Search results with tag "Earned"

BROWSE MENU

www.treasurydirect.govvalue $50 int. earned $50 redemp. value $75 int. earned $75 redemp. value $100 int. earned $100 redemp. value $200 int. earned $200 redemp. value $500 int. earned $500 redemp. value $1,000 int. earned $1,000 redemp. value $5,000 int. earned $5,000 redemp. value $10,000 int. earned $10,000 yield from issue 2021 jan - dec not eligible for payment

2021 Earned Income Credit - LAWorks

www2.laworks.netEarned Income Credit EIC2021 Notice to Employees of Federal Earned Income Tax Credit (EIC) If you make $51,000* or less, your employer should notify you at the time of hiring of the potential availability of Earned Income Tax Credits. Earned Income Tax Credits are reductions in federal income tax liability for which you may be eligible if you

New Jersey Earned Sick Leave - Government of New Jersey

nj.govto accrue earned sick leave under this law beginning on the date that the agreement expires. Date Earned Sick Leave is Available for Use. You can begin using earned sick leave accrued under this law on February 26, 2019, or the 120th calendar day after you begin employment, whichever is later. However, your employer can provide benefits that ...

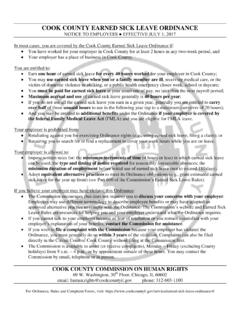

COOK COUNTY EARNED SICK LEAVE ORDINANCE

www.cookcountyil.govminimum duration of employment before initial use of earned sick leave (not to exceed 180 days). Adopt equivalent alternative practices to meet its Ordinance obligations (e.g., grant estimated earned sick leave for the year up front) (see Part 600 of the Commission’s Earned Sick Leave Rules).

Article 9: City of San Diego Earned Sick Leave and Minimum …

docs.sandiego.gov(“City of San Diego Earned Sick Leave and Minimum Wage” added 2-8-2016 by O–20604 N.S.; effective 7-11-2016.) §39.0101 Purpose and Intent This Division ensures that employees who work in the City receive a livable minimum wage and the right to take earned, paid sick leave to ensure a decent and healthy life for themselves and their families.

2020 Form 3514 California Earned Income Tax Credit

www.ftb.ca.govCalifornia Earned Income Tax Credit Attach to your California Form 540, Form 540 2EZ or Form 540NR. Name(s) as shown on tax return Your SSN or ITIN Before you begin: If you claim the California Earned Income Tax Credit (EITC) even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years.

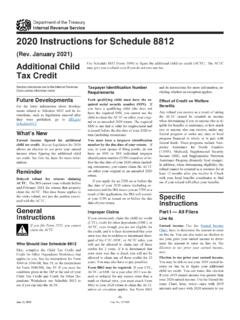

2020 Instructions for Schedule 8812 (Rev. January 2021)

www.irs.govif your 2019 earned income is greater than your 2020 earned income. To make this election, enter “PYEI” and the amount of your 2019 earned income in the space next to Form 1040, 1040-SR, or 1040-NR, line 28. Line 6b. Nontaxable combat pay. Enter on line 6b the total amount of nontaxable combat pay that you, and your spouse if filing jointly ...

FYI Income 17 Credit for Income Tax Paid to Another State

tax.colorado.goventer any tax paid on income that was earned while a resident of the other state. This amount can be calculated by dividing that portion of the total income earned and taxed by both states by that portion of the total income earned and taxed only by the other state, then multiplying the result by the total tax liability in the other state.

CLGS-32-3 (1-19) QUARTERLY ESTIMATED Local Earned …

keystonecollects.comLocal Earned Income Tax PO Box 539 • Irwin PA 15642 You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes. Contact your Tax Officer. Taxpayer Helpline: 1-866-539-1100

NJ 1040 - New Jersey Resident Income Tax Return

www.nj.govFill in if you had the IRS calculate your federal earned income credit Fill in if you are a CU couple claiming the NJ Earned Income Tax Credit 57. Excess New Jersey UI/WF/SWF Withheld (Enclose Form NJ-2450) (See instructions) .....57. , . 58.

STATE OF OREGON EARNED INCOME TAX CREDIT …

f.hubspotusercontent00.netthe State and Federal earned income tax credits (EITC). This requirement began calendar year 2017. The notice must: • Be in English and in the language the employer typically uses to communicate with the employee • Be sent annually with the employee's federal form W-2

FINANCIAL STATEMENT ANALYSIS - Pearson

www.pearsonhighered.comAnalysts can find value in all of these information sources, provided they adjust for existing biases. ... investment bank earned over $10 million annually for its services to the North ... be earned through financial analysis. This might lead one to ask, “Why should

DTF-215.2 Earned Income Tax Credit Brochure Revised 12/21

www.tax.ny.govTitle: DTF-215.2 Earned Income Tax Credit Brochure Revised 12/21 Created Date: 12/9/2021 8:59:30 AM

Professional Tax Preparer’s Guide

keystonecollects.comIf you are retired and are no longer receiving a salary, wages or income from a business, you may not owe an earned income tax. Social Security payments, payments from qualified pension plans, interest and/or dividends accrued from bank accounts and/or investments are not subject to local earned income tax.

TAX RETURN PREPARERS’ DUE DILIGENCE REQUIREMENTS

www.crosslinktax.comEarned Income Ranges to Receive the Maximum EIC Maximum EIC Amount EIC Phaseout Limit AT LEAST BUT LESS THAN No Children $9,800 $11,650 $1,502 $21,430 One Child $10,600 $19,550 $3,618 $42,158 Two Children $14,950 $19,550 $5,980 $47,915 Three or More Children $14,950 $19,550 $6,728 $51,464 2021 EARNED INCOME CREDIT

TELEPHONE Many New Jersey Taxpayers Are Eligible ... - State

www.state.nj.usFor 2021 Earned Income Tax Credits . Both a federal and New Jersey Earned Income Tax Credit (NJEITC) are available to eligible taxpayers. Workers who are eligible for the federal credit also qualify for the NJEITC. Like the federal credit, the NJEITC can reduce the amount of tax you owe, or increase the amount of your refund check.

SAMPLE MCQ’s for Project Management - MMBGIMS

www.mmbgims.com45. Amount of work completed to date compared with planned in the Earned Value Management method is A. Schedule Performance Index B. Cost Performance Index C. Percentage Complete D .Percentage Spent 46. The budgeted cost for all the activities in a project with the help of Earned Value Method is A. Actual Cost B. Budget at completion

APM – ACostE Estimating Guide

www.apm.org.uk5.1 Earned value S-curve 44. vi ... and the Association for Project Management (APM) in publishing this guide. In project management, effective monitoring of a project’s performance depends ... meet internal governance guidelines on cost-benefit-risk. n Organisations that manage a portfolio of projects require credible cost

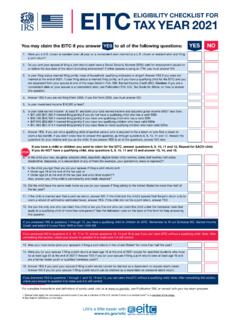

ELIGIBILITY CHECKLIST FOR TAX YEAR 2021

www.irs.govare separated from your spouse in one of the ways listed in Pub. 596, Earned Income Credit (EIC). Caution: If you are a nonresident alien or your spouse is a nonresident alien, see Publication 519, U.S. Tax Guide for Aliens, on how to answer

18 UBM 306 FINANCIAL MANAGEMENT Multiple Choice …

www.ngmc.orgearned is often referred to as _____. A. P resent value. B. S imple interest. C .F uture value. D. C ompound interest. ANSWER: D 37 .The long - run objective of financial management is to _____. A. M aximize earnings per share. B. M aximize the value of the firm's common stock. C. M aximize return o n investment.

2021-22 OSAP Student Income Verification: Canadian Non ...

osap.gov.on.caStudent income information 1. Your total 2020 non-taxable income received in Canada was greater than zero. Examples: income earned as a person registered under the Indian Act on a First Nations reserve, lottery winnings totaling over …

QUARTERLY ESTIMATED Local Earned Income Tax …

www.hab-inc.comApr 30, 2021 · Resident PSD Code Work Location PSD Code PO Box 25157 Lehigh Valley, PA 18002-5157 You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by calling Berkheimer at 610-599-3182 Or, you can visit our website at www.hab-inc.com.

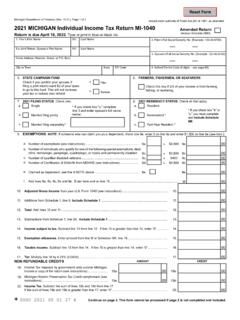

2021 Michigan Individual Income Tax Return MI-1040

www.michigan.gov27. Earned Income Tax Credit. Multiply line 27a by 6% (0.06) and enter result on line 27b. 27a. 00 . 27b. 28. Michigan Historic Preservation Tax Credit (refundable). Include Form 3581. 28. 29. Credit for allocated share of tax paid by an electing flow-through entity (see instructions) 30. Michigan tax withheld from Schedule W, line 6.

Nontaxable Combat Pay Election and the Earned Income …

www.irs.govFor this study, we constructed an individual-level dataset containing the population of EITC-eligible military person-nel with nontaxable combat pay by combining military personnel data with tax return data for Tax Years 2005-2009. Military personnel data come from the U.S. Department of Defense (DOD) and include characteristics such as pay

Corporate Tax Rates - KPMG

home.kpmgtable “Federal and Provincial/Territorial Tax Rates for Income Earned by a General Corporation”). CCPCs that earn M&P income within the small business threshold in Yukon enjoy a reduced M&P income tax rate of 1.5% in 2020. Yukon will decrease its small business M&P income tax rate to 0% (from 1.5%) effective January 1, 2021.

CERTIFIED STATEMENT OF INCOME AND TAX FILING STATUS ...

www.dfas.milincur taxes on moving expense reimbursements in one state because of residency in that state, and in another state because that particular state taxes income earned within its jurisdiction irrespective of whether the employee is a resident. ... this Certification Form, matches the income tax documentation submitted with the ITA claim. R

KSR Part III - Kerala

www.img.kerala.gov.inNo Pension or Gratuity or DCR Gratuity will be paid in the case of resignation, dismissal or removal from service. R 29 (a) & (b) P-III ... either to accept another employment in Government service or to leave the service accepting pension benefits based on qualifying service so far earned by the individual. The pension granted as opted by the ...

HOLIDAYS WITH PAY

moj.gov.jm(2) The minimum gratuity payable to a casual worker under this paragraph shall be 3 per cent of the total wages earned by him during the year in respect of which, and in the service of the employer by whom, such gratuity is payable. Holiday 7.-41) Upon termination of the employment of any worker his remuner-

7.1 LEAVE RULES - South Central Railway zone

scr.indianrailways.gov.inThe leave encashment availed prior to 1.1.2004 shall not be taken . 3 ... 7.1.4 Casual Leave (CL) i. Casual Leave is not earned by duty. A staff on CL is not treated as absent from duty. CL cannot be claimed as of right and is subject to a maximum of …

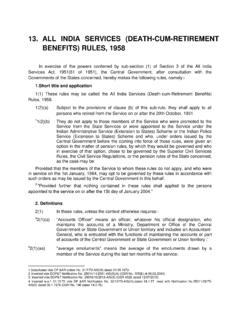

13. ALL INDIA SERVICES (DEATH-CUM-RETIREMENT …

dopt.gov.inand twenty days of earned leave where such leave was for more than one hundred and twenty days; 2(1)(b) "death-cum-retirement gratuity” means the lump sum granted to a member of the Service or his family in accordance with rule 19. 102(1)(bb)"Emoluments" means the basic pay, as defined in clause (aa) of rule 2 of the Indian

2021 Schedule VK-1 - tax.virginia.gov

www.tax.virginia.govYoueceived r this Schedule VK-1 because the above-named PTE earned income from Virginia sources and has passed ... receives Virginia source income is subject to taxation by Virginia regardless of state of residency or domicile. You may be required to file a Virginia tax return even though you may be a nonresident individual or a business ...

WHAT’S NEW FOR LOUISIANA 2021 INDIVIDUAL INCOME TAX?

revenue.louisiana.govIndividual Income Tax Return, has been discontinued. All nonresident and part-year resident individuals must file Schedules NRPA-1 and NRPA-2 along with Form IT-540B electronically if he or she is a professional athlete who earned income as a result of services rendered within Louisiana and is required to file a federal individual income tax ...

Putnam Stable Value Fund - The Vanguard Group

institutional.vanguard.comAstable value fund is designed as alow-risk investment but you could still lose money by investing in it. The primary risks of investing in the fund are: ... five years, on average, producing arate of fund income that will be higher than that earned on …

Earned Value Management Tutorial Module 8: Reporting

www.energy.govearned value: Planned Value (PV) , Earned Value (EV) and Actual Cost (AC). • In Module 6 we discussed Earned value metrics and performance measurements (CV, SV, SPI, CPI,etc.) • In Module 7 we discussed the Integrated Baseline Review (IBR), rebaselining of a project and proper baseline control or change control

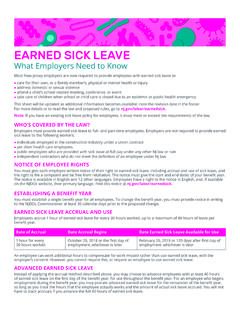

EARNED SICK LEAVE - Government of New Jersey

www.nj.govMost New Jersey employers are now required to provide employees with earned sick leave to: • care for their own, or a family member’s, physical or mental health or injury • address domestic or sexual violence • attend a child’s school-related meeting, conference, or event • take care of children when school or child care is closed due to an epidemic or public health emergency

Earned Income Tax Credit - Social Security Administration

www.ssa.govThe Earned Income Tax Credit (EITC) is a special Federal income tax credit for low-income workers.The credit reduces the amount of tax they owe (if any) and is intended to offset some of the increases in living expenses and Social Security taxes. Eligible persons who owe no taxes, or whose tax liability is smaller than

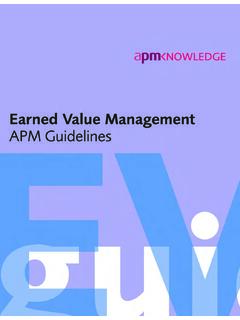

Earned Value Management: APM Guidelines

www.apm.org.ukEarned Value Management: APM Guidelines can be applied to projects of vary-ing size, scope and duration to ensure that the EVM process is operated in a consistent manner across all implementing teams. Each implementing project should take into account: • …

Doorstroom van kleuters - PO-Raad

www.poraad.nlIn andere landen hebben kinderen bijvoorbeeld gedurende de leerplichtleeftijd (niet altijd vanaf 5 jaar) het recht om automatisch ... en Van der Veen pleitten er in 2007 al voor dat scholen meer terughoudend ... Dit is afhankelijk van het specifieke aspect dat is onderzocht.

Adviesrapport - Hanze

www.hanze.nlWanneer een specifieke groep medewerkers bedoeld wordt (bijvoorbeeld senior of junior medewerkers), wordt dit vermeld. 9 2. Onderzoekskader ... Het draait om de relatie tussen het personeel en de andere elementen van de organisatie en de omgeving. Het model gaat uit van samenhang en evenwicht tussen de

Aanvraag tijdskrediet landingsbanen

www.rva.beDit formulier heeft geen betrekking op de specifieke vormen van loopbaanonderbre-king. Als u ouderschapsverlof, verlof voor medische bijstand of verlof voor palliatieve zorgen ... landingsbanen en binnen dezelfde vorm (1/2-tijds of 1/5-tijds). ... één of andere reden geen recht hebt op uitkeringen, kunt u aanspraak maken op een tijdskrediet ...

Overzicht CPV codes van sociale en andere specifieke …

www.pianoo.nl85310000-5 Maatschappelijke diensten. (5) 85311000-2 Maatschappelijke dienstverlening waarbij onderdak wordt verschaft. (5) 85311100-3 Welzijnszorg voor bejaarden. (5) 85311200-4 Welzijnszorg voor gehandicapten. (5) 85311300-5 Welzijnszorg voor kinderen en jongeren. (5) 85312000-9 Maatschappelijke dienstverlening waarbij geen onderdak wordt ...

Controleverklaringen verklaard - NBA

www.nba.nlVerder is het Bado al genoemd als voorbeeld van specifieke regelgeving voor de controle van de jaarrekening. Vanuit de NBA zijn voor de jaarrekeningcontrole vooral relevant de Nadere Voorschriften Controle- en overige Standaar - den (NV COS), die ook gelden voor de publieke sector. Deze Standaarden geven onder andere aan hoe de accountant een

WKR in 2022? Wat kun je met de - loket.nl

www.loket.nlKerstpakketten en andere geschenken aan je medewerkers. Bijdrage aan een sportschoolabonnement. Een mobiele telefoon, laptop en/of tablet wanneer deze niet noodzakelijk is. voor de werkzaamheden. Gereedschap. Een fiets van de zaak. Een netto bonus (mits beperkt in omvang) Een gedeelte van de reiskostenvergoeding die . boven. de €0,19 per ...

Oog voor mensen met een licht verstandelijke ... - Movisie

www.movisie.nlMovisie: kennis en aanpak van sociale vraagstukken ... (en andere kwetsbare groepen) aan te pakken. ... diensten en ruimten voor mensen met een beperking te bevorderen en daarmee bij te dragen aan het realiseren van een inclusieve samenleving’ (Memorie van Toelichting Wmo, 2015, pag. 1). Ook de invoering van de ...

Verdrag inzake de Rechten van het Kind

www.kinderrechtencommissariaat.beDe Staten die partij zijn, nemen alle nodige wettelijke, bestuurlijke en andere maatregelen om de in dit Verdrag erkende rechten te verwezenlijken. Ten aanzien van economische, sociale en culturele rechten nemen de Staten die partij zijn deze maatregelen in de ruimste mate waarin de hun ter beschikking

Similar queries

Value, Earned, 2021 Earned Income Credit, Earned Income, Income, Leave, Government of New Jersey, Earned sick leave, Minimum, Earned Sick Leave and Minimum, Earned Sick Leave and Minimum Wage, Minimum wage, California Earned Income Tax Credit, California, Election, Nontaxable combat pay, Income tax, Income earned, New Jersey, EARNED INCOME TAX CREDIT, Federal earned income tax credits, EITC, Federal, FINANCIAL STATEMENT ANALYSIS, Analysis, Earned Income Tax, Preparer, Earned Income Credit, State, Earned Income Tax Credits, SAMPLE MCQ’s for Project Management, Earned Value Management, Earned value, Association for Project Management, Management, Guidelines, ELIGIBILITY CHECKLIST, OSAP Student Income Verification: Canadian Non, Student income, QUARTERLY ESTIMATED Local Earned Income Tax, Resident PSD, Form, Nontaxable Combat Pay Election and the Earned Income, Level, Corporate Tax, Residency, Certification Form, Gratuity, 7.1 LEAVE RULES, Leave encashment, INDIA SERVICES DEATH-CUM-RETIREMENT, Earned leave, Putnam Stable Value Fund, Social Security Administration, Earned Value Management: APM Guidelines, Andere, En Van, Specifieke, Van sociale en andere specifieke, Maatschappelijke, Controleverklaringen verklaard, Sociale, En andere, Diensten en, Verdrag inzake de Rechten van het, Sociale en