Search results with tag "Form 4868"

2020 Form 4868 - IRS tax forms

www.irs.govFile a Paper Form 4868 . If you wish to file on paper instead of electronically, fill in the Form 4868 below and mail it to the address shown under . Where To File a Paper Form 4868, later. For information on using a private delivery service, see . Private Delivery Services, later. Note: If you’re a fiscal year taxpayer, you must file a paper ...

Premium Online federal forms - H&R Block

www.hrblock.comForm 4868 Automatic Extension of Time to File Form 4952 Investment Interest Expense Form 4972 Tax on Lump-Sum Distributions Form 5329 Return for IRA and Retirement Plan Tax Form 5405 Repayment of First-Time Homebuyer Credit Form 5498-SA Health Savings Account Form 5695 Residential Energy Credits Form 6251 Alternative Minimum Tax

2021 Form 4868 - IRS tax forms

www.irs.govAliens Abroad. Form 1040-NR filers. If you can’t file your return by the due date, you should file Form 4868. You must file Form 4868 by the regular due date of the return. If you didn’t receive wages as an employee subject to U.S. income tax withholding, and your return is due June 15, 2022, check the box on line 9. Total Time Allowed

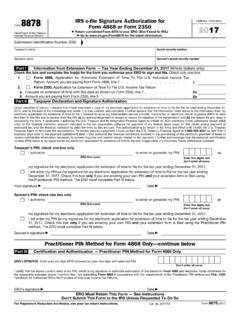

2017 Form 8878 - irs.gov

www.irs.govForm 8878 Department of the Treasury Internal Revenue Service IRS e-file Signature Authorization for Form 4868 or Form 2350 Return completed Form 8878 to your ERO.

Payments and Miscellaneous Refundable Credits - IRS tax …

apps.irs.govLater, when taxpayers file their return, they report the payment made with Form 4868 on the applicable line on Form 1040, Schedule 3. example One of Bernice’s Forms W-2 was lost in the mail. She requested a copy from her former employer, but it did not arrive by April 15. She filed for an extension, calculated the amount of taxes owed based

Instructions for Forms 740 and 740-EZ General ... - Kentucky

revenue.ky.govfor Extension of Time to File, Form 40A102, and send with payment. Write “KY Income Tax—2010” and your Social Security number(s) on the face of the check. (2)Military Personnel— Federal Automatic Extension—Make a copy of the lower portion of the federal Application for Automatic Extension, Form 4868, and send with payment. Write “KY ...

Tax Year 2021 e-file Calendar - download.cchsfs.com

download.cchsfs.comTax Year 2021 e-file Calendar Individual Returns Transmitting of live IRS Individual Income Tax Returns begins (MeF Only) TBD Transmitting timely filed returns and Form 4868 April 18, 2022 Retransmission rejected timely filed returns and Form 4868 April 23, 2022

2021 Instructions for Form 8615 - IRS tax forms

www.irs.govusing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Please note that an extension of time to file isn’t an extension of time to pay. Amended Return. If the parents’ income changes after the child’s return is filed, the child’s tax must be refigured using the adjusted amounts. The child's

2021 Form 4868(SP) - IRS tax forms

www.irs.govdeclaración del impuesto sobre el ingreso personal de los Estados Unidos: 1. Puede pagar todo o parte de su impuesto estimado sobre el ingreso que adeude e indicar que dicho pago es para una prórroga utilizando el . Direct Pay (Pago directo), en inglés; el Sistema de Pago Electrónico del Impuesto Federal (EFTPS,

2021 Nebraska

revenue.nebraska.govA six-month extension to file Form 1040N may only be obtained by: 1.Attaching a copy of a timely-filed Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, Federal Form 4868, to the Nebraska return when filed;

hio Department of Taxation Use only black ink/UPPERCASE ...

tax.ohio.govCheck here if you filed the federal extension form 4868. Check here if someone else is able to claim you (or your spouse if joint return) as a dependent. Do not staple or paper clip. Ohio Nonresident Statement – See instructions for required criteria Primary meets the five criteria for irrebuttable presumption as nonresident.

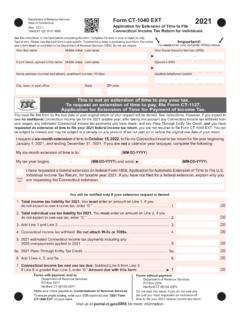

CT-1040 EXT 20170911 - Connecticut

www.ct.govI request a six-month extension of time to October 15, 2018, to fi le my Connecticut income tax return for the year beginning January 1, 2017, and ending December 31, 2017. If you are not a calendar year taxpayer, complete the following: My six-month extension of time is to: (MM-DD-YYYY)My tax year begins (MM-DD-YYYY) and ends: I have requested a federal extension on federal Form 4868 ...

Form MO-1040 Book - Individual Income Tax Long Form

dor.mo.govthe top of the Form MO-1040 indicating you have an approved federal extension and attach a copy of your Application for Automatic Extension of Time To File U.S. Individual Income Tax Return (Federal Form 4868) with your Missouri income tax return when you file. If you expect to owe Missouri income tax, file Form MO-60 with

Form CT-1040 EXT 2021 - Connecticut

portal.ct.govfederal Form 4868, you can apply for a six-month extension to file your Connecticut income tax return provided you have good cause for your request. ... Late Filing Penalty: If no tax is due, DRS may impose a $50 penalty for the late filing of any return or …