Search results with tag "Irs tax forms"

Form CT-2 (Rev. March 2022) - IRS tax forms

www.irs.gova detailed statement explaining the credit claimed. However, don’t include a credit for an overpayment of Additional Medicare Tax for an earlier year. Any Additional Medicare Tax paid will be credited against the total tax liability shown on your Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors.

2022 Form W-2 VI - IRS tax forms

www.irs.govTax on Unreported Tip Income, with your income tax return to figure the social security and Medicare tax owed on tips you didn’t report to your employer. Enter this amount on the wages line of your tax return. (Form 1040-SS filers, see the instructions for Form 1040-SS, Part I, line 6.) By filing this form, your social

VTA-2020-03 - IRS tax forms

www.irs.govtaxes depends on whether the taxpayer, who is the care provider, is an employee of the agency, an employee of the individual care recipient, or an independent contractor. o If the agency is the taxpayer’s employer, the payments are subject to Social Security and Medicare taxes.

LB&I Process Unit - IRS tax forms

www.irs.gov263A, with a tax year beginning on or before 12/31/1986, (a member of this group is a "pre-enactment taxpayer"). The second group comprises taxpayers who came into existence after IRC 263A‘s enactment, a member of which hereafter is referred to as a “post -enactment taxpayer.”

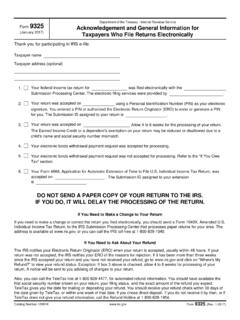

9325 Acknowledgement and General ... - IRS tax forms

www.irs.govIndividual Income Tax Return, to the IRS Submission Processing Center that processes paper returns for your area. The address is available at . www.irs.gov, or you can call the IRS toll-free at 1-800-829-1040. ... If your return has a balance due, you must pay the amount you owe by the prescribed due date. If you paid by electronic funds ...

Free File Fillable Forms Tutorial - IRS tax forms

www.irs.govusers are encouraged to use the helpful links on the IRS Free File landing page. Taxpayers with a 2013 Adjusted Gross Income of $58,000 or less should consider using brand name, interview based, tax software to assist in preparing a federal return. Get help choosing

Nonresident Aliens and Real Estate - IRS tax forms

www.irs.govNonresident Aliens and Foreign Entities Publication 519, U.S. Tax Guide for Aliens Publication 527, Residential Rental Property IRS Publications and Additional Resources Publication 946, How to depreciate property International Tax Topics – IRS.gov

Return Signature - IRS tax forms

apps.irs.govTaxSlayer will automatically note on the top of Form 1040, U.S. Individual Income Tax Return, the decedent’s name, and date of death. Form 2848, Power of Attorney and Declaration of Representative, is invalid once the taxpayer dies; therefore Form 56 or new Form 2848 signed by estate executor or representative must be completed.

2019 Instructions for Schedule 8812 - IRS tax forms

www.irs.gov2019 Instructions for Schedule 8812Additional Child Tax Credit Use Schedule 8812 (Form 1040 or 1040-SR) to figure the additional child tax credit (ACTC). The ACTC may give you a refund even if you do not owe any tax. Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about ...

Form W-4V Voluntary Withholding Request - IRS tax forms

www.irs.govthe administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. ... voluntary withholding of federal income tax, you are required by sections 3402(p) and 6109 and their regulations to provide

2020 Form 6251 - IRS tax forms

www.irs.govAdd Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result any foreign tax credit from Schedule 3 (Form 1040), line 1.

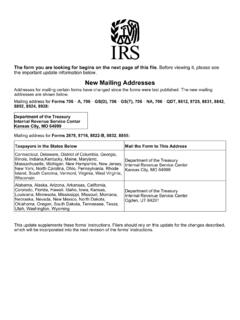

New Mailing Addresses - IRS tax forms

www.irs.govstatement with us for any tax for which you are liable. Section 6109 requires that you provide your identifying number on what you file. This is so we know who you are, and can process your form and other papers. Generally, tax returns and return information are confidential, as required by section 6103. However, we may give

Casualty and Theft Losses on Rental Property - IRS tax forms

www.irs.govpenses for managing, conserving, or maintain- for rental purposes. If you buy a leasehold for ing the property until it is sold. rental purposes, you can deduct an equal part Tax return preparation. You can deduct, as of the cost each year over the term of the a rental expense, the part of tax return prepa-Personal use of rental property.

2020 Instructions for Form 1099-DIV - IRS tax forms

www.irs.govthe instructions for box 8 in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. Substitute payments in lieu of dividends may be reported on a composite statement to the recipient with Form 1099-DIV. See Pub. 1179. 3. Payments made to certain payees. These include a corporation, tax-exempt organization, any IRA, Archer MSA,

2021 Schedule K-3 (Form 8865) - IRS tax forms

www.irs.govSchedule K-3 (Form 8865) 2021 Partner’s Share of Income, Deductions, Credits, etc.— International Department of the Treasury Internal Revenue Service OMB No. 1545-1668 . For calendar year 2021, or tax year beginning / / 2021 , ending / . See separate instructions. Final K-3. Amended K-3 Information About the Partnership . A

0894 Form W-10 - IRS tax forms

www.irs.govsafety, literary, or educational purposes, or for the prevention of cruelty to children or animals. Complete this part only if your care provider will return the form to you later. If either 1 or 2 above applies, you must show the correct name, address, and taxpayer identification number (TIN) of each care provider on Form 2441, Child and ...

Gasoline Excise Taxes, 1933-2000 - IRS tax forms

www.irs.govgasoline, diesel and special motor fuels, tread rubber, tires and inner tubes, trucks, etc. were transferred from the General Fund of the Treasury to the newly created Highway Trust Fund. The Mass Transit Account for expenditures was established by the Urban Mass Transportation Act of

Instructions for Forms W-2c and W-3c - IRS tax forms

www.irs.govthe payer still has the responsibility for making sure the incorrect Form W-2 (see Example 2). However, state, local, Form W-3c and attachments are filed correctly and timely. and Federal government employers who are preparing The payer is subject to any penalties that result from not corrections for Medicare Qualified Government Employment

GAMBLING INCOME AND EXPENSES - IRS tax forms

www.irs.govpayer may be required to withhold 28% of the proceeds for Federal income tax. However, if you did not provide your Social Security number to the payer, the amount withheld will be 31%. The full amount of your gambling winnings for the year must be reported on line 21, Form 1040. If you itemize deductions, you can deduct your gambling

2018 Form 2555-EZ - IRS tax forms

www.irs.gov• Don’t claim the foreign housing exclusion or deduction. Part I . Tests To See if You Can Take the Foreign Earned Income Exclusion . 1 Bona Fide Residence Test . a . Were you a bona fide resident of a foreign country or countries for a period that includes an entire tax year?

Assets Dispositions of Sales and Other - IRS tax forms

www.irs.govInstallment sales. See Pub. 537, Install-ment Sales. • Transfers of property at death. See Pub. 559, Survivors, Executors, and Administra-tors. Note. Although the discussions in this publi-cation refer mainly to individuals, many of the rules discussed also apply to taxpayers other than individuals. However, the rules for property

Form 8332 Release of Claim to Exemption - IRS tax forms

www.irs.gov2120, Multiple Support Declaration). Form 8332 (Rev. 12-2000) Part I Part II I agree not to claim an exemption for for the tax year(s) . Name(s) of child (or children) Signature of custodial parent releasing claim to exemption Custodial parent’s SSN Date General Instructions You are the custodial parent if you had custody of the child for ...

I. PURPOSE - IRS tax forms

www.irs.gov18004, or 18008 of the CARES Act or another emergency financial aid grant described in section 277(b)(3) of the COVID Relief Act made to students in response to qualifying emergencies. 4. Treasury Program loan forgiveness. A lender is not required to file with the IRS, or furnish to a borrower, a Form 1099-C reporting forgiveness of loans under

Form 4852 (Rev. 10-1998) - IRS tax forms

www.irs.govinstructions to Form 4972. If you do not receive a lump-sum distribution, the amount shown is the NUA attributable to employee contributions, which is not taxed until you sell the securities. 8. Distribution code: Please enter one of the codes which describes the distribution you received: 1. Early distribution, no known exception (in most

2020 Form 1098 - IRS tax forms

www.irs.govIf you hold a mortgage credit certificate and can claim the mortgage interest credit, see Form 8396. If the interest was paid on a mortgage, home equity loan, or line of credit secured by a …

2020 Form 8915-E - IRS tax forms

www.irs.govPart III Qualified 2020 Disaster Distributions From Traditional, SEP, SIMPLE, and Roth IRAs: 12 : Did you receive a qualified 2020 disaster distribution from a traditional, SEP, SIMPLE, or Roth IRA that is required to be reported on 2020 Form 8606? Yes. Go to line 13. No.

2020 Instructions for Form 2106 - IRS tax forms

www.irs.govOct 01, 2020 · Armed Forces reservists, quali ed performing artists, fee-basis state or local government of cials, and individuals with disabilities should see the instructions for line 10 to nd out where to deduct employee expenses. Form 2106 may be used only by Armed Forces reservists, quali ed performing artists, fee-basis state

Disabled Elderly or the - IRS tax forms

www.irs.govcredit because she is engaged in a substantial gainful ac-tivity. Example 2. Mary, the president of XYZ Corporation, re-tired on disability because of her terminal illness. On her doctor's advice, she works part-time as a manager and is paid more than the minimum wage. Her employer sets her days and hours. Although Mary's illness is terminal

Form 9465 (Rev. February 2017) - IRS tax forms

www.irs.govForm 9465 (Rev. February 2017) Department of the Treasury Internal Revenue Service . Installment Agreement Request . OMB No. 1545-0074. Information about Form 9465 and its separate instructions is at

n-19-66 (002) - IRS tax forms

www.irs.gov465 at-risk purposes for 2019. Nothing in this notice relieves partnerships and partners from complying with the requirements of Form 6198, At-Risk Limitations, for 2019. In particular, partnerships must continue to comply with the instructions to Form 6198 for 2019, which require

2021 Form 4868(SP) - IRS tax forms

www.irs.govdeclaración del impuesto sobre el ingreso personal de los Estados Unidos: 1. Puede pagar todo o parte de su impuesto estimado sobre el ingreso que adeude e indicar que dicho pago es para una prórroga utilizando el . Direct Pay (Pago directo), en inglés; el Sistema de Pago Electrónico del Impuesto Federal (EFTPS,

Form 1099-LTC (Rev. October 2019) - IRS tax forms

www.irs.govassigned to distinguish your account. Box 1. Shows the gross benefits paid under a long-term care insurance contract during the year. Box 2. Shows the gross accelerated death benefits paid during the year. Box 3. Shows if the amount in box 1 or 2 was paid on a per diem basis or was reimbursement of actual long-term care expenses.

Parte I Ingreso Adicional - IRS tax forms

www.irs.govANEXO 1 (Formulario 1040(SP)) 2021 Ingreso Adicional y Ajustes al Ingreso Department of the Treasury Internal Revenue Service Adjunte al Formulario 1040(SP), 1040-SR(SP) o 1040-NR(SP).

2020 Form 5500-EZ - IRS tax forms

www.irs.govMailing address (room, apt., suite no. and street, or P.O. box) City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions) 3b . Administrator’s EIN. 3c . Administrator’s telephone number. 4 . If the employer’s name, the employer’s EIN, and/or the plan name has changed since the

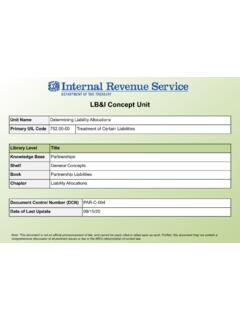

LB&I Concept Unit - IRS tax forms

www.irs.govPublication 541 and Treas. Reg 1.752- 2 discuss the allocation rules for recourse liabilities. A partnership liability is a recourse liability to the extent that any partner or a related person has an economic risk of loss for that liability. A partner's share of a recourse liability equals his economic risk of loss for that liability.

Internal Revenue Service Memorandum - IRS tax forms

www.irs.govyears beginning after December 31, 1998 “in order to reduce the disparity of treatment between insurance expenses of self-employed individuals and employer-provided health insurance and to help make health insurance more affordable for self-employed individuals.” H.R. Rep. No. 105-817, 105th Cong., 2d Sess. 55 (1998), 1998-4 C.B. 307

2020 Instructions for Form 8995 - IRS tax forms

www.irs.govgrantor or another person is treated as owning all or part of a trust or estate, the owner will compute its QBI deduction for the portioned owned as if section 199A items had been received directly by the owner. Generally, a non-grantor trust or estate may either claim the QBI deduction or provide information to their beneficiaries.

Rev. Rul. 78-145, 1978-1 C.B. 169 - IRS tax forms

www.irs.govprocedure called plasmapheresis, in which whole blood is drawn from a donor, the red cells are separated and replaced in the donor, and plasma is collected. This plasmapheresis technique is ... depends in each case upon the facts and circumstances involved. Section 1.513-1(d)(4)(ii) of the regulations provides that,

2021 Form 8879-PE - IRS tax forms

www.irs.govForm 8879-PE when the partner or member or PR wants to use a personal identification number (PIN) to electronically sign a partnership’s electronic return of partnership income or AAR. A partner or member or PR who doesn’t use Form 8879-PE must use Form 8453-PE. For more information, see the instructions for Form 8453-PE.

General Instructions 20 - IRS tax forms

www.irs.govForm 8582 is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). However, you don’t have to file Form 8582 if you meet the following exception. Exception You actively participated in rental real estate activities (see Special Allowance for Rental Real Estate Activities, later),

Form 5305-S (Rev. April 2017) - IRS tax forms

www.irs.govSIMPLE Individual Retirement Trust Account (Under section 408(p) of the Internal Revenue Code) Do not . file with the Internal Revenue Service . ... remaining life expectancy as determined in the year following the death of the participant and reduced by 1 for each subsequent year, or over the period in paragraph (a)(iii) below if longer. ...

2021 Form 8865 - IRS tax forms

www.irs.govIf “Yes,” enter the amount of gross income derived from sales, leases, exchanges, or other dispositions (but not licenses) from transactions with or by the foreign partnership that the filer included in its computation of foreign-derived deduction

Types of Coverage Exemptions - IRS tax forms

apps.irs.govFor this purpose, an immigrant with Deferred Action for Childhood Arrivals (DACA) status is not considered lawfully present and therefore qualifies for this exemption. For more information about who is treated as lawfully present in the U.S. for purposes of this coverage exemption, visit

2020 Instructions for Form 990-T - IRS tax forms

www.irs.govYou will need to file Form 990-T with Form 8997 attached annually until you dispose of the investment. See the Instructions for Form 8997. Qualified business income deduction. If you are a trust filing Form 990-T and have unrelated business income, you may have Qualified Business Income (QBI) and may be allowed a QBI deduction under section 199A.

2018 Form 1099-R - IRS tax forms

www.irs.gov2018. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Copy A For Internal Revenue ... insurance premiums $ 6 . Net unrealized appreciation in employer’s securities $ 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total. 9b.

2020 Instructions for Form 8606 - IRS tax forms

www.irs.govtraditional IRA or a Roth IRA depending on which type it was. See Pub. 590-A for more details. Traditional IRAs. For purposes of Form 8606, a traditional IRA is an individual retirement account or an individual retirement annuity other than a SEP, SIMPLE, or Roth IRA. TIP Contributions. An overall contribution limit applies to traditional IRAs ...

2016 Form 990-EZ - IRS tax forms

www.irs.govForm 990-EZ (2016) Page . 2 Part II Balance Sheets (see the instructions for Part II) Check if the organization used Schedule O to respond to any question in this Part II . . . . . . . . . .

2020 Instructions for Form 8889 - IRS tax forms

www.irs.govpenses. The Coronavirus Aid, Relief, and Economic Security (CARES) Act expands the definition of “qualified medical expenses” that may be reimbursed from HSAs. Under the CARES Act, menstrual care products and over-the-counter products and medications are now reimbursable from an HSA without a prescription. These

2020 Form 8880 - IRS tax forms

www.irs.govEnter the applicable decimal amount from the table below. ... But not over— And your filing status is— Married filing jointly Head of household: Enter on line 9— Single, Married filing separately, or Qualifying widow(er)--- $19,500: 0.5 0.5: 0.5 $19,500 ... • Distributions from an inherited IRA by a nonspousal beneficiary. If you’re ...

2020 Instructions for Form 1099-G - IRS tax forms

www.irs.govEnter USDA agricultural subsidy payments made during the year, including market facilitation program payments. If you are a nominee that received subsidy payments for another person, file Form 1099-G to report the actual owner of the payments and report the amount of the payments in box 7. Box 8. Trade or Business Income (Checkbox)

Similar queries

IRS tax forms, Statement, Form W, Provider, Independent, 263A, Returns, Balance due, Free File Fillable Forms Tutorial, Free, Help, Aliens, Individual, Tax Return, 2019 Instructions for Schedule 8812, 2019 Instructions for Schedule, Schedule 8812, Voluntary, Administration, Penses, 2020, 1099, Composite statement, Schedule K, Form 8865, Form W-10, Prevention of cruelty, Animals, Gasoline, Motor, Local, Corrections, GAMBLING INCOME AND EXPENSES, To withhold, Housing, Sales, Installment sales, Install-ment Sales, Release of Claim to Exemption, Declaration, Exemption, Grant, Loan forgiveness, Forgiveness, Form, Form 4972, Mortgage credit certificate, Mortgage, Credit, Form 8915-E, Traditional, IRAs, Quali ed, Ac-tivity, At-risk, Notice, 6198, At-Risk Limitations, 6198, Form 4868SP, Impuesto, 1099-LTC, Distinguish, Ingreso Adicional, Ingreso Adicional y, Street, Allocation, Revenue, Memorandum, Order, Instructions, Grantor, Plasmapheresis, Facts, Form 8879, 8582, SIMPLE, Life, Other, Deduction, Deferred Action for Childhood, 2018 Form 1099-R, 2018, Premiums, Table, Single, Inherited, Subsidy