Search results with tag "Return preparer"

Publication 135 Consumer Bill of Rights Regarding Tax ...

www.tax.ny.govhire a tax return preparer Most tax return preparers act within the law and treat their clients fairly, but there are some who do not. This brochure contains important informa-tion about how to protect yourself when you hire a tax return preparer. Tax return preparers must: • post their New York State Tax Preparer

Instructions for Form 8867 (Rev. December 2021)

www.irs.govreturn. • If you are the paid tax return preparer signing the return and you are mailing the return to the IRS for the taxpayer (which should only be done after the taxpayer has reviewed and signed the paper return), mail the completed Form 8867 to the IRS with the return. Nonsigning tax return preparers. If you are the paid tax

Disaster Resource Guide

www.irs.govclients; however, some preparers are dishonest. Report abusive tax preparers and suspected tax fraud to the IRS. Use Form 14157, Complaint: Tax Return Preparer. If you suspect a return preparer filed or changed the return without your consent, you should also file Form 14157-A, Return Preparer Fraud or Misconduct Affidavit. You can get these forms

AFTR Course Exempt Preparers

www.irs.govReturn preparers who hold an Accredited Tax Preparer (ATP) or Accredited Business Accountant/ Advisor credential (ABA). Annual Filing Season Continuing Education Requirements Credentialed Return Preparers Certified Public Accountant (CPA) Exempt as long as preparer holds current credential ;

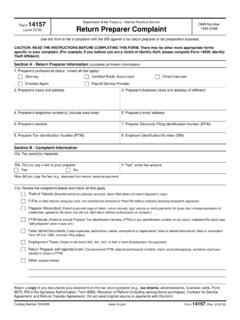

14157 (June 2018) Return Preparer Complaint - IRS tax forms

www.irs.govReturn preparers are generally prohibited from filing a return prior to receipt of Forms W-2, W-2G, and 1099-R. - Used non-commercial software to prepare returns that appear self prepared by the taxpayer and is not including his or her name, PTIN, or firm name. Similarly, the preparer used the “Free File” program to prepare and file tax ...

Publication 58:(1/15):Information for Income Tax Return ...

www.tax.ny.govcertain tax return preparers, facilitators of refund anticipation loans, and facilitators of refund anticipation checks. In addition, the law includes certain requirements and restrictions on tax return preparers and facilitators, with significant penalties for those who do not comply. Tax Preparer Registration Program definitions

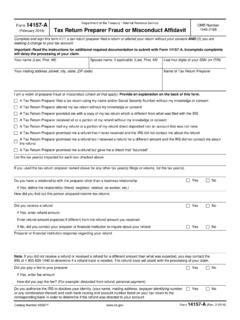

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govTax Return Preparer Fraud or Misconduct Affidavit - Complete form in its entirety and sign under penalties of perjury. If your filing status is Married Filing Joint, at least one signature is required. Form 14157, Complaint: Tax Return Preparer - Complete form in its entirety. Information provided on this form will be shared with

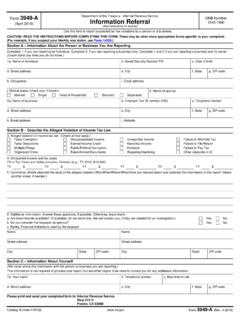

Form 3949-A Information Referral - IRS tax forms

www.irs.govmisconduct by your tax return preparer. Use Form 14157. Submit to the address on the Form 14157. o If your paid preparer filed a return or made changes to your return without your authorization. Instead, use . Form 14157 AND . Form 14157 …

EITC Due Diligence

taxces.com• Identify the tax return preparer’s earned income credit due diligence requirements; and • List the sanctions that may be applied on a tax return preparer and his or her employer for a failure to meet due diligence requirements. 1 SOI Tax Stats-Individual Income Tax …

Estate and Trust Form 1041 Issues for Tax Return Preparers

media.straffordpub.comEstate and Trust Form 1041 Issues for Tax Return Preparers Allocating Income and Deductions, Calculating DNI, Understanding Reporting Rules for Trusts, and More WEDNESDAY, FEBRUARY 27, 2013, 1:00-2:50 pm Eastern WHOM TO CONTACT For Additional Registrations: -Call Strafford Customer Service 1-800-926-7926 x10 (or 404-881-1141 x10)

Preparer IRS Answer Question

www.eitc.irs.govOpportunity Tax Credit (AOTC). All paid tax return preparers who determine the eligibility for, or the amount of, the EITC, CTC or the AOTC are now subject to the refundable credit due diligence requirements and the penalties for failure to comply with these requirements. The penalties apply to preparers who sign the return, preparers who prepare