Search results with tag "Kentucky"

740-NP

revenue.ky.govSince Kentucky conforms to the Internal Revenue Code as of December 31, 2018, Kentucky did not adopt these federal changes. A new form 2441-K was created to calculate the allowable Kentucky child and dependent care credit. KENTUCKY 8863–K, KENTUCKY EDUCATION AND TUITION TAX CREDIT—Kentucky does not conform to the

KY Income Tax Employer’s State KY State Wages ... - Kentucky

revenue.ky.govComplete this Schedule KW-2 to determine the total Kentucky income tax withholding to be entered on Kentucky Form 740, 740-NP, or 740-NP-R. This schedule must be fully completed in order to receive proper credit for Kentucky income tax withheld. Include multiple Schedule KW-2(s) as needed to report all Kentucky income tax withholdings.

INSTRUCTIONS 725 KENTUCKY SINGLE MEMBER LLC …

revenue.ky.govcredit of up to 100% of the Kentucky income tax imposed under KRS 141.040 or 141.020, and the LLET imposed under KRS 141.0401 (not below the $175 minimum) that would otherwise be owed by the approved company to the Commonwealth for the approved company’s tax year, on the income, Kentucky gross profits, or Kentucky gross

FORM K-5C CORRECTED REPORT OF KENTUCKY …

revenue.ky.govK-5C CORRECTED REPORT OF KENTUCKY WITHHOLDING STATEMENTS Commonwealth of Kentucky Department of Revenue FORM Mail To: Sign Here Name Date Telephone Number Kentucky Department of Revenue Station # 57 501 High Street Frankfort, KY 40601-2103 ä Corrections may be made to Tax Year and Withholding Statements only (See instructions)

92A205 (6-16) Kentucky Inheritance FOR DEPARTMENT USE …

revenue.ky.gov92A205 (6-16) Commonwealth of Kentucky DEPARTMENT OF REVENUE Kentucky Inheritance Tax Return (Short Form) This form is designed for small, uncomplicated estates. Requirements for use of this return—This return may be used when (1) a federal estate tax return is not required to be filed, (2) the assets of the estate consist of 10 items or less ...

210005 42A740-NP (10-21)

revenue.ky.govMoved out of Kentucky . State moved to . 6 You must file a 740-NP-R if you are a full-year resident of a reciprocal state (IL, IN, MI, OH, VA, WV or WI) with Kentucky income of wages and salaries only. RESIDENCY STATUS (check one box) Check if applicable: Amended (Enclose copy of 1040X, if applicable.) 740-NP 2021 Commonwealth of Kentucky

ALPHABETICAL BRAND LIST - Oregon Department of Justice

www.doj.state.or.usThe following is Oregon's Directory of Cigarette Brands Approved for Stamping and Sale in alphabetical order. The List is Divided into Three Sections: First Section - Deletions to the List in the Last 30 Days ... Kentucky's Best - Gold 6 oz Bag Farmer's Tobacco Co. of Cynthiana PM RYO 9/29/2014 Kentucky's Best - Menthol 16 oz Bag Farmer's ...

740-NP - Kentucky

revenue.ky.gov501 High Street, 40601-2103 (502) 564–4581 (General Information) (502) 564–3658 (Forms) ... Capital Gains on Sale of Kentucky Turnpike Bonds Taxable Exempt 8. Other States’ Municipal Bond Interest Income Exempt Taxable ... 3 What’s New FAMILY SIZE TAX CREDIT ...

2020 Specifications for Electronic Submission of 1099B ...

revenue.ky.govElectronic filing is required when reporting 26 or more 1099 or W2G forms. Always identify yourself and your company with an external label on the CD. Include only payee records pertinent to Kentucky in your electronic file. Always use the correct Kentucky Withholding Account Number (6 digits) in the appropriate fields.

Update on the Kentucky ePrescribing Mandate Jan. 7, 2021

chfs.ky.govUpdate on the Kentucky ePrescribing Mandate Jan. 7, 2021 The Centers for Medicare & Medicaid Services (CMS) recently announced that enforcement of ... If you have an Electronic Health Record (EHR) system that is not currently EPCS certified, you ... Specific to Pharmacists KRS 218A.182 specifically states that a pharmacist who receives a ...

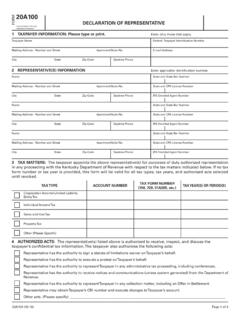

FORM 20A100 DECLARATION OF REPRESENTATIVE

revenue.ky.govDeclaration of Representative (Form 20A100) to authorize the individual(s) to represent you before the Kentucky Department of Revenue. You may grant the individual(s) authorization to act on your behalf with regard to any tax administered by the Kentucky Department of Revenue. Form 20A100 is provided for the taxpayer’s convenience.

FIDUCIARY BOND - Kentucky Court of Justice

kycourts.govCommonwealth of Kentucky Court of Justice www.courts.ky.gov KRS 62.060; 395.130; 395.140; 454.180 -.185 FIDUCIARY BOND lex et justitia C O M M O N W E A L T H O F K E N T U C K Y C O U R T OF J U S T I E IN RE: Estate of _____

Understanding Trauma and Traumatic Stress - Kentucky

education.ky.govof Kentucky, and part of the Education and Workforce Development Cabinet. The . ... Trauma-informed strategies in school are important to mitigate the negative effects of trauma. 4. Trauma-informed responses should be universally provided to ensure all students may benefit; ... health approach to trauma-informed practices is recommended.

Temporary Tag Log - Kentucky Transportation Cabinet

transportation.ky.govKentucky Transportation Cabinet Division of Motor Vehicle Licensing TEMPORARY TAG LOG TC 96-210 Rev. 07/2010 Page 1 of 1 PO BOX 2014, Frankfort KY 40622 Dealer Name Phone ( Include Area Code ) Note: This Log must be made available to law enforcement officers upon request and kept for a period of two years.

ADMINISTRATIVE SPECIALIST III - Kentucky

personnel.ky.govAug 19, 2020 · Provides professional support to the division head, office or unit in developing, implementing and maintaining various complex programs, projects or activities; may supervise subordinate employees; and performs other duties as required. MINIMUM REQUIREMENTS: EDUCATION: Graduate of a college or university with a bachelor's degree.

2022 PERSONAL PROPERTY TAX FORMS AND …

revenue.ky.govINSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS (REVENUE FORMS 62A500, 62A500-A, 62A500-C, 62A500-L , 62A500-S1, 62A500-W and 62A500–MI) Definitions and General Instructions ... Kentucky on January 1 must file a tangible property tax return. All tangible property is taxable, except the following:

CMS COVID-19 Staff Vaccination Interim Final Rule FAQ

www.nachc.orgJan 01, 2022 · Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Texas, Utah, West Virginia and Wyoming. We encourage health centers to review the information below and periodically check for updates on the NACHC Employee COVID-19 Vaccination Mandate …

JANUARY 31, 2022 Service Excellence Awards

res.cloudinary.comAward winners are announced monthly. Thank you for helping us to recognize our employees and providers who strive for Service Excellence! January: Cooperation ... Printing paid from state funds, KRS 57.375. Western Kentucky University is an equal opportunity institution of higher education and (270) 766-5115

Orchardgrass (Dactylis glomerata) Plant Guide

www.nrcs.usda.govPlease consult the PLANTS Web site and your State Department of Natural Resources for this plant’s current status (e.g., threatened or endangered species, state ... state natural resource, or state agriculture ... grasses such as smooth brome, perennial rye, or Kentucky bluegrass (Moser, et al., 1996). Management . Under dryland conditions ...

740-NP - Kentucky

revenue.ky.gov• Casualty or theft losses (IRC Sec 165) • Medical care expenses (IRC Sec 213) • Moving expenses (IRC Sec 217) • Gambling losses (IRC Sec 165) (For tax year 2018 only) • Other miscellaneous deductions subject to the 2% floor (IRC Sec 67) The following items can still be claimed as deductions. • Home mortgage interest and points

Do I Need to File A Return? - Kentucky

revenue.ky.govto file a state income tax return or if you need to change your withholding so you will not have to file an unnecessary return in the future. If you do not anticipate any tax liability for the tax year you can file Form K-4E with your employer. This is a Special Withholding Certificate Exemption that exempts you from state income tax withholding.

Public Health Surveillance: Methods and Application 223

www.jhsph.edu• Detect changes in health practices and behaviors • Facilitate planning. SHIGELLOSIS 1970-2000 Year 0 5 10 15 ... Kentucky, 1983 Active Sample Passive Sample Specialty N Cases Rate * N Cases Rate GP/FP Pediatrics Internal Medicine ... – Line listing is best – Half a page is okay – One side of one page is maximum.

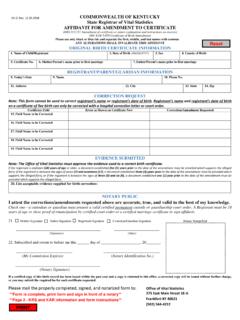

VS-2J Rev. 12.20.2018 COMMONWEALTH OF KENTUCKY …

chfs.ky.govAFFIDAVIT FOR AMENDMENT TO CERTIFICATE (KRS 213.121 Amendment of certificate or report explanation and instructions on reverse) (901 KAR 5:070 Certificate of Birth Amendment) Please use only black or blue ink and separate the first, middle, and last names with commas ANY ALTERATIONS SHALL INVALIDATE THIS AFFIDAVIT

Career Cluster Student Interest Survey - Kentucky

education.ky.gov• respect rules and regulations • ... Designing, producing, exhibiting, performing, writing and publishing multimedia content, including visual and performing arts and design, journalism and entertainment services. 4 Business, Management & Administration

ID-128 University of Kentucky Home Vegetable

www2.ca.uky.edusuch as sweet corn, tomatoes and pole beans should be plant‑ ed on the north or west side of the garden where they will not shade smaller vegetable crops. However, summer lettuce should be grown in a partially shaded area if possible. Table 1. Average vegetable yields and amounts to plant per person. Vegetable Yield per 10 ft of row Planting ...

VS-8 Rev. 8.2020 COMMONWEALTH OF KENTUCKY State …

chfs.ky.govPURSUANT TO KRS 213.046 When a birth occurs in a hospital or enroute to the hospital to a woman who is unmarried, the hospital representative shall present to the mother and father, if available, except when either parent is a minor, information regarding the establishment of paternity. If the parents agree, the hospital representative shall provide the Voluntary …

740-NP - Kentucky

revenue.ky.gov11. Election Workers—Income for Training or Taxable Exempt Working at Election Booths 12. Artistic Contributions Noncash contribution allowed as Appraised value allowed as itemized deduction itemized deduction or adjustment to income 13. State Income Taxes Deductible Nondeductible 14.

TEACHER WORK SAMPLE - Western Kentucky University

www.wku.eduimpact of the work, and whether scholarly precedents and contributions have been accounted for. ... Identifies leadership opportunities that enhance student learning and/or professional environment of the school: 10.2: Develops a plan for engaging in leadership activities: 10.3: Implements a plan for engaging in leadership activities:

2021 1041 Forms and Schedules - riahelp.com

www.riahelp.comForm K-41V Kentucky Form 40A102 Form 741 Schedule D Schedule K-1 Louisiana Form IT-541 Form R-10606 Form R-6466 Schedule K-1 Equivalent Maine Form 1041ME Form 1041ME, Schedules 1, 2, 3 Form 1041ME-ES Form 1041ME-EXT Form 1041ME-PV Form 2210-ME Form1099ME 3/11/2022 Page 14 of 28

DR-701 Inlets & Storm Sewers Introduction - Kentucky

transportation.ky.govThe function of a storm sewer system is to collect storm runoff, convey the water to an outlet point and discharge the flow in an environmentally acceptable manner. The design is, at a minimum, a four step process with some iteration until a final design is achieved. 1. Determine the location of inlets into the storm sewer. This involves spacing

SOCIAL SERVICE WORKER I - Kentucky

personnel.ky.govNov 25, 2000 · adult protection, juvenile justice, guardianship services, adoption services and services to juvenile offenders. Provides services to patients in a mental health/mental retardation facility and to children with special health care needs. Interviews clients and explains or interprets agency services.

Kentucky Medicaid MCO Prior Authorization Request Form ...

www.uhcprovider.comThis form completed by Phone # Kentucky Medicaid MCO Prior Authorization Request Form . MAP 9 –MCO 2020 MCO Prior Authorization Phone Numbers ANTHEM BLUE CROSS BLUE SHIELD KENTUCKY DEPARTMENT PHONE FAX/OTHER Medical Precertification 1-855-661-2028 1-800-964-3627

KENTUCKY SPRING HUNTING GUIDE - Kentucky …

fw.ky.govguides for fishing and boating and fall hunting and trap-ping at other times during the year. The fall Hunting and Trapping Guide includes waterfowl and other mi-gratory bird hunting (dove, wood duck, teal, woodcock, snipe and crow). ABOUT THIS GUIDE This is a summary of hunting laws, intended solely for informational use.

Kentucky Medicaid External Clinical Criteria

kyportal.magellanmedicaid.comKentucky Medicaid Single PDL Prior Authorization (PA) Criteria Effective March 3, 2022 BETA BLOCKERS + DIURETIC COMBINATIONS Preferred Agents Non-Preferred Agents atenolol/chlorthalidone Lopressor® HCT bisoprolol/HCTZ metoprolol tartrate/HCTZ nadolol/bendroflumethiazide propranolol/HCTZ

Kentucky Department of Education: New Minimum …

education.ky.govArts could include, but are not limited to: Chorus 1, Orchestra 1, Visual Arts 1, Theatre 1, Band 1, etc. All required courses must be aligned to the Kentucky Academic Standards. These are state minimum standards and additional requirements may vary by district. Other Graduation Requirements: • Pass state-mandated civics test

Similar queries

Kentucky, Code, 2018, Schedule, Instructions, Kentucky income tax, Income, Kentucky Withholding, Withholding, Kentucky Inheritance, Directory, Bonds, Exempt, Electronic, Electronic filing, Update on the Kentucky ePrescribing Mandate Jan. 7, Health, System, Pharmacists, Declaration of Representative, K E N T U C K Y, Trauma, Workforce, Informed, Approach, Kentucky Transportation Cabinet, Kentucky Transportation Cabinet Division of Motor, SPECIALIST, Professional, Other, PROPERTY TAX, INSTRUCTIONS TANGIBLE PROPERTY TAX, Tangible property tax, Tangible property, Employee, Award winners, Announced, State, Resources, Kentucky bluegrass, Losses, Need to File A Return, File, Practices, Best, AFFIDAVIT, Amendment, Rules and regulations, Exhibiting, Plant, COMMONWEALTH OF KENTUCKY State, Workers, TEACHER WORK SAMPLE, Western Kentucky University, Work, Professional environment, Form, Kentucky Form, Form 741, Storm, Juvenile justice, Juvenile offenders, Mental health, Mental, Needs, KENTUCKY SPRING HUNTING GUIDE, Fishing, Hunting, GUIDE, Kentucky Medicaid, Criteria, Authorization, Kentucky Department of Education, Arts, Theatre, Standards, Graduation Requirements