Tax Return Preparer

Found 3 free book(s)Form1120-POL U.S. Income Tax Return for Certain Political ...

www.irs.govdiscuss its 2021 tax return with the paid preparer who signed it, check the “Yes” box in the signature area of the return. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the return. It doesn’t apply to the firm, if any, shown in that section.

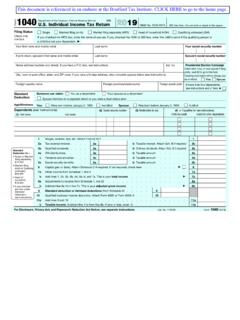

1040 U.S. Individual Income Tax Return 2019

www.bradfordtaxinstitute.comSpouse’s signature. If a joint return, both must sign. Date Spouse’s occupation If the IRS sent your spouse an Identity Protection PIN, enter it here (see inst.) Phone no. Email address . F. Paid Preparer Use Only . Preparer’s name Preparer’s signature Date PTIN Check if: 3rd Party Designee Firm’s name . a. Phone no. Self-employed

Form ST-809 New York State and Local Sales and Use Tax ...

www.tax.ny.govJan 01, 2022 · Mandate to use Sales Tax Web File - Most filers fall under this requirement. See Form ST-809-I, Instructions for Form ST-809. No tax due? Enter your gross sales and services in box 1 of Step 1 below; enter none in boxes 2 and 3. You must file by the due date even if no tax is due. There is a $50 penalty for late filing of a no-tax-due return.