Search results with tag "Corporation tax"

General Corporation Tax Rates - New York City

www1.nyc.govFor tax years beginning in or before 2008 a minimum tax of $300. If a return is filed for a period of less than one year, the tax is still $300. It cannot be prorated. For tax years beginning in or after 2009, the minimum tax is based on a corporation’s New York City receipts computed as follows: If New York City receipts are: Fixed dollar ...

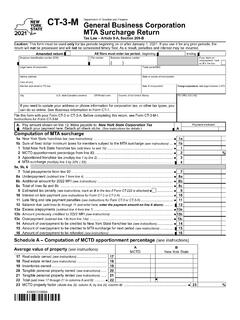

Form CT-3-M General Business Corporation MTA Surcharge ...

www.tax.ny.govGeneral Business Corporation MTA Surcharge Return Tax Law – Article 9-A, Section 209-B A. Pay amount shown on line 12. Make payable to: New York State Corporation Tax Attachyourpaymenthere.Detachallcheckstubs.(See instructions for details.) A Paymentenclosed Caution: This form must be used only for tax periods beginning on or after January 1 ...

CHALLAN Tax Applicable NO./ (0020) INCOME …

www.incometaxindia.gov.in* Important : Please see notes overleaf before filling up the challan Single Copy (to be sent to the ZAO) CHALLAN Tax Applicable (Tick One)* NO./ (0020) INCOME-TAX ON COMPANIES Assessment Year ITNS 280 (CORPORATION TAX) - (0021) INCOME TAX …

2020 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.govrebuttable presumption of economic nexus for out-of-state corporations with $500,000 or more of gross receipts sourced to Pennsylvania. Corporation Tax Bulletin 2019-04 cites the U.S. Supreme Court’s South Dakota v. Wayfair Inc. decision as authority supporting a presumption of nexus and provides that corporations

legislation contained in the Taxes Consolidation Act 1997 ...

www.revenue.ieUpdated November 2016 2. Rates of Corporation Tax: The standard rate of corporation tax is 12.5% and generally applies to trading income. The standard …

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED …

www.treasury.govGeneral Scope 1. Except as specifically provided herein, this Convention is applicable only to persons ... (iii) the corporation tax; and (iv) the petroleum revenue tax. 4 4. This Convention shall apply also to any identical or substantially similar taxes that ... the term “pension scheme” means any plan, scheme, fund, trust or other ...

CHAPTER 1 INTRODUCTION TO CORPORATION TAX

www.tolleytaxtutor.co.ukCompanies are liable to corporation tax for each chargeable accounting period. The chargeable accounting period is usually the period for which the company makes up a set of accounts. For example, a company prepares a set of accounts for the year ended 31 December 2011.

UK issues Summer Finance Bill: a review of corporate tax ...

www.ey.comGlob ert 3 release rules in sections 361 and 362 Corporation Tax Act 2009 for certain corporate rescue situations. Both these rules deem that a loan

Finance Act 2010 - legislation

www.legislation.gov.ukFinance Act 2010 CHAPTER 13 CONTENTS PART 1 CHARGES, RATES ETC Income tax 1 Charge, main rates, thresholds and allowances etc for 2010-11 Corporation tax 2 Charge and main rate for financial year 2011

Barbados budget 2015-2016 - EY - United States

www.ey.comFocus on Barbados Budget 2015 | 4 Corporation tax The Minister announced his intention to amend the Income Tax Act to remove the Group relief …

CHAPTER 19 THE PRINCIPLES OF GROUP RELIEF

www.tolleytaxtutor.co.ukTolley® Exam Training CORPORATION TAX CHAPTER 19 © Reed Elsevier UK Ltd 2015 228 FA 2015 19.2 75% Subsidiaries For group relief to apply, one company must be a 75% ...

R&D - EY

www.ey.com11 The R&D incentive in the current environment Page 30 10 September 2014 Optimising your R&D incentives 25% Credit available on qualifying incremental R&D expenditure Allowable against Irish corporation tax Where excess credit is available the excess will be refunded per below 25% Credit available on qualifying incremental R&D expenditure

Company Expenses - Scott-Moncrieff

www.scott-moncrieff.comFor an expense to be allowable for corporation tax purposes, it must be incurred wholly and exclusively for the purpose of the trade. Company expenses This means that the expense must be incurred for

Corporation Tax Act 2009 - Legislation.gov.uk

www.legislation.gov.ukCorporation Tax Act 2009 CHAPTER 4 CONTENTS PART 1 INTRODUCTION t c Af owe i v r e1Ov PART 2 CHARGE TO CORPORATION TAX: BASIC PROVISIONS CHAPTER 1 THE CHARGE TO CORPORATION TAX Charge to tax on profits 2 Charge to corporation tax 3 Exclusion of charge to income tax

Corporation tax and groups – group relief - ACCA Global

www.accaglobal.comcorporation tax and groups

Similar queries

Corporation tax, New York City, Return, Corporation, Business Corporation, Return Tax, CHALLAN Tax Applicable NO./ (0020) INCOME, INCOME, INCOME TAX, Nexus, Trading, General Scope, Scheme, CHAPTER 1 INTRODUCTION TO CORPORATION TAX, UK issues Summer Finance Bill: a, Finance Act 2010, 2010, Barbados budget 2015-2016, Relief, CHAPTER 19 THE PRINCIPLES OF GROUP RELIEF, R&D, Company expenses, Corporation Tax Act 2009, Corporation tax and groups – group