Search results with tag "Tax return"

Form 200 Virginia Litter Tax Return

www.tax.virginia.govThe Litter Tax Return, Form 200, must be filed with the Virginia Department of Taxation and the tax paid on or before May 1, regardless . of whether you operate on a calendar or fiscal year basis for tax purposes. When the return is filed, the full amount of the tax as shown on the face of the return should be paid. The Code of Virginia does not

Trust and Estate Tax Return Guide (2020)

assets.publishing.service.gov.ukTrust and Estate Tax Return Guide 2020 for the year ended 5 April 2020 (2019-20) How to fill in the Trust and Estate Tax Return This guide has step-by-step instructions to help you fill in the Trust and Estate Tax Return. The notes are numbered to match the boxes in the Trust and Estate Tax Return. These notes will answer most of your questions.

Amendments to tax returns - GOV.UK

assets.publishing.service.gov.ukCorporation Tax Self-Assessment (CTSA) and VAT returns differ and are not ... tax return is therefore linked to the filing date for the particular return. For example, if a taxpayer has filed a 2016-2017 return online (with a filing date ... where a taxpayer forgot to fill in an entry or wants to change an entry. HMRC

Form IT-2105 Estimated Income Tax Payment Voucher Tax …

www.tax.ny.govthe Web at www.tax.ny.gov to pay your estimated tax electronically. For assistance, see Form IT-2105-I, Instructions for Form IT‑2105, Estimated Tax Payment Voucher for Individuals. To help us match your New York State estimated tax account to your New York State income tax return, and to avoid a delay in processing your return, note the ...

RDT 121 I (05/15/2021) IFTA QUARTERLY TAX RETURN …

www.dmv.virginia.govIFTA QUARTERLY TAX RETURN INSTRUCTIONS. RDT 121 I (05/15/2021) Use these instructions to complete form RDT 121, IFTA Quarterly Tax Return. Distance and fuel purchases for your tax qualified motor vehicle(s) (QMV) that do not have apportioned IRP registration may be included on the IFTA Quarterly Tax Return.

Supplemental Information Regarding Annual and …

www.lctcb.orgQuarterly Tax Return and Payment Requirement In addition to the annual tax return filing requirement, any person who is otherwise required to file an annual return and who is either self-employed or does not have the tax withheld from his or her paycheck must file quarterly tax returns and make quarterly estimated tax payments.

Disaster Form 4506-T Request for Transcript of Tax Return ...

yoursourcenews.comReturn Transcript, which includes most of the line items of a tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return is processed. Transcripts are only available for the following returns: Form 1040 series, Form 1065, Form 1120, Form 1120-A, Form 1120-H, Form 1120-L, and Form 1120S.

EMPLOYER QUARTERLY TAX REPORT - New Hampshire

www.nhes.nh.gov11. unemployment insurance (ui) tax due (multiply line 10 by tax rate) ui tax rate % 12. administrative contribution (ac) due (multiply line 10 by rate) ac rate % do not include this amount when filing federal unemployment tax return (futa) 13. total tax due (add lines 11 and 12) 14. if payment is delinquent add 1% per month on total tax due 15.

2022 General Instructions for Certain Information Returns

www.irs.govElectronic filing of returns. The Taxpayer First Act of 2019, enacted July 1, 2019, authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250-return requirement for 2022 tax returns. If final regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at

Instructions for Form CT-300 Mandatory First Installment ...

www.tax.ny.govreceipts tax return, you should enter the state franchise, excise, or gross receipts tax return form number you expect to file, if different. Do not enter slashes or dashes when entering the form number in the Return type box. Use the chart on page 2 to determine the two-digit code to enter in the Tax sub type box based on your return type ...

IFTA Quarterly Fuel Use Tax Return - Government of New …

www.tax.ny.govIFTA-100 (5/19) This return must be filed by the last day of the month following the end of the quarter. Most motor carriers are required to e-file their quarterly returns. Use this form for filing your quarterly fuel use tax return as required under the International Fuel Tax Agreement (IFTA). Read the instructions on page 2 carefully.

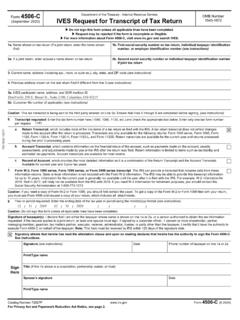

Form 4506-C OMB Number (September 2020) IVES Request …

www3.mtb.comReturn Transcript, which includes most of the line items of a tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return is processed. Transcripts are only available for the following returns: Form 1040 series, Form 1065, Form 1120, Form 1120-A, Form 1120-H, Form 1120-L, and Form ...

HOW TO DOWNLOAD YOUR IRS TAX TRANSCRIPT

www.alamancecc.eduChoose among Tax Return Tax Account, Record of Account, or Wage and Income transcripts or a Verification of Nonfiling Letter. Need help? More information about Get Transcript Online. Get Transcript by MAIL Transcripts arrive in 5 to 10 calendar days. Choose from either a Tax Return or Tax Account Transcript by Mail is available en Español ...

Processing an IFTA Quarterly Tax Return

www.modot.orgThe IFTA Return screen is displayed. 4. Complete the fields on this screen as follows: REPORTIING AMENDMENT FUEL TYPES* Click SUBMIT twice to confirm. If this is a quarterly tax return reporting zero miles (a no operation return), advance to the IFTA Billing Screen instructions Step 10.

60 OUR AL ORN A TAX U AT ON OUN L ( T ) QUAL Y N U AT …

gstti.comincludes information about the requirements of practice before the IRS including power of attorney, rules for tax preparers (Circular 230) and tax return preparer penalties. Please Note: Due to the major tax reforms implemented by the Tax …

Circular No. 2

www.incometaxindia.gov.inSubject: One-time relaxation for verification of all income tax-returns e-filed for the Assessment Year 2020-21 which are pending for verification and processing of such returns -reg. 1. In respect of an Income-tax Return (lTR) which is filed electronically without a digital signature, the taxpayer is required to verify it using anyone of the ...

2020 Form 765 Instructions - Home | Virginia Tax

www.tax.virginia.govSee the return preparation instructions, starting on Page 6 of this booklet. New Amended Return Reason Codes ... tax return by each nonresident individual owner of the PTE. The composite return is filed in the name of the PTE, using the PTE’s federal employer identification number (FEIN) and

Processing an IFTA Quarterly Tax Return

www.modot.orgReturn to Step 2 to restart. 11. Click SUBMIT twice to invoice the return. The IFTA Main Menu screen is displayed with the following message: The IFTA tax return has been filed and invoiced. To avoid a penalty or accumulated interest, PAYMENT must be made online or postmarked on or before the last day of the filing period.

Form PT-102 Tax on Diesel Motor Fuel Revised 1/22

www.tax.ny.govthe total number of gallons shown on this part is not to be indicated on any line of the tax return. Failure to complete Part 1 will result in additional correspondence and a delay in processing your return. A Combined B Gallons tax rate Tax Page 2 of 2 PT-102 (1/22) 30 Sales or use of non-highway B20 that is commercial gallonage

FTB 3516 - Request for Copy of Personal Income or ...

www.ftb.ca.govRequest for Copy of Personal Income or Fiduciary Tax Return Send a check or money order payable to the Franchise Tax Board for $20 for each tax year you request. Mail your payment and this completed FTB 3516 to: Data Storage Section, Franchise Tax Board, PO Box 1570, Rancho Cordova CA 95741-1570.

Sample Engagement Letter Wording

mcgowanprograms.comSample Engagement Letter Wording . Audit Engagement Wording. 6 - 10 Compilation Engagement Wording 11 - 15 Review Engagement Wording. 16 - 20 Tax Return (Personal) Wording 21 - 25 Tax Return (Business) Wording . 26 - 30 Combined Services Audit & Tax Engagement Wording 31 - 37 Agreed Upon Procedures Engagement Wording. 38 - 43

Form G-49, Annual General Excise/Use Tax Return ...

files.hawaii.gov1 Transient Accommodations Rentals 1 Interest and 1 Landed Value of Imports Form G-49 (Rev. 2019) 16 O 9 DO NO I IN I 16 (Rev. 2019) TAX YEAR ENDING HAWAII TAX I.D. NO. GE Last 4 digits of your FEIN or SSN NAME: _____ STATE OF HAWAII DEPARTMENT OF TAXATION N XI NN N ONIIION TTA O ON OD

Georgia Form (Rev. 08/02/16) Page 1

dor.georgia.gov(Rev. 08/02/16) Individual Income Tax Return Georgia Department of Revenue 5. ... Amount to be credited to 2017 ESTIMATED TAX ..... 29. 30. Georgia Wildlife Conservation Fund ... W-2s, OTHER WITHHOLDING DOCUMENTS, OR TAX RETURN. I authorize the …

Truckers Tax Deductions - Trucker to Trucker

truckertotrucker.comyour tax pro). You CANNOT deduct charitable contributions against your self-employment earnings or on the Schedule C or Form 2106 on a business tax return…although it is possible to deduct “business gifts” to your broker, co-workers, employees, employers, supervisors, and/or vendors…but these are limited to $25 per specific individual or

Instructions for Form IFTA-21 IFTA-21-I (9/16)

www.tax.ny.govCarriers who get a New York State IFTA license must file Form IFTA-100, IFTA Quarterly Fuel Use Tax Return, and include all vehicles operating under the IFTA license in the computation of the tax. The Tax Department mails Form IFTA-100 to carriers before the due date. Line instructions Line 1a – IFTA licenses are issued for a calendar year only

Form G-49, Annual General Excise/Use Tax Return ...

files.hawaii.govTransient Accommodations Rentals 15. I 16. V I Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg Neg ... ANNUAL RETURN & RECONCILIATION (mm/dd/yy) ATTACH CHECK OR MONEY ORDER HERE G49_I 2017A 01. G49 ... Write the ling period and your Hawaii Tax I.D. No. on your check or money order. Mail to: HAWAII DEPARTMENT OF …

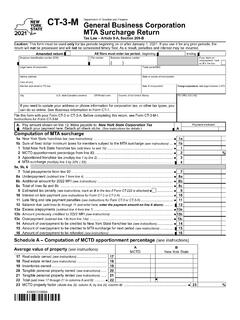

Form CT-3-M General Business Corporation MTA Surcharge ...

www.tax.ny.govGeneral Business Corporation MTA Surcharge Return Tax Law – Article 9-A, Section 209-B A. Pay amount shown on line 12. Make payable to: New York State Corporation Tax Attachyourpaymenthere.Detachallcheckstubs.(See instructions for details.) A Paymentenclosed Caution: This form must be used only for tax periods beginning on or after January 1 ...

Hines and Company, P.C.

www.hinesandcompanypc.comThe Internal Revenue Service imposes penalties upon taxpayers, and upon us as tax professionals, for failure to observe due ... We will render such accounting and bookkeeping assistance as you request for preparation of the tax return. ... Please provide letter or transcript from IRS or copy of bank statement/transaction showing deposit.

Form SS-4 Application for Employer Identification Number ...

www.irs.govc You are a withholding agent required to withhold taxes on income, other than wages, paid to a nonresident alien (individual, corporation, partnership, etc.). A withholding agent may be an agent, broker, fiduciary, manager, tenant, or spouse, and is required to file Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign ...

PRENUPTIAL AGREEMENT

images.template.netreturns may show ordinary income and capital gains from property owned and held as separate property of one party. The parties agree that the mere filing of any such joint tax returns shall not convert separate property into marital property or property co-owned by the −5−

Sample Record Retention and Destruction Policies

nonprofitrisk.orgPayroll and Employment Tax Records. Earnings Records 7 years Garnishment Records 7 years Payroll Tax returns 7 years W-2 Statements 7 years . Employee Records. Records Relating to Promotion, Demotion or Discharge 7 years after termination Accident Reports and Worker’s Compensation Records 5 years after termination of claim

F. No. 225/49/2021/ITA-II Government of India Ministry of ...

www.incometaxindia.gov.inSubject: - Extension ofimelines t for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22– reg. On consideration of difficulties reported by the taxpayers and other stakeholders due to COVID and in electronic filing of various reports of …

LIHEAP CHECKLIST - Navajo Nation

www.nndss.navajo-nsn.govName (as shown on your income tax return). Name is required on this line; do not leave this line blank. 2. Business name/disregarded entity name, if different from above. 3. Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only . one. of the following seven boxes. Individual/sole ...

pasig-assets.raksoct.com

pasig-assets.raksoct.com2020 Income Tax Return/Audited Financial Statement Barangay Clearance* • 2021 Tax Order Payment *Must be obtained from the barangay where the business is located. For those who will process any of the business applications via authorized representative, you will be asked to present the following: (1) authorization letter signed by the owner;

Federal Communications Commission FCC 10-72 Before the ...

docs.fcc.goveligibility is based on income, the consumer must provide acceptable documentation of income eligibility including, among other things, the prior year’s state, federal, or tribal tax return and a current income statement from an employer.11 5. Carriers offering Lifeline services in states that do not maintain their own low-income

tax.utah.gov TC-62S Sales and Use Tax Return

d2l2jhoszs7d12.cloudfront.netI declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return. Authorized Signature Date Telephone Return the original form; make a copy for your records. Utah State Tax Commission † tax.utah.gov 210 N 1950 W † Salt Lake City, UT 84134-0400 Sales and Use Tax Return Acct. #: Period:

Return Signature - IRS tax forms

apps.irs.govTaxSlayer will automatically note on the top of Form 1040, U.S. Individual Income Tax Return, the decedent’s name, and date of death. Form 2848, Power of Attorney and Declaration of Representative, is invalid once the taxpayer dies; therefore Form 56 or new Form 2848 signed by estate executor or representative must be completed.

TAX ORGANIZER

dpwcpas.com2021 TAX ORGANIZER This tax organizer has been prepared for your use in gathering the information needed for your 2021 tax return. It also includes our engagement letter (following this page) which explains the services we will provide to you. Please sign and return your engagement letter; as well with your completed questionnaire and organizer.

Similar queries

Virginia, Tax return, Return, Shown, Trust, Tax Return Guide, Guide, Entry, Your, Your return, TAX RETURN INSTRUCTIONS, Instructions, Supplemental Information Regarding Annual and, Quarterly Tax Return, QUARTERLY TAX, Quarterly, Transcript, Return Transcript, Tax return transcript, New Hampshire, Returns, Tax returns, Franchise, Excise, IFTA Quarterly, Government of New, IFTA, International Fuel Tax Agreement, IRS TAX TRANSCRIPT, Tax Return Tax, Processing an IFTA Quarterly Tax Return, For tax preparers, Tax-returns, Virginia Tax, Highway, Income, Sample Engagement Letter Wording, Engagement, Personal, Tax Engagement, Annual, Transient Accommodations, HAWAII TAX, HAWAII, 2017, WITHHOLDING, Tax Deductions, ANNUAL RETURN, Your Hawaii Tax, Business Corporation, Return Tax, Corporation Tax, Internal Revenue Service, Request, Fiduciary, Reports, IRS tax forms, Individual, Engagement letter