Fiduciary return

Found 8 free book(s)2021 Iowa Fiduciary Instructions (IA 1041)

tax.iowa.gov1041 Iowa Fiduciary Return • A copy o fthe federal orm 1041 return and appropriate schedule, including federal Ks - 1s for each beneficiary,must accompany each Iowa fiduciary return filed. A copy of the decedent’s will must fiduciary return if the Department has not previously received a • A copy of inter vivos trust instruments must

Instructions for Form IT-205 Fiduciary Income Tax Return ...

www.tax.ny.govIf the fiduciary of a New York City resident estate or trust is required to file a New York State fiduciary return, the New York City income tax liability is based on the same taxable income as for New York State tax purposes and must be reported on the state return as explained in the New York City instructions beginning on page 16.

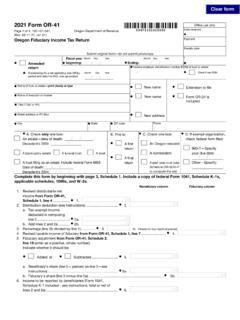

2021 Form OR-41, Oregon Fiduciary Income Tax Return, 150 ...

www.oregon.govreturn • Federal employer identification number (FEIN) of trust or estate • Check if new FEIN • Oregon Department of Revenue 00472101010000 2021 Form OR-41 Oregon Fiduciary Income Tax Return Submit original form—do not submit photocopy Office use only Page 1 of 4, 150-101-041 (Rev. 08-11-21, ver. 01) • 1 Phone If amending for a net ...

New York State Modernized e-File (MeF) Guide For Return ...

www.tax.ny.govElectronic return originators (EROs) authorized by the Internal Revenue Service (IRS) to e-file federal personal income tax, fiduciary, and partnership returns are also authorized to e-file returns with NYSDTF. EROs are not required to submit a separate application for NYS e-file or provide copies of their IRS acceptance letters.

MO-1041 - 2021 Fiduciary Income Tax Return

dor.mo.gov2021 Fiduciary Income Tax Return. Form. MO-1041. 1. Taxation Division. P.O. Box 3815. Jefferson City, MO 65105‑3815 . Phone: (573) 751‑1467. Fax: (573) 522‑1762 Enter Missouri modifications which are related to items of income, gain, loss, and deductions that are determinants of federal distributable net income.

Table of Contents - State

www.state.nj.usThe 2021 return filed by an administrator or an executor of an estate must cover the period from January 1, 2021, or fiscal year beginning in 2021, or the date of death of decedent (if death occurred after January 1, 2021) to the end of the tax year selected by the fiduciary when appro-priate. The 2021 return filed by a trustee of a trust must

Go to www.irs.gov/Form56

www.irs.govCheck this box if you are revoking earlier notices concerning fiduciary relationships on file with the Internal Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship . . . . . . b . Specify to whom granted, date, and address, including ZIP code. . Section C—Substitute Fiduciary 8

A Guide for VA Fiduciaries

benefits.va.govfiduciary, you are required to keep separate financial accounts on behalf of a beneficiary. The law requires a fiduciary to manage and place beneficiary funds in reasonable, safe investments, protect the funds from creditors and any loss, and provide additional protection when required by VA. (See pages 14, 15, and 16 for further information.)