, 2022 · Oct 17, 2022 –Last day to file federal income tax return if 6-month extension was requested by April 18, 2022. Last day to recharacterize an eligible Traditional IRA or Roth IRA contribution from 2021 if extension was filed or tax return was filed by April 18, 2022 (and certain conditions were met). Last day to

New Jersey Resident Return NJ-1040 - State

www.state.nj.usyour NJ tax return, and file it online. Any resident (or part-year resident) can use it to file their 2019 NJ-1040 for free. NJ E-File You can file your Form NJ-1040 for 2019 using NJ E-File, whether you are a full-year resident or a part-year resident. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer

TAX ORGANIZER

dpwcpas.com2021 TAX ORGANIZER This tax organizer has been prepared for your use in gathering the information needed for your 2021 tax return. It also includes our engagement letter (following this page) which explains the services we will provide to you. Please sign and return your engagement letter; as well with your completed questionnaire and organizer.

How To Create A Return Label For FedEx

www.tamiu.eduPackage & Shipment Details-> *Return label type –> select “Email Label” -> enter appropriate email address. *Service type (Priority overnight= arrives morning 10:30 AM/ Standard overnight = arrives afternoon 3:00PM) *Package type = select option, if it is their own packaging please ask them to measure dimensions and weigh package so

FLOW EZY FILTERS

www.flowezyfilters.comsales and return policy. 3 sales and return policy index page sump strainers ... spin-on filters 24 reusable magnets for spin-on 25 replacement lube filters 25 300 psi inline filters 26 low cost in-line filters 10-gpm in-line filters 27 7050 series 27 1500 and 3000-psi in-line filters 28 cartridge filter housings 29 meltblown cartridges 30

MO-1041 - 2021 Fiduciary Income Tax Return

dor.mo.gov2021 Fiduciary Income Tax Return. Form. MO-1041. 1. Taxation Division. P.O. Box 3815. Jefferson City, MO 65105‑3815 . Phone: (573) 751‑1467. Fax: (573) 522‑1762 Enter Missouri modifications which are related to items of income, gain, loss, and deductions that are determinants of federal distributable net income.

Guidelines For When A Student Returns to School Following ...

www.maine.govGuidelines For When A Student Returns to School Following an Absence for Suicidal Behavior This information is found in the Youth Suicide Prevention, Intevention and Postvention Guidelines published by the Maine youth Suicide Prevention Program (third edition 2006). The document is available at www.mainesuicideprevention.org or by calling the

1) END USER LICENSE AGREEMENT English 2 ... - Rosetta …

resources.rosettastone.comproduct will be promptly made available for licensee’s use, and licensee does ... and promptly return the package in unopened form. licensee may obtain a full or prorated refund of licensee’s payment for the rosetta stone product by returning the media and materials for the rosetta stone product and submitting a written request for refund ...

5 Steps for Brain-Building Serve and Return

46y5eh11fhgw3ve3ytpwxt9r-wpengine.netdna-ssl.com5 Steps for Brain-Building Serve and Return developingchild.harvard.edu page 1 of 2 Is the child looking or pointing at something? Making a sound or facial

SAMPLE RETURN TO WORK ACTION PLAN - Woodruff …

woodruffsawyer.comThis sample return to work action plan serves as an example plan for businesses to use as a template when preparing their own plans. It does not account for state and local

2022 Instructions for Form FTB 3536

www.ftb.ca.govLimited Liability Company Return of Income, Side 1, line 2, Limited Liability Company fee. As the fee owed for 2022 may not be known by the 15th day of the 6th month of the current taxable year, you may estimate your 2022 fee by completing the prior year Schedule IW, LLC Income Worksheet, included in the 2021 Form 568 Limited Liability Company ...

Tax Facts 97-4, Form N-15: Nonresident and Part-Year ...

files.hawaii.govAND PART-YEAR RESIDENT RETURN This issue of Tax Facts is devoted to answering questions about Form N-15. 1 Why do we have Form N-15? Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who …

Federal Communications Commission FCC 10-72 Before the ...

docs.fcc.goveligibility is based on income, the consumer must provide acceptable documentation of income eligibility including, among other things, the prior year’s state, federal, or tribal tax return and a current income statement from an employer.11 5. Carriers offering Lifeline services in states that do not maintain their own low-income

Management Plan Handbook - IREM

www.irem.orgWHAT IS A MANAGEMENT PLAN? A real estate management plan is an operating plan developed to maximize a property’s potential and support ownership objectives. The plan is created by you, the real estate manager, based on data and stated assumptions. Just as with any other business plan, it outlines measures to maximize the return to investors.

GlaxoSmithKline plc Notice of Annual General Meeting 2022

www.gsk.comTotal Shareholder Return under-performance. The policy review has sought to ensure our ... THAT, in accordance with sections 366 and 367 of the Companies Act 2006 (the Act), the company and all companies that are or become, at any time during the period for ... shares for cash as if section 561 of the Act did not apply to any such allotment or ...

Delaware Withholding Form W3 Annual Reconciliation ...

revenuefiles.delaware.govAnnual Reconciliation INSTRUCTIONS ... returns electronically for Delaware. Include only those employees who have Delaware wages. Failure to comply will result in penalties equal to one-half the amounts specified in the Internal Revenue Code for the same requirement.

Ransomware Risk Management

nvlpubs.nist.govdemand an additional payment in return for not disclosing the information to authorities, competitors, or the public. This Ransomware Profile identifies the Cybersecurity Framework Version 1.1 security objectives that support identifying, protecting against, detecting, responding to, and recovering from ransomware events.

Return of Organization Exempt From Income Tax 2012

www.irs.govReturn of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) The organization may have to use a copy of this return to satisfy state reporting requirements. OMB No. 1545-0047. 2012. Open to Public Inspection. A

Return to Work Plan Package - WSIB

www.wsib.caSAMPLE: Return to Work Plan 1 The Workplace Safety and Insurance Act requires that the workplace parties (workers and employers) co-operate with each other and the WSIB in the process of returning an injured or ill worker to work.

Return Signature - IRS tax forms

apps.irs.govTaxSlayer will automatically note on the top of Form 1040, U.S. Individual Income Tax Return, the decedent’s name, and date of death. Form 2848, Power of Attorney and Declaration of Representative, is invalid once the taxpayer dies; therefore Form 56 or new Form 2848 signed by estate executor or representative must be completed.

MET 新美会場配布リスト 和英版

met.exhn.jp38 Joseph Mallord William Turner★ ヤン・ステーン テラスの陽気な集い 1670 油彩/カンヴァス Jan Steen Merry Company on a Terrace ca. 1670 Oil on canvas Fletcher Fund, 1958 58.89 39 ★ ジャン・シメオン・シャルダン シャボン玉 1733–34年頃 油彩/カンヴァス Jean Siméon Chardin Soap Bubbles ca ...

Similar queries

Return, Returns, Tax returns, Need to File A Return, Kentucky, File, File this return online at Gross sales, Massachusetts, 2020 Information Returns Specifications for, Spreadsheet, ELECTRONIC, IRS tax forms, Balance due, WSIB, To work, Return to Work, IA 1065 Partnership Return of Income, Partnership, Income, 2020, Partnership Return, Partnership 1065, RETURN FORM, Product, Form, Fiduciary, California, FIDUCIARY INCOME, Fiduciary return, Fiduciary Income Tax return, 2020 IA 1065 Partnership Return of Income, Rate of Return on Everything, 1870 2015, Imperial, Capital, Real Property Return, Oregon, Income Tax, Tennessee, PERSONAL PROPERTY TAX, INSTRUCTIONS TANGIBLE PROPERTY TAX, General Instructions, Tangible personal property tax return, Instructions, Tax Tables 2022 Edition, Morgan Stanley, IRA contribution, Jersey Resident Return, State, Resident, Tax Return, Engagement letter, To Create A Return Label For FedEx, Enter, Filters, And return, Spin, On filters, Inline filters, In-line filters, Student Returns to School Following, Student Returns to School Following an Absence for Suicidal Behavior, Maine, END USER LICENSE AGREEMENT English 2, Unopened form, Steps for Brain-Building Serve and Return, Sample return to work action plan, Limited Liability Company Return of Income, Limited Liability Company, Year, YEAR RESIDENT RETURN, Hawaii, Management, Companies Act 2006, Companies, Shares, Allotment, Annual, And the WSIB, Individual, Joseph Mallord William Turner