Income Tax Ct

Found 6 free book(s)Form CT-3 General Business Corporation Franchise Tax ...

www.tax.ny.gov8Investment and other exempt income (from Form CT-3.1, Schedule D, line 1) ... 20 Business income base tax (multiply line 19 by the appropriate business income tax rate from the tax rates schedule in Form CT-3-I; enter here and on Part 2, line 1a; see instructions) ...

2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS …

portal.ct.gov2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS AND CREDITS ARE INCLUDED And you are .... And you are .... And you are .... More Than Less Than or Equal To Single * Married Filing ... **Form CT-1040 - Line 5; Form CT-1040NR/PY - Line 7. 2021 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS AND CREDITS ARE INCLUDED …

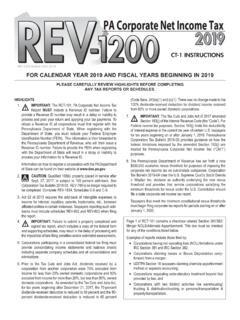

2019 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.govIMPORTANT: The RCT-101, PA Corporate Net Income Tax Report MUST include a Revenue ID number. Failure to ... CT-1 INSTRUCTIONS REV-1200 Booklet (SU) 10-19 Page 1 of RCT-101 contains a checkbox labeled Section 381/382/ Merger NOLS/Alternate Apportionment. This box must be checked

New York State Modifications CT-225 - Government of New …

www.tax.ny.govFile this form with Form CT-3, CT-3-S, or CT-33. Complete all parts that apply to you. See Form CT-225-I, Instructions for Form CT-225. Schedule A – Certain New York State additions to federal income Part 1 – For certain additions to federal income that did not flow through from a partnership, estate, or trust

80024 IRA State Income Tax Withholding Election (11/2021)

iradirect.ascensus.coma completed Form CT-W4P. Form CT-W4P may be obtained from the Connecticut Department of Revenue Services. DISTRICT OF COLUMBIA. Lump-sum IRA distributions are subject to mandatory state withholding at 10.75% of the gross payment, except for any after-tax amount in a lump-sum distribution or a trustee to trustee transfer between IRAs. IOWA.

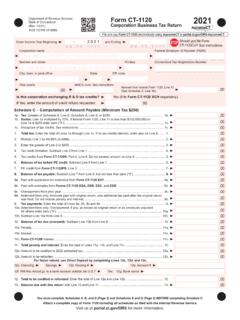

Form CT-1120 2021 Corporation Business Tax Return

portal.ct.govbusiness tax credit change change operating loss change line below. 3. If this is a final return, has the corporation: Dissolved Withdrawn Merged/reorganized: Enter survivor’s Connecticut (CT) Tax Registration Number: 4. Federal return was filed on: 1120 1120-H 1120-REIT 1120-RIC Other: