1041

Found 8 free book(s)MI-1041 MICHIGAN 2017

www.michigan.gov2 Who Must File Important: Fiduciary returns cannot be e-filed. You must file a Michigan Fiduciary Income Tax Return (Form MI-1041) and pay the tax due if you are the fiduciary for an estate or trust that was required to file a U.S. Form 1041 or 990-T or that had income taxable to Michigan that was not taxable on the U.S. Form 1041.If no tax is due, you must file

BY ORDER OF THE AIR FORCE INSTRUCTION 32-1041 …

static.e-publishing.af.milby order of the secretary of the air force air force instruction 32-1041 17 february 2017 civil engineering pavement evaluation program compliance with this publication is mandatory

NFPA 1041 Instructor 2 Pre-Test - Darin Murphy

www.darinmurphy.comWSP – Fire Protection Bureau NFPA 1041 Instructor 2 Pre-Test Referenced to: IFSTA Fire and Emergency Services Instructor 6th Edition 23. The law of _____ says that if the

Form 1041-A U.S. Information Return Trust Accumulation of ...

www.irs.govForm 1041-A (Rev. September 2018) Department of the Treasury Internal Revenue Service . U.S. Information Return Trust Accumulation of Charitable Amounts

2018 Form 1041-V

www.irs.govForm 1041-V (2018) Page . 2 Where To File If you are located in Please mail to the

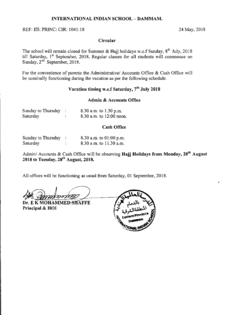

1041 - iisdammam.edu.sa

www.iisdammam.edu.saINTERNATIONAL INDIAN SCHOOL - REF: IIS: PRINC: CIR: 1041:18 Circular DAMMAM. 24 May, 2018 The school will remain closed for Summer & Hajj holidays w.e.f Sunday, 8th July, 2018

1041 U.S. Income Tax Return for Estates and Trusts 2016

www2.csudh.eduForm 1041 (2016) Page 2 Schedule A Charitable Deduction. Don't complete for a simple trust or a pooled income fund. 1 Amounts paid or permanently set aside for charitable purposes from gross income. See instructions. . . . . . . . 1 2 Tax-exempt income allocable to charitable contributions. See instructions

City of New York

www.nyc.govBill de Blasio Mayor Police Department City of New York James P. O’Neill Police Commissioner Volume 24 Number 18 CompStat Citywide Report Covering the Week 5/1/2017 Through 5/7/2017