Return Preparers

Found 10 free book(s)Publication 135 Consumer Bill of Rights Regarding Tax ...

www.tax.ny.govhire a tax return preparer Most tax return preparers act within the law and treat their clients fairly, but there are some who do not. This brochure contains important informa-tion about how to protect yourself when you hire a tax return preparer. Tax return preparers must: • post their New York State Tax Preparer

Publication 58:(1/15):Information for Income Tax Return ...

www.tax.ny.govcertain tax return preparers, facilitators of refund anticipation loans, and facilitators of refund anticipation checks. In addition, the law includes certain requirements and restrictions on tax return preparers and facilitators, with significant penalties for those who do not comply. Tax Preparer Registration Program definitions

AFTR Course Exempt Preparers

www.irs.govReturn preparers who hold an Accredited Tax Preparer (ATP) or Accredited Business Accountant/ Advisor credential (ABA). Annual Filing Season Continuing Education Requirements Credentialed Return Preparers Certified Public Accountant (CPA) Exempt as long as preparer holds current credential ;

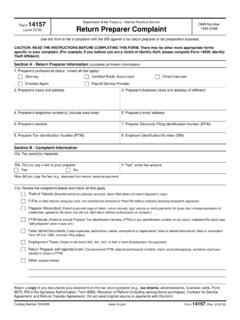

14157 (June 2018) Return Preparer Complaint

www.irs.govReturn preparers are generally prohibited from filing a return prior to receipt of Forms W-2, W-2G, and 1099-R. - Used non-commercial software to prepare returns that appear self prepared by the taxpayer and is not including his or her name, PTIN, or firm name. Similarly, the preparer used the “Free File” program to prepare and file tax ...

Estate and Trust Form 1041 Issues for Tax Return Preparers

media.straffordpub.comEstate and Trust Form 1041 Issues for Tax Return Preparers Allocating Income and Deductions, Calculating DNI, Understanding Reporting Rules for Trusts, and More WEDNESDAY, FEBRUARY 27, 2013, 1:00-2:50 pm Eastern WHOM TO CONTACT For Additional Registrations: -Call Strafford Customer Service 1-800-926-7926 x10 (or 404-881-1141 x10)

Amended and Prior Year Returns - IRS tax forms

apps.irs.govreturn, expecting the correction to result in a refund. If he gets it postmarked on or before April 15, 2019, it will be within the three-year limit, and the return will be accepted. But if the amended 2015 return ... Volunteer tax preparers can amend returns regardless of where the original return was prepared, using

Sample Return - Services For CPA & Tax Preparers

www.servicesfortaxpreparers.com.an officer must sign the return..mail your return on or before 09-15-2011 to: department of the treasury internal revenue service center cincinnati, oh 45999-0013 _____ instructions for filing 2010 georgia form 600s.your return has a balance due of $10.00..an officer must sign the return..make a check for $10.00 payable to: taxpayer services ...

Sample Return - Services For CPA & Tax Preparers

www.servicesfortaxpreparers.com.mail your return, voucher and check on or before 04-18-2011 to: department of the treasury internal revenue service center ogden, ut 84201-0148 _____ instructions for filing 2010 idaho form 66.your return has a balance due of $1,971.00..the fiduciary or officer representing fiduciary must sign the return.

Consumer Bill of Rights Regarding Tax Preparers | English

www1.nyc.gov• A copy of your tax return prepared at the time the original is filed or given to you to file. (Note: Tax preparers must sign every tax return prepared.) • An itemized receipt listing the individual cost of each service and form prepared for you. The receipt must list the address and phone number where you

NYC Signage Requirements for Tax Preparers

www1.nyc.govABC Tax Preparers 123 Street New York, NY 10000 212-555-5555 • You are entitled to a written estimate of all fees before receiving services for which we are charging a fee. • You are entitled to a copy of every tax return we prepare for you at the time you give us …