Search results with tag "Preparers"

November2020 Disclosure and Use of Tax Information ...

www.irs.govVITA/TCE programs. Final Treasury Regulations under IRC 7216, Disclosure or Use of Tax Information by Preparers of Returns, became effective December 28, 2012. In general, the regulation requires tax return preparers – including volunteer preparers – who intend to …

AFTR Course Exempt Preparers

www.irs.govReturn preparers who hold an Accredited Tax Preparer (ATP) or Accredited Business Accountant/ Advisor credential (ABA). Annual Filing Season Continuing Education Requirements Credentialed Return Preparers Certified Public Accountant (CPA) Exempt as long as preparer holds current credential ;

Estate and Trust Form 1041 Issues for Tax Return Preparers

media.straffordpub.comEstate and Trust Form 1041 Issues for Tax Return Preparers Allocating Income and Deductions, Calculating DNI, Understanding Reporting Rules for Trusts, and More WEDNESDAY, FEBRUARY 27, 2013, 1:00-2:50 pm Eastern WHOM TO CONTACT For Additional Registrations: -Call Strafford Customer Service 1-800-926-7926 x10 (or 404-881-1141 x10)

Publication 58:(1/15):Information for Income Tax Return ...

www.tax.ny.govcertain tax return preparers, facilitators of refund anticipation loans, and facilitators of refund anticipation checks. In addition, the law includes certain requirements and restrictions on tax return preparers and facilitators, with significant penalties for those who do not comply. Tax Preparer Registration Program definitions

New York State Modernized e-File (MeF) Guide For Return ...

www.tax.ny.govinformation requirements. NYS Tax Law §§ 32 and 685 prescribe penalties for paid preparers who fail to meet their responsibilities. Tax preparers are subject to these penalties if they fail to do the following: • Sign a NYS tax return or report refund anticipation loans or refund anticipation check documentationwhen required.

LB&I Transaction Unit

www.irs.govTax return preparers normally use one of two methods to record the change of ownership on the Form 1065, Schedule M -2. − In the first method, on lines 2 and 6 of Schedule M-2 the preparers record the change in ownership as a capital contribution and distribution between the …

Registered Tax Return Preparer Test Explained

www.irs.govBecause the test will cover 2010 tax issues, the IRS encourages preparers to download the publications and save them to their computers so they can be sure they have the correct tax year as a study guide. Scheduling a Test and Paying the Fee Preparers who need to take the test can schedule an appointment beginning next week

Tax Return Preparer Ethical Issues

taxces.complan agents and other qualified tax return preparers. Within each category, the IRS further delineates the permitted scope of responsibilities. In this chapter we will look at the scope of tax return preparer responsibilities. In so doing, we will discuss the practices identified as best practices by the IRS that tax preparers should follow in

Consumer Bill of Rights Regarding Tax Preparers in English

www1.nyc.govConsumer Bill of Rights Regarding Tax Preparers Continued > Deferred Payment Options The tax preparer may offer you products to delay payment for tax preparation at the time of service, instead taking fees out of your refund. These deferred payment products include a Refund Advance Check (RAC) or a Refund Transfer.

NYC Signage Requirements for Tax Preparers

www1.nyc.govABC Tax Preparers 123 Street New York, NY 10000 212-555-5555 • You are entitled to a written estimate of all fees before receiving services for which we are charging a fee. • You are entitled to a copy of every tax return we prepare for you at the time you give us …

DEPT Vermont Department of Taxes USE *201111100* ONLY …

tax.vermont.govTAX.VERMONT.GOV FOR MORE INFORMATION. 13. Charitable Contribution Deduction (Enter the lesser of Line 12 or $1,000) . . . . . . ... Preparers cannot use return information for purposes other than preparing returns. Other State Credit (Schedule IN-117, Line 21) Vermont Tax Credits (Schedule IN-119, Part II) Total Vermont Credits

Stormwater Management and Sediment and Erosion …

scdhec.gov(SCR100000), which was issued on October 15, 2012. SWPPP Preparers should not utilize this checklist as a substitute for the language in the permit and should review the permit itself for more information on each ... 6. SOILS INFORMATION (3.2.7.A.II) Location in …

Supplemental Information Regarding Annual and …

www.lctcb.orgIf you mail a paper return using the USPS, you are encouraged to keep a copy of your signed return. Failure of the USPS to deliver your return may result in a late filing fee charge to you. If you use a tax preparer please note that most preparers do not mail the local tax return for you, mailing the return is your responsibility.

60 OUR AL ORN A TAX U AT ON OUN L ( T ) QUAL Y N U AT …

gstti.comincludes information about the requirements of practice before the IRS including power of attorney, rules for tax preparers (Circular 230) and tax return preparer penalties. Please Note: Due to the major tax reforms implemented by the Tax …

Sample Return - Services For CPA & Tax Preparers

www.servicesfortaxpreparers.com.mail your return, voucher and check on or before 04-18-2011 to: department of the treasury internal revenue service center ogden, ut 84201-0148 _____ instructions for filing 2010 idaho form 66.your return has a balance due of $1,971.00..the fiduciary or officer representing fiduciary must sign the return.

Electronic Filing Guide for the New Employee Registry …

www.edd.ca.govTax preparers (payroll agents, payroll services, certified public accountants [CPA], or other employer representatives) can establish their own username and password to report on behalf of their clients. ... Electronic Filing Guide for the New Employee Registry Program

Full-Year Resident Income Tax Return

www.tax.ny.govapply to all tax preparers, for returns filed or required to be filed for tax years beginning in tax year 2019. • Treatment of certain gambling winnings Beginning in tax year 2019, New York State withholding is required for any gambling winnings from a wagering transaction within New York State if the proceeds from the

Office of Tax and Revenue D-20ES 2021 D-20ES Franchise Tax ...

otr.cfo.dc.gov•The Preparer Tax Identification Number (PTIN) is an identification number issued by the IRS that all paid tax preparers must use on tax returns or claims for refund. You must wait until you receive a TIN before you file a DC return. Your return may be rejected if your TIN is missing, incorrect or invalid. Help us identify your forms and ...

Challenges and successes in implementing international ...

www.cimaglobal.comtives – regulators, standard setters, preparers from entities of various sizes, auditors from large and small accounting firms, and investment professionals – and shared a com-bination of organization-wide and personal views. Appendix 1 contains a list of focus groups, interviews, and respondents to the invitation to submit written responses.

Illustrative Annual Accounts - Deloitte

www2.deloitte.comAppendix - List of the main references to the Accounting and Company Laws 205 Appendix - IRE Taxonomy guidelines ... This illustrative brochure seeks to give guidance and provide practical examples to preparers and reviewers ... c onsolidated financial statements a nd reports of certain types of companies ...

New York State Department of Taxation and Finance ...

www.tax.ny.govtax return on Form CT‑3‑S, New York S Corporation Franchise Tax Return, ... If sent by registered or certified mail, the date ... If an outside individual or firm prepared the election, all applicable entries in the paid preparer section must be completed, including ...

Registered Tax Return Preparer Exam Study Guide

www.1040ed.comForm 2848 (Rev. October 2011): Power of Attorney and Declaration of Representative Form 2848 Instructions (Rev. October 2011) Form 8821 (Rev. October 2011): Tax Information Authorization Publication 1345 (Rev. 3-2009): Handbook for Authorized IRS e-file Providers Publication 4600 (Rev. October 2008): Safeguarding Taxpayer Information Quick ...

2021 Form 592 Resident and Nonresident Withholding …

www.ftb.ca.govDeclaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge . Print or type withholding agent's name Telephone Date Print or type preparer’s name Preparer's PTIN Date Preparer’s address Telephone Withholding agent's signature Preparer's signature. 7081213.. Due Date: •

Chapter 13 Petition Package - United States Courts

www.cacb.uscourts.govL. ankruptcy Petition Preparer’s Notice,B Declaration and Signature (Official Form 119 ) - this form must be filed only if the debtor paid a nonattorney bankruptcy - petition preparer prepared any of the bankruptcy filing documents. [11 U.S.C. § 110]. M. isclosure of Compensation of Attorney fD or Debtor (Official Form 2030 ) – this

EITC Due Diligence

taxces.comThe earned income credit rules tend to be fairly complex, and that complexity can result in errors that may be expensive for both the taxpayer and the tax return preparer. The rules concerning a taxpayer’s eligibility for the earned income credit include: • Rules that apply to everyone;

WORKERS' COMPENSATION - FIRST REPORT OF INJURY OR …

www.dii-ins.comDATE PREPARED PREPARER'S NAME TITLE PHONE NUMBER ... DATE RETURN(ED) TO WORK HOSPITAL OR OFFSITE TREATMENT (NAME & ADDRESS) LOST TIME ANTICIPATED ... incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20. Page 3 of 5. ACORD 4 (2013/01) Page 4 of 5 ...

Office of Tax and Revenue D-40ES 2021 D-40ES Individual ...

otr.cfo.dc.govtax using a computer-prepared or computer-generated substitute ... tification Number (ITIN) or Preparer Tax Identification Number (PTIN). ... Enter 1 if married/registered domestic partner filing jointly or filing separately on same return and your spouse/registered domestic partner is …

Tax News December 2021

www.ftb.ca.govcases of tax evasion, tax fraud, refund fraud, and preparer fraud. As part of their investigations, special agents may also uncover other financial crimes such as money laundering, embezzlement, and theft. Through the investigation process, special agents write and execute

2020 Michigan Individual Income Tax Return MI-1040

www.michigan.govEarned Income Tax Credit. Multiply line 27a by 6% (0.06) and enter result on line 27b. 27a. 00 . 27b. 28. Michigan Historic Preservation Tax Credit (refundable). ... I declare under penalty of perjury that the information in this return Preparer’s Name (print or type) and attachments is true and complete to the best of my knowledge. Filer’s ...

MARYLAND 2020 FORM 502

marylandtaxes.govLocal earned income credit (from Local Earned Income Credit Worksheet in Instruction 19.) . . 29. 30. ... Printed name of the Preparer / or Firm's name Street address of preparer or Firm's address Signature of preparer other than taxpayer (Required by Law) City, State, ZIP Code + 4

Annual Filing Season Program - IRS tax forms

www.irs.govDepending on certain factors, a tax return preparer will need either 15 or 18 hours of continuing education from an IRS-approved continuing education provider. The following categories need 15 hours annually: • Anyone who passed the Registered Tax Return Preparer test administered by the IRS between November 2011 and January 2013.

PREPARER SIGNATURE REQUIREMENTS UNDER SECTION …

www.irs.gova tax return preparer in order to avoid a section 6695(b) penalty under current regulations, and (2) identify the returns and claims for refund that will be required to be signed by a tax return preparer in order to avoid a section 6695(b) penalty under future regulations published by the Treasury Department and IRS. This interim guidance will

VITA/TCE QUALITY REVIEW REFRESHER - IRS tax forms

www.irs.govThe volunteer tax preparer helps the quality reviewer by: • Providing a completed Form 13614-C, which means all taxpayer information is filled-in; all questions are answered; all “unsure” answers are clarified and changed to either “yes” or “no”; and preparer fields are completed.

1040 U.S. Individual Income Tax Return 2019

www.bradfordtaxinstitute.comSpouse’s signature. If a joint return, both must sign. Date Spouse’s occupation If the IRS sent your spouse an Identity Protection PIN, enter it here (see inst.) Phone no. Email address . F. Paid Preparer Use Only . Preparer’s name Preparer’s signature Date PTIN Check if: 3rd Party Designee Firm’s name . a. Phone no. Self-employed

Paid Preparer Due Diligence - IRS tax forms

www.irs.govBy law, if you are paid to prepare a tax return or claim for refund claiming one or more of the following tax benefits, you must meet four due diligence requirements. The tax benefits are the earned income tax credit (EITC), the child tax credit (CTC), the additional child tax credit (ACTC), the credit for other dependents (ODC), the American opportunity tax credit (AOTC),

Connecticut 2021 Resident FORM Income Tax

portal.ct.govYou and your preparer must sign and declare that your income tax filing is “true, complete, and correct ” That includes calculating and reporting on Line 15 all purchases of goods or services, whether in Connecticut or from outside the state, on which Connecticut sales tax was due but not paid. Failure to report use tax due on

IFTA Quarterly Fuel Tax Return

dor.georgia.gov2. Penalty: 10% of Tax Due or $50.00, whichever is greater 2. 3. Total Balance Due/Credit (add lines 1.e. and 2) 3. 4. Refund amount requested 4. / / IFTA Quarterly Fuel Tax Return (03/07/17) Georgia Department of Revenue Paid Preparer’s Name or Firm (if other than taxpayer)

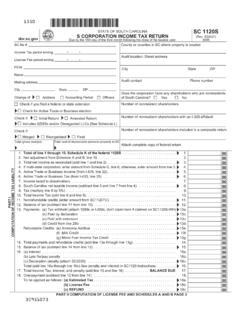

STATE OF SOUTH CAROLINA SC 1120S S CORPORATION …

dor.sc.govPreparer's Use Only Preparer's signature Firm's name (or yours if self-employed) and address Date Check if self-employed Preparer's phone number PTIN or FEIN ZIP I authorize the Director of the SCDOR or delegate to discuss this return, attachments, and related tax matters with the preparer. No Print preparer's name Yes

Professional Tax Preparer’s Guide

keystonecollects.comIf you are retired and are no longer receiving a salary, wages or income from a business, you may not owe an earned income tax. Social Security payments, payments from qualified pension plans, interest and/or dividends accrued from bank accounts and/or investments are not subject to local earned income tax.

Department of the Treasury Internal Revenue Service 01/26 ...

www.eitc.irs.gov• Complete and send Form 8867, Paid Preparer's Due Diligence Checklist, with every return you prepare claiming any of the benefits listed above. • Complete all worksheets, or equivalents, showing how you computed the credits claimed on a return or amended return.

PREPARER UNE SEQUENCE DE FORMATION EN …

eduscol.education.frpreparer une sequence de formation en enseignement professionnel dans le cadre de l’apprentissage ll’’iinnccoonnttoouurrnnaabbllee ...

8867 Paid Preparer’s Due Diligence Checklist

www.irs.govPaid Preparer’s Due Diligence Checklist Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), Child Tax Credit (CTC) (including the Additional Child Tax Credit (ACTC) and Credit for Other Dependents (ODC)), and Head of Household (HOH) Filing Status

Paid Preparer Due Diligence Checklist - taxdivas.com

taxdivas.comDue Diligence: Additional Questions and Information (list not all-inclusive) •Ask questions, contemporaneously document questions and client responses •Must not know of any reason to know that the client’s information is false. •Do not ignore the implications of any information provided by the client and make additional inquiries.

Part I Due Diligence Requirements 1 N/A - IRS tax forms

www.irs.govPaid Preparer’s Due Diligence Checklist Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), Child Tax Credit (CTC) (including the Additional Child Tax Credit (ACTC) and Credit for Other Dependents (ODC)), and Head of Household (HOH) Filing Status

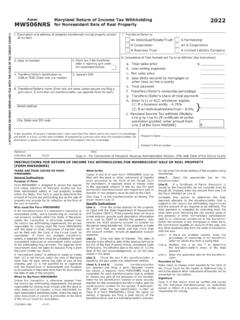

Form Maryland Return of Income Tax Withholding 2022 ...

www.marylandtaxes.govMaryland Return of Income Tax Withholding ... declaration is based on all information to which the preparer has any nowledge. ... property, and (2) is not qualified by or registered with the Department of Assessments and Taxation to do business in Maryland more than 90 days before

Similar queries

Preparers, Return preparers, 1041, Return, Registered Tax Return Preparer Test Explained, Guide, Tax return preparer, Chapter, Consumer Bill of Rights Regarding Tax Preparers, Stormwater Management and Sediment and, Supplemental Information Regarding Annual and, For tax preparers, Tax Return, Sample Return, Electronic Filing Guide for the New Employee Registry, Electronic Filing Guide for the New Employee Registry Program, Tax preparers, Preparer Tax, Appendix, List, Illustrative Annual Accounts, Department of Taxation and Finance, Registered, Prepared, Preparer, Registered Tax Return Preparer Exam Study Guide, Form, Form 8821, Tax Information Authorization, Information, Earned Income Credit, Fraud, Preparer fraud, Michigan Individual Income Tax Return, Earned income, Credit, Michigan, MARYLAND, Annual Filing Season Program, IRS tax forms, Registered Tax Return Preparer, QUALITY REVIEW REFRESHER, Preparer Due Diligence, Due Diligence, IFTA Quarterly Fuel Tax Return, S CORPORATION, Income, Checklist, Paid Preparer, Due Diligence Checklist, Paid Preparer Due Diligence Checklist, Paid Preparer’s Due Diligence Checklist