Search results with tag "Property tax"

96-1740 Texas Property Tax Exemptions

comptroller.texas.govProperty Tax Exemptions — 1 Texas Property Tax Property Tax Exemptions Property tax in Texas is locally assessed and locally admin-istered. There is no state property tax. Property tax brings in the most money of all taxes available to local taxing units. Property taxes pay for schools, roads, police and firemen,

Personal Property Tax - Wa

dor.wa.govMost people know that property tax applies to real property, however, some may not know that property tax also applies to personal property. Most personal property owned by individuals is exempt. For example, household goods and personal effects are not subject to property tax. However, if these items are used in a business, property tax applies.

LOUISIANA PROPERTY TAX BASICS Constitutional authority …

www.house.louisiana.govThere are two classes of taxable property subject to ad valorem tax, real property and personal property. Real property includes land, buildings and other improvements to land, and mobile homes. Personal property includes movable items such as machinery, fixtures, and furnishings.

Instructions for Form IT-229 Real Property Tax Relief ...

www.tax.ny.govFor tax years beginning on or after January 1, 2021, eligible individual taxpayers may claim the real property tax relief credit on qualified real properties. Any unused amount of the credit for the current tax year will be treated as a refund or overpayment of tax to be credited to the next year’s tax. Interest will not be paid on the refund or

NYC RESIDENTIAL 1 property taxes one two three family

www1.nyc.gov* In 2016, STAR was changed by state law from a property tax exemption to an income tax credit. If you received the exemption as of tax year 2015-16 and later lost it, you can apply with DOF to have it restored. Current recipients of the STAR property tax exemption can continue to receive it. New applicants must apply to the state for the credit.

2022 PERSONAL PROPERTY TAX FORMS AND …

revenue.ky.govINSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS (REVENUE FORMS 62A500, 62A500-A, 62A500-C, 62A500-L , 62A500-S1, 62A500-W and 62A500–MI) Definitions and General Instructions ... Kentucky on January 1 must file a tangible property tax return. All tangible property is taxable, except the following:

December 2020

www.sccounties.orgSouth Carolina Association of Counties 2020 Property Tax Report METHODOLOGY OF PROPERTY TAX COLLECTION . The annual . South Carolina Property Tax Rates Report by County. details millage rates for every jurisdiction that levies property taxes in the state. We appreciate the contributions of county auditors from each of the 46 counties.

50-162 Appointment of Agent for Property Tax Matters

comptroller.texas.govAppointment of Agent for Property Tax Matters . This form is for use by a property owner in designating a lessee or other person to act as the owner’s agent in property tax matters. You should read all applicable law and rules carefully, including Tax Code Section 1.111 and Comptroller Rule 9.3044.

FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.govA business owner of tangible personal property having multipleocations l in the District must report that property on one personal property tax return. Attach a separate schedule identifying tangible property for each location. Do not file separate re turns f or each location. Value of Tangible Personal Property — You must

Oregon Property Tax Deferral for Disabled and Senior ...

www.oregon.govunder the Property Tax Deferral program or personal property. 8. Either: • You don’t have a reverse mortgage, or • You were on the Property Tax Deferral program with a reverse mortgage prior to 2011 or you have acquired a reverse mortgage in years 2011-2016 (See Form OR-RMI for more details). 9. The real market value of your homestead as ...

Deferred Property Tax Payments - comptroller.texas.gov

comptroller.texas.govDeferred Property Tax Payments . Texans may postpone paying current and delinquent property taxes on their homes by signing a tax deferral affidavit at the (NAME) County Appraisal District office if they are: • age 65 or older; • disabled as defined by law

Texas Property Tax Law Changes

comptroller.texas.govthe board of directors, a property tax consultant, a property owner, an agent of a property owner, or another person if the communication is made in good faith exercise of the officer’s statutory duties. Effective June 15, 2021. HB 2941 makes conforming changes to subsection (f) by re-moving the reference to Tax Code Section 6.41(d-1) (county

UPDATED 2/17/22 MARYLAND HOMEOWNER ASSISTANCE …

dhcd.maryland.govThe payment for the property tax bill could have become due before January 21, 2020 and continued after January 21, 2020 due to pandemic hardship. Applicants cannot receive more than the documented property tax bill and/or costs necessary to remove a lien placed on the property due to failure to pay property taxes due after January 21, 2020 ...

LEGAL DESCRIPTION: Applicant - Oklahoma

oklahoma.govsurer’s office. On October 1st of each year, the county treasurer will provide a copy of the personal property tax lien docket to the county assessor. Based upon the personal property tax lien docket, the county assessor shall act to cancel the homestead exemption of all property owners having delinquent personal property taxes. Such

Senior Citizens Property Tax Exemption

www.tax.ny.govThe senior citizens property tax exemption can reduce property taxes for lower-income homeowners who are at least 65 years old by up to 50 percent. Cities, towns, villages, counties, and school districts all have the option to offer this exemption.

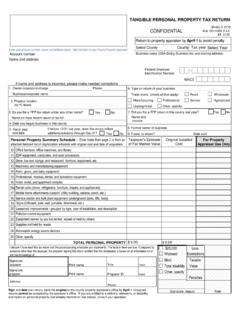

TANGIBLE PERSONAL PROPERTY TAX RETURN

floridarevenue.comTANGIBLE PERSONAL PROPERTY TAX RETURN CONFIDENTIAL DR-405, R. 01/18 Rule 12D-16.002, F.A.C. Eff. 01/18 Enter your account number, name, and address below. Mail this form to your County Property Appraiser. ... INSTRUCTIONS DR-405, R. 01/18, page 3 WHAT TO REPORT Include on your return: 1. Tangible Personal Property. Goods, chattels, and

Publication 18, Nonprofit Organizations - California

www.cdtfa.ca.govgency shelter would be tax exempt. However, tax does apply to purchases of items that the qualifying organization uses rather than donates or sells, such as office supplies or equipment, tools, displays, etc. Welfare exemption from property tax. For information on the welfare exemption, see the . Property Tax

Missouri Property Tax Credit

dor.mo.govRENTERS: If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit. Were you or your spouse 65 years of age or older as of December 31, 2015, and were you or your spouse a Missouri resident the entire 2015 calendar year? If so,

VETERANS' PROPERTY TAX EXEMPTIONS

www.cga.ct.govJan 21, 2015 · The main state-mandated veterans’ property tax exemptions in Connecticut are granted through two statutes: CGS § 12-81(19) requires municipalities to exempt from taxation $1,000 of the property owned by a veteran or his or her surviving spouse. CGS § 12-81g requires municipalities to give veterans who get the basic exemption an additional ...

Request For Photocopy of Missouri Income Tax Return or ...

dor.mo.govThe confidentiality provisions of the Missouri income tax law protect you by prohibiting other persons from obtaining informati . on contained on your tax return or property tax credit claim(s). In compliance with these provisions, please complete this form to obtain a copy of your tax return(s). Form. 1937. Request for Photocopy of Missouri Income

BOARD OF EQUALIZATION PROPERTY TAX RULES

www.boe.ca.govPROPERTY TAX RULES Division 1. State Board of Equalization-Property Tax . Chapter 4. Equalization by State Board . Article 4. Change in Ownership and New Construction . ... Code section 61, subdivision (i), 64, subdivision (c), or 64, subdivision (d) …

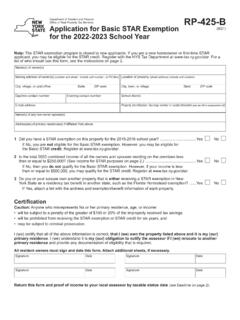

Form RP-425-B:8/21 Application for Basic STAR Exemption ...

www.tax.ny.govof Taxation and Finance or the Office of Real Property Tax Services. Application instructions Print the name and mailing address of each person who owns and primarily resides in the property. (If the title to the property is in a trust or is held in a life estate, the trust beneficiaries or life tenants are deemed to be the owners for STAR ...

Application for Property Tax Abatement Exemption

comptroller.texas.govIf the property owner is a company or other legal entity (not an individual), the Federal Tax I.D. Number is to be provided. Disclosure of your social security number (SSN) may be required and is authorized by law for the purpose of tax administration and identification of any individual affected by

2020 Property Tax Refund Return (M1PR) Instructions

www.revenue.state.mn.usIf the property is not classified as homestead on your property tax statement or you bought your home in 2020, you must apply for homestead status with your county assessor’s office and have it approved on or before December 15, 2021. At the time you apply for homestead status, request a signed statement saying that your application was approved.

Income Thresholds for Senior Citizen and Disabled Persons ...

dor.wa.govIncome Thresholds for Senior Citizen and Disabled Persons Property Tax Exemption and Deferral Author: WA State Department of Revenue Keywords: Income Thresholds for Senior Citizen and Disabled Persons Property Tax Exemption and Deferral for Tax Years 2020-2024 Created Date: 7/11/2019 9:54:35 AM

California Property Tax - California State Board of ...

www.boe.ca.govThe website also contains a calendar of property tax dates. Note: This publication summarizes the law and applicable regulations in effect when the publication was written, as noted on the cover. However, changes in the law or in regulations may have occurred since that time. If …

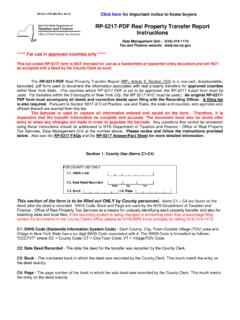

RP-5217-PDF Real Property Transfer Report Instructions

www.tax.ny.govusing these instructions should be addressed to NYS Department of Taxation and Finance - Office of Real Property Tax Services, Data Management Unit at the number above. Please review and follow the instructions provided below. Also see the . RP-5217 FAQs. and the . RP-5217 Answer/Fact Sheet for more detailed information.

-420-a-Org (9/08) NYS DEPARTMENT OF TAXATION & …

www.tax.ny.govProperty Tax Service's forms. A two-part application should be filed in each assessing unit in which exemption is sought: Form RP-420-a-Org (I-Organization purpose) and form RP-420-a/b-Use (II-Property use). One copy of Form RP-420-a-Org should be filed in each assessing unit.

APPLICATION FOR SENIOR SCHOOL PROPERTY TAX CREDIT …

financefiles.delaware.goventireties, a separate application form must be used for each individual claiming this credit. 3. Use lines (A) and (B) to submit the name and address of any co-owners of the property. Use line (C) to state the nature of the relationship with the co …

MICHIGAN GRETCHEN WHITMER DEPARTMENT OF …

www.michigan.gov2022 PROPERTY TAX, COLLECTIONS AND EQUALIZATION CALENDAR . By the 1st day of each month County Treasurer must account for and deliver to the State the State Education Tax collections on hand on or before the 15th day of the immediately preceding month. MCL 211.43(10) By the 15th day of each month County Treasurer must account for and deliver to ...

or RENT REBATE PROGRAM 2020

www.revenue.pa.govJun 30, 2021 · To be eligible for a rebate, the claimant must have lived at least one day of a claim year, owned and occupied and paid taxes or rented and occupied and paid rent for the claim year during the time period the claimant was alive. The property tax paid for a deceased claimant will be prorated based upon the number of days the claimant lived PA-1000

Application for Charitable Organization Property Tax …

comptroller.texas.govdocument with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices may be found on the Comptroller’s . website. APPLICATION DEADLINES: The completed application and supporting documentation must be submitted to the appraisal district beginning Jan. 1 and .

TAX CODE TITLE 1. PROPERTY TAX CODE SUBTITLE A. …

statutes.capitol.texas.govTAX CODE TITLE 1. PROPERTY TAX CODE SUBTITLE A. GENERAL PROVISIONS CHAPTER 1. GENERAL PROVISIONS Sec. 1.01. SHORT TITLE. This title may be cited as the Property Tax Code. Acts 1979, 66th Leg., p. 2218, ch. 841, Sec. 1, eff. Jan. 1, 1982. Sec. 1.02. APPLICABILITY OF TITLE. This title applies to a taxing unit that is created by or pursuant to any ...

Tax Facts & Figures 2021 - Cyprus

www.pwc.com.cy2 Tax Facts Figures 2021 - Cyprus Table of contents Foreword 1 Personal income tax 2 Corporation tax 11 Special Contribution for Defence 26 Capital gains tax 32 Inheritance Tax 35 Value Added Tax 36 Immovable Property Tax 48 Trusts 50 Transfer fees by the department of land and surveys 52 Social insurance 54 General health system 56 Stamp duty 58 Capital duty …

PROPERTY TAX BENEFITS FOR PERSONS 65 OR OLDER

floridarevenue.comCertain property tax benefits are available to persons 65 or older in Florida. Eligibility for property tax exemptions depends on certain requirements. Information is available from the property appraiser’s office in the county where the applicant owns a homestead or other property. Available Benefits. A board of county commissioners or the ...

Property Tax Guide for Georgia Citizens

georgiadata.orgReal property is taxable in the county where the land is located, and personal property is taxable in the county where the owner maintains a permanent legal residence unless otherwise provided by law. (O.C.G.A. 48-5-11) For most counties, taxes are due by December 20, but this may vary from county to county. If taxes are not collected

Property Tax Reimbursement (Senior Freeze) Program, 2020 ...

www.nj.govproperty (tangible or intangible) seized, lost, or misappropriated as a result of Nazi actions or ... Property tax bills for both 2019 and 2020, along with 2. Proof of the amount of property taxes paid, which can be either: 2020 Form PTR-1 Instructions Page 4 a. …

PROPERTY TAX BENEFITS FOR ACTIVE DUTY MILITARY AND …

floridarevenue.comappraiser. If the property appraiser denies your application, you may file a petition with the county’s value adjustment board. For more information, see . Petitions to t he Value Adjustment Board. PT-109, R. 01/21 . PROPERTY TAX BENEFITS FOR ACTIVE DUTY MILITARY AND VETERANS. Certain property tax benefits are available to members of the ...

Property Tax Welfare Exemption - California State Board of ...

www.boe.ca.govCalifornia property tax law has its own requirements that may differ from other state and federal laws. One of these differences affects organizations applying for the Welfare Exemption. California property tax law requires that in order to qualify for the Welfare Exemption, the organization must be organized . and. operated exclusively for one or

PROPERTY TAX SAVINGS - Greenville County

www.greenvillecounty.orgHomestead Exemption (SC Code of Laws 12-37-250) The S. C. Homestead Tax Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property. The

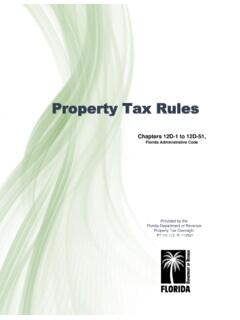

Property Tax Rules - Florida Dept. of Revenue

www.floridarevenue.comExemptions) Required to Be Filed with the Property Appraiser 12D-1.005 Access to Financial Records 12D-1.006 Exchange of Information Among …

Similar queries

Property Tax, Property Tax Property Tax, Property, Other, INSTRUCTIONS TANGIBLE PROPERTY TAX, Instructions, Kentucky, Tangible property tax, Tangible property, PROPERTY TAX COLLECTION, Tax Code, Property Tax Instructions, Tangible, The Property Tax, Applicant, Homestead, Homeowners, Exemption, Missouri Property Tax, Rent, Missouri, Veteran, Code, Application, Basic STAR, CALENDAR, Organization, Individual, RENT REBATE PROGRAM 2020, Rebate, Texas Comptroller of Public Accounts, Comptroller, Website, Tax Facts & Figures 2021 - Cyprus, Tax Facts Figures 2021 - Cyprus, Information, Taxable, Personal property, Property Tax Reimbursement, Petitions, Greenville County, Homestead Tax, Exemptions