Search results with tag "Fiduciary"

MO-1041 - 2021 Fiduciary Income Tax Return

dor.mo.govFiduciary Income Tax Return. File Electronically. Electronic Filing Options for Federal and State E-File - Estates and trusts may file Missouri. Form MO‑1041 Fiduciary Income Tax Returns electronically. Missouri, in cooperation with the Internal Revenue Service (IRS), offers a joint federal and state electronic filing of fiduciary

SC1041 DEPARTMENT OF REVENUE FIDUCIARY INCOME …

dor.sc.govThe fiduciary of a resident estate or trust must file a South Carolina Fiduciary return (SC1041) if the estate or trust: † is required to file a federal Fiduciary Income Tax return for the taxable year † had any South Carolina taxable income for the taxable year † …

2021 Iowa Fiduciary Instructions (IA 1041)

tax.iowa.gov1041 Iowa Fiduciary Return • A copy o fthe federal orm 1041 return and appropriate schedule, including federal Ks - 1s for each beneficiary,must accompany each Iowa fiduciary return filed. A copy of the decedent’s will must fiduciary return if the Department has not previously received a • A copy of inter vivos trust instruments must

Representative Payee Application - OPM.gov

www.opm.govmade to a court-appointed fiduciary or to a person we select to represent the annuitant. A fiduciary is a person or institution appointed by a State court to be responsible for managing funds on behalf of another person. Under the retirement law, the preferred payee in this type of case is a court-appointed fiduciary.

2021 Form 8879-F - An official website of the United ...

www.irs.govA fiduciary and an ERO use Form 8879-F when the fiduciary wants to use a personal identification number (PIN) to electronically sign an estate’s or trust’s electronic income tax return and, if applicable, consent to electronic funds withdrawal. A fiduciary who doesn’t use Form 8879-F must use Form 8453-FE,

The Excellent Fiduciary: Bridging the Gap Between ...

rolandcriss.comThe Excellent Fiduciary: Bridging the Gap Between Fiduciary Committees and IT Ronald E. Hagan * Technology-empowered threats to the security and con- ... pants accounts, technology is the enabler. The lines between human resources functions and technology functions are blurring. Yet, the information

ERISA Causes of Action - Practising Law Institute

legacy.pli.eduBreach of Fiduciary Duty Claims Q 1.3 What rights or duties are at issue in breach of fiduciary duty claims? ERISA allows participants, beneficiaries, and the Secretary of Labor to bring actions under § 502(a) against ERISA fiduciaries for breach of fiduciary duty. Under § 502(a), plaintiffs may obtain relief against ERISA

PA-41 PA Fiduciary Income Tax Return PA-41 (EX) MOD PA ...

www.revenue.pa.govFiduciary Income Tax Return, to report: • The income, deductions, gains, losses, etc., of the. estate or trust; • The income that is either accumulated or held for future. distribution or distributed currently to the beneficiaries; and • Any income tax liability of the estate or trust. The fiduciary of a nonresident estate or trust uses ...

Please review the updated information below. - IRS tax …

www.irs.govliability for the decedent’s income, gift, and estate taxes. Nine months, or 6 months in the case of a fiduciary’s request, after the IRS’s receipt of the request for discharge or the earlier payment of any amount determined by the IRS to be owed, the executor or fiduciary will be discharged from personal liability for any

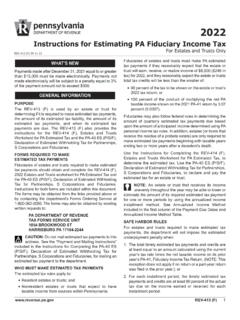

2022 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.gov41, Fiduciary Income Tax Return, tax liability as this year’s estimated tax to avoid underpayment penalty unless the tax rate for both tax years is the same and the prior tax 2 REV-413 (F) www.revenue.pa.gov If the estate or trust first meets the requirement to make estimated tax payments: Calendar year filers Fiscal year filers

Bank Wire Authorization - Fidelity Investments

www.fidelity.comor the fiduciary of an employer-sponsored retirement plan, that you are responsible for complying with your legal and fiduciary obligations. • Authorize us, upon receiving instructions from you or as otherwise authorized by you, to make payments from you by credit entries to the account at the financial institution indicated in the form (Bank).

Voluntary Fiduciary Correction Program Fact Sheet

www.dol.govVoluntary Fiduciary Correction Program (VFCP), which simplified and expanded the original VFCP published in 2002. The VFCP is designed to encourage employers to voluntarily comply with the Employee Retirement Income Security Act (ERISA) by self-correcting certain violations of the law. Many workers can

Help for representative payees and VA fiduciaries

files.consumerfinance.govRepresentative payee or VA fiduciary questions and answers What is a representative payee or VA fiduciary ? A government agency may appoint someone to manage income benefits for a person who needs help managing those benefits. For example, the Social Security Administration, the Office of Personnel Management, and the Railroad Retirement

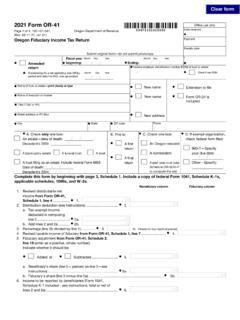

2021 Form OR-41, Oregon Fiduciary Income Tax Return, 150 ...

www.oregon.govreturn • Federal employer identification number (FEIN) of trust or estate • Check if new FEIN • Oregon Department of Revenue 00472101010000 2021 Form OR-41 Oregon Fiduciary Income Tax Return Submit original form—do not submit photocopy Office use only Page 1 of 4, 150-101-041 (Rev. 08-11-21, ver. 01) • 1 Phone If amending for a net ...

3(21) vs. 3(38) Fiduciary Differences

www.fisher401k.com3(21) VS. 3(38) FIDUCIARY SERVICES Q&As Helping You Manage Plan Investment Responsibilities If you are responsible for managing the investments for your company’s 401(k) plan, this Q&A may help you understand more about your …

Client Manual - Consumer Accounts - Citi

online.citi.comNov 18, 2021 · Account Statements and Notices, Periodic Statements 28 Cancelled Check Options 28 Substitute Checks and Your Rights 29 ... That is, we owe you the amount of your deposit. No fiduciary, quasi-fiduciary or other special relationship ... a …

FTB 3520 PIT Individual or Fiduciary Power of Attorney ...

www.ftb.ca.govOnline access is not available for fiduciary accounts. Part VI – Signature Authorizing Power of Attorney Declaration. Our privacy notice can be found in annual tax booklets or online. Go to . ftb.ca.gov/privacy. to learn about our privacy policy statement, or go to . ftb.ca.gov/forms. and search for . 1131

Title 12 Decedents’ Estates and Fiduciary Relations

delcode.delaware.govTitle 12 - Decedents’ Estates and Fiduciary Relations Page 2 Part II Wills Chapter 2 General Provisions Subchapter I Tenets and Principles § 201. Who may make a will. Any person of the age of 18 years, or upwards, of sound and disposing mind and memory, may make a will of real and personal estate.

2021 New Jersey Income Tax Fiduciary Return, Form NJ-1041

www.state.nj.usIncome Tax Fiduciary Return For Tax Year January 1, 2021 – December 31, 2021, Or Other Tax Year Beginning , 2021, Ending 20 Check this box if application for federal extension is enclosed or enter confirmation number

Understanding Your Brokerage and Investment Advisory ...

www.morganstanley.comto have a fiduciary relationship with you In addition, for advisory retirement accounts,2 we are acting as a fiduciary under the Employee Retirement Income Security Act of 1974 (“ERISA”) and/ or under section 4975 of the Internal Revenue Code (“Code”). What is Your Financial Advisor’s Role When Handling an Investment Advisory Account?

FOR SMALL BUSINESSES - DOL

www.dol.govFiduciary Responsibilities Many of the actions needed to operate a profit sharing plan involve fiduciary decisions. This is true whether you hire someone to manage the plan for you or do some or all of the plan management yourself. Controlling the assets of the plan or using discretion in administering and managing the plan

COMPANY LAW - LECTURE NOTES - Weebly

www.csstudypoint.weebly.comDefinition of a "Company" A company is a "corporation" - an artificial person created by law. ... and the auditing of accounts which do not apply to partnerships. (k) The affairs of a company are subject to more publicity than those of a ... The courts then began to impose a fiduciary duty on promoters similar to that imposed on agents. A ...

2021 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.govthe estimated tax liability and subsequent estimated tax payments, use the REV-414 (F), Estates and Trusts Worksheet for PA Estimated Tax, to recalculate the estimated tax liability. After completing the recalculation, subtract any estimated tax payments already paid or carryover credits from the previous tax year. Use Line 5 of

SAMPLE GUIDE FOR FILING ACCOUNTS - Maryland

www.registers.maryland.govof the “partial refund of fiduciary income tax.” 2. An adjustment for a payment made by the decedent or the estate in advance of a real estate salesuch , as pre-paid county property taxes shown on the Closing Disclosure form, Line F.04, is reported on Schedule 2. If the estate is subject to inheritance tax, also note the following: 1.

ITE OW-8-ESC Oklahoma Corporate, Fiduciary and …

oklahoma.govAccounts Division - Corporate Section at 405.521.3126. Form OW-8-ESC - page 2 How to Compute Estimated Tax Trust tax rates are found in the Packet 513 or 513-NR instruc-tions. Corporate income tax is 4% of taxable income. The tax for partnerships will be determined by reference to Form 514-PT and instructions. How to Complete Your Tax ...

Form SS-4 Application for Employer Identification Number ...

www.irs.govc You are a withholding agent required to withhold taxes on income, other than wages, paid to a nonresident alien (individual, corporation, partnership, etc.). A withholding agent may be an agent, broker, fiduciary, manager, tenant, or spouse, and is required to file Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign ...

AUTHORIZATION TO ACCESS TIAA ACCOUNTS

www.tiaa.orgtransfer/exchange funds among like accounts within TIAA; and cancel transfers/exchanges of funds among like accounts within TIAA. Full Power of Attorney/Fiduciary Rights— Please attach an executed TIAA Power of Attorney form or its legal equivalent. This authorization level will apply for all court-appointed representatives for whom TIAA

Blackmon - Settlement Agreement (Executed for Plaintiffs)

www.strategicclaims.netFiduciary, not to exceed $25,000; and (f) all fees, expenses, and costs associated with providing CAFA Notices. Excluded from Administrative Expenses are Defendants’ internal expenses and the Settling Parties’ respective legal fees and expenses. Administrative Expenses shall be paid from the Gross Settlement Amount. 1.3.

BASIC PLAN DOCUMENT - Paychex

download.paychex.com1.05 Application of ERISA. The Medical FSA portion of the Plan is an “employee welfare benefit plan” within the meaning of section 3(1) of ERISA. Certain requirements of ERISA, including the fiduciary responsibility provisions, apply to the Medical FSA, as referenced in ARTICLES X and XI of this Plan document.

Revenue Information Bulletin No. 19-019 February 5, 2020 ...

revenue.louisiana.govIndividual Income Tax Corporation Income Tax Fiduciary Income Tax Guidance on the Pass-Through Entity Election Act 442 of the 2019 Regular Session allows an S corporation or an entity taxed as a partnership for federal income tax purposes to elect to be taxed as if the entity had been required to file a federal income tax return as a C corporation.

SC 1065 2020 PARTNERSHIP RETURN - South Carolina

dor.sc.govFile Return for Fiduciary & Partnership, by the 15th day of the third month following the end of the partnership's tax year. You can also choose to pay your balance due online at dor.sc.gov/pay. Select Business Income Tax Payment to get ... accountings of these amounts. 1. 2

Approved, SCAO STATE OF MICHIGAN FILE NO. LETTERS OF ...

www.courts.michigan.govYou have no authority over the estate's real estate or ownership interests in a business entity that you identified on your ... in the court suspending your powers and appointing a special fiduciary in your place. ... Subsequent annual and final accountings must be filed within 56 days following the close of the accounting period. When the ...

2020 I-030 Wisconsin Schedule CC, Request for a Closing ...

www.revenue.wi.govEstate’s/Trust’s federal EIN County of jurisdiction (Name Only) City. M.I. ... If No, provide either a) copies of informal or formal annual accountings for the past four years, or b) annual schedules show- ... Fiduciary’s address City State Zip code PART II.

MANAGING GENERAL AGENTS ACT Table of Contents

content.naic.orgC. All funds collected for the account of an insurer will be held by the MGA in a fiduciary capacity in an institution that is insured by the FDIC. This account shall be used for all payments on behalf of the insurer. The MGA may retain no more than three months estimated claims payments and allocated loss adjustment expenses.

Operational Risk Integrated Online Network (ORION)

www.bnm.gov.my2 Including fiduciary breaches and Shariah non-compliance by Islamic financial institutions. Page 6 of 94 ... “Control function” refers to the definition as provided in the policy ... system and financial accounts. 9. Roles and responsibilities of ORION users

The Law Commission

www.lawcom.gov.ukThe definition of “to defraud” 3.6 14 ... accounts) 4.11 26 Deception which causes a loss and obtains a gain where the ... trust or fiduciary duty 4.39 32 Obtaining a service by giving false information to a machine 4.47 34 “Fixing” an event on which bets have been placed 4.48 34

Fairfax Circuit Court Fiduciary/Probate Fees

www.fairfaxcounty.govCCR A-30 Effective July 1, 2021 Page 4 Certificate of Qualification $ 2.00 §17.1-275A(9) 302 One free certificate is issued at time of the appointment. Disclaimers for Exempt Property or Family Allowance $18.00 §17.1-275A(2) 302 & 145 Recording up to 10 pages. Additional pages see Clerk’s Recording Fees above.

Retirement Counselors are Here to Help SERS’ Board

sers.pa.govfiduciary responsibility for its management is vested in an 11-member board. The investment plan benefits are funded through a combination of member and employer contributions, and the investment earnings from the participant’s personal investment choices. Day-to-day management of SERS is the responsibility of the executive director who, with

Director’s liability for breach of their duties - CIPC

www.cipc.co.zaDirector liability The Companies Act holds directors & POs liable in numerous circumstances where they fail to comply with their duties . . . Where directors & prescribed officers (‘POs’)fail in their fiduciary duties toward the organisation (or are at fault in the organisation they serve) which causes losses to the

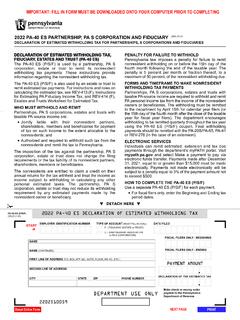

2022 PA-40 ES PARTNERSHIP, PA S CORPORATION AND …

www.revenue.pa.govThe PA-40 ES (P/S/F) is also used by an estate or trust to FORMS AND TIMEFRAME TO MAKE NONRESIDENT remit estimated tax payments. For instructions and rules on calculating the estimated tax, see REV-413 (F), Instructions for Estimating PA Fiduciary Income Tax, and REV-414 (F), Estates and Trusts Worksheet for Estimated Tax.

What Is Fiduciary Liability Insurance and Why Do ... - Chubb

www.chubb.comChubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit . www.chubb.com. Insurance provided by ACE American Insurance Company and its U.S. based Chubb underwriting company affiliates. All products may not be available in all states.

Fiduciary Adviser Disclosure Investment Advice Services ...

www.fidelity.comFiduciary Status and Compliance When we provide investment advice to you regarding your workplace plan, IRA, or HSA within the meaning of Title I of the Employee Retirement Income Security Act and/or the Internal Revenue Code, as applicable, we are a fiduciary within the meaning of these laws governing retirement accounts.

Fiduciary Duties - National Association of Realtors

www.nar.realtorA duty of loyalty is one of the most fundamental fiduciary duties owed by an agent to his principal. This duty obligates a real estate broker to act at all times solely in the best interests of his principal to the exclusion of all other interests, including the broker’s own self-interest. A corollary of this duty of loyalty is a duty to

Fiduciary Income Tax Return - Michigan

www.michigan.govanMI-1041. Use the MI-1041 only as a transmittal for the MI-1040.Write “Attachmentto MI-1041: Do not detach” inthe top margin of the MI-1040. Include the MI-1040 behindthe MI-1041. Complete only the identificationarea of MI-1041.Enter the name of the debtor on line 2 (e.g., “John Smith,Public BankruptcyEstate”).

Similar queries

Fiduciary, Fiduciary Income, Fiduciary return, Fiduciary Income Tax Return, Income, Return, United, Accounts, ERISA Causes of Action, Breach of fiduciary duty, For breach of fiduciary duty, Income tax, Please review the updated information below, IRS tax, Liability, Bank Wire Authorization, Fidelity Investments, Employee Retirement Income Security Act, ERISA, Representative, 21) VS. 3(38) FIDUCIARY, Client Manual - Consumer Accounts, Account, Periodic, Fiduciary accounts, Decedents’ Estates and Fiduciary Relations, Income Tax Fiduciary Return, COMPANY LAW, Definition, Company, 2021 Instructions for Estimating PA Fiduciary Income Tax, Estimated tax, Tax Return, AUTHORIZATION TO ACCESS TIAA ACCOUNTS, Paychex, SC 1065 2020, Accountings, Estate, Fairfax Circuit Court Fiduciary/Probate Fees, Retirement Counselors are Here to, Instructions, Instructions for Estimating PA Fiduciary, What Is Fiduciary Liability Insurance and Why, Chubb, Insurance, Duty, Michigan, Transmittal