Search results with tag "Income tax"

Individual Municipal Income Tax Forms - CCA

ccatax.ci.cleveland.oh.usIndividual Municipal Income Tax Forms Tax forms due April 15, 2021 eFile with CCA at https://efile.ccatax.ci.cleveland.oh.us Read the instruction booklet to determine whether you have taxable income for municipal income tax purposes. If you have taxable income complete and file the City Tax Form.

State Individual Income Tax Rates and Brackets for 2021

files.taxfoundation.orgThis map Top State Marginal Individual Income Tax Rates does not show effective marginal tax rates, which would include the effects of phase-outs of various tax preferences. Local income taxes are not included. (*) State has a flat income tax. (**) State only taxes interest and dividends income. NH** 00 VT 8.75% MA* 00 CT 6.99% RI 5.99% NJ ...

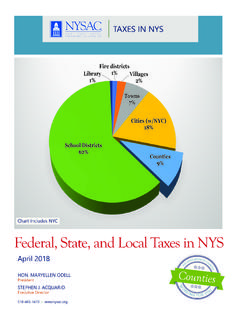

Federal, State, and Local Taxes in NYS

www.nysac.orgPersonal Income Tax (Article 22 of the Tax Law) New York State imposes an income tax on the entire income of New York State residents, as well as the income that non-residents earn in New York. The computation of tax starts from federal adjusted gross income (FAGI), which is an individual’s total gross income minus specific deductions.

Indonesia Individual Income Tax Guide - Deloitte

www2.deloitte.comprepayment (“Article 25 Income Tax”), the amount of which is to be calculated when the annual income tax due is calculated and to be reported in the annual income tax return. • Maintain documents to support the income, taxes paid, and assets and liabilities declared in …

WHAT’S NEW FOR LOUISIANA 2021 INDIVIDUAL INCOME TAX?

revenue.louisiana.govbenefit provided directly or indirectly by the state or federal government as a COVID-19 relief benefit if the income was included in the taxpayer’s Federal Adjusted Gross Income. Benefits may include payments from the ... income tax return, you must file a Louisiana income tax return reporting all income earned in 2021.

Personal tax tip #59 Gambling Winnings and Your Maryland …

www.marylandtaxes.govForm 502D, Declaration of Estimated Tax, and pay the tax on that income within 60 days of the time you receive the prize money. You can claim a credit for taxes paid with the 502D on your annual income tax return. Failure to pay the estimated tax due or report the income could result in penalty and interest charges.

Annual Income Tax Return 1701A Individuals Earning Income ...

home.kpmg66 Spouse’s Taxpayer Identification Number (TIN) 67 RDO Code 68 Filer’s Spouse Type - - - 0 0 0 0 0 ProfessionalSingle Proprietor II014 Income from Profession 69 Alphanumeric Tax Code (ATC) II012 Business Income - Graduated IT Rates –Graduated IT Rates II015 Business Income - 8% IT Rate II017 Income from Profession – 8% IT Rate 70 ...

Online state forms - Tax Preparation Services Company

www.hrblock.comConnecticut 1040 Resident Income Tax Return 1040-EFW Connecticut Electronic Withdrawal Payment Record 1040AW Part Year Resident Allocation 1040NR-CT-SI Part Year / Nonresident Schedule 1040NR/PY Part Year / Nonresident Income Tax Return 1040V Electronic Filing Payment Voucher 1040WH Income Tax Withholding CT-EITC Earned Income Tax Credit …

2020 Minnesota Income Tax for Estates and Trusts ...

www.revenue.state.mn.usA trust must make quarterly estimated tax payments if it has: • an estimated tax of $500 or more • any nonresident beneficiary’s share of estimated composite income tax of $500 or more Payments are due by the 15th day of the fourth, sixth, and ninth months of the tax year and the first month following the end of the tax year.

2020 Income Tax Return FORM for Trusts and CT-1041 Estates

portal.ct.govConnecticut Income Tax Withholding Any trust or estate that maintains an office or transacts business in Connecticut (regardless of the location of the payroll department) and is an employer for federal income tax withholding purposes must withhold Connecticut income tax from Connecticut wages as defined in Conn. Agencies Regs. § 12-706(b)-1.

FORMS AND INSTRUCTIONS - Michigan

www.michigan.govApr 15, 2021 · You must make estimated income tax payments if you expect to owe more than $100 when you file your City Income Tax Return. File a City Estimated Individual Income Tax Voucher (Form 5123) by April 15, 2021 and pay at least one-fourth (¼) of the estimated tax. The remaining estimated tax is due in three equal payments on June 15, 2021;

State Farm Funds Tables

static1.st8fm.comThe following five tables referencing our State Farm Funds may be used in preparing your 2021 income tax returns. 2 The taxable portion (for regular income tax purposes) of your dividends has been reported to the Internal Revenue Service (IRS) on Form 1099-DIV. The tax-exempt portion (for regular income tax purposes) of your dividends, and any

PA-41 PA Fiduciary Income Tax Return PA-41 (EX) MOD PA ...

www.revenue.pa.govFiduciary Income Tax Return, to report: • The income, deductions, gains, losses, etc., of the. estate or trust; • The income that is either accumulated or held for future. distribution or distributed currently to the beneficiaries; and • Any income tax liability of the estate or trust. The fiduciary of a nonresident estate or trust uses ...

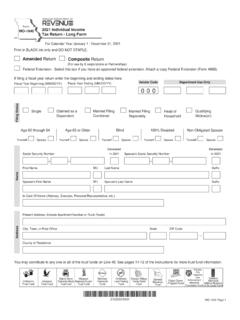

MO-1040 2021 Individual Income Tax Return - Long Form

dor.mo.gov13. Federal income tax deduction – Multiply Line 11 by the percentage on Line 12. Enter this amount not to exceed $5,000 for an individual or $10,000 for combined filers. ..... 13 Missouri Adjusted Gross Income, Line 6. Use the chart below to. Missouri Adjusted Gross Income Range, Line 6: Federal Tax Percentage: $25,000 or less

WHAT’S NEW FOR LOUISIANA 2021 INDIVIDUAL INCOME TAX?

revenue.louisiana.govIndividual Income Tax Return, has been discontinued. All nonresident and part-year resident individuals must file Schedules NRPA-1 and NRPA-2 along with Form IT-540B electronically if he or she is a professional athlete who earned income as a result of services rendered within Louisiana and is required to file a federal individual income tax ...

5123, 2021 City Estimated Income Tax for ... - Michigan

www.michigan.govhave estimated tax due. Payment Due Dates . File a . City Estimated Individual Income Tax Voucher (Form 5123) by April 15, 2021 and pay at least one-fourth (1/4) of the estimated tax. The remaining estimated tax is due in three equal payments on the following dates: June 15, 2021; September 15, 2021; and, January 18, 2022.

Application for 1901 Registration January 2000 (ENCS)

www.officialgazette.gov.ph20 Contact Person/ Accredited Tax Agent (if different from taxpayer) 21 Telephone Number Last Name, First Name, Middle Name (if individual) / Registered Name (if non-individual) 22 Tax Types (choose only the tax types that are applicable to you) FORM TYPE ATC (To be filled up by the BIR) (To be filled up by the BIR) Income Tax Value-added Tax

Ontario - Combined federal and provincial personal income ...

assets.ey.comJan 15, 2022 · reduction. The low-income tax reduction ($257 of Ontario tax) is clawed back for income in excess of $16,230 until the reduction is eliminated, resulting in an additional 5.05% of provincial tax on income between $16,231 and $21,319. 7. The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an ...

CERTIFIED STATEMENT OF INCOME AND TAX FILING STATUS ...

www.dfas.milincur taxes on moving expense reimbursements in one state because of residency in that state, and in another state because that particular state taxes income earned within its jurisdiction irrespective of whether the employee is a resident. ... this Certification Form, matches the income tax documentation submitted with the ITA claim. R

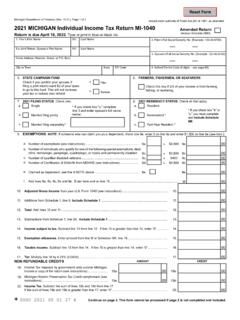

2021 Michigan Individual Income Tax Return MI-1040

www.michigan.gov27. Earned Income Tax Credit. Multiply line 27a by 6% (0.06) and enter result on line 27b. 27a. 00 . 27b. 28. Michigan Historic Preservation Tax Credit (refundable). Include Form 3581. 28. 29. Credit for allocated share of tax paid by an electing flow-through entity (see instructions) 30. Michigan tax withheld from Schedule W, line 6.

SOUTH AFRICAN REVENUE SERVICE CONVENTION BETWEEN …

www.sars.gov.za(b) in the case of the United Kingdom: (i) the income tax; (ii) the corporation tax; and (iii) the capital gains tax; (hereinafter referred to as “United Kingdom tax”). 4. This Convention shall also apply to any identical or substantially similar taxes that are

State of Connecticut Schedule CT K-1 2021 Member’s Share ...

portal.ct.gov1. Composite Income Tax payment made by PE on behalf of nonresident individual (NI) member..... 1. 00 Nonresident individuals: Report this amount on Form CT-1040NR/PY, Connecticut Nonresident and Part‑Year Resident Income Tax Return, on one of the lines for income tax withheld (Lines 20a through 20f). See instructions. Part 5 - Connecticut ...

2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS …

portal.ct.gov2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS AND CREDITS ARE INCLUDED And you are .... And you are .... And you are .... More Than Less Than or Equal To Single * Married Filing ... **Form CT-1040 - Line 5; Form CT-1040NR/PY - Line 7. 2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS AND CREDITS ARE INCLUDED …

NOTICE REGARDING THE IMPLEMENTATION OF THE …

www.michigan.govto file as a partnership for federal income tax purposes.5 Based on these definitions, the following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan: 1. Limited liability companies (LLCs) that file federal income tax returns as partnerships; 2.

California Tax Credit Allocation Committee Regulations ...

www.novoco.comJan 23, 2013 · Credits awarded to the applicant for purposes of income tax reporting to the IRS and/or the California Franchise Tax Board (“FTB”). c) Applicable Credit Percentage. The monthly rate, published in IRS revenue rulings pursuant to IRC Section 42(b)(1), applicable to the Federal Program for purposes of calculating annual Tax Credit amounts.

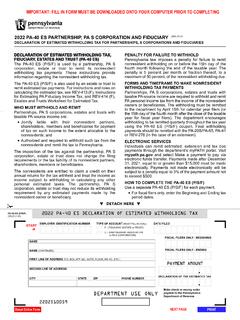

2022 PA-40 ES PARTNERSHIP, PA S CORPORATION AND …

www.revenue.pa.govThe PA-40 ES (P/S/F) is also used by an estate or trust to FORMS AND TIMEFRAME TO MAKE NONRESIDENT remit estimated tax payments. For instructions and rules on calculating the estimated tax, see REV-413 (F), Instructions for Estimating PA Fiduciary Income Tax, and REV-414 (F), Estates and Trusts Worksheet for Estimated Tax.

2021 Form 4868

www.irs.govfile a U.S. individual income tax return. 1. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or using a credit or debit card. See. How To Make a Payment, later. 2. You can file Form 4868 electronically by accessing IRS . e-file

2021 - blackrock.com

www.blackrock.comImportant Tax Information for Open-End Funds This booklet is a summary of useful tax information for certain BlackRock Open-End mutual funds. It will assist you, as an investor, in the preparation of your 2021 Federal and state income tax returns. We recommend consulting with your tax preparer for assistance

Hall Income Tax Manual - tn.gov

www.tn.govthe return. Income received during the period of legal domicil e in another state may be reported on Schedule B of the return. A Tennessee partnership (i.e., a partnership whose comm ercial domic ile is in Tennessee) whose taxable interest and dividend income exceede d …

Rent Receipt for Income Tax Purposes Template

images.template.netRent Receipt for Income Tax Purposes This is to certify that I/We received from _____ (tenant) the sum* of $_____, which is the total rent paid during the tax year ... Information about the person or company issuing this receipt (required by the Canada Revenue Agency):

Return of Organization Exempt From Income Tax 2012

www.irs.govReturn of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) The organization may have to use a copy of this return to satisfy state reporting requirements. OMB No. 1545-0047. 2012. Open to Public Inspection. A

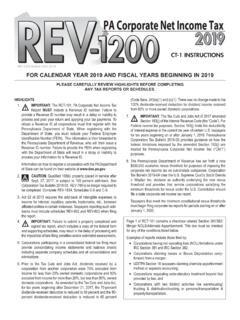

2019 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.govIMPORTANT: The RCT-101, PA Corporate Net Income Tax Report MUST include a Revenue ID number. Failure to ... CT-1 INSTRUCTIONS REV-1200 Booklet (SU) 10-19 Page 1 of RCT-101 contains a checkbox labeled Section 381/382/ Merger NOLS/Alternate Apportionment. This box must be checked

Updated in March 2021, to include Strategic Advisers funds ...

www.fidelity.comWe are sending this information to help you prepare your state income tax return. If you owned shares of any of the ... state tax. California, Connecticut, and New York exempt dividend income only when a fund has met a certain minimum investment ... Fidelity® Nasdaq Composite Index® Fund* FNCMX 0.66%

NHS Pensions - Deferred benefits claim form

www.nhsbsa.nhs.ukNo go to question 4.5 (i) Gross annual rate (before deduction of income tax) of pension(s) in payment, from your separate pension arrangements (not your main NHS pension) at the earlier of either today’s date or a date at 4.3(ii). £.

2021 Form 540 California Resident Income Tax Return

www.ftb.ca.gov333 3101213 Form 540 2021 Side 1 6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst ..... 6 Exemptions. For line 7, line 8, line 9, and line 10: Multiply the number you enter in the box by the pre-printed dollar amount for that line.

R. HOMEOWNERS' ASSOCIATIONS UNDER IRC 501 ... - IRS …

www.irs.govIntroduction A discussion of the exemption of homeowners' associations was included in ... exemption from federal income tax under IRC 501(c)(4), 501(c)(7), or 528. 2. Background - IRC 501(c)(4) ... The case involved a nonprofit membership housing cooperative that provided low cost housing to its members. In denying exemption,

INCOME TAXES - TD

www.tdbank.comthe average income tax burden for an individual. Exclusions: dollar amounts of income that are tax-exempt, or not subject to federal income tax. An example would be interest on most U.S. state and municipal bonds. Tax-Deferred Income: income to be taxed at a later date, such as interest/earnings from a traditional Individual Retirement Account ...

TAX STRUCTURE BOOKLET OF THE U.S. VIRGIN ISLANDS

bir.vi.govJan 31, 2021 · the U.S. Court of Appeals for the Third Circuit, which is based in Philadelphia, Pennsylvania. The U.S. Tax Court does not have jurisdiction to hear tax cases arising under the income tax laws applicable in the Virgin Islands. However, …

TAX INFORMATION RELEASE NO. 97-1 - Hawaii

files.hawaii.govThis Tax Information Release (TIR) is intended to provide taxpayers with further guidance in determining their residency status, and is based on section 235-1, Hawaii Revised Statutes (HRS) and section 18-235-1, Hawaii Administrative Rules (HAR) (1982). I. In General For Hawaii State income tax purposes, a resident is defined as:

Similar queries

Individual Municipal Income Tax Forms, Individual Municipal Income Tax Forms Tax, Income, Income tax, State Individual Income Tax Rates and, State, Individual Income Tax Rates, Tax rates, Individual, Benefit, Income tax return, Personal tax, Code, Type, Tax Code, Online state forms, Connecticut, Composite Income Tax, Michigan, Estimated income tax, Estimated, Estimated tax, Fiduciary Income Tax Return, Fiduciary, Missouri, Form, Earned income, 5123, 2021 City Estimated Income Tax, TYPE ATC, Personal income, Personal, Residency, Income earned, Certification Form, Earned Income Tax, Convention, United Kingdom, United Kingdom tax, California Tax, California Franchise Tax, Instructions, Instructions for Estimating PA, Individual income tax, Booklet, Return, Tennessee, Canada, Income Tax - CT, Composite, California, Introduction, Housing, INCOME TAXES, TAX STRUCTURE BOOKLET OF THE U.S, Philadelphia, Hawaii